We published this notice Tuesday March 25 to make our readers aware that a group of home owners organized by the Neighborhood Assistance Corporation of America (NACA) planned to protest government bailout of Bear Sterns and other investment banks that made bad bets in the mortgage industry.

Complete press release here.

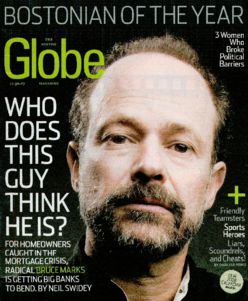

Lest you think the NACA is some kind of wacky fringe group, note that its CEO received the Boston Globe's Bostonian of the Year for his two decades of work enabling lower income families to purchase homes but without ripping them off.

Guarding the House

December 30, 2007 (Neil Swidey - Boston Globe)

It is for his relentless advocacy and sensible innovation in working to find a way out of this mortgage mess that affects so many that Bruce Marks is our 2007 Bostonian of the Year.

Wall Street made billions off the backs of homeowners. But when the mortgage crisis blew up, a pit bull named Bruce Marks stood up for the Average Joes and, incredibly, got some of the biggest banks to bend.

There are guys you'd want to talk Sox trades with over a beer, guys you'd want to deliver the toast at your wedding, guys you'd want by your side if some goateed knucklehead took a swing at you because you accidentally bumped into his girlfriend. Bruce Marks is none of these guys.

But if you should find yourself up against one of the nation's most powerful banks, feeling abused by a maddening loop of automated messages, threatening letters, and buck-passing paper pushers, if you should feel powerless to reassure your little daughter when she tearfully asks you if you're going to lose the only home she's ever known, well then, there's nobody you'd want in your corner more than Bruce Marks. And sadly, a whole lot of desperate people had to turn to Marks for help this year, and a whole lot more will need his emergency services in the year ahead.

Marks credits his deep-seated anger for keeping him barking from behind the same chain-link junkyard fence for two decades. During that time, Marks watched as many of the world's most powerful financial institutions went from ignoring people of modest means to coveting them, realizing they could make billions by catering directly to that mortgage market. But instead of doing it through the tedious, disciplined work of a group like NACA - which offers extensive education before qualifying borrowers for a below-market-rate, 30-year fixed mortgage with no down payment or closing costs - they opted for the subprime route. Suddenly, virtually anyone could qualify for a loan. It was just a question of how much they'd be charged. Subprime loans generally come with a rate at least 3 percentage points higher than the going prime rate, but they are often masked by lower "teaser" rates and have nooselike provisions slipped into the fine print, such as penalties for prepayment and timed resets to extremely high rates. Wall Street fell in love with all this subprime "product," because loans were bundled into huge funds, theoretically minimizing risk - but in reality pushing it downstream - while producing hefty returns for investment firms. As the players all along the lending process got rich, from mortgage brokers to servicers to investment bankers, the demand for more borrowers exploded. Before long, the normal safeguards for underwriting loans got tossed faster than losing scratch tickets outside a convenience store.

It got so bad that some lenders began offering what they called "no-doc" loans, where borrowers didn't need to provide even the most basic documentation for their income. One 41-year-old Brockton woman named Tammy told me that even though she made no more than $15,000 a year as a part-time newspaper delivery person, she watched as her mortgage broker put down her income as $44,000. "I was smart enough to know what was happening," Tammy says. "Who's going to give me a loan when all I have is a damn paper route?" But she figured that was just the ways things were done.

As the number of subprime loans climbed, Marks railed against them as just old-fashioned predatory lending gussied up in a new skirt and pumps. He says NACA lost a good deal of business when low-and moderate-income borrowers found they could qualify for a lot more money, with a lot less work, by signing a subprime note with a big-name bank.

In the meantime, Marks busied himself making the NACA process better, working with his IT guy to develop a streamlined Web-based software system that was able to determine, efficiently and reliably, what a borrower could afford to pay. The system improved quality control for Marks as he continued to open new NACA offices across the country.

