IMF to make Chinese yuan reserve currency in historic move

Renminbi will join basket of elite currencies including dollar, pound, euro and yen

The yuan will be included with the pound, dollar, euro and yen Photo: AFP

The yuan will be included with the pound, dollar, euro and yen Photo: AFP

By James Titcomb

4:30PM GMT 29 Nov 2015

Follow

2 Comments

2 Comments

The International Monetary Fund is to give the yuan a historic vote of confidence on Monday when it includes the Chinese currency in its elite club of major currencies.

The yuan, also known as the renminbi, is widely expected to be added to the IMF’s group of international reserve currencies after an IMF meeting held by its managing director Christine Lagarde.

It comes after lengthy efforts by Chinese officials to legitimise the yuan, which critics say has been kept artificially cheap to artificially boost exports in the world’s second-largest economy.

China has lobbied hard for the currency to be included in the list, which at present is made up of just the dollar, the euro, the pound and the Japanese yen. The list has not been altered since 2000, when the euro replace the franc and deutschmark.

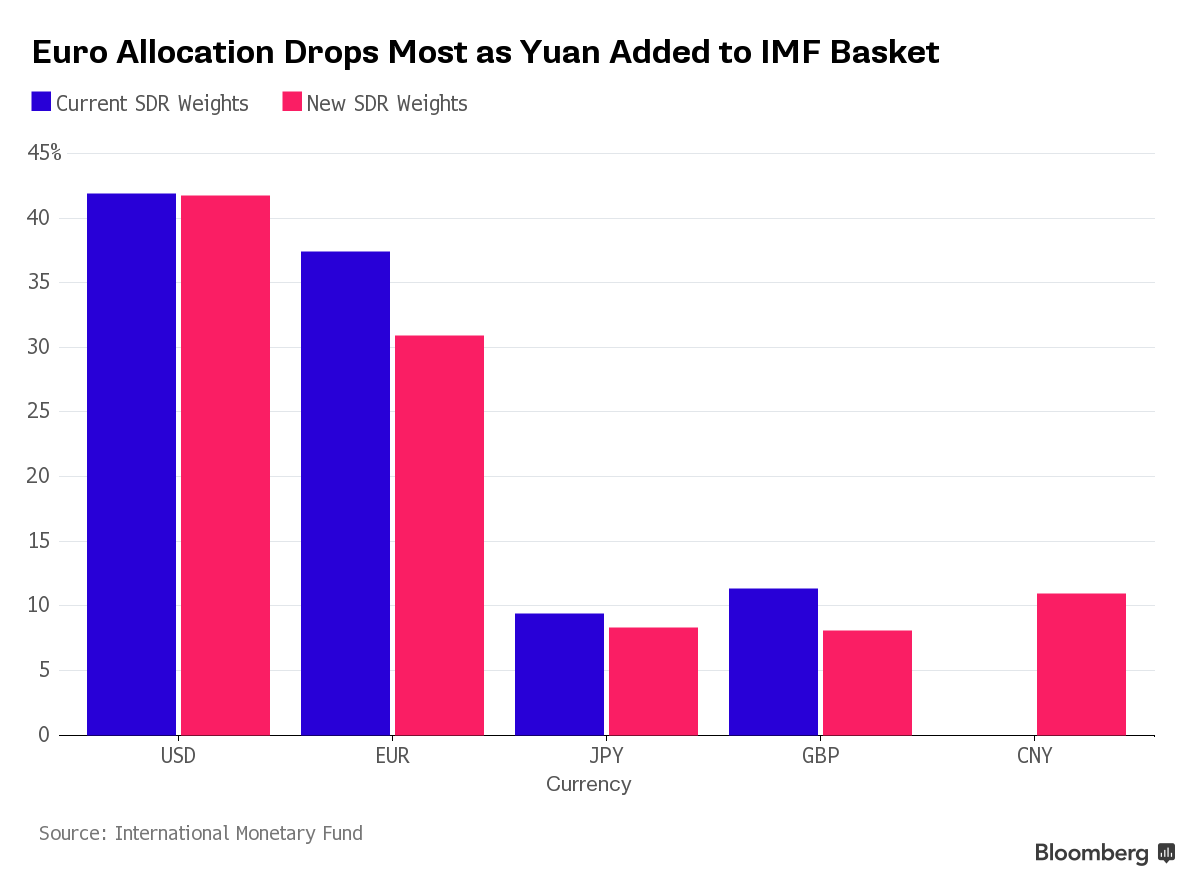

While being a part of the club carries no particular conditions, and is largely symbolic, the yuan will contribute to the value of the special drawing right – a weighted average of the currencies – which the IMF uses to price its emergency loans.

Christine Lagarde, managing director of the IMF Photo: AP

Christine Lagarde, managing director of the IMF Photo: AP

More significant is the diplomatic legitimacy that inclusion will grant the yuan, whose value is carefully managed by Chinese authorities. Officials devalued it over the summer in a shock move to respond to slowing growth, but it is still seen as tightly controlled with the country’s central bank lacking transparency.

Being included in the IMF basket will draw additional scrutiny and see officials encouraged to open up the currency at the same time that China faces economic slowdown, which could put the brakes on reform.

Although the decision is expected to be announced today, the yuan will not officially become a reserve currency until September 2016.

Renminbi will join basket of elite currencies including dollar, pound, euro and yen

The yuan will be included with the pound, dollar, euro and yen Photo: AFP

The yuan will be included with the pound, dollar, euro and yen Photo: AFP

By James Titcomb

4:30PM GMT 29 Nov 2015

Follow

2 Comments

2 Comments The International Monetary Fund is to give the yuan a historic vote of confidence on Monday when it includes the Chinese currency in its elite club of major currencies.

The yuan, also known as the renminbi, is widely expected to be added to the IMF’s group of international reserve currencies after an IMF meeting held by its managing director Christine Lagarde.

It comes after lengthy efforts by Chinese officials to legitimise the yuan, which critics say has been kept artificially cheap to artificially boost exports in the world’s second-largest economy.

China has lobbied hard for the currency to be included in the list, which at present is made up of just the dollar, the euro, the pound and the Japanese yen. The list has not been altered since 2000, when the euro replace the franc and deutschmark.

While being a part of the club carries no particular conditions, and is largely symbolic, the yuan will contribute to the value of the special drawing right – a weighted average of the currencies – which the IMF uses to price its emergency loans.

Christine Lagarde, managing director of the IMF Photo: AP

Christine Lagarde, managing director of the IMF Photo: APMore significant is the diplomatic legitimacy that inclusion will grant the yuan, whose value is carefully managed by Chinese authorities. Officials devalued it over the summer in a shock move to respond to slowing growth, but it is still seen as tightly controlled with the country’s central bank lacking transparency.

Being included in the IMF basket will draw additional scrutiny and see officials encouraged to open up the currency at the same time that China faces economic slowdown, which could put the brakes on reform.

Although the decision is expected to be announced today, the yuan will not officially become a reserve currency until September 2016.

Comment