Re: Gold bubble goes pop!

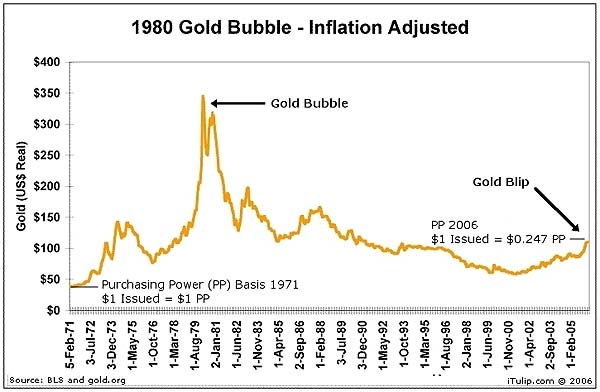

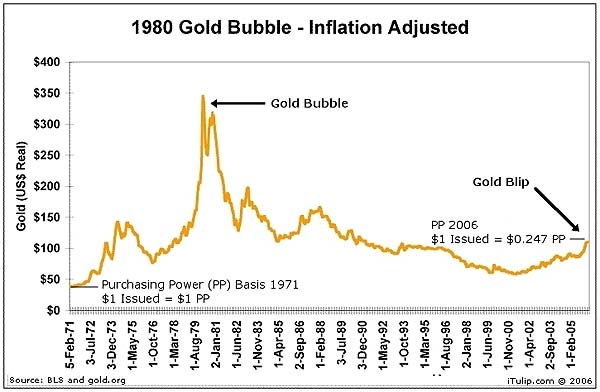

agreed. this chart is still instructive... from what gold bubble oct. 2006

wonder how many didn't read it... were scared out of the market in 2006 by idiots calling the gold market a bubble then.

Originally posted by GeraldRiggs

View Post

wonder how many didn't read it... were scared out of the market in 2006 by idiots calling the gold market a bubble then.

Comment