When subprime went south and homeowners started defaulting and getting squeezed out of their homes, Marks shifted into his activist mode. He refused to see borrowers as anything but victims, even if some of them, like Tammy of Brockton, blamed themselves. "Bruce has a Messiah complex," says local real estate analyst John C. Anderson. "He refuses to differentiate between people suffering discrimination and people who are legitimately bad credit risks." The latter, Anderson says, "have always been able to borrow their way out of trouble, until now."

But Marks blamed only the greed of the big guys. He started by going after the biggest of them all, Countrywide. He prepared himself for a long fight and was shocked to see the lender cave within 48 hours.

The teetering company no doubt wanted to shut Marks up. More important, though, was NACA's state-of-the-art system, which integrates financial counseling and behavioral change on the part of the borrower with the creation of a solid new loan package based on what that particular borrower can afford to pay. Marks offered Countrywide a more reliable alternative to a flood of expensive foreclosures.

As senior policy adviser to the Financial Services Roundtable, veteran banking executive Bill Longbrake is one of the key players in plotting the response, by government and industry, to the mortgage meltdown. Until now, he never wanted anything to do with Marks, given his reputation. But after seeing NACA's operation up close, he became a believer in Marks. Now he's trying to persuade other banking executives to do the same. "The time is right for what he's built, given the crisis in this country," Longbrake says. "It's almost as if Bruce has two personalities. There's the advocate and bomb thrower, which has made many people in banking wary of him. But behind that, there's this incredibly effective, disciplined businessperson." more...

So how did the homeowner protest go? Here's an amateur video of the event.

How did the press cover it? Depends on where you go for coverage. Here is the CNBC coverage.

Danny Schechter was there covering the coverage. For those of you who don't know Danny, here's an article of his published today by Editor & Publisher Magazine.

* NACA LATE LOANS

The most recent available data on the percentage of mortgages in the NACA portfolio that are at least 90 days late - called "seriously delinquent" - compared with the national average:

NACA RATE 1.15 percent VS. NATIONAL RATE 2.95 percent*

*Prime loans, which make up the bulk of mortgages, have a national "seriously delinquent" rate of 1.31 percent. For subprime loans, that rate is 11.38 percent.

NOTE: NACA borrowers pay into a Neighborhood Stabilization Fund, to which they can apply for assistance if they run into financial trouble. NACA reports that 6.32 percent of its borrowers have taken advantage of that fund.

SOURCES: Neighborhood Assistance Corporation of America, National Delinquency Survey from the Mortgage Bankers Association, Third Quarter 2007

Complete press release here.

Lest you think the NACA is some kind of wacky fringe group, note that its CEO received the Boston Globe's Bostonian of the Year for his two decades of work enabling lower income families to purchase homes but without ripping them off.

|

December 30, 2007 (Neil Swidey - Boston Globe)

It is for his relentless advocacy and sensible innovation in working to find a way out of this mortgage mess that affects so many that Bruce Marks is our 2007 Bostonian of the Year.

Wall Street made billions off the backs of homeowners. But when the mortgage crisis blew up, a pit bull named Bruce Marks stood up for the Average Joes and, incredibly, got some of the biggest banks to bend.

There are guys you'd want to talk Sox trades with over a beer, guys you'd want to deliver the toast at your wedding, guys you'd want by your side if some goateed knucklehead took a swing at you because you accidentally bumped into his girlfriend. Bruce Marks is none of these guys.

But if you should find yourself up against one of the nation's most powerful banks, feeling abused by a maddening loop of automated messages, threatening letters, and buck-passing paper pushers, if you should feel powerless to reassure your little daughter when she tearfully asks you if you're going to lose the only home she's ever known, well then, there's nobody you'd want in your corner more than Bruce Marks. And sadly, a whole lot of desperate people had to turn to Marks for help this year, and a whole lot more will need his emergency services in the year ahead.

