How does the GAGFO hypothesis account for the recent (3 months) price action in gold, oil, and the USD? My seat o' the pants take is that gold is wildly overbought/overvalued here. Oil down big, USD up big, gold up moderately.

Announcement

Collapse

No announcement yet.

GAGFO and recent history

Collapse

X

-

Re: GAGFO and recent history

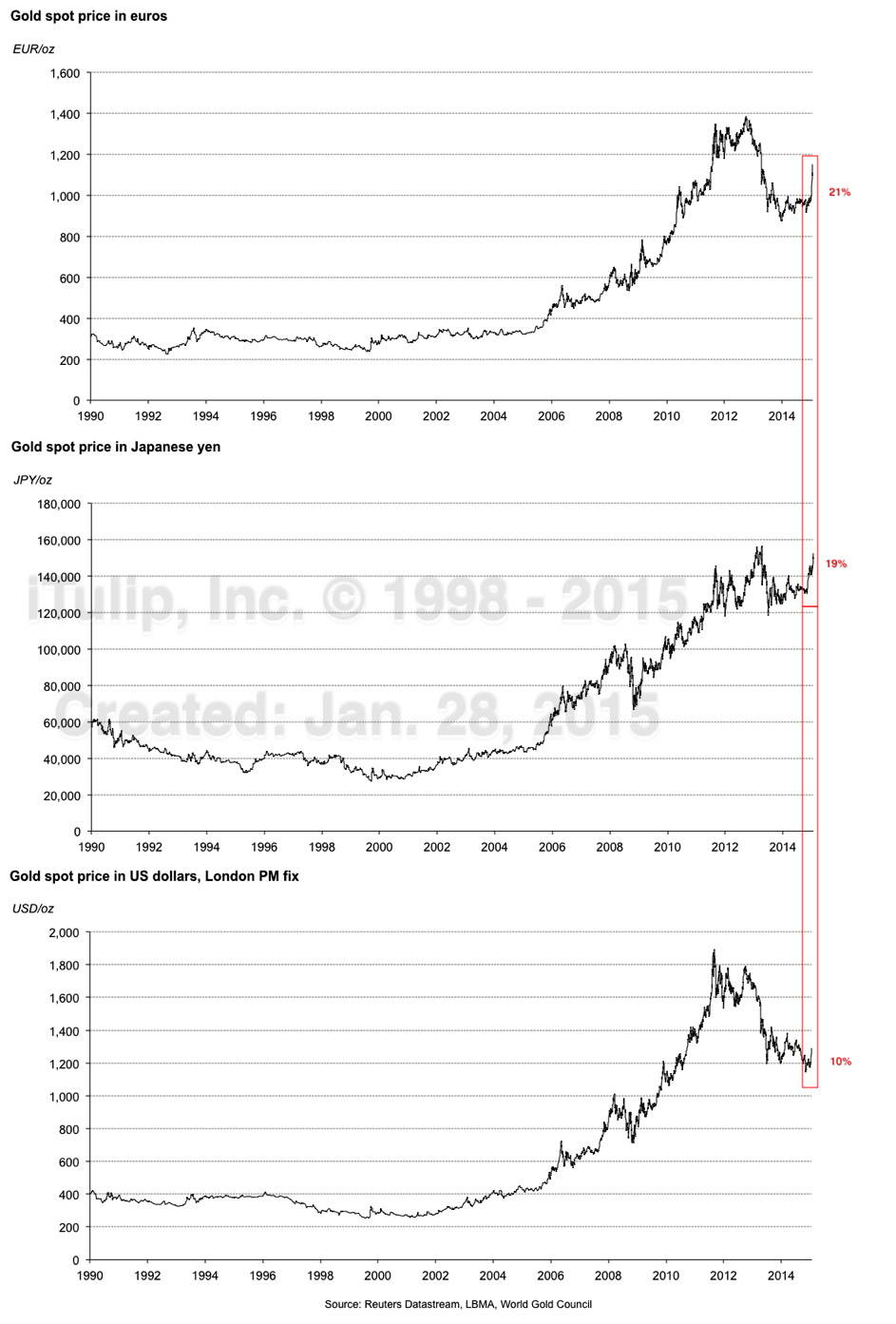

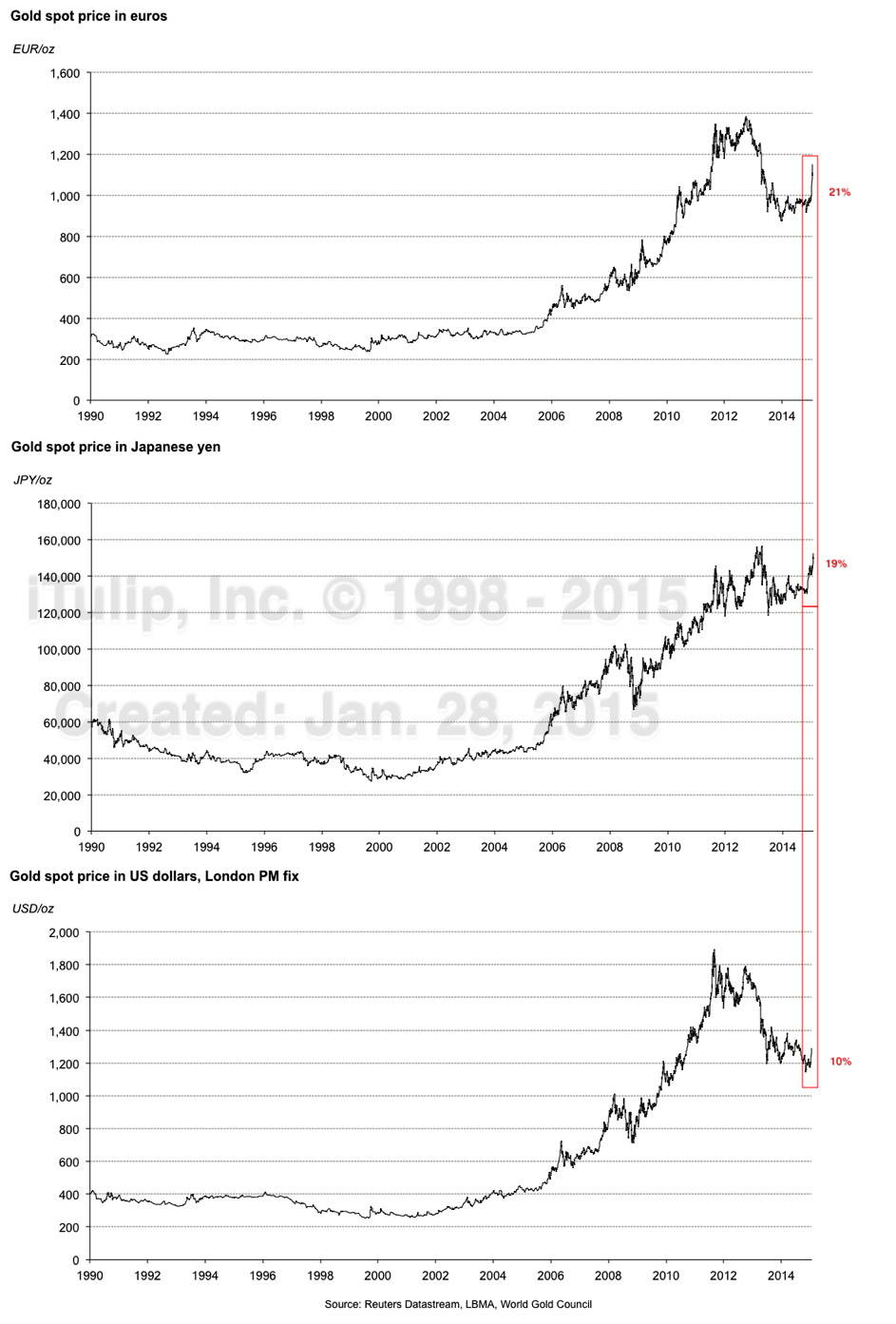

As parities to the global central banking system take turns at currency devaluation to deflate debt against currencies -- forget "currencies wars" -- gold continues to ratchet up one currency at a time. Note that gold in yen is now nearly as high as at its all time peak. Gold in USD is last in line.Originally posted by goadam1 View PostGold is acting as a currency hedge. It's a Nirp world in the fits of competitive devaluation. Nothing from nothing leave something up.

Comment

-

Re: GAGFO and recent history

So based on price changes over the last couple of months, it is reasonable to say the Euro is next?Originally posted by EJ View PostAs parities to the global central banking system take turns at currency devaluation to deflate debt against currencies -- forget "currencies wars" -- gold continues to ratchet up one currency at a time. Note that gold in yen is now nearly as high as at its all time peak. Gold in USD is last in line.

