Janet’s Yellen’s pettifogging today about her patient lack of impatience was downright pathetic. Her verbal hair-splitting is starting to make medieval ritual incantations sound coherent by comparison.

But unlike the financial media’s dopey dithering about “dot plots”, Yellen at least has something to hide behind all the gibberish. Namely, she and her merry band of money printers are becoming more petrified each month that they will trigger a thundering Wall Street hissy fit if they move to “normalize” interest rates—-even as they are slowly beginning to realize that continuance of ZIRP much longer will only intensify the market’s addiction to rampant speculation, free money carry trades and the associated risks to financial stability.

But the Fed’s new found worry that it’s tsunami of liquidity might have untoward effects doesn’t even rank as a death bed conversion. It’s way too late to worry about a financial bubble that has become epic in scope and danger; and its especially too late to think that it can be weasel-worded down from its Brobdingnagian heights.

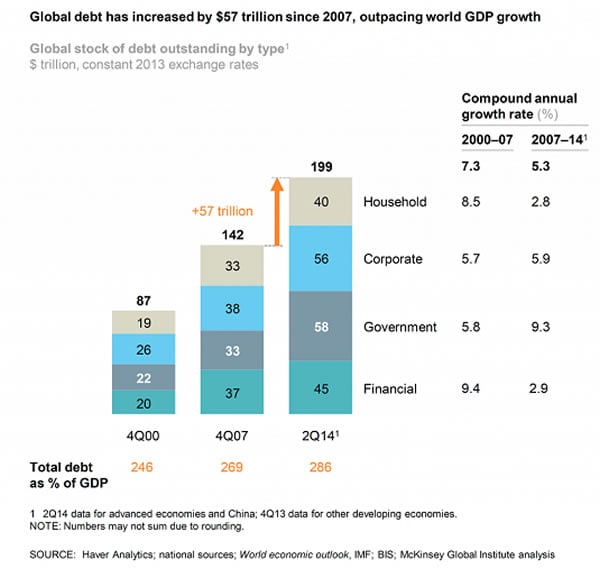

The reason the Fed is impaled in a monster trap is that history is closing in on it. We have now had upwards of three decades of increasingly aggressive monetary inflation—-a corrosive trend culminating in what will be 80 months of zero money market rates and a massive monetization of debt claims that originally funded the consumption of real labor and capital resources.

Needless to say, that has generated a dangerous and ever widening disconnect between the real main street economy and the nominal value of assets in the financial system. This rupture has been called “financialization”, but it amounts to this: Fed attempts at monetary stimulus are now wholly contained within the financial system where it generates persistent inflation of existing asset values. That is, stimulus never leaves the canyons of Wall Street.

There is no monetary policy transmission outward to the real economy because the credit channel to households and businesses is terminally busted. This condition is partially owing to peak debt among households, meaning that they can’t borrow any more even if the interest carry cost is virtually free; and also due to financial arbitrage in the corporate sector, where equity is being systematically strip-mined by debt-financed financial engineering in the form of stock buybacks, M&A takeovers and LBOs.

Accordingly, the financial system has ballooned dramatically faster than the real economy over recent decades—–even when measured by nominal GDP, including the latter’s considerable element of pure price inflation on a cumulative long-term basis. The economic tether between the two, therefore, is now stretched like a rubber band to the breaking point. The possibility it might snap and cause a drastic implosion of the financial system is what the monetary politburo fears, even if it fails to realize the full extend of the danger.

A big picture approximation of this disconnect can be seen in the ratio of the market value of corporate equities compared to nominal GDP. Even on a pure read-the-charts basis, it is evident that at the current market capitalization-to-GDP ratio of 127%—-we are on the far edge of historical observation. In fact, during the 250 quarters since 1950 shown in the graph, the ratio has been higher only 4 times. And that was at the lunatic peak of the dotcom bubble in late 1999 and 2000!

Yet that’s only the half of it. Prior to Greenspan’s arrival at the Fed in 1987, and the subsequent evolution of the wealth effects doctrine and practice at the Fed under his superintendence, the mean ratio of market cap to GDP averaged about 60% and the cyclical amplitude fluctuated between 40% and 80%. Since 1994 when the Fed capitulated to Wall Street during the bond market bust and the Mexican peso crisis, however, the ratio has averaged nearly 100% of GDP and the amplitude of cyclical oscillation has widened dramatically.

The point is that this is not just about timeless chart cycles which rise and fall——although even in that context the current point is obviously precarious by all past experience. Instead, the reality is that we are in a new, central bank-driven serial bubble cycle that reflects the progressive radicalization of monetary policy.

The implications of this financialization are vast. In no sense is the Fed any longer rationally or proactively managing the main street macro-cycle as in the pre-Greenspan era—-whether this really worked effectively and efficiently or not. Now it is simply racing ahead of the tidal wave of financial inflation that it unleashes in the canyons of Wall Street, hoping not to be overtaken by the inexorable bust which follows speculative booms.