Marks credits his deep-seated anger for keeping him barking from behind the same chain-link junkyard fence for two decades. During that time, Marks watched as many of the world's most powerful financial institutions went from ignoring people of modest means to coveting them, realizing they could make billions by catering directly to that mortgage market. But instead of doing it through the tedious, disciplined work of a group like NACA - which offers extensive education before qualifying borrowers for a below-market-rate, 30-year fixed mortgage with no down payment or closing costs - they opted for the subprime route. Suddenly, virtually anyone could qualify for a loan. It was just a question of how much they'd be charged. Subprime loans generally come with a rate at least 3 percentage points higher than the going prime rate, but they are often masked by lower "teaser" rates and have nooselike provisions slipped into the fine print, such as penalties for prepayment and timed resets to extremely high rates. Wall Street fell in love with all this subprime "product," because loans were bundled into huge funds, theoretically minimizing risk - but in reality pushing it downstream - while producing hefty returns for investment firms. As the players all along the lending process got rich, from mortgage brokers to servicers to investment bankers, the demand for more borrowers exploded. Before long, the normal safeguards for underwriting loans got tossed faster than losing scratch tickets outside a convenience store.

It got so bad that some lenders began offering what they called "no-doc" loans, where borrowers didn't need to provide even the most basic documentation for their income. One 41-year-old Brockton woman named Tammy told me that even though she made no more than $15,000 a year as a part-time newspaper delivery person, she watched as her mortgage broker put down her income as $44,000. "I was smart enough to know what was happening," Tammy says. "Who's going to give me a loan when all I have is a damn paper route?" But she figured that was just the ways things were done.

As the number of subprime loans climbed, Marks railed against them as just old-fashioned predatory lending gussied up in a new skirt and pumps. He says NACA lost a good deal of business when low-and moderate-income borrowers found they could qualify for a lot more money, with a lot less work, by signing a subprime note with a big-name bank.

In the meantime, Marks busied himself making the NACA process better, working with his IT guy to develop a streamlined Web-based software system that was able to determine, efficiently and reliably, what a borrower could afford to pay. The system improved quality control for Marks as he continued to open new NACA offices across the country.

When subprime went south and homeowners started defaulting and getting squeezed out of their homes, Marks shifted into his activist mode. He refused to see borrowers as anything but victims, even if some of them, like Tammy of Brockton, blamed themselves. "Bruce has a Messiah complex," says local real estate analyst John C. Anderson. "He refuses to differentiate between people suffering discrimination and people who are legitimately bad credit risks." The latter, Anderson says, "have always been able to borrow their way out of trouble, until now."

But Marks blamed only the greed of the big guys. He started by going after the biggest of them all, Countrywide. He prepared himself for a long fight and was shocked to see the lender cave within 48 hours.

The teetering company no doubt wanted to shut Marks up. More important, though, was NACA's state-of-the-art system, which integrates financial counseling and behavioral change on the part of the borrower with the creation of a solid new loan package based on what that particular borrower can afford to pay. Marks offered Countrywide a more reliable alternative to a flood of expensive foreclosures.

As senior policy adviser to the Financial Services Roundtable, veteran banking executive Bill Longbrake is one of the key players in plotting the response, by government and industry, to the mortgage meltdown. Until now, he never wanted anything to do with Marks, given his reputation. But after seeing NACA's operation up close, he became a believer in Marks. Now he's trying to persuade other banking executives to do the same. "The time is right for what he's built, given the crisis in this country," Longbrake says. "It's almost as if Bruce has two personalities. There's the advocate and bomb thrower, which has made many people in banking wary of him. But behind that, there's this incredibly effective, disciplined businessperson." more...

How did the press cover it? Depends on where you go for coverage. Here is the CNBC coverage.

Danny Schechter was there covering the coverage. For those of you who don't know Danny, here's an article of his published today by Editor & Publisher Magazine.

Where Was Media When Sub-Prime Disaster Unfolded?

If we were long on the edge of "disaster" with a "financial nuclear winter" waiting in the wings, why were American news consumers among the last to know?

By Danny Schechter (March 27, 2008) -- "It is somewhat surprising," Larry Elliott, economics editor of London's The Guardian observed recently, "that there is not already rioting in the streets, given the gigantic fraud perpetrated by the financial elite at the expense of ordinary Americans.” If such a fraud was taking place, and if Wall Street’s financial crisis, according to the usually staid Economist, was on the edge of “disaster” with a “financial nuclear winter” waiting in the wings, why were American news consumers among the last to know? more...

