Re: Peak Expensive Oil

While not making a specific bet like GRG did with his brother I did expect an oil price fall in May of last year in the paid subscriber section.

I posted this:

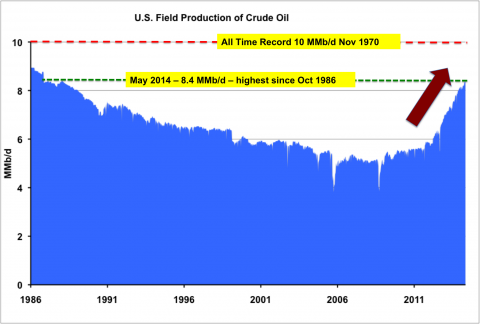

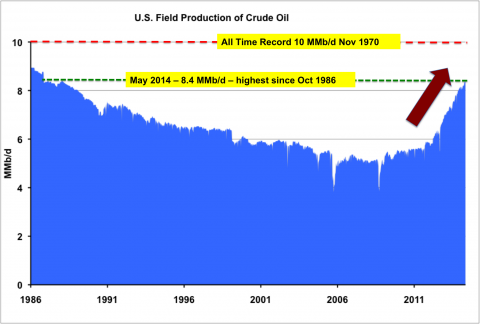

Whenever you see the above kind of chart with the exponential increase in any "commodity or asset" it usually means the rapid decline is fast approaching.

And this:

An indicator of the end?

Mark Hiduke just raised $100 million to build his three-week-old company. This 27-year-old isn’t a Silicon Valley technology entrepreneur. He’s a Texas oilman.

The oil and gas industry is suddenly brimming with upstart millennials like Hiduke after decades of failing to attract and retain new entrants. Now that a breakthrough in drilling technology has U.S. oil and gas production surging, an aging workforce is welcoming a new generation of wildcatters, landmen, engineers, investors, entrepreneurs and aspiring oil barons.

“I’ve never seen an industry do what the oil and gas industry has done in the last 10 years,” T. Boone Pickens, the 85-year-old billionaire oilman, said in an April 25 phone interview from his Dallas office. “Ten years ago I could not have made this statement that you have picked the right career.”

Hiduke’s company, Dallas-based PetroCore LLC, received the $100 million commitment from a local private-equity firm in May. He and his three partners plan to buy underdeveloped land and drill shale wells, he said. They’ll draw on the expertise of their engineer, who, at 57, is old enough to be his father.

The shale boom has “created a lot of opportunity for young professionals to jump in and be given enormous responsibility,” Hiduke said by telephone May 6. “It’s pretty much tech and then energy.”

Young Professionals

As oil and gas producers change their focus from grabbing land to drilling, young entrepreneurs are forming companies to trade everything from minerals to leases and wells to equities. They’re competing against, and sometimes collaborating with, industry veterans twice their age.

“These guys are going to be the poster children of self-made oil and gas tycoons,” Nathen McEown, a 33-year-old accountant at Whitley Penn LLP in Dallas who organizes networking dinners, said in an e-mail April 1. “Or they could be the poster children of how too much money is chasing deals.”

Since the generational shift coincides with a technological breakthrough, the younger crop only knows the shale boom and knowledge of conventional drilling might retire with the baby boomers, Kimberly Lacher said by phone May 8. The 38-year-old studied to be a chemical engineer and was reassigned by her employer to petroleum just when the shale boom was starting.

Watering Holes

Now she and her 31-year-old business partner, Wood Brookshire, head Vendera Resources, which has invested a total of more than $50 million in about 1,200 wells. The Dallas-based duo turned their first fund of a few hundred thousand dollars between the two of them into $4 million today, Brookshire said.

The new dynamic is on display at the oil patch’s venerable watering holes: members-only, jackets-required institutions such as the Dallas Petroleum Club and the Park City Club. Fresh-faced young professionals gather there to sip bourbon, saw through $49 steaks and swap stories. The rest of the patrons are mostly gray-haired. Some lean on walkers.

This phenomenon is known in the industry as “the great crew change.” About 71 percent of the oil industry’s workforce is age 50 and up, according to a survey by the Washington-based Independent Petroleum Association of America. At the other end, the ranks of the Dallas chapter of Young Professionals in Energy surged 60 percent to 4,000 since 2009, most of them under age 37. In between there’s a gap left from when oil averaged less than $25 a barrel in each of the years between 1986 and 1999.

Stay Away

“Everyone who had kids said don’t get into this business,” Patrick Collins, a 34-year-old third-generation landman, a salesman who collects leases in resource-rich areas, said in an interview April 28. “I tried to get away, but I love this industry.”

