Announcement

Collapse

No announcement yet.

People are catching on

Collapse

X

-

Re: people are catching on

wonder what it was like early days of the currency crash in argentina in the late 1990s? maybe political cartoons like that... then the currency kept going down... then more... then more... then the wheelbarrow jokes weren't funny anymore... then instead of amusing cartoons........Originally posted by GRG55 View PostContrary US $ buy signal??? :eek:

how does uncle jack put it? it's all fun fun and games...

at this point it's all still good natured...

Activists bare teeth over foreclosures

March 01, 2008: 12:57 PM EST

Mar. 1, 2008 (Thomson Financial delivered by Newstex) --

CLEVELAND (AP) - Folks on Humphrey Hill Drive were still waking up on the icy Saturday morning the shark hunters came to town. They rounded the suburban traffic circle in a pair of rented school buses after a half-hour ride from far more modest neighborhoods, rumbling to a stop at the Garmone family's driveway. Forty-two caffeinated Clevelanders piled out, their leaders carrying bullhorns.

Their quarry, Mike Garmone -- a regional vice president at Countrywide Financial Corp. (NYSE:CFC) , the nation's largest mortgage lender -- didn't answer his door. So they deployed, ringing bells at the big homes with three-car garages, handing out accusatory fliers and lambasting Garmone and his company's loans. Before departing, they left their calling card -- thousands of 2 1/2-inch plastic sharks -- flung across Garmone's frozen flower beds, up into the gutters, littering the doorstep.

The commotion was the work of an in-your-face activist group called the East Side Organizing Project, with a paid staff then of just two, mobilized to battle Cleveland's mortgage 'loan sharks.' Years before the rest of the country was rocked by the fallout from aggressive lending, their neighborhoods were already home to the nation's highest concentration of foreclosures -- and they were fed up.

Comment

-

Re: people are catching on

But, as EJ has pointed out, the USA is not Argentina. Unlike Argentina, what happens in (and to) the USA matters to much of the rest of the world. And that is why the big economy Central Banks will, at some point, do what they must to save the US$. Or die trying...Originally posted by metalman View Postwonder what it was like early days of the currency crash in argentina in the late 1990s? maybe political cartoons like that... then the currency kept going down... then more... then more... then the wheelbarrow jokes weren't funny anymore... then instead of amusing cartoons........

Comment

-

Re: people are catching on

I can tell you what hedge funds long gold are telling us: the US experience will turn out like Argentina but the process may be slower. Foreign governments holding dollars can provide a buffer that the Argentines did not have but ultimately when the process is over the dollar will be far lower than it is today.Originally posted by GRG55 View PostBut, as EJ has pointed out, the USA is not Argentina. Unlike Argentina, what happens in (and to) the USA matters to much of the rest of the world. And that is why the big economy Central Banks will, at some point, do what they must to save the US$. Or die trying...

Over the weekend I met a young man from formerly East Germany who was 11 when the Berlin Wall came down. Very well educated, and like all children of parents who suffered under Communist rule very pro-Reagan, at least those that I've met.

The most striking thing about the conversations I have with folks from Asia and Europe when we talk about the dollar is how little they care about the declining dollar. It has no impact on their investments as they don't own dollars and the inflationary impact on Europeans, or at least their perception of it as it results from competitive devaluation, has been muted.

It's hard for Americans to understand that much of the world regards the dollar problem the way most US citizens regarded the "peso problem" in Mexico, as an abstraction. At this point, now that most holders of dollars overseas are governments one's belief in the rate of decline of the dollar comes down to confidence in the will and ability of foreign governments to manage the process.

So, yes, as I said the US is not Argentina but the US is not Japan, either.

