Announcement

Collapse

No announcement yet.

The "Forever" Canadian Housing Bubble

Collapse

X

-

Re: The "Forever" Canadian Housing Bubble

Originally posted by jk View Postdo you know anything about sales volumes? usually at tops sales volume goes way down as sellers don't want to adjust to the new reality. otoh, maybe it was the lifting of restrictions in china, eh?

Two part post.

Part I is response to above question regarding sales volumes. Three charts: Vancouver, Calgary and Toronto. All showing marked downtrend in sales volumes (mauve lines near bottom of each chart is sales volume).

Part II, "Owe Canada", below the charts, is an interesting read from the head of the Canada Mortgage and Housing Corporation, Evan Sidall. CMHC is a Federal agency, backed by the taxpayers, and is the largest mortgage insurance organization in the country. It's balance sheet has ballooned in the last 15 years as Canada has enjoyed the MOAB (Mother Of All (housing) Bubbles). If the downpayment is below a certain government mandated threshold (I think 20%?) then it is mandatory that buyers secure mortgage insurance.

Although the speaking notes carry the innocuous title "Supporting Financial Stability During the COVID-19 Pandemic", in actual fact there was some very sobering commentary from Mr Sidall to the Government of Canada's Standing Committee on Finance in Ottawa yesterday.

PART I

PART II

[Highlights below are mine]

https://www.cmhc-schl.gc.ca/en/media-newsroom/speeches/2020/supporting-financial-stability-during-covid19-pandemic

Supporting Financial Stability During the COVID-19 Pandemic

Thank you, Chair, for this opportunity to update the Committee on how CMHC is helping to stabilize Canada’s financial system and support the economic well-being of households and small businesses during the COVID-19 pandemic. My appearance before you today is also timely in informing you about new measures we are contemplating to promote housing affordability and to reduce risks to CMHC and to our economy.

Early in the crisis, in co-ordinated action with the Bank of Canada and the Department of Finance, we relaunched the Insured Mortgage Purchase Program...Under the current revised program, we stand ready to purchase up to $150 billion of insured mortgages...

...In addition, we acted quickly to help Canadians who are having difficulty paying their mortgages or rent due to income loss because of COVID-19. In co-ordination with private mortgage insurers, we are offering temporary deferral of mortgage payments for up to six months. We estimate that 12 per cent of mortgage holders have elected to defer payments so far, and that figure could reach nearly 20 per cent by September...

...However, as the Committee is no doubt aware, almost everything we have done in response to the crisis involves borrowing. Just as governments are taking on more debt to finance the COVID-19 response, mortgage deferrals are adding to already historic levels of household indebtedness.

Canadians are among world leaders in household debt. Pre-COVID, the ratio of gross debt to GDP for Canada was at 99 per cent. Due in part to increased borrowing but even more so to declines in GDP, we estimate it will increase to above 115 per cent in Q2 2020 and reach 130 per cent in Q3, before declining. These ratios are well in excess of the 80 per cent threshold above which the Bank for International Settlements has shown that national debt intensifies the drag on GDP growth.

Pre-COVID, the ratio of gross debt to GDP for Canada was at 99 per cent. Due in part to increased borrowing but even more so to declines in GDP, we estimate it will increase to above 115 per cent in Q2 2020 and reach 130 per cent in Q3, before declining. These ratios are well in excess of the 80 per cent threshold above which the Bank for International Settlements has shown that national debt intensifies the drag on GDP growth.

Looking at debt multiples of disposable income, that measure will climb from 176 per cent in late 2019 to well over 200 per cent through 2021. Moreover, CMHC is now forecasting a decline in average house prices of 9 – 18 per cent in the coming 12 months. The resulting combination of higher mortgage debt, declining house prices and increased unemployment is cause for concern for Canada’s longer-term financial stability.

The resulting combination of higher mortgage debt, declining house prices and increased unemployment is cause for concern for Canada’s longer-term financial stability.

A team is at work within CMHC to help manage a growing debt “deferral cliff” that looms in the fall, when some unemployed people will need to start paying their mortgages again. As much as one fifth of all mortgages could be in arrears if our economy has not recovered sufficiently...

