Has the Fed decided to end ZIRP?

This article says Yellen has made that decision.

https://www.nytimes.com/2017/09/26/u...inflation.html

Around here I've been complaining about ZIRP for a long time, saying it's well past time to reverse course.

Like the legendary dog that finally caught a car, I'm not sure I know what to do if it really happens.

It's interesting to think about and explore.

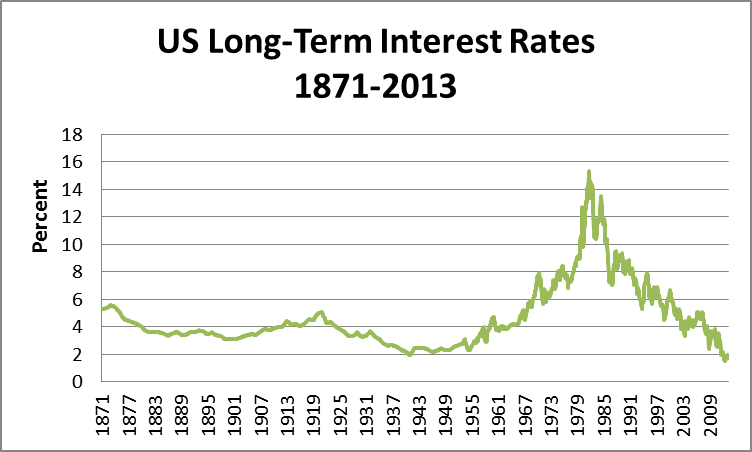

One of EJ's central themes leading up to the financial crisis was interest rates.

Namely, how that long slow decline in interest rates from Volker to Bernake served to juice up the economy for so long in some important ways.

You can see it here in this chart from Forbes, declining interest rates starting in 1981.

Perhaps it's time to discuss some general trends and investment strategies for scenarios with the fed raising rates a point every year for 5 years or more.

Will it be the 1950's again?

Warren Buffet made his fortune in that environment, so there is money to be made in a raising rates environment.

This article says Yellen has made that decision.

https://www.nytimes.com/2017/09/26/u...inflation.html

Around here I've been complaining about ZIRP for a long time, saying it's well past time to reverse course.

Like the legendary dog that finally caught a car, I'm not sure I know what to do if it really happens.

It's interesting to think about and explore.

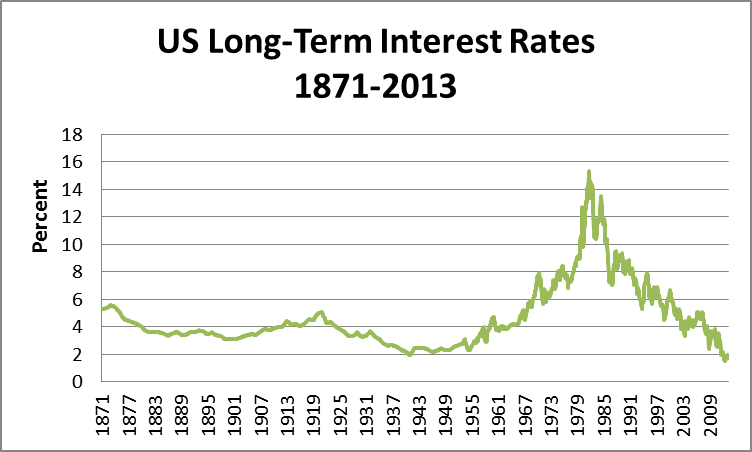

One of EJ's central themes leading up to the financial crisis was interest rates.

Namely, how that long slow decline in interest rates from Volker to Bernake served to juice up the economy for so long in some important ways.

You can see it here in this chart from Forbes, declining interest rates starting in 1981.

Perhaps it's time to discuss some general trends and investment strategies for scenarios with the fed raising rates a point every year for 5 years or more.

Will it be the 1950's again?

Warren Buffet made his fortune in that environment, so there is money to be made in a raising rates environment.

Comment