I would welcome comments on the following commentary from Denninger at Market Ticker:

http://market-ticker.denninger.net/

The conclusions he draws are:

This has profound investment implications.

If you are investing today on the premise that "The Fed has our backs", you're wrong.

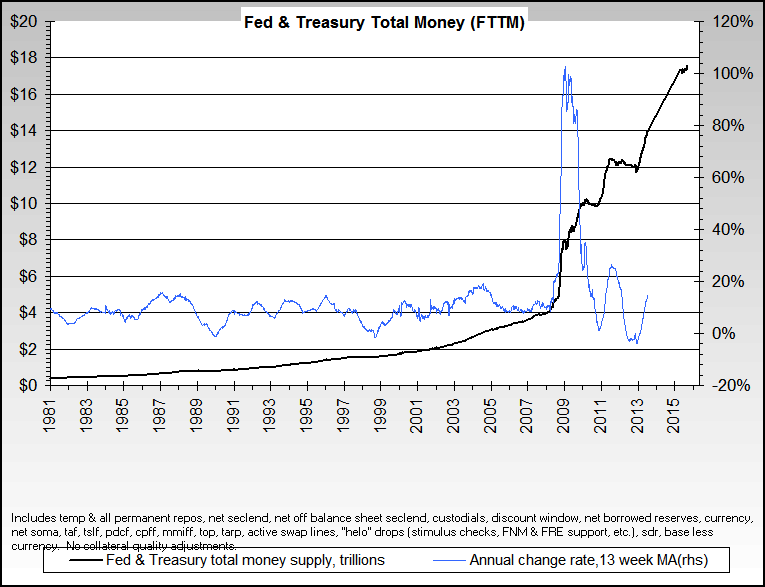

If you are buying metals in the belief that The Fed is intentionally devaluing the dollar and hyperinflating the money supply, you're wrong.

If you think The Fed is intentionally being "the bagholder of last resort", monetizing bad debt, you're wrong.

If you think The Fed leads the market and sets rates, again, you're wrong. (Read the entire PDF - very carefully - you will find that The Fed is in fact following the market, and admits so!)

There simply is no more debate on any of these points, because we now have the actual data from the Horse's Mouth.

There are is no more "postulating" this or that, as we now have the facts, and they are what they are.

There is no bailout in process via monetization. Period.

There is no hyperinflation via "printing." Period.

The Fed does not "set" interest rates. The market does, and The Fed then does their damndest to deal with it. Period.

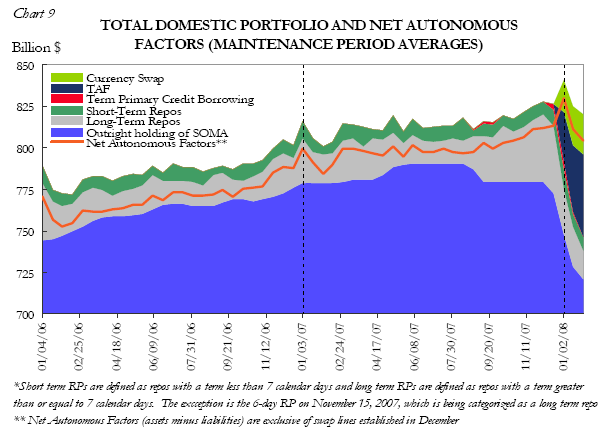

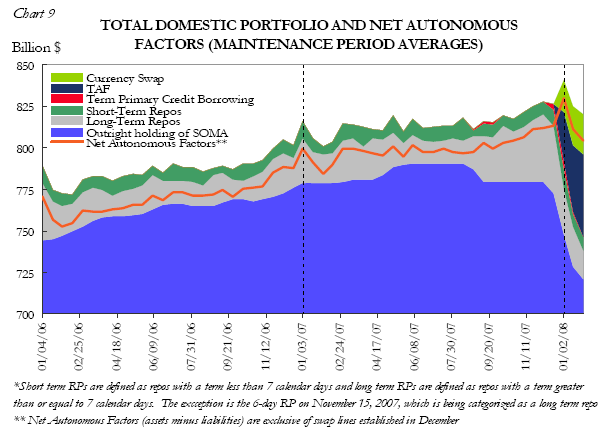

In fact, The Fed is actually taking down risk, as I have said repeatedly, and de-leveraging not only their own balance sheets but they are also forcibly taking down risk in the primary dealers - whether they like it or not!

Now we know - for a fact - why Citibank had to go to the Arabs for money at double-digit rates. Why the other money-center banks are issuing preferreds and other instruments with returns at more than double the interest coupon required to borrow through the primary Fed credit facility (whether it be the TAF or the Discount Window.)

We now know the facts of life:

Fact: The good collateral has all been pledged.

Fact: The margin credit supply has been decreased.

Fact: Risk capacity is being withdrawn actively by The Fed.

Fact: The money supply is deflating.

Get that all in your head and make sure it sticks, because if it is not the foundation of your investment thesis over the next several months, you are proceeding from an incorrect premise.

That doesn't sound like the itulip thesis to me.

http://market-ticker.denninger.net/

The conclusions he draws are:

This has profound investment implications.

If you are investing today on the premise that "The Fed has our backs", you're wrong.

If you are buying metals in the belief that The Fed is intentionally devaluing the dollar and hyperinflating the money supply, you're wrong.

If you think The Fed is intentionally being "the bagholder of last resort", monetizing bad debt, you're wrong.

If you think The Fed leads the market and sets rates, again, you're wrong. (Read the entire PDF - very carefully - you will find that The Fed is in fact following the market, and admits so!)

There simply is no more debate on any of these points, because we now have the actual data from the Horse's Mouth.

There are is no more "postulating" this or that, as we now have the facts, and they are what they are.

There is no bailout in process via monetization. Period.

There is no hyperinflation via "printing." Period.

The Fed does not "set" interest rates. The market does, and The Fed then does their damndest to deal with it. Period.

In fact, The Fed is actually taking down risk, as I have said repeatedly, and de-leveraging not only their own balance sheets but they are also forcibly taking down risk in the primary dealers - whether they like it or not!

Now we know - for a fact - why Citibank had to go to the Arabs for money at double-digit rates. Why the other money-center banks are issuing preferreds and other instruments with returns at more than double the interest coupon required to borrow through the primary Fed credit facility (whether it be the TAF or the Discount Window.)

We now know the facts of life:

Fact: The good collateral has all been pledged.

Fact: The margin credit supply has been decreased.

Fact: Risk capacity is being withdrawn actively by The Fed.

Fact: The money supply is deflating.

Get that all in your head and make sure it sticks, because if it is not the foundation of your investment thesis over the next several months, you are proceeding from an incorrect premise.

That doesn't sound like the itulip thesis to me.

Comment