...Our support for homeownership cannot be unlimited. Homeownership is like blood pressure: you can have too much of it. Housing demand is far easier to stimulate than supply and the result, as we’ve seen, is Economics 101: ever-increasing prices...

Last edited by GRG55; May 21, 2020, 12:38 AM.

Comment

-

Re: The "Forever" Canadian Housing Bubble

May data. Every major city except Ottawa and Montreal, the two cities that benefit most from Federal Government largess, is headed south now. By all appearances we are setting up for a "winter of discontent" in the Canadian property markets. Eight million households in Canada are on the COVID related income support program. Of 3.65 million mortgage holders almost 1 million elected to start deferring mortgage payments. Mortgage deferrals are significant and therefore total household debt is rising (the deferred payments are added to the end of the mortgage period, so are not forgiven, but add to the debt load). But then I thought Vancouver was in a bubble in 2010, a full decade ago, so WTF do I know...

"...Realtors across the country reported a jump of almost 70% in properties hitting the market in May after a barren April. Says (Robert) Hogue (economist at RBC): “There are early signs demand and supply are decoupling. We expect further decoupling in the period ahead. Economic hardship is no doubt taking a toll on a number of current homeowners — including investors. Some of them could be running out of options once government support programs and mortgage payment deferrals end, and may be compelled to sell their property.”

From Brian Ripley's chpc.biz site: http://www.chpc.biz/6-canadian-metros.html

Comment

-

Re: The "Forever" Canadian Housing Bubble

5 year term mortgage rates can now be had at <2% in Canada. Despite COVID-19 the property markets in Victoria, Vancouver, Toronto, Ottawa, Montreal, Halifax and a number of smaller centers throughout the country are back on fire again.

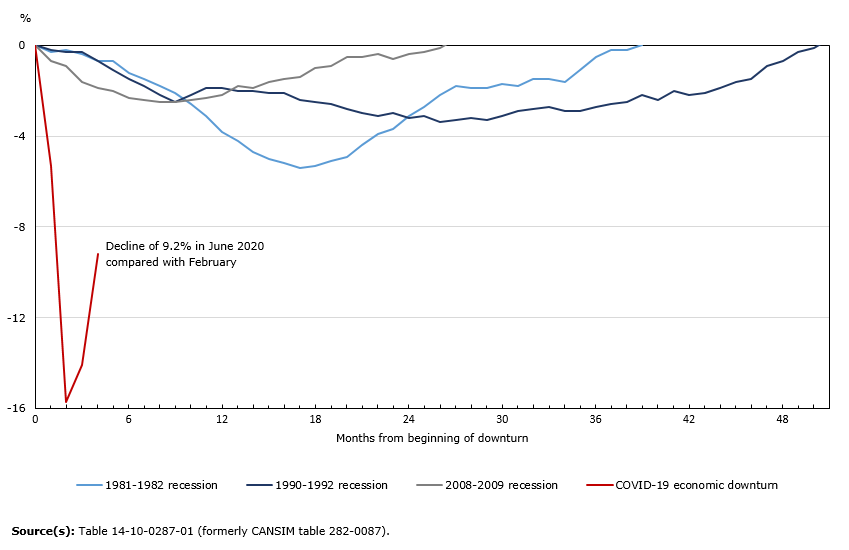

This in the face of record job losses this year:

The latest from Brian Ripley. Check out the upward inflections.

Comment

-

Re: The "Forever" Canadian Housing Bubble

The upward inflections in Canadian SFD housing prices continues in most markets...in the face of record unemployment, closed borders, massive government support payments and collapsing businesses. Toronto up, Ottawa up, long moribund Montreal up, even battered Edmonton and Calgary are showing signs of price inflation. Difficult to discern any serious correction going on in stratospheric Vancouver. Condos in the three major cities went flat long before COVID showed up.

Shows what Central Bank cheap money policy can really do. Extraordinarily powerful influence. For now.

5 year mortgages from the banks in Canada are now below 2%, if you can qualify.

So, hands up everyone here who thinks its those dastardly Chinese buyers doing this.

Comment

Comment