As always, the bullish crowd in the casino thinks this time is different, but actually this time is more dangerous. Sooner or later the bubble will burst when the last sheep are herded into the casino, as has happened already twice this century. But now the financial system’s tether to the real economy is extended like never before in history, meaning that the Fed’s dithering and dissimulation—on full display once again today—–will only result in a more traumatic dislocation eventually.

On this score, the recent Q4 release of the flow of funds report, which showed household net worth has now vaulted well above it levels during the previous two market peaks, is telling. As shown below, net worth is soaring and now stands at $83 trillion as of Q4 2014. That compares to $68 trillion at the pre-Lehman peak and only $45 billion at the time of the dotcom bubble.

Needless to say, these dramatic gains have occurred not because households are saving and investing more or because the US economy has become dramatically more productive and profitable. In fact, it represents a vast inflation of financial and real estate assets.

Even if the current $83 trillion household wealth figure is adjusted for the GDP deflator, it still means that there has been a 40% gain in aggregate real household net worth since the turn of the century. By contrast, real wage and salary income is up by only 17% and median real household income is actually down from $57k to $52k or by nearly 10%.

This latter figure highlights the double whammy of central bank driven financialization. One the on hand, financial asset valuations are unsustainably inflated; yet even the so-called wealth effects from these artificial and ultimately temporary gains have not trickled down to the 90% of households which account for only a tiny fraction of financial assets. As a result, there is no kicker to GDP outside of upper-income conspicuous consumption, even as the financial bubble steadily enlarges.

Not only is this a problem for financial stability, it may also eventually become an even more potent challenge to political stability. Indeed, the 7X gap between mean household net worth of $300k and median net worth of $45k suggests that the day of pitchforks and torches may not be all that far down the road.

Meanwhile, the financialization timebomb remains lodged in the markets. Aggregate household net worth has soared not because there has been any meaningful deleveraging since the financial crisis. In fact, household debt has declined only marginally—-after soaring for more than three decades.

And that gets to the heart of the danger. Notwithstanding this enormous rise in aggregate debt, net worth has continued to surge because asset values have been so dramatically inflated. Thus, the ratio of household financial assets to GDP now stands far above any prior history.

When household real estate is added, which is also driven by financialization, the picture is even more extreme. In 1970 the combined value of household real estate and financial assets was $3.9 trillion and it represented just 3.5X GDP. Even after the fed induced inflation of the 1970s, the combined value was only $19 trillion or 3.9X GDP when Greenspan arrived at the Fed in 1987.

By contrast, household real estate and financial assets today total $92 trillion or 5.2X GDP. There is absolutely no explanation for this aberrant condition other than the radical monetary inflation fueled by the nation’s central bank. If anything, the efficiency, international competitiveness and growth capacity of the main street economy has eroded measurably since the early 1970s, meaning that valuation multiples should have been tempered, not dramatically enlarged.

So we have learned once again today that the Fed still has a lot of patience. Perhaps we will also soon learn that by cowering its way forward our monetary politburo is making the eventual day of reckoning all the more perilous.

Stockman

But unlike the financial media’s dopey dithering about “dot plots”, Yellen at least has something to hide behind all the gibberish. Namely, she and her merry band of money printers are becoming more petrified each month that they will trigger a thundering Wall Street hissy fit if they move to “normalize” interest rates—-even as they are slowly beginning to realize that continuance of ZIRP much longer will only intensify the market’s addiction to rampant speculation, free money carry trades and the associated risks to financial stability.

But the Fed’s new found worry that it’s tsunami of liquidity might have untoward effects doesn’t even rank as a death bed conversion. It’s way too late to worry about a financial bubble that has become epic in scope and danger; and its especially too late to think that it can be weasel-worded down from its Brobdingnagian heights.

The reason the Fed is impaled in a monster trap is that history is closing in on it. We have now had upwards of three decades of increasingly aggressive monetary inflation—-a corrosive trend culminating in what will be 80 months of zero money market rates and a massive monetization of debt claims that originally funded the consumption of real labor and capital resources.

Needless to say, that has generated a dangerous and ever widening disconnect between the real main street economy and the nominal value of assets in the financial system. This rupture has been called “financialization”, but it amounts to this: Fed attempts at monetary stimulus are now wholly contained within the financial system where it generates persistent inflation of existing asset values. That is, stimulus never leaves the canyons of Wall Street.

There is no monetary policy transmission outward to the real economy because the credit channel to households and businesses is terminally busted. This condition is partially owing to peak debt among households, meaning that they can’t borrow any more even if the interest carry cost is virtually free; and also due to financial arbitrage in the corporate sector, where equity is being systematically strip-mined by debt-financed financial engineering in the form of stock buybacks, M&A takeovers and LBOs.

