Crude oil is not the only commodity that is crashing. Iron ore is on a similar trajectory and for a common reason. Namely, the two-decade-long economic boom fueled by the money printing rampage of the world’s central banks is beginning to cool rapidly. What the old-time Austrians called “malinvestment” and what Warren Buffet once referred to as the “naked swimmers” exposed by a receding tide is now becoming all too apparent.

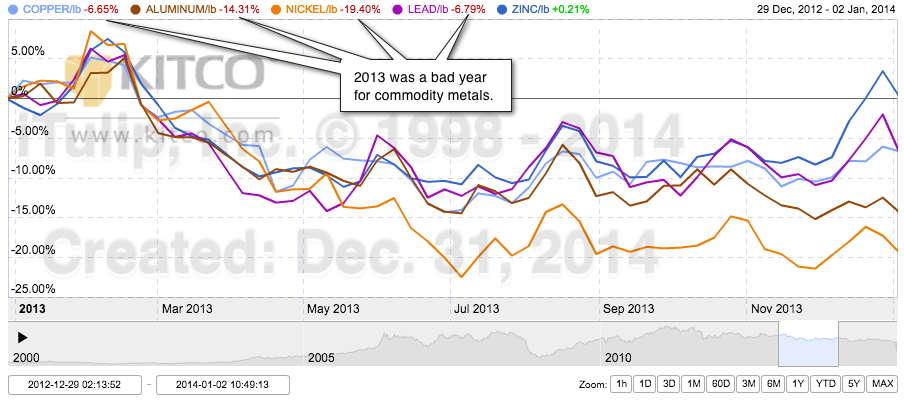

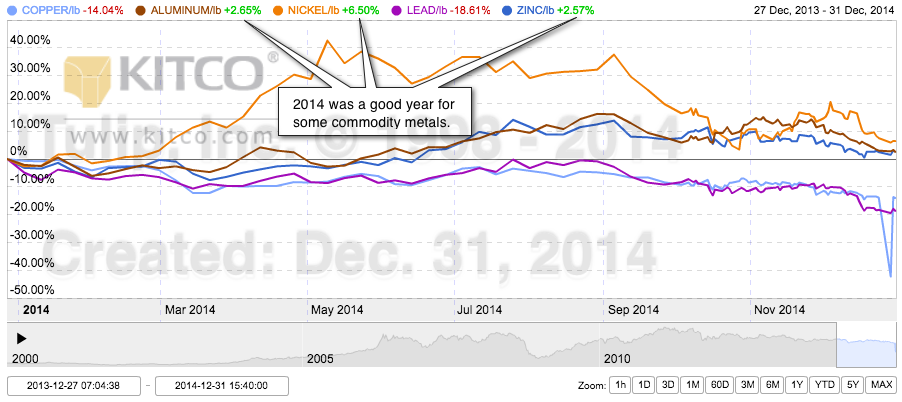

This cooling phase is graphically evident in the cliff-diving movement of most industrial commodities. But it is important to recognize that these are not indicative of some timeless and repetitive cycle—–or an example merely of the old adage that high prices are their own best cure.

Instead, today’s plunging commodity prices represent something new under the sun. That is, they are the product of a fracturing monetary supernova that was a unique and never before experienced aberration caused by the 1990s rise, and then the subsequent lunatic expansion after the 2008 crisis, of a cancerous regime of Keynesian central banking.

Stated differently, the worldwide economic and industrial boom since the early 1990s was not indicative of sublime human progress or the break-out of a newly energetic market capitalism on a global basis. Instead, the approximate $50 trillion gain in the reported global GDP over the past two decades was an unhealthy and unsustainable economic deformation financed by a vast outpouring of fiat credit and false prices in the capital markets.

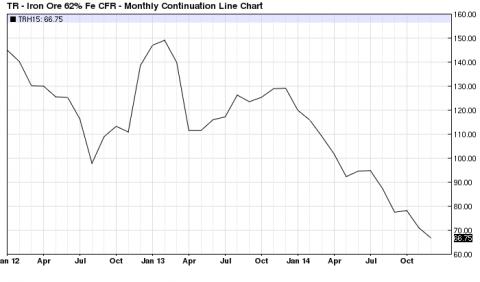

For that reason, the radical swings in commodity prices during the last two decades mark the path of a central bank generated macro-economic bubble, not merely the unique local supply and demand factors which pertain to crude oil, copper, iron ore, or the rest. Accordingly, the chart below which shows that iron ore prices have plunged from $150 per ton in early 2013 to about $65 per ton at present only captures the tail end of the cycle.

