|

23 comments |

Includes: DXJ, EWJ, JOF

Kevin Wilson⊕Follow(332 followers)

Registered investment advisor, contrarian, value, bonds

Send Message|

Website(125 clicks)

An underappreciated threat to the global economy involves the potential failure of Japan's NIRP measures, which, in conjunction with the apparent failure of Abenomics, may send Japan into its endgame.

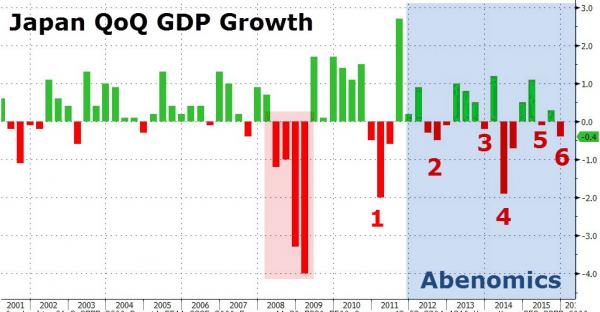

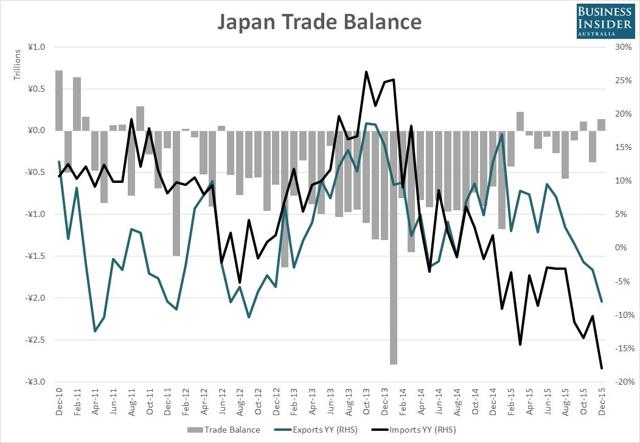

Japanese interest rate, money velocity, inflation, GDP, trade, consumer, currency exchange, and banking data all provide evidence of the failure of Abenomics and the potential failure of NIRP.

The Japanese stock and bond markets also reflect extreme stress, but the macro outlook is such that apparently cheap stocks may actually be the biggest short ever (EWJ, DXJ, JOF).

Hoarding of cash and a surge in sales of personal safes are potential harbingers of a deflationary death spiral in which consumers simply do not respond to government actions.

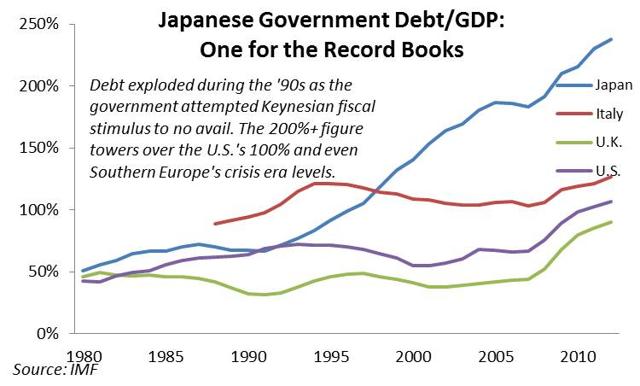

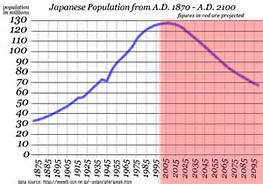

Given Japan's massive debt and demographic headwinds, the oncoming recession may trigger an endgame that would involve a possible depression, and eventual default and devaluation.

For some time, now many analysts have been focused on at least three major threats to the global economy: 1) the risk of a hard landing and currency devaluation in China; 2) the chance that Italy's failing banks and weakening economy will trigger the next round of the European financial crisis; and 3) the potential for a major credit crisis and trade collapse in emerging markets, as commodities continue their collapse and the dollar holds strong. There are, of course, other threats to the global economy as well, including one that should be getting more media coverage than it has: the chance that "Abenomics" fails and Japan finally gets to its endgame. Since the BOJ shifted unexpectedly to NIRP in late January, signs have started to appear that not only is NIRP failing to deliver on its promised improvements so far, but the opposite has transpired instead.