Accordingly, the financial system has ballooned dramatically faster than the real economy over recent decades—–even when measured by nominal GDP, including the latter’s considerable element of pure price inflation on a cumulative long-term basis. The economic tether between the two, therefore, is now stretched like a rubber band to the breaking point. The possibility it might snap and cause a drastic implosion of the financial system is what the monetary politburo fears, even if it fails to realize the full extend of the danger.

A big picture approximation of this disconnect can be seen in the ratio of the market value of corporate equities compared to nominal GDP. Even on a pure read-the-charts basis, it is evident that at the current market capitalization-to-GDP ratio of 127%—-we are on the far edge of historical observation. In fact, during the 250 quarters since 1950 shown in the graph, the ratio has been higher only 4 times. And that was at the lunatic peak of the dotcom bubble in late 1999 and 2000!

Yet that’s only the half of it. Prior to Greenspan’s arrival at the Fed in 1987, and the subsequent evolution of the wealth effects doctrine and practice at the Fed under his superintendence, the mean ratio of market cap to GDP averaged about 60% and the cyclical amplitude fluctuated between 40% and 80%. Since 1994 when the Fed capitulated to Wall Street during the bond market bust and the Mexican peso crisis, however, the ratio has averaged nearly 100% of GDP and the amplitude of cyclical oscillation has widened dramatically.

The point is that this is not just about timeless chart cycles which rise and fall——although even in that context the current point is obviously precarious by all past experience. Instead, the reality is that we are in a new, central bank-driven serial bubble cycle that reflects the progressive radicalization of monetary policy.

The implications of this financialization are vast. In no sense is the Fed any longer rationally or proactively managing the main street macro-cycle as in the pre-Greenspan era—-whether this really worked effectively and efficiently or not. Now it is simply racing ahead of the tidal wave of financial inflation that it unleashes in the canyons of Wall Street, hoping not to be overtaken by the inexorable bust which follows speculative booms.

As always, the bullish crowd in the casino thinks this time is different, but actually this time is more dangerous. Sooner or later the bubble will burst when the last sheep are herded into the casino, as has happened already twice this century. But now the financial system’s tether to the real economy is extended like never before in history, meaning that the Fed’s dithering and dissimulation—on full display once again today—–will only result in a more traumatic dislocation eventually.

On this score, the recent Q4 release of the flow of funds report, which showed household net worth has now vaulted well above it levels during the previous two market peaks, is telling. As shown below, net worth is soaring and now stands at $83 trillion as of Q4 2014. That compares to $68 trillion at the pre-Lehman peak and only $45 billion at the time of the dotcom bubble.

Needless to say, these dramatic gains have occurred not because households are saving and investing more or because the US economy has become dramatically more productive and profitable. In fact, it represents a vast inflation of financial and real estate assets.

Even if the current $83 trillion household wealth figure is adjusted for the GDP deflator, it still means that there has been a 40% gain in aggregate real household net worth since the turn of the century. By contrast, real wage and salary income is up by only 17% and median real household income is actually down from $57k to $52k or by nearly 10%.

This latter figure highlights the double whammy of central bank driven financialization. One the on hand, financial asset valuations are unsustainably inflated; yet even the so-called wealth effects from these artificial and ultimately temporary gains have not trickled down to the 90% of households which account for only a tiny fraction of financial assets. As a result, there is no kicker to GDP outside of upper-income conspicuous consumption, even as the financial bubble steadily enlarges.

Not only is this a problem for financial stability, it may also eventually become an even more potent challenge to political stability. Indeed, the 7X gap between mean household net worth of $300k and median net worth of $45k suggests that the day of pitchforks and torches may not be all that far down the road.

Meanwhile, the financialization timebomb remains lodged in the markets. Aggregate household net worth has soared not because there has been any meaningful deleveraging since the financial crisis. In fact, household debt has declined only marginally—-after soaring for more than three decades.

And that gets to the heart of the danger. Notwithstanding this enormous rise in aggregate debt, net worth has continued to surge because asset values have been so dramatically inflated. Thus, the ratio of household financial assets to GDP now stands far above any prior history.

When household real estate is added, which is also driven by financialization, the picture is even more extreme. In 1970 the combined value of household real estate and financial assets was $3.9 trillion and it represented just 3.5X GDP. Even after the fed induced inflation of the 1970s, the combined value was only $19 trillion or 3.9X GDP when Greenspan arrived at the Fed in 1987.

By contrast, household real estate and financial assets today total $92 trillion or 5.2X GDP. There is absolutely no explanation for this aberrant condition other than the radical monetary inflation fueled by the nation’s central bank. If anything, the efficiency, international competitiveness and growth capacity of the main street economy has eroded measurably since the early 1970s, meaning that valuation multiples should have been tempered, not dramatically enlarged.

So we have learned once again today that the Fed still has a lot of patience. Perhaps we will also soon learn that by cowering its way forward our monetary politburo is making the eventual day of reckoning all the more perilous.

Stockman

Comment