Announcement

Collapse

No announcement yet.

Peaceful protests don't work!

Collapse

X

-

Re: Peaceful protests don't work!

How Iraq has left us with the biggest financial bubble in history

Iraq has been a catastrophe on many fronts, but its dire economic and financial consequences are only now becoming fully understoodFacebook 4Twitter 27Pinterest 0LinkedIn 0Share 31Email

Isil's murderous thugs are only part of the disaster of Iraq. The rest is economic

Isil's murderous thugs are only part of the disaster of Iraq. The rest is economic

Visit Costa Rica on a dream cruise The Thomson Cruises Pride of Panama itinerary calls at a host of exotic destinations, including Costa Rica, Panama and Colombia

Sponsored by Thomson Cruises

By Jeremy Warner

7:08PM BST 19 May 2015

Follow

14 Comments

14 Comments

All history is contemporary history, according to the Italian philosopher Benedetto Croce, by which he meant that historical analysis tends to tell you as much about the time it was written as the past itself; inevitably, history is seen through the prism of the present.

For Tony Blair, architect of Britain’s involvement in the Iraqi war, Croce's truism offers only the slenderest of hopes to cling to as he contemplates the stain on his legacy of this desperately misjudged piece of foreign adventurism. Yet it is the only one he’s got – that in the fullness of time, the judgment of history might be a little kinder on him than it is now.

For the moment, however, Iraq is seen not just as a mistake - based on a delusion assessment of the threat posed by Saddam Hussein, if not an outright lie - but a monumental, geopolitical disaster.

Isil’s latest surge, unleashing yet another wave of maniacal vermin on an undeserving and civilised people, only serves to reinforce this damning verdict. If it ever sees the light of day, the doorstopper of a report by the Chilcot committee of inquiry – now coming up for an astonishing six years in the making – is unlikely to provide much in the way of mitigation.

Yet one thing Chilcot will not be touching on is the wider economic consequences of Iraq and the events leading up to it. On many levels, these have proved equally disastrous, and in terms of their impact on Western growth potential, utterly catastrophic. It is not just the direct costs, which including Afghanistan are already estimated at around $4 trillion for the US alone. Even as Keynesian-style stimulus, it is hard to argue that this “investment” will ever reach payback.

PKK fighters adjust a machine gun as they prepare to join others near a position which had been hit by Islamic State car bombs in Sinjar

Yet much worse are the wider economic and financial effects. For what Iraq also did was light the fuse on a series of policy mistakes in our own backyard, the consequences of which are still very much with us today in the manifest and destabilising mismatch between depressed incomes and booming asset prices.

It is one of the great imponderables of modern economics – was it globalisation and the accompanying Asian savings glut that caused the financial crisis, or was it unduly loose monetary policy and the hubris of bankers? Were central banks merely accommodating wider trends in global markets by cutting policy rates so low, or by doing so were they leading us over the cliff?

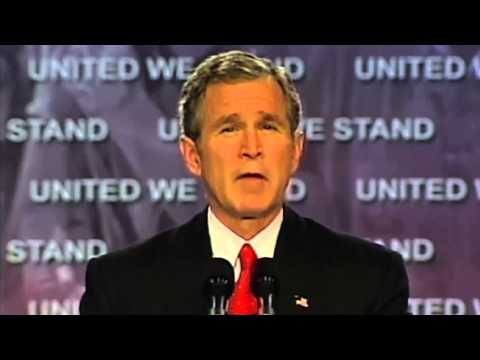

To me it seems clear that central banks must take at least some of the blame for where we are today. I have a vivid recollection of the lead-up to the Iraqi invasion, and in particular a speech by Colin Powell, then US Secretary of State, at Davos just a few months before it happened. If it wasn’t already obvious, participants were left in no doubt that with or without international support, the US was about to go to war.

In the immediate aftermath of the speech, economists and former policy makers lined up to say that the Federal Reserve would have no option but to cut interest rates to zero and perhaps beyond to counter the damage to confidence. It was the first time I had ever come across the term “quantitative easing”, later to become part of the economic lexicon, but it was this sort of monetary mumbo jumbo that some participants were already talking about.

As the stock market plumbed new depths, Howard Davies, then chairman of Britain’s Financial Services Authority, was called home early to deal with growing fears for the solvency of the UK insurance sector. It was an early wake-up call for the earthquake to come in five years' time. Yet it was met in time-honoured fashion with yet further bouts of stimulus.

A PKK fighter looks towards a position which has been hit by Islamic State car bombs in Sinjar

Iraq couldn’t be described as the start of it; that more correctly came from the bursting of the dot-com bubble, and then a year later from the shock to confidence of 9/11. But it very much fitted the pattern by which all economic setbacks and shocks, rather than being allowed to run their course, are answered with another heavy dose of supposedly counteractive monetary activism.

Iraq was just the latest example of what had become known as the “Greenspan put”, the reassuring knowledge that whenever disaster threatened, the cavalry of the US Federal Reserve could always be relied on to come riding over the hill. From the stock market crash of 1987 onwards the Fed became the favoured economic fix. As each bubble burst, the monetary authorities would respond by sowing the seeds for the next one.

What Iraq did was set the stage for the final, disastrous, blow-off in already grossly inflated financial markets. In the process, advanced economies became almost wholly dependent on cheap debt to support growth. It wasn’t just mortgages and credit cards; governments also used the easy money environment to take the lid off spending or, in America’s case, cut taxes.

Fast-forward to today, and we find a world even more awash with central bank money printing than it was back then. It’s hard to argue that this was the wrong response to the financial crisis. The alternative of mass liquidation was tried in the 1930s, and it is fair to say that it did not end well. It is also true that contrary to much prediction at the time, it has not proved particularly inflationary. To the contrary, Britain has recorded its first negative annual rate of inflation since 1960.

Iraqi soldiers fire their weapons towards Islamic State positions in the Garma district, west of the Iraqi capital Baghdad

One thing it has done, however, is put a renewed rocket under asset prices. From fine art and metropolitan property prices, to bond markets and equities, seemingly everything has gone through the roof. This at a time when income growth in many advanced economies has slowed to a virtual standstill. Global debt, on the other hand, has continued to rise at a frightening pace.

If there is one thing we have learned from the history of credit cycles, it is that big debt overhangs tend to be economically highly toxic, especially in a lowflation, slow-growth world when the normal process of debt erosion via higher prices and incomes becomes impaired.

The financial crisis should have been a cathartic, cure all event. It has not proved so. The folly of men, and the debt markets they create, continues largely unchecked.

The invasion of Iraq has become a geo-political train crash, which seems destined, once Isil has been defeated, to turn large parts of the region into little more than an Iranian colony.

As for the world economy, it has proved equally destructive, turbo-charging in its policy response a series of destabilising bubbles which are virtually certain to end badly.

All history is indeed contemporary history, but it is hard to envisage an age when the Bush/Blair legacy will be seen as in any way an enlightened one.

Comment

Comment