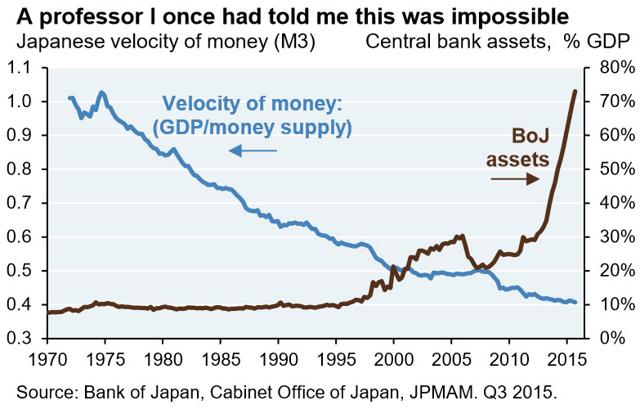

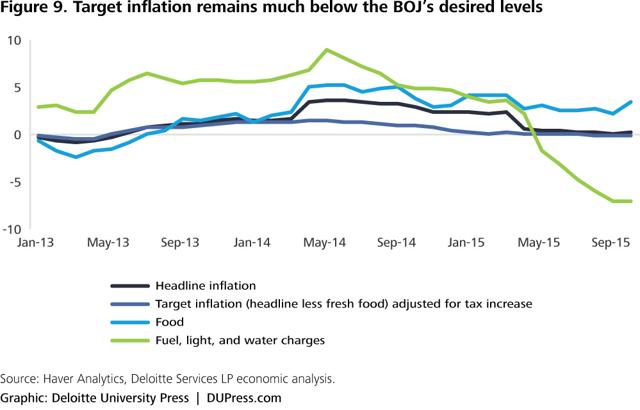

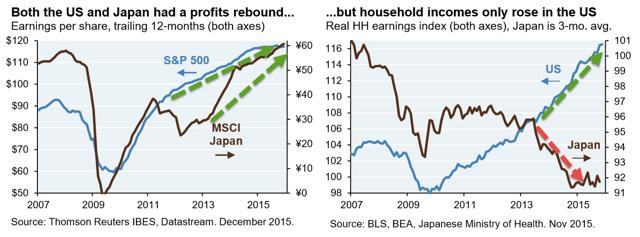

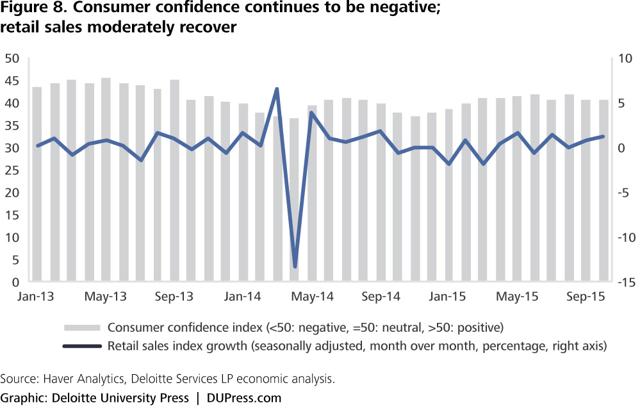

It was already evident that there were problems with Abenomics even before the NIRP decision. For example, the velocity of money has continued to fall, inflation has stayed stubbornly low or negative, household incomes were declining rather than rising, household spending declined sharply as the tax increases from Abenomics kicked in, and as a result, consumer confidence in Japan has been negative for years on end.

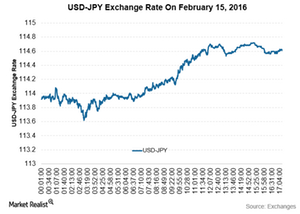

The yen initially fell dramatically under Abenomics, but has made little or no progress towards a lower valuation in the last 18 months or so. The yen was supposed to weaken even more under NIRP, but has instead paradoxically strengthened, at least in the short run.