What really happened is that the central bank instigated global macro-economic bubble ripped commodity pricing cycles out of their historical moorings, resulting in a one time eruption of price levels that had no relationship to sustainable supply and demand factors in the mines and petroleum patch. What materialized, instead, was an unprecedented one-time mismatch of commodity production and use that caused pricing abnormalities of gargantuan proportions.

Thus, the true free market benchmark for iron ore is the pre-1994 price of about $20-25 per ton. This represented the long-time equilibrium between advancing mining technology and diminishing ore grades available to steel mills in the DM economies.

But as shown below, after Mr. Deng institutionalized export mercantilism and printing press prosperity in the form of China’s red capitalism in the early 1990s, iron ore prices broke orbit and soared to $100 per ton in the second half of the decade and then went parabolic from there. After peaking at $140 per ton on the eve of the financial crisis,China’s mad cap “infrastructure” stimulus boom after 2008 drove the price to a peak of $180 per ton in 2011-2012. To wit, iron ore prices peaked at nearly 9X their historic range.

The crucial point is that there was nothing normal, sustainable or economic about the $180 per ton peak. It was a pure deformation of central bank credit expansion and the accompanying false pricing of debt and other forms of long-term capital.

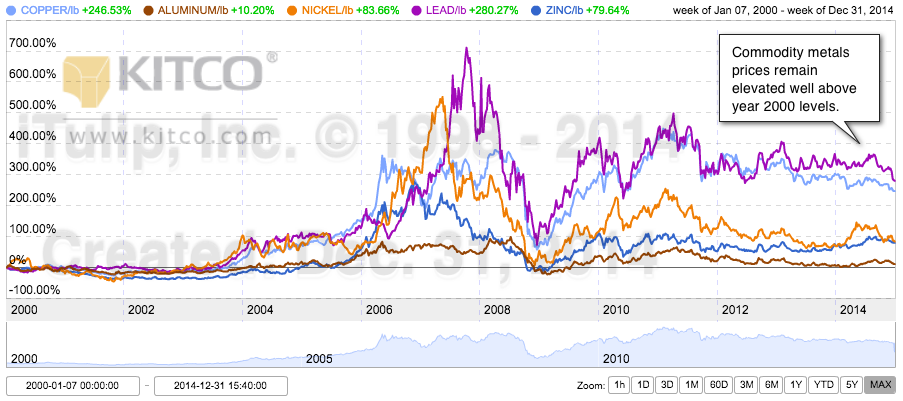

Needless to say, the same thing is true of copper. Its historical benchmarks were in the 60 cents to 100 cents per pound range. Yet after 1994, the global bubble—again led by the enormous credit explosion and currency exchange rate suppression in China and its BRIC satellites—carried the price to $4 per pound in the eve of the financial crisis, and then to nearly $5 during the peak of China’s post-crisis credit explosion.

Indeed, in the case of copper, not only was the cycle driven by unsustainable construction demand; it was also powered by dodgy forms of financial engineering that turned copper inventories into financing collateral that was sometimes re-hypothecated many times over.

The exact same considerations apply most especially to crude oil. China’s GDP grew from $1 trillion to $9 trillion during the 13 years after the turn of the century. Growth of such enormous proportions is not remotely possible in an honest economy based on productivity, savings, investment and sound money. Likewise, China’s call on the global oil supply system—-which soared by 4X from 3 million bbls/day to nearly 12 million—–is also a drastic aberration; it is a product of runaway credit creation that financed false “demand”.

And that was only the beginning of the aberration. The China engine pulled additional false petroleum demand into the world market equation due to the boom among its suppliers—such as Brazil, Canada and Australia for raw materials and South Korea and Taiwan for components and parts. Output levels and petroleum consumption in Germany and the US were also goosed by China’s voracious demand for German capital goods and Caterpillar’s heavy machinery, for example.

Accordingly, the crude oil price path shown below reflects the same global monetary supernova. The $20 price in place during the 1990s was no higher in inflation adjusted terms than it had been one century earlier when the mighty Spindletop gusher was discovered in East Texas in 1901. By contrast, the 5X eruption to north of $100 per barrel during this century represents the impact of fiat credit and false capital market prices deforming the entire warp and woof of the global economy.

Self-evidently, we are now in the cliff-diving phase, but unlike the bounce after the September 2008 financial crisis, there will be no rebound this time around. That is owing to two reasons.

