Re: What's with Bernanke jawboning the stock market upwards?

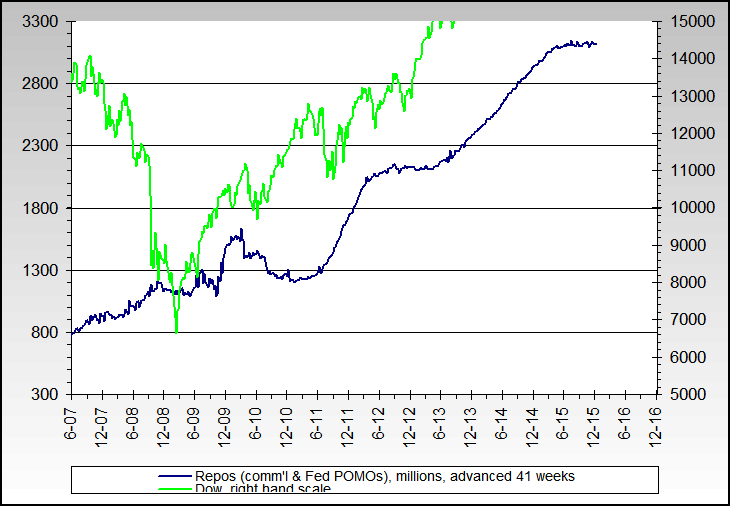

So repos would be inclusive/representative of all money supply changes? I guess I am confused ... I though they were just one of several Fed tools for manipulating money supply. Maybe you can clarify?

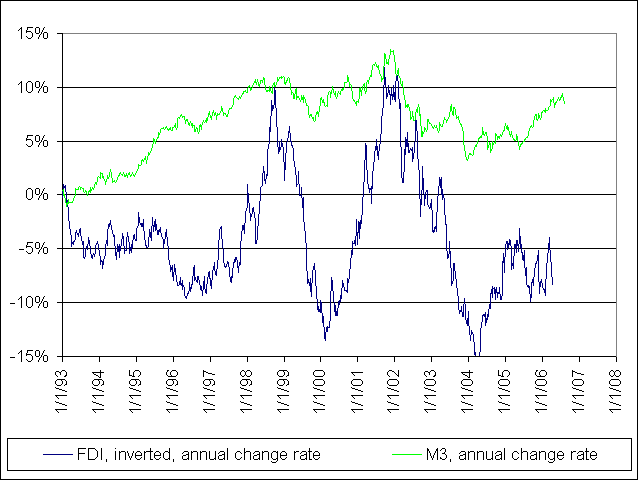

It depends - are you saying that something other than money supply drives price inflation? If it's money supply, then we should see some correlation between changes in m3b and changes in FDI.

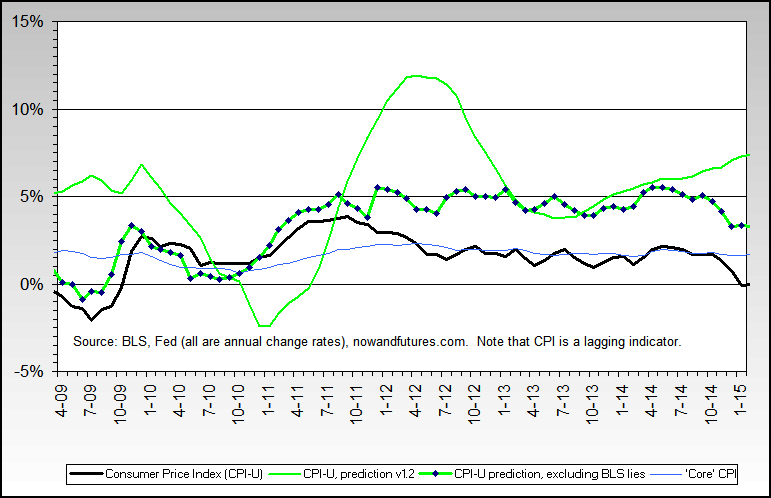

The only reservation I'd have about a CPI forecast is that the CPI is not a good measure of inflation to begin with. You are already familiar with my diatribes on that topic ... and have ventured a few yourself... ;)

Originally posted by bart

Originally posted by bart

The only reservation I'd have about a CPI forecast is that the CPI is not a good measure of inflation to begin with. You are already familiar with my diatribes on that topic ... and have ventured a few yourself... ;)

Comment