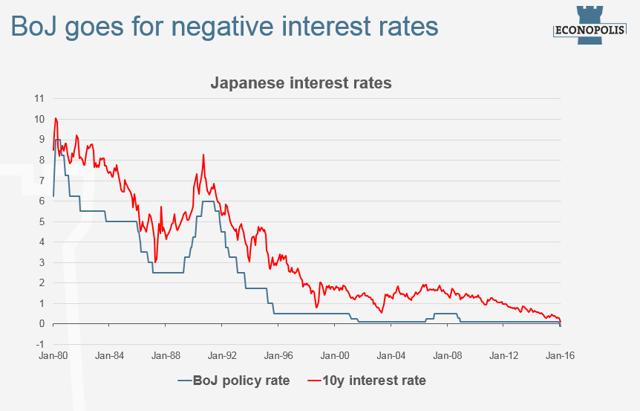

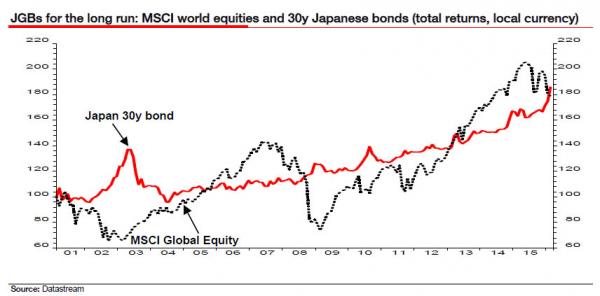

Japanese banks sold off massively in response to the decision on NIRP. Even the newly minted Japan Post Bank, which just had its IPO six months ago, plummeted over 20% below its IPO price, according to Gillian Tett of theFinancial Times. The JGB yield is now negative out to 10-year maturities.

Once again, Japanese bonds have defied the short-sellers and produced a capital gain for holders. Indeed, as renowned perma bear Albert Edwards of SocGen pointed out recently, for Japanese investors, the total return on the JGB 30-year bond has beaten that from the MSCI Global Equity Index over the last 15 years.

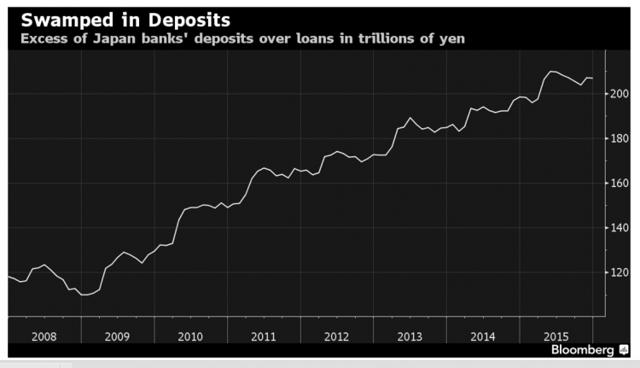

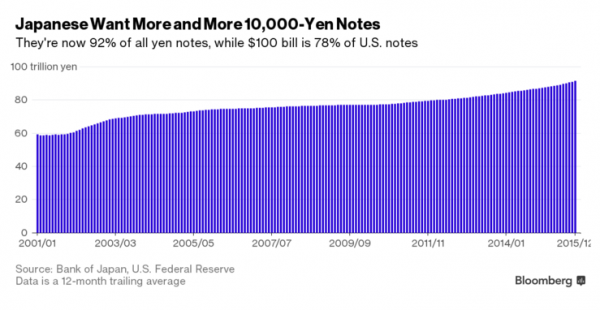

Demand for cash in Japan, always relatively high, has increased since the NIRP decision, according to Naohiko Baba, Tomohiro Ota, and Yuriko Tanaka at Goldman Sachs. They note that demand for cash is now very sensitive to interest rates, even to the point that cash and deposits are nearly perfect substitutes. Since deposit rates are so low now, there is little penalty or downside in holding cash. Not coincidentally, sales of household safes for storing (hoarding) cash have soared in Japan since the NIRP decision.

