Re: the strong usd

the most interesting part being this; which to my way of thinking points towards an unnatural period of employment statistics reporting; Simply unbelievable!

Deficit-Driven Liquidity Shortage

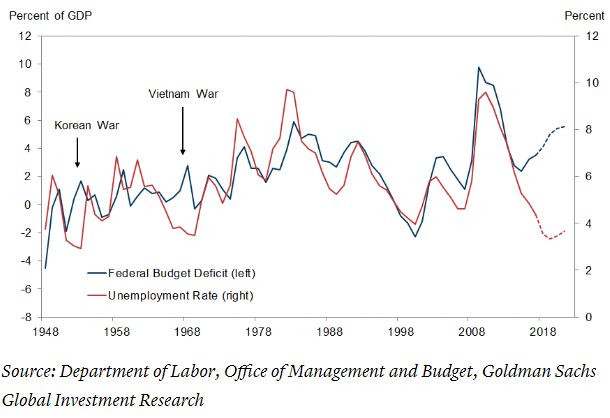

A significant chunk of U.S. economic outperformance over the past five years has been about fiscal stimulus.

In my opinion, this next chart is one of the most important visuals to be aware of over the next few years and I've included it in a few recent articles, because this isn't going away. The blue line is the U.S. federal budget deficit as a percentage of GDP. The red line is the unemployment rate. For the first time in modern history, the U.S. deficit is widening to a large deficit during a non-wartime non-recessionary period:

Chart Source: Goldman Sachs, Retrieved from CNBC

Originally posted by Chomsky

View Post

Deficit-Driven Liquidity Shortage

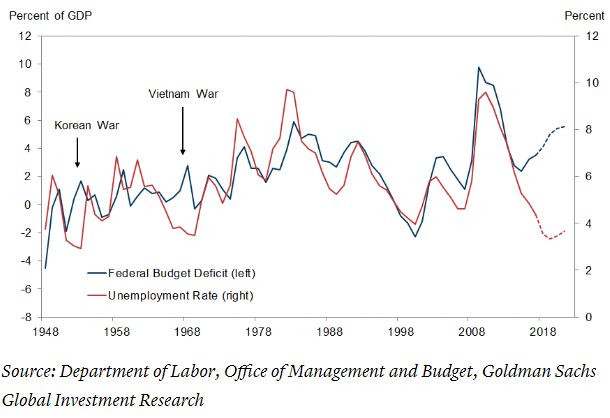

A significant chunk of U.S. economic outperformance over the past five years has been about fiscal stimulus.

In my opinion, this next chart is one of the most important visuals to be aware of over the next few years and I've included it in a few recent articles, because this isn't going away. The blue line is the U.S. federal budget deficit as a percentage of GDP. The red line is the unemployment rate. For the first time in modern history, the U.S. deficit is widening to a large deficit during a non-wartime non-recessionary period:

Chart Source: Goldman Sachs, Retrieved from CNBC

Comment