First, most of the world is at “peak debt”. That is, the ratio of total credit market debt to current national income ranges between 350% and 500% in every major economy; and that is the limit of what can be serviced even at today’s aberrantly low interest rates.

As Milton Friedman famously observed, markets are ultimately not fooled by the money illusion. In this case, the illusion is that today’s sub-economic interest rates will last forever and that debt carrying capacity has been elevated accordingly.

Not true. Short-term interest rates may be temporarily and artificially pegged at the zero bound by central bankers, but at the end of the day debt carrying capacity is tethered by real economics and normalized costs of money and debt.

Accordingly, the central banks are now pushing on a string. The credit channel of monetary transmission is over and done. The only remaining effect of the residual level of money printing still underway is that ZIRP enables carry trade gamblers to drive financial asset prices ever higher, thereby setting up another thundering collapse of the financial bubbles being generated for the third time this century by the world’s central banks.

The second reason for no commodity price rebound is the monumental overhang of the malinvestments which have been made, especially since the 2008 crisis. That is obviously what is now pummeling the petroleum sector.

The huge expansion of high cost crude oil capacity—–in the shale patch, tar sands and deep off-shore—-was due to the aberrationally high price of oil and the inordinately cheap cost of capital which were generated during the last two decades by the global central banks. The above price chart for the WTI marker price of crude, for example, is what explains the eruption of shale oil production from 1 million bbls/day prior to the financial crisis to more than 4 million at present., not an alleged technological miracle called “fracking”.

However, the iron ore capacity expansion story is no less cogent. On the eve of the financial crisis, the Big Three miners—-Vale, BHP and Rio—had already doubled their mining capacity from 250 million tons annually at the turn of the century, to 195 million tons per quarter or 780 million tons annually.

But when prices soared to $180/ton in 2012, investment levels were drastically scaled-up even further. Currently, the Big Three have combined capacity of more than 1.1 billion tons annually that is not only in the investment pipeline, but is actually so far advanced that completion makes more sense than abandonment. Accordingly, not withstanding the massive over-supply already in the market, several hundred million more tons will compound the surplus and drive prices even closer to the out-of-pocket cash cost of production in the years immediately ahead.

The above depicted capacity expansion is a quintessential reflection of the manner in which false prices in the capital markets drive excessive and wasteful investment, and cause the crash following the credit driven boom to be all the more destructive. So the cliff-diving price action here is not just another commodity cycle, but instead is a proxy for the fracturing global credit bubble, led by China department.

During the course of its mad scramble to become the world’s export factory and then its greatest infrastructure construction site, China’s expansion of domestic credit broke every historical record and has ultimately landed in the zone of pure financial madness. To wit, during the 14 years since the turn of the century China’s total debt outstanding–including its vast, opaque, wild west shadow banking system—soared from $1 trillion to $25 trillion, and from 1X GDP to upwards of 3X.

But these “leverage ratios” are actually far more dangerous and unstable than the pure numbers suggest because the denominator—national income or GDP—-has been erected on an unsustainable frenzy of fixed asset investment. Accordingly, China’s so-called GDP of $9 trillion contains a huge component of one-time spending that will disappear in the years ahead, but which will leave behind enormous economic waste and monumental over-investment that will result in sub-economic returns and write-offs for years to come. Stated differently, China’s true total debt ratio is much higher than 3X currently reported due to the unsustainable bloat in its reported national income.

Nearly every year since 2008, in fact, fixed asset investment in public infrastructure, housing and domestic industry has amounted to nearly 50% of GDP. But that’s not just a case of extreme of growth enthusiasm, as the Wall Street bulls would have you believe. It’s actually indicative of an economy of 1.3 billion people who have gone mad digging, building, borrowing and speculating.

Nowhere is this more evident than in China’s vastly overbuilt steel industry, where capacity has soared from about 100 million tons in 1995 to upwards of 1.2 billion tons today. Again, this 12X growth in less than two decades is not just red capitalism getting rambunctious; its actually an economically cancerous deformation that will eventually dislocate the entire global economy. Stated differently, the 1 billion ton growth of China’s steel industry since 1995 represents 2X the entire capacity of the global steel industry at the time; 7X the size of Japan’s then world champion steel industry; and 10X the then size of the US industry.

Already, the evidence of a thundering break-down of China’s steel industry is gathering momentum. Capacity utilization has fallen from 95% in 2001 to 75% last year, and will eventually plunge toward 60%, resulting in upwards of a half billion tons of excess capacity. Likewise, even the manipulated and massaged financial results from China big steel companies have begin to sharply deteriorate. Profits have dropped from $80-100 billion RMB annually to 20 billion in 2013, and are now in the red; and the reported aggregate leverage ratio of the industry has soared to in excess of 70%.

