Re: Not Just Thye but ALL the Usual Suspects are here

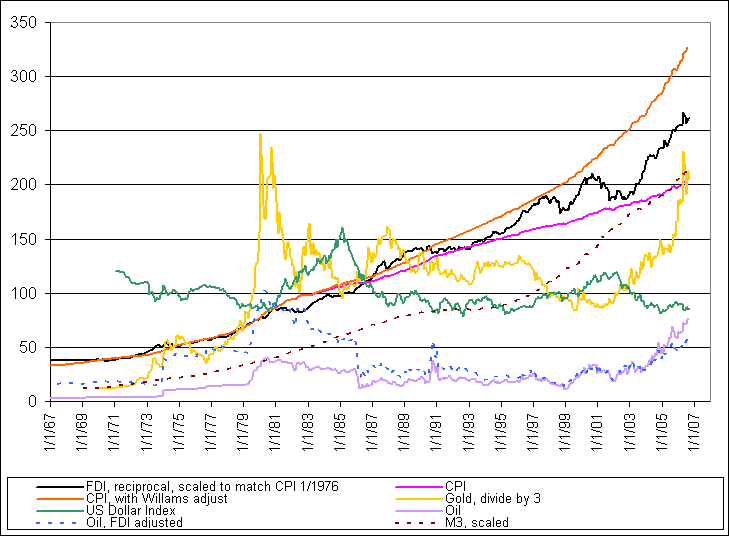

Indeed, just because we're getting a whiff of deflation now doesn't mean we're in it for the long haul. I totally agree on minimizing and ideally eliminating debt, and holding some cash and short term high quality credit. And because of that likely return of the liquidity flush, definitely think a generous portion of gold and other hard commodities is very a good policy.

Originally posted by the Hobbit

Comment