Here are excerpts of Danny's coverage of the coverage of yesterday's protest. Fair coverage? You be the judge.If we were long on the edge of "disaster" with a "financial nuclear winter" waiting in the wings, why were American news consumers among the last to know?

By Danny Schechter (March 27, 2008) -- "It is somewhat surprising," Larry Elliott, economics editor of London's The Guardian observed recently, "that there is not already rioting in the streets, given the gigantic fraud perpetrated by the financial elite at the expense of ordinary Americans.” If such a fraud was taking place, and if Wall Street’s financial crisis, according to the usually staid Economist, was on the edge of “disaster” with a “financial nuclear winter” waiting in the wings, why were American news consumers among the last to know? more...

THE “COVERAGE”

First Reuters (from 43rd St) which beat out the AP (that came all the way from West 33)…They reported “ABOUT 60 PROTESTERS, not homeowners or family members facing foreclosure but just “protesters,” as if that was their only identity and raison d’etre.. Then look at how they describe the Bear Stearns employees—soon to become former employees, by the way—but don’t quote any official from the firm for a reaction. That would have taken work.

NEW YORK (Reuters) - About 60 protesters opposed to the U.S. Federal Reserve’s help in bailing out Bear Stearns entered the lobby of the investment bank’s Manhattan headquarters on Wednesday, demanding assistance for struggling homeowners.

Demonstrators organized by the Neighborhood Assistance Corporation of America chanted “Help Main Street, not Wall Street” and entered the lobby without an invitation for around half an hour before being escorted out by police.

“There are no provisions for homeowners in this deal. There are people out there struggling who need help,” said Detria Austin, an organizer at NACA, an advocacy group for home ownership.

Bear Stearns employees were alternatively amused and perplexed, taking pictures on their cell phones.

“Homeowners, that’s more than $1 trillion (in mortgage debt), you’re crazy,” one man in a suit screamed at a protester on the street.”

I guess “one man in a suit” was the stand-in for Bear Stearns. Funny, I was wearing a suit.

Now here’s DEALMAKER, a Wall Street Tabloid. They are even more snide and but at least put the number at 200, quite a few more than Reuters. But their second paragraph is as stupid as it is insensitive suggesting that the demonstrators “ wandered off to do whatever it is demonstrators do after a demonstration. (We’re guessing: wait in TKTKS line for Xanadu tickets.)”.

The Daily News was one of the few local news outlets that actually covered the protesters at St Barts Church where they assembled on Park Avenue.

CNBC did interview one banker at BEAR who said, anonymously of course, that he sympathized with the protest and would probably lose his job and his house. Few at Bear were talking about the issue or the protest---perhaps because they are crying about their own futures or, in some cases, sneering.

One brainiac in the latter camp was interviewed by the NY Post. I have to put this in CAPS lest you miss it. He was identified as a 23 years old.

'IT SEEMS KIND OF FUNNY TO PEOPLE UPSTAIRS.....IT'S LIKE A BIG JOKE. WE REALLY DON'T KNOW WHAT THEY ARE PROTESTING ABOUT.”

At least we know part of the reason: The media has done such a miserable job covering the crisis. more...

We ask: In the case of the mortgage crisis, what would Albert J. Nock do?First Reuters (from 43rd St) which beat out the AP (that came all the way from West 33)…They reported “ABOUT 60 PROTESTERS, not homeowners or family members facing foreclosure but just “protesters,” as if that was their only identity and raison d’etre.. Then look at how they describe the Bear Stearns employees—soon to become former employees, by the way—but don’t quote any official from the firm for a reaction. That would have taken work.

NEW YORK (Reuters) - About 60 protesters opposed to the U.S. Federal Reserve’s help in bailing out Bear Stearns entered the lobby of the investment bank’s Manhattan headquarters on Wednesday, demanding assistance for struggling homeowners.