But these are just mild intimations of what is coming. The hidden truth of the matter is that China would be lucky to have even 500 million tons of annual “sell-through” demand for steel to be used in production of cars, appliances, industrial machinery and for normal replacement cycles of long-lived capital assets like office towers, ships, shopping malls, highways, airports and rails. Stated differently, upwards of 50% of the 800 million tons of steel produced by China in 2013 likely went into one-time demand from the frenzy in infrastructure spending.

Indeed, the deformations are so extreme that on the margin China’s steel industry has been chasing its own tail like some stumbling, fevered dragon. Thus, demand for plate steel to build dry bulk carriers has soared, but the underlying demand for new bulk carrier capacity was, ironically, driven by bloated demand for the iron ore needed to make the steel to build China’s empty apartments and office towers and unused airports, highways and rails.

In short, when the credit and building frenzy stops, China will be drowning in excess steel capacity and will try to export its way out— flooding the world with cheap steel. A trade crisis will soon ensue, and we will shortly have the kind of globalized import quota system that was imposed on Japan in the early 1980s. Needless to say, the latter may stabilize steel prices at levels far below current quotes, but it will also mean a drastic cutback in global steel production and iron ore demand.

And that gets to the core component of the deformation arising from central bank fueled credit expansion and the drastic worldwide repression of interest rates and cost of capital. The 12X expansion of China’s steel industry was accompanied by an even more fantastic expansion of iron ore production, processing, transportation, port and ocean shipping capacity.

On the one hand, capacity could not grow at the breakneck speed of China’s initial ramp in steel production—so prices soared. And again, not just in the range of traditional cyclical amplitudes. As indicated above, prices rose from $20 per ton in the early 1990s to $180 per ton by 2012—meaning that vast windfall rents were earned on the difference between low cash costs on existing or recently constructed iron ore capacity and the soaring prices in spot and contract markets.

The reality of truly obscene current profits and the propaganda about endless growth in the miracle of red capitalism, combined with the cheap debt available in global capital markets, resulted in an explosion of iron ore mining capacity like the world has never before witnessed in any mineral industry.

Stated differently, the Big Three miners would never have expanded their capacity from 250 million tons to 1.1 billion tons in an honest free market. Nor would they have posted such egregious financial trends as have occurred over the past decade. To wit, even as the global iron ore (and also copper) boom gather steam in the run-up to the financial crisis, the three miners spent $55 billion on CapEx during the four years ending in 2007.

By contrast, during the four most recent years they spent 3.2X more or $175 billion. Not surprisingly, the residue on their balance sheets is unmistakable. Their combined debt went from about $12 billion in 2004 to more than $90 billion at present.

But now, prices will be driven down to the lowest marginal cost of supply, meaning that Big Three EBITDA will violently collapse, causing leverage ratios to soar and new CapEx to be drastically downsized. In turn, Caterpillar’s order book will take a giant hit, and so will its supply chain running all the way back to Peoria.

So the collapse of the mother of all commodity bubbles is virtually baked into the cake. As one industry CEO recently acknowledged, his company’s truly variable, cash cost of production is about $20 per ton and he will not hesitate to keep producing for positive variable profit. That means iron ore prices will also plunge far below the current $66 per ton quote now extant in the market.

In short, when the classical Austrians talked about “malinvestment” the pending disasters in the global steel and iron ore industries (and also mining equipment and other supplier industries) are what they had in mind. Except none of them could have imagined the fevered and irrational magnitudes of the deformations that have resulted from the actions of the mad money printers who now run the world’s central banks.

David Stockton

This cooling phase is graphically evident in the cliff-diving movement of most industrial commodities. But it is important to recognize that these are not indicative of some timeless and repetitive cycle—–or an example merely of the old adage that high prices are their own best cure.

Instead, today’s plunging commodity prices represent something new under the sun. That is, they are the product of a fracturing monetary supernova that was a unique and never before experienced aberration caused by the 1990s rise, and then the subsequent lunatic expansion after the 2008 crisis, of a cancerous regime of Keynesian central banking.

Stated differently, the worldwide economic and industrial boom since the early 1990s was not indicative of sublime human progress or the break-out of a newly energetic market capitalism on a global basis. Instead, the approximate $50 trillion gain in the reported global GDP over the past two decades was an unhealthy and unsustainable economic deformation financed by a vast outpouring of fiat credit and false prices in the capital markets.