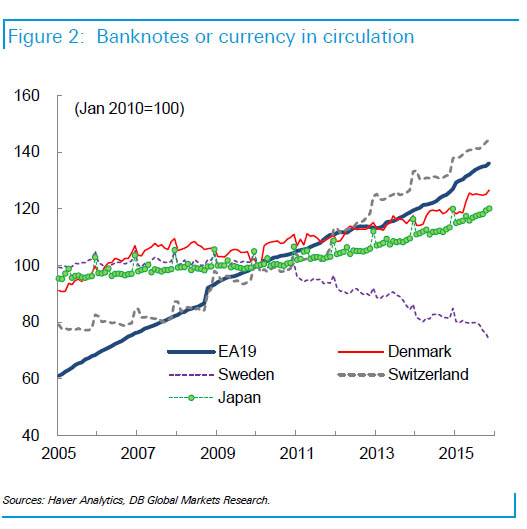

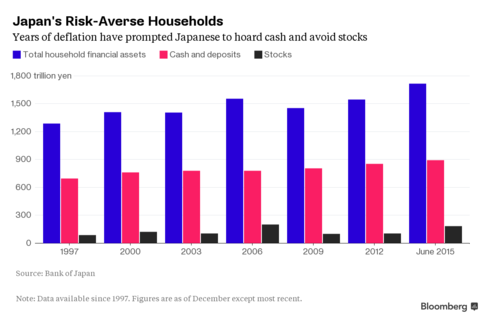

Hoarding is about the worst consumer outcome one can imagine, relative to the ultimate success or failure of Abenomics. Of course, years of market underperformance, deflation, and ZIRP have convinced Japanese consumers (the famous mythical investor "Mrs. Watanabe") to preserve cash assets and avoid stocks. Clearly, the BOJ's recent NIRP decision has backfired with the already fearful average Japanese consumer. The number of banknotes in circulation in Japan is extremely high relative to GDP and to other national economies, such as those of the USA, Switzerland, the eurozone, Denmark, and Sweden. This is in part due to a Japanese cultural preference for cash, and in part due to the long-term decline in deposit rates. Note that all of these, except the USA, already have NIRP in place, in some cases for years now.

As I have said elsewhere, the debt-deflation cycle in Japan has resisted Keynesian and monetary stimulus, including extreme measures like QQE and ZIRP, for years. Japan is again entering recession, deflation has again reared its head, and trade has given up its early gains under Abenomics and is now in serious decline again. Virtually every aspect of Abenomics is now in failure mode, and since the reform part of the package has never been enacted, it is unlikely that the government can regroup in a meaningful way under present conditions.

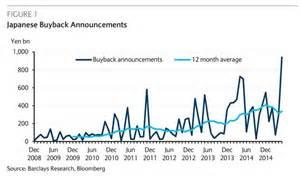

Years of stubborn adherence to theory has scared the populace into a semi-permanent skepticism and deep fear about what is coming. The government, despite its good intentions, has failed to sell the deal. Now, the Japanese government faces a thoroughly discouraged and mistrusting consumer, who is hoarding cash in the same way that many people did during the Great Depression. A deflationary death spiral may be on the way. The Japanese corporate sector has not responded to calls from the government to increase wages, but it has been willing to exploit cheap money for some malinvestment games, like share buyback programs.

Given the absolutely enormous debt load on the Japanese economy, and the structural headwinds they face as a result of deteriorating demographics, it seems to me that the Japanese economy, as noted years ago by author John Mauldin, is "a fly in search of a windshield."

I believe the failure of NIRP is going to provide that metaphorical windshield in the next two years or less, as Japan at last faces its endgame. I make this somewhat bold prediction based on the fact that the country is already monetizing the majority of their deficit, has more income from debt than they do from tax receipts, has already conducted the biggest QQE stimulus on the planet by far, and will face far worse trouble as the recession takes root. Something like this was predicted years ago by Mauldin and his co-author Jonathan Tepper (see their book Endgame, 2011, John Wiley & Sons, New York, 318p). Those who think Japanese stocks (EWJ, DXJ, JOF) look cheap right now should bear in mind that the macro picture is about to turn as ugly as it ever gets. In fact, in my opinion, Japan Inc. is the biggest short ever, just as hedge fund manager Kyle Bass said it would be. And if you are looking for something that could finally trigger a US recession, assuming we are not already in one by then, I think an event like this would easily qualify.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: BWCA is a state registered investment adviser in all states in which it is required to be registered. All Blue Water Capital Advisorsí customer assets are held in the customerís name with TD Ameritrade Institutional Services, clearing through TD Ameritrade Clearing, Inc, Member FINRA/SIPC, TD Ameritrade Inc. a Qualified Custodia

Comment