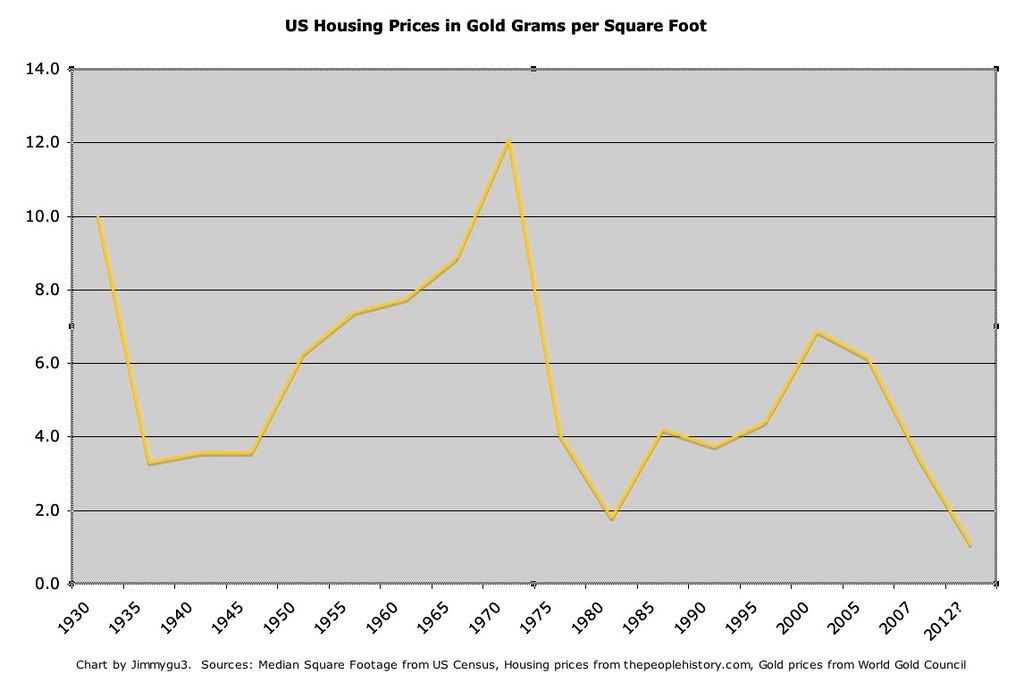

Re: Real estate prices in gold hitting a 20 year low

Lukester - This chart did not makes sense to me so I went to the St. Louis Fed site to check out their version of it. The Fed version is updated through 12/1/2007. If this Fed chart is correct, the Greenrush chart is doctored. Any idea what's going on here?

http://research.stlouisfed.org/fred2/series/BOGNONBR

Originally posted by Lukester

View Post

http://research.stlouisfed.org/fred2/series/BOGNONBR

Comment