Re: Blockchain update

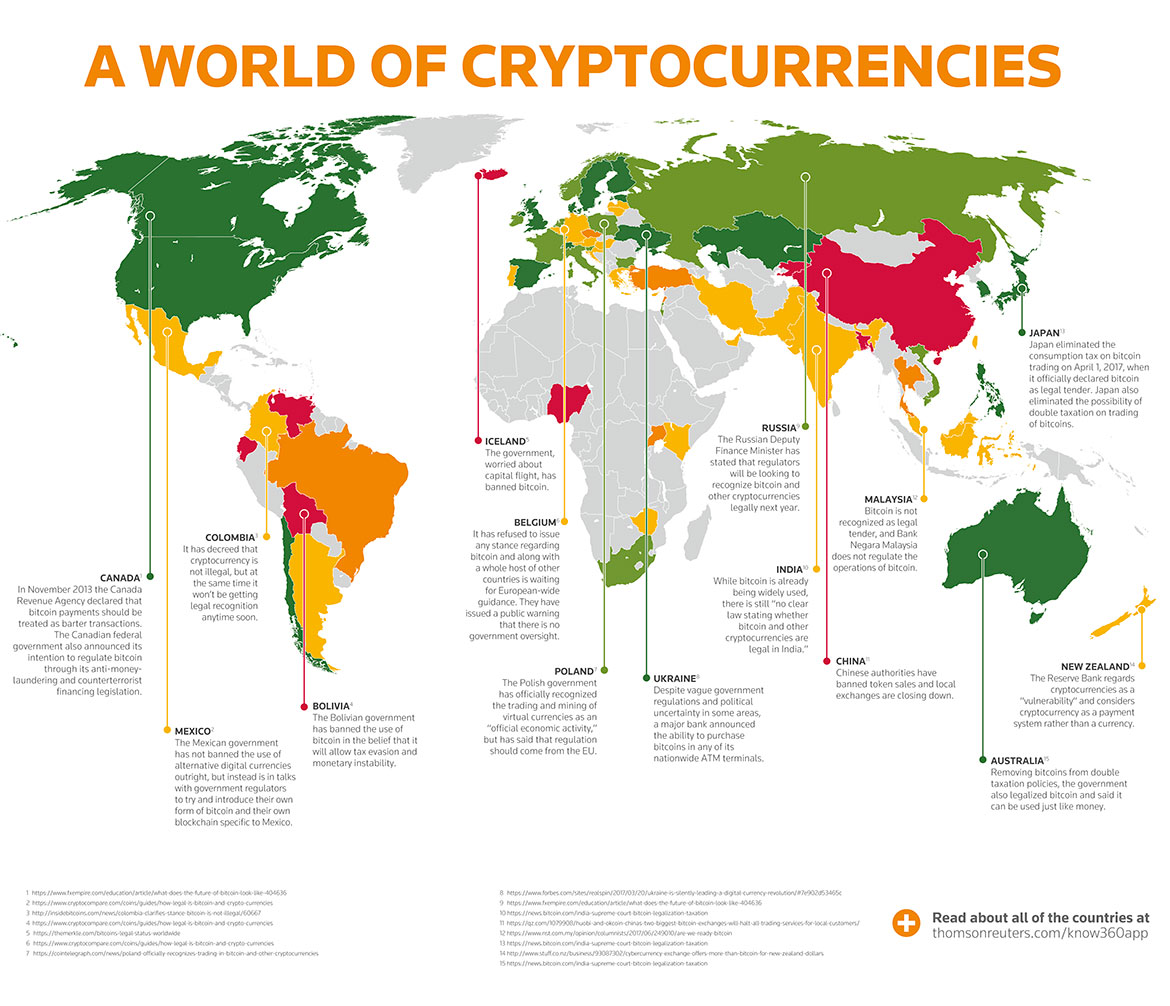

How about the legal aspect of cryptocurrency? Are cryptocurrencies actually legal in the first place? I do know that it is illegal to issue your own paper currency without approval from the government.

For example, if I were to create notes which I call "iTulip Dollars" and start selling these on ebay at a value of 1 iTulip $ = 1 US$, I can be arrested in many countries on many charges including money laundering.

On the other hand, I can print collector's game cards and sell them on ebay without any legal implications.

Originally posted by patrikkorda

View Post

How about the legal aspect of cryptocurrency? Are cryptocurrencies actually legal in the first place? I do know that it is illegal to issue your own paper currency without approval from the government.

For example, if I were to create notes which I call "iTulip Dollars" and start selling these on ebay at a value of 1 iTulip $ = 1 US$, I can be arrested in many countries on many charges including money laundering.

On the other hand, I can print collector's game cards and sell them on ebay without any legal implications.

Comment