Demonstrators organized by the Neighborhood Assistance Corporation of America chanted “Help Main Street, not Wall Street” and entered the lobby without an invitation for around half an hour before being escorted out by police.

“There are no provisions for homeowners in this deal. There are people out there struggling who need help,” said Detria Austin, an organizer at NACA, an advocacy group for home ownership.

Bear Stearns employees were alternatively amused and perplexed, taking pictures on their cell phones.

“Homeowners, that’s more than $1 trillion (in mortgage debt), you’re crazy,” one man in a suit screamed at a protester on the street.”

I guess “one man in a suit” was the stand-in for Bear Stearns. Funny, I was wearing a suit.

Now here’s DEALMAKER, a Wall Street Tabloid. They are even more snide and but at least put the number at 200, quite a few more than Reuters. But their second paragraph is as stupid as it is insensitive suggesting that the demonstrators “ wandered off to do whatever it is demonstrators do after a demonstration. (We’re guessing: wait in TKTKS line for Xanadu tickets.)”.

The Daily News was one of the few local news outlets that actually covered the protesters at St Barts Church where they assembled on Park Avenue.

CNBC did interview one banker at BEAR who said, anonymously of course, that he sympathized with the protest and would probably lose his job and his house. Few at Bear were talking about the issue or the protest---perhaps because they are crying about their own futures or, in some cases, sneering.

One brainiac in the latter camp was interviewed by the NY Post. I have to put this in CAPS lest you miss it. He was identified as a 23 years old.

'IT SEEMS KIND OF FUNNY TO PEOPLE UPSTAIRS.....IT'S LIKE A BIG JOKE. WE REALLY DON'T KNOW WHAT THEY ARE PROTESTING ABOUT.”

At least we know part of the reason: The media has done such a miserable job covering the crisis. more...

Heretofore in this country sudden crises of misfortune have been met by a mobilization of social power. In fact (except for certain institutional enterprises like the home for the aged, the lunatic-asylum, city-hospital and county-poorhouse) destitution, unemployment, "depression" and similar ills, have been no concern of the State, but have been relieved by the application of social power. Under Mr. Roosevelt, however, the State assumed this function, publicly announcing the doctrine, brand-new in our history, that the State owes its citizens a living. Students of politics, of course, saw in this merely an astute proposal for a prodigious enhancement of State power; merely what, as long ago as 1794, James Madison called "the old trick of turning every contingency into a resource for accumulating force in the government"; and the passage of time has proved that they were right. The effect of this upon the balance between State power and social power is clear, and also its effect of a general indoctrination with the idea that an exercise of social power upon such matters is no longer called for. - Our Enemy, The State by Albert J. Nock - 1935

Getting back to the NACA it seems to us that allowing an orderly transfer of subprime mortgage assets to the NACA from distressed banks instead of government bailouts is a free market solution that neither unfairly uses taxpayer money to assist one group over another nor hands further power to the State over social affairs that better managed by society and the marketplace. Why not create a New Bank that uses NACA practices, with its time tested economics*, and scale it up to allow all of the banks that are now demanding bailouts because the are "too big to fail" to sell their assets to the New Bank, management of the failed banks can retire of do whatever it is incompetent and failed bankers do. We'd suggest selling used cars but that's too hard on used car salesmen; at least a used car salesman has to look his or her customer in the eye before ripping them off.* NACA LATE LOANS

The most recent available data on the percentage of mortgages in the NACA portfolio that are at least 90 days late - called "seriously delinquent" - compared with the national average:

NACA RATE 1.15 percent VS. NATIONAL RATE 2.95 percent*

*Prime loans, which make up the bulk of mortgages, have a national "seriously delinquent" rate of 1.31 percent. For subprime loans, that rate is 11.38 percent.

NOTE: NACA borrowers pay into a Neighborhood Stabilization Fund, to which they can apply for assistance if they run into financial trouble. NACA reports that 6.32 percent of its borrowers have taken advantage of that fund.

SOURCES: Neighborhood Assistance Corporation of America, National Delinquency Survey from the Mortgage Bankers Association, Third Quarter 2007

Comment