This recent article in the Hong Kong Development Council expresses this well.On the Dollar's Downtrend and the Dollar Crisis

The secular dollar drop can be traced back to 2002

The US dollar has weakened dramatically since 2007, with the Nominal Major Currencies Dollar Index dropped to 71.1053 in early November, marking a year-to-date decline of 12.7% or a year-on-year decline of 10%. Such drastic fall of the USD has aroused concerns among global investors. The current downtrend of the dollar can be traced back to March 20021. Despite a mild rebound in 2005 (details as shown in the following tables), the USD index fell to 73.2693 at the end of 2007, the fresh low after the U.S. government decided to suspend gold convertibility in 1971. Over the past six years, the index has declined 34%, and specifically the dollar has slipped 39% against the euro, 27% against the British bound, 14% against the Japanese yen and 12% against the RMB.

Comment

-

Re: People are catching on

if a european works for, e.g., airbus then they've got to care about the falling dollar. [i believe airbus is talking about moving some of its manufacturing to the u.s. because of the weak dollar as well as for political reasons in getting the military tanker contract.]

but we should be careful about what "dollar" we're talking about. usually everyone, including me, looks at the dollar index which is traded on the futures market, and which is 50% just the euro. a trade weighted dollar index doesn't look as bad. here's one from the atlanta fed:

http://www.frbatlanta.org/dollarinde...chart_menu.cfm

[sorry i couldn't figure out how to paste the image], set the parameters for the max - 1/95 through 1/08 - and you'll see how much the euro has contributed to the classic index's decline.

Comment

-

Re: people are catching on

When I say "saving" the US$ I do not mean it won't go lower, I mean it will go lower, slower. Not an outright collapse. Again, it's not the absolute change that matters now, it's the rate-of-change.Originally posted by EJ View PostI can tell you what hedge funds long gold are telling us: the US experience will turn out like Argentina but the process may be slower. Foreign governments holding dollars can provide a buffer that the Argentines did not have but ultimately when the process is over the dollar will be far lower than it is today.

I just cannot see how the Fed, and perhaps other Central Banks, won't intervene either covertly or overtly, if necessary, to counter the speculative sharks that are pressing the downward momentum hard right now.

Comment

-

Re: people are catching on

If you right click on the image - and look at the image properties, you should be able to find the location of the image -- copy and paste the URL to the insert image dialog in the compose post box.Originally posted by WDCRob View PostGod as my witness I wish I could figure out how to post a fracking image.

Comment

-

Re: people are catching on

For sites that allow hot linking:Originally posted by WDCRob View PostGod as my witness I wish I could figure out how to post a fracking image.

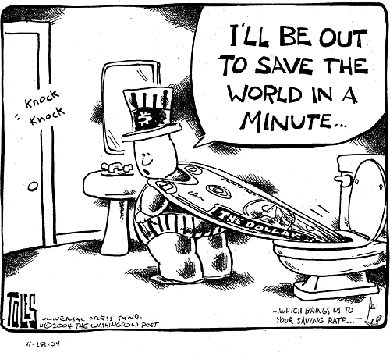

Toles: right on cue from today's Post.

http://www.washingtonpost.com/wp-srv...oles_main.html

This is copyrighted to the Washington Post. If they ask us to remove it we will, but it makes a great ad for the Washington Post.

The Treasury has been furiously intervening in the currency markets. That's one factor that is making everyone so nervous. The interventions are less and less effective. What is needed is structural change. When is that coming?

Ed.

Comment

-

Re: people are catching on

Originally posted by EJ View PostAt this point, now that most holders of dollars overseas are governments one's belief in the rate of decline of the dollar comes down to confidence in the will and ability of foreign governments to manage the process.

Does foreign gov. holding dollars have any future placement of dollars if they are in politically correct circles?

As the economy sinks and the dollar declines at what point will the USA let those dollar holders come in and purchase US assets and promote job creation ( will be excepted when unemployment spikes) ? How much more dollar decline will it take? Dollar holders are very nervous at this point without many options for placement. Will global dollar holders take another 40-50% decline before USA allows the repudiation program? Will USA start to let politically correct dollar holders in first and limit the rest as the dollar continues its downward path over the years?

Last edited by bill; March 03, 2008, 02:38 PM.

Comment

Comment