Collins’s father warned him as a kid to stay away from oil because the U.S. was running out. The Midland, Texas, native went off to New York to study history at Columbia University. He interned in marketing, then went to business school and worked for a hedge fund research firm before deciding to retrace his father’s footsteps.

He became a landman just as the shale boom was getting hot in the mid-2000s. Companies had figured out how to extract oil and gas from shale formations more than a mile deep and previously impermeable by drilling horizontally across the rock layers and cracking them up with blasts of sand, water and chemicals.

New Opportunity

That was the breakthrough that London-based BP Plc says is putting the U.S. on course to meet all its own energy needs by 2035. It propelled the U.S. to overtake Russia and Saudi Arabia as the world’s biggest combined producer of oil and gas last year, according to Energy Department projections. Domestic fields are pumping the most oil since 1986 and natural gas output set new highs in each of the past seven years, government data show.

Collins saw an opening to use his knowledge of the terrain to scoop up neglected properties, sell them to new drillers and keep a stake. In 2008 he founded Dallas-based Cortez Resources LLC, which now has sold acreage valued at more than $100 million. At one of their first meetings, Collins and his business partner were dealing with two men who were each more than 80 years old, he said.

One of Collins’s friends, Ryan Watts, graduated from the energy management program at the University of Oklahoma in Norman, Oklahoma, in 2004 when there were about 100 students enrolled. Today the program has more than 600, according to the university’s website.

$6 Billion

“The shale revolution changed everything,” Watts, 34, said in an April 30 interview. His Dallas-based company, Addax Minerals LLC, has raised about $35 million from wealthy individuals and family investors to buy stakes in potential hot spots, gain a slice of the revenue from drilling and sometimes consolidate and resell the positions.

PetroCore’s founding partners have participated in oil and gas transactions valued at more than $6 billion, the company said in a statement. Hiduke, who graduated in 2009 from Southern Methodist University in University Park, Texas, with a degree in finance and economics, was previously a financial analyst at TD Securities and a supervisor at Pioneer Natural Resources Co., he said.

Matt Miller, 30, a former McKinsey & Co. consultant, teamed up with Griffin Perry, an ex-banker and the 30-year-old son of Texas Governor Rick Perry, to start Grey Rock Energy Partners, which buys minority stakes in wells. They brought in Kirk Lazarine, a 60-year-old veteran of San Ramon, California-based Chevron Corp.

‘So Tormented’

“What you had was an industry that went up, went down, there were constantly people getting laid off, and people got to the point where they just didn’t want to be in the oil industry,” Lazarine said by phone May 1 from Houston. “That’s why you see that 20-year gap, because the industry was so tormented until 2005.”

Their year-old, Dallas-based firm has raised $40 million so far, Miller said in a May 1 interview. Perry will grow a mustache if they haven’t made it to $200 million by August, according to the pledge scrawled on the conference room whiteboard.

“What’s going to happen when the older folks retire, we don’t know,” Miller said. “You’re going to see a lot of volatility. You’re going to see young people making decisions that were handled by predecessors who had more experience.”

Originally posted by aaron

View Post

I posted this:

Whenever you see the above kind of chart with the exponential increase in any "commodity or asset" it usually means the rapid decline is fast approaching.

And this:

An indicator of the end?

Mark Hiduke just raised $100 million to build his three-week-old company. This 27-year-old isn’t a Silicon Valley technology entrepreneur. He’s a Texas oilman.

The oil and gas industry is suddenly brimming with upstart millennials like Hiduke after decades of failing to attract and retain new entrants. Now that a breakthrough in drilling technology has U.S. oil and gas production surging, an aging workforce is welcoming a new generation of wildcatters, landmen, engineers, investors, entrepreneurs and aspiring oil barons.

“I’ve never seen an industry do what the oil and gas industry has done in the last 10 years,” T. Boone Pickens, the 85-year-old billionaire oilman, said in an April 25 phone interview from his Dallas office. “Ten years ago I could not have made this statement that you have picked the right career.”

Hiduke’s company, Dallas-based PetroCore LLC, received the $100 million commitment from a local private-equity firm in May. He and his three partners plan to buy underdeveloped land and drill shale wells, he said. They’ll draw on the expertise of their engineer, who, at 57, is old enough to be his father.

The shale boom has “created a lot of opportunity for young professionals to jump in and be given enormous responsibility,” Hiduke said by telephone May 6. “It’s pretty much tech and then energy.”

Young Professionals

As oil and gas producers change their focus from grabbing land to drilling, young entrepreneurs are forming companies to trade everything from minerals to leases and wells to equities. They’re competing against, and sometimes collaborating with, industry veterans twice their age.

“These guys are going to be the poster children of self-made oil and gas tycoons,” Nathen McEown, a 33-year-old accountant at Whitley Penn LLP in Dallas who organizes networking dinners, said in an e-mail April 1. “Or they could be the poster children of how too much money is chasing deals.”

