Back in April 2013, Apple shocked the world when in a dramatic U-turn to Steve Jobs beliefs, it announced what was "the largest single share repurchase authorization in history" when it boosted its share repurchase authorization to $60 billion from $10 billion. Today, GE did its best to match this number, when it reported that as part of a massive business restructuring, it announced a "new Board authorization of up to $50B buyback."

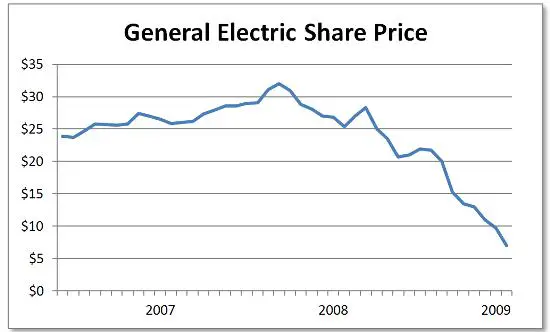

The main reason for this near record buyback announcement is two-fold: GE's belief that there is no incremental value left in GE Capital, the bulk of whose assets it is selling, a division which nearly bankrupted the conglomerate back in 2008 when as a result of its massive leverage, anywhere between 9x and 10x...

... the division that was more profitable than the Industrial section precisely due to this massive leverage...

...forced GE to participate in any number of the freshly created bailout programs and which led to GE being branded a Systemically Important Financial Institution, or SIFI, a stigma which management was less than happy with. As a result of the GECC sale, Jeff Immelt was delighted to report that it "will eliminate the only Industrial, wholesale-funded, non-bank SIFI." The proud buyers of the bulk of GE Capital's assets: Blackstone and Wells Fargo, who are part of a $22.5 billion sale agreement.

So just how will GE fund the massive buyback and generate "up to $90 billion in potential return to shareholders"? Here is the breakdown from the just released presentation:

Why is the company doing this transaction now? Here are its thoughts:

Visually, this is what GE is selling and what it is keeping.

A drilldown into the assets to be sold:

And while GE winddowns the bulk of GE Capital, this is what it will do with the proceeds:

The funniest part of the presentation: the financial bridge, which shows that all the losses due to the company's decline (25 cents in the next 3 years), will be matched by the gains from the collapse in the amount of outstanding GE stock (25 cent buyback impact boost).

And what goes without saying is that the main driver for the mega transaction is that without the SIFI overhang of "Capital", Industrial now becomes a very atttractive acquisition target for an acquisitive international acquirer. Because in the New Normal Siemens issuing €200 billion in negative interest debt to acquire GE sounds like just the kind of centrally-planned insanity that the central banks have unleashed on the world.

Plus it's clear that Immelt is tired of managing this behemoth and wants to rest.

The main reason for this near record buyback announcement is two-fold: GE's belief that there is no incremental value left in GE Capital, the bulk of whose assets it is selling, a division which nearly bankrupted the conglomerate back in 2008 when as a result of its massive leverage, anywhere between 9x and 10x...

... the division that was more profitable than the Industrial section precisely due to this massive leverage...

...forced GE to participate in any number of the freshly created bailout programs and which led to GE being branded a Systemically Important Financial Institution, or SIFI, a stigma which management was less than happy with. As a result of the GECC sale, Jeff Immelt was delighted to report that it "will eliminate the only Industrial, wholesale-funded, non-bank SIFI." The proud buyers of the bulk of GE Capital's assets: Blackstone and Wells Fargo, who are part of a $22.5 billion sale agreement.

So just how will GE fund the massive buyback and generate "up to $90 billion in potential return to shareholders"? Here is the breakdown from the just released presentation:

- $26.5B of Real Estate transactions announced

- Plan to sell ~$200B of ENI ex. liquidity (~$260B of assets) … day 1 charge of ~$16B, including $2.4B disc. ops. charge for Real Estate

Why is the company doing this transaction now? Here are its thoughts:

- Business model for large, wholesale-funded Finco has changed dramatically; more difficult to generate acceptable returns

- Synchrony and other dispositions are proof points that GE Capital platforms are more valuable elsewhere

- Strong seller’s market for financial assets, with good GE track record of execution and value realization

- More clarity on SIFI de-designation process

- Efficient approach for exiting non-vertical assets that works for GE and GE Capital debtholders and GE shareholders, including guaranteeing GE Capital debt-a)

Visually, this is what GE is selling and what it is keeping.

A drilldown into the assets to be sold:

And while GE winddowns the bulk of GE Capital, this is what it will do with the proceeds:

The funniest part of the presentation: the financial bridge, which shows that all the losses due to the company's decline (25 cents in the next 3 years), will be matched by the gains from the collapse in the amount of outstanding GE stock (25 cent buyback impact boost).

And what goes without saying is that the main driver for the mega transaction is that without the SIFI overhang of "Capital", Industrial now becomes a very atttractive acquisition target for an acquisitive international acquirer. Because in the New Normal Siemens issuing €200 billion in negative interest debt to acquire GE sounds like just the kind of centrally-planned insanity that the central banks have unleashed on the world.

Plus it's clear that Immelt is tired of managing this behemoth and wants to rest.

Comment