Comment

-

Re: GAGFO and recent history

The process started in November 2014. Gold in EUR is up 21% since Nov. 5. That's already greater than the 19% move in gold in JPY June 2013 to Jan 2015.Originally posted by jneal3 View PostSo based on price changes over the last couple of months, it is reasonable to say the Euro is next?

Comment

-

Re: GAGFO and recent history

currently:Originally posted by EJ View PostThe process started in November 2014. Gold in EUR is up 21% since Nov. 5. That's already greater than the 19% move in gold in JPY June 2013 to Jan 2015.

gold in yen: 139,872

gold in euro: 1100.65

gold in dollars: 1240

basically gold is just in the midrange of each rise that ej documented a bit over a year ago.

Comment

-

Re: GAGFO and recent history

I think that is the best news for gold holders in almost a decade. Isn't there a lot of debt still to deflate against?Originally posted by jk View Postcurrently:

gold in yen: 139,872

gold in euro: 1100.65

gold in dollars: 1240

basically gold is just in the midrange of each rise that ej documented a bit over a year ago.

Comment

-

Re: GAGFO and recent history

Oh! Oh! ... Allow me... Gold in Canadian dollars? $40 Canadian Pesos away from an all time high, and I bet we break that in less than 2 weeks at the rate things are going.

In other news...

Canada sells off large chunks of its gold reserves

Source: http://globalnews.ca/news/2508940/ca...gold-reserves/

The latest data, published last week by the Department of Finance, show the total Canadian gold reserves have now dropped to 0.62 tonnes. That’s less than 0.1 per cent of the country’s total reserves, which also include foreign currency deposits and bonds.

---

According to Lee, there may soon come a time when Canada’s gold reserves are entirely a thing of the past. There are better assets to focus on, he argued, calling the government’s decision to dump gold “wise and astute.”

--

“It gives them more strategic flexibility to sell the gold, take the money and invest in U.S. government bonds, or United Kingdom bonds or French bonds or German bonds,” Lee said

... which means... one day soon, I will hold in my hand more gold than the entire government of CANADA!!!

Last edited by Adeptus; February 12, 2016, 10:22 PM.Warning: Network Engineer talking economics!

Comment

-

Re: GAGFO and recent history

Amazing. Your CB must be even more incompetent than ours. I had not thought of it, but GAGFO must work in reverse for oil exporters---the cheaper oil is, the weaker their currency is, so the higher the gold price.Originally posted by Adeptus View PostOh! Oh! ... Allow me... Gold in Canadian dollars? $40 Canadian Pesos away from an all time high, and I bet we break that in less than 2 weeks at the rate things are going

In other news...

Canada sells off large chunks of its gold reserves

Source: http://globalnews.ca/news/2508940/ca...gold-reserves/

... which means... one day soon, I will hold in my hand more gold than the entire government of CANADA!!!

At any rate, by selling off the gold, they can invest in Vancouver Real Estate!

Comment

-

Re: GAGFO and recent history

They are already "invested" in Vancouver real estate. It's called CMHC.Originally posted by Polish_Silver View PostAmazing. Your CB must be even more incompetent than ours. I had not thought of it, but GAGFO must work in reverse for oil exporters---the cheaper oil is, the weaker their currency is, so the higher the gold price.

At any rate, by selling off the gold, they can invest in Vancouver Real Estate!

The Government of Canada (the Bank of Canada) has for some very long time felt no need to hold any material amount of national reserves in gold bullion. Canada has significant gold reserves, mine production internal to its borders and net exports of bullion, and the view in Ottawa has been there will always be an available source of the barbarous relic.

Comment

-

Re: GAGFO and recent history

Sprott may one day be the most popular canuck in all of Canada. I wonder if his take-over of GTU was related to these events."...the western financial system has already failed. The failure has just not yet been realized, while the system remains confident that it is still alive." Jesse

Comment

-

Gold as inflation hedge

Originally posted by EJ View PostAs parities to the global central banking system take turns at currency devaluation to deflate debt against currencies -- forget "currencies wars" -- gold continues to ratchet up one currency at a time. Note that gold in yen is now nearly as high as at its all time peak. Gold in USD is last in line.

That is consistent with Gold as an inflation hedge.

Comment

Comment