Since the generational shift coincides with a technological breakthrough, the younger crop only knows the shale boom and knowledge of conventional drilling might retire with the baby boomers, Kimberly Lacher said by phone May 8. The 38-year-old studied to be a chemical engineer and was reassigned by her employer to petroleum just when the shale boom was starting.

Watering Holes

Now she and her 31-year-old business partner, Wood Brookshire, head Vendera Resources, which has invested a total of more than $50 million in about 1,200 wells. The Dallas-based duo turned their first fund of a few hundred thousand dollars between the two of them into $4 million today, Brookshire said.

The new dynamic is on display at the oil patch’s venerable watering holes: members-only, jackets-required institutions such as the Dallas Petroleum Club and the Park City Club. Fresh-faced young professionals gather there to sip bourbon, saw through $49 steaks and swap stories. The rest of the patrons are mostly gray-haired. Some lean on walkers.

This phenomenon is known in the industry as “the great crew change.” About 71 percent of the oil industry’s workforce is age 50 and up, according to a survey by the Washington-based Independent Petroleum Association of America. At the other end, the ranks of the Dallas chapter of Young Professionals in Energy surged 60 percent to 4,000 since 2009, most of them under age 37. In between there’s a gap left from when oil averaged less than $25 a barrel in each of the years between 1986 and 1999.

Stay Away

“Everyone who had kids said don’t get into this business,” Patrick Collins, a 34-year-old third-generation landman, a salesman who collects leases in resource-rich areas, said in an interview April 28. “I tried to get away, but I love this industry.”

Collins’s father warned him as a kid to stay away from oil because the U.S. was running out. The Midland, Texas, native went off to New York to study history at Columbia University. He interned in marketing, then went to business school and worked for a hedge fund research firm before deciding to retrace his father’s footsteps.

He became a landman just as the shale boom was getting hot in the mid-2000s. Companies had figured out how to extract oil and gas from shale formations more than a mile deep and previously impermeable by drilling horizontally across the rock layers and cracking them up with blasts of sand, water and chemicals.

New Opportunity

That was the breakthrough that London-based BP Plc says is putting the U.S. on course to meet all its own energy needs by 2035. It propelled the U.S. to overtake Russia and Saudi Arabia as the world’s biggest combined producer of oil and gas last year, according to Energy Department projections. Domestic fields are pumping the most oil since 1986 and natural gas output set new highs in each of the past seven years, government data show.

Collins saw an opening to use his knowledge of the terrain to scoop up neglected properties, sell them to new drillers and keep a stake. In 2008 he founded Dallas-based Cortez Resources LLC, which now has sold acreage valued at more than $100 million. At one of their first meetings, Collins and his business partner were dealing with two men who were each more than 80 years old, he said.

One of Collins’s friends, Ryan Watts, graduated from the energy management program at the University of Oklahoma in Norman, Oklahoma, in 2004 when there were about 100 students enrolled. Today the program has more than 600, according to the university’s website.

$6 Billion

“The shale revolution changed everything,” Watts, 34, said in an April 30 interview. His Dallas-based company, Addax Minerals LLC, has raised about $35 million from wealthy individuals and family investors to buy stakes in potential hot spots, gain a slice of the revenue from drilling and sometimes consolidate and resell the positions.

PetroCore’s founding partners have participated in oil and gas transactions valued at more than $6 billion, the company said in a statement. Hiduke, who graduated in 2009 from Southern Methodist University in University Park, Texas, with a degree in finance and economics, was previously a financial analyst at TD Securities and a supervisor at Pioneer Natural Resources Co., he said.

Matt Miller, 30, a former McKinsey & Co. consultant, teamed up with Griffin Perry, an ex-banker and the 30-year-old son of Texas Governor Rick Perry, to start Grey Rock Energy Partners, which buys minority stakes in wells. They brought in Kirk Lazarine, a 60-year-old veteran of San Ramon, California-based Chevron Corp.

‘So Tormented’

“What you had was an industry that went up, went down, there were constantly people getting laid off, and people got to the point where they just didn’t want to be in the oil industry,” Lazarine said by phone May 1 from Houston. “That’s why you see that 20-year gap, because the industry was so tormented until 2005.”

Their year-old, Dallas-based firm has raised $40 million so far, Miller said in a May 1 interview. Perry will grow a mustache if they haven’t made it to $200 million by August, according to the pledge scrawled on the conference room whiteboard.

“What’s going to happen when the older folks retire, we don’t know,” Miller said. “You’re going to see a lot of volatility. You’re going to see young people making decisions that were handled by predecessors who had more experience.”

Comment