For that reason, the radical swings in commodity prices during the last two decades mark the path of a central bank generated macro-economic bubble, not merely the unique local supply and demand factors which pertain to crude oil, copper, iron ore, or the rest. Accordingly, the chart below which shows that iron ore prices have plunged from $150 per ton in early 2013 to about $65 per ton at present only captures the tail end of the cycle.

What really happened is that the central bank instigated global macro-economic bubble ripped commodity pricing cycles out of their historical moorings, resulting in a one time eruption of price levels that had no relationship to sustainable supply and demand factors in the mines and petroleum patch. What materialized, instead, was an unprecedented one-time mismatch of commodity production and use that caused pricing abnormalities of gargantuan proportions.

Thus, the true free market benchmark for iron ore is the pre-1994 price of about $20-25 per ton. This represented the long-time equilibrium between advancing mining technology and diminishing ore grades available to steel mills in the DM economies.

But as shown below, after Mr. Deng institutionalized export mercantilism and printing press prosperity in the form of China’s red capitalism in the early 1990s, iron ore prices broke orbit and soared to $100 per ton in the second half of the decade and then went parabolic from there. After peaking at $140 per ton on the eve of the financial crisis,China’s mad cap “infrastructure” stimulus boom after 2008 drove the price to a peak of $180 per ton in 2011-2012. To wit, iron ore prices peaked at nearly 9X their historic range.

The crucial point is that there was nothing normal, sustainable or economic about the $180 per ton peak. It was a pure deformation of central bank credit expansion and the accompanying false pricing of debt and other forms of long-term capital.

Needless to say, the same thing is true of copper. Its historical benchmarks were in the 60 cents to 100 cents per pound range. Yet after 1994, the global bubble—again led by the enormous credit explosion and currency exchange rate suppression in China and its BRIC satellites—carried the price to $4 per pound in the eve of the financial crisis, and then to nearly $5 during the peak of China’s post-crisis credit explosion.

Indeed, in the case of copper, not only was the cycle driven by unsustainable construction demand; it was also powered by dodgy forms of financial engineering that turned copper inventories into financing collateral that was sometimes re-hypothecated many times over.

The exact same considerations apply most especially to crude oil. China’s GDP grew from $1 trillion to $9 trillion during the 13 years after the turn of the century. Growth of such enormous proportions is not remotely possible in an honest economy based on productivity, savings, investment and sound money. Likewise, China’s call on the global oil supply system—-which soared by 4X from 3 million bbls/day to nearly 12 million—–is also a drastic aberration; it is a product of runaway credit creation that financed false “demand”.

And that was only the beginning of the aberration. The China engine pulled additional false petroleum demand into the world market equation due to the boom among its suppliers—such as Brazil, Canada and Australia for raw materials and South Korea and Taiwan for components and parts. Output levels and petroleum consumption in Germany and the US were also goosed by China’s voracious demand for German capital goods and Caterpillar’s heavy machinery, for example.

Accordingly, the crude oil price path shown below reflects the same global monetary supernova. The $20 price in place during the 1990s was no higher in inflation adjusted terms than it had been one century earlier when the mighty Spindletop gusher was discovered in East Texas in 1901. By contrast, the 5X eruption to north of $100 per barrel during this century represents the impact of fiat credit and false capital market prices deforming the entire warp and woof of the global economy.

Self-evidently, we are now in the cliff-diving phase, but unlike the bounce after the September 2008 financial crisis, there will be no rebound this time around. That is owing to two reasons.

First, most of the world is at “peak debt”. That is, the ratio of total credit market debt to current national income ranges between 350% and 500% in every major economy; and that is the limit of what can be serviced even at today’s aberrantly low interest rates.

As Milton Friedman famously observed, markets are ultimately not fooled by the money illusion. In this case, the illusion is that today’s sub-economic interest rates will last forever and that debt carrying capacity has been elevated accordingly.

Not true. Short-term interest rates may be temporarily and artificially pegged at the zero bound by central bankers, but at the end of the day debt carrying capacity is tethered by real economics and normalized costs of money and debt.

Accordingly, the central banks are now pushing on a string. The credit channel of monetary transmission is over and done. The only remaining effect of the residual level of money printing still underway is that ZIRP enables carry trade gamblers to drive financial asset prices ever higher, thereby setting up another thundering collapse of the financial bubbles being generated for the third time this century by the world’s central banks.

The second reason for no commodity price rebound is the monumental overhang of the malinvestments which have been made, especially since the 2008 crisis. That is obviously what is now pummeling the petroleum sector.

The huge expansion of high cost crude oil capacity—–in the shale patch, tar sands and deep off-shore—-was due to the aberrationally high price of oil and the inordinately cheap cost of capital which were generated during the last two decades by the global central banks. The above price chart for the WTI marker price of crude, for example, is what explains the eruption of shale oil production from 1 million bbls/day prior to the financial crisis to more than 4 million at present., not an alleged technological miracle called “fracking”.

However, the iron ore capacity expansion story is no less cogent. On the eve of the financial crisis, the Big Three miners—-Vale, BHP and Rio—had already doubled their mining capacity from 250 million tons annually at the turn of the century, to 195 million tons per quarter or 780 million tons annually.

But when prices soared to $180/ton in 2012, investment levels were drastically scaled-up even further. Currently, the Big Three have combined capacity of more than 1.1 billion tons annually that is not only in the investment pipeline, but is actually so far advanced that completion makes more sense than abandonment. Accordingly, not withstanding the massive over-supply already in the market, several hundred million more tons will compound the surplus and drive prices even closer to the out-of-pocket cash cost of production in the years immediately ahead.

The above depicted capacity expansion is a quintessential reflection of the manner in which false prices in the capital markets drive excessive and wasteful investment, and cause the crash following the credit driven boom to be all the more destructive. So the cliff-diving price action here is not just another commodity cycle, but instead is a proxy for the fracturing global credit bubble, led by China department.

During the course of its mad scramble to become the world’s export factory and then its greatest infrastructure construction site, China’s expansion of domestic credit broke every historical record and has ultimately landed in the zone of pure financial madness. To wit, during the 14 years since the turn of the century China’s total debt outstanding–including its vast, opaque, wild west shadow banking system—soared from $1 trillion to $25 trillion, and from 1X GDP to upwards of 3X.

But these “leverage ratios” are actually far more dangerous and unstable than the pure numbers suggest because the denominator—national income or GDP—-has been erected on an unsustainable frenzy of fixed asset investment. Accordingly, China’s so-called GDP of $9 trillion contains a huge component of one-time spending that will disappear in the years ahead, but which will leave behind enormous economic waste and monumental over-investment that will result in sub-economic returns and write-offs for years to come. Stated differently, China’s true total debt ratio is much higher than 3X currently reported due to the unsustainable bloat in its reported national income.

Nearly every year since 2008, in fact, fixed asset investment in public infrastructure, housing and domestic industry has amounted to nearly 50% of GDP. But that’s not just a case of extreme of growth enthusiasm, as the Wall Street bulls would have you believe. It’s actually indicative of an economy of 1.3 billion people who have gone mad digging, building, borrowing and speculating.

Nowhere is this more evident than in China’s vastly overbuilt steel industry, where capacity has soared from about 100 million tons in 1995 to upwards of 1.2 billion tons today. Again, this 12X growth in less than two decades is not just red capitalism getting rambunctious; its actually an economically cancerous deformation that will eventually dislocate the entire global economy. Stated differently, the 1 billion ton growth of China’s steel industry since 1995 represents 2X the entire capacity of the global steel industry at the time; 7X the size of Japan’s then world champion steel industry; and 10X the then size of the US industry.

Already, the evidence of a thundering break-down of China’s steel industry is gathering momentum. Capacity utilization has fallen from 95% in 2001 to 75% last year, and will eventually plunge toward 60%, resulting in upwards of a half billion tons of excess capacity. Likewise, even the manipulated and massaged financial results from China big steel companies have begin to sharply deteriorate. Profits have dropped from $80-100 billion RMB annually to 20 billion in 2013, and are now in the red; and the reported aggregate leverage ratio of the industry has soared to in excess of 70%.

But these are just mild intimations of what is coming. The hidden truth of the matter is that China would be lucky to have even 500 million tons of annual “sell-through” demand for steel to be used in production of cars, appliances, industrial machinery and for normal replacement cycles of long-lived capital assets like office towers, ships, shopping malls, highways, airports and rails. Stated differently, upwards of 50% of the 800 million tons of steel produced by China in 2013 likely went into one-time demand from the frenzy in infrastructure spending.

Indeed, the deformations are so extreme that on the margin China’s steel industry has been chasing its own tail like some stumbling, fevered dragon. Thus, demand for plate steel to build dry bulk carriers has soared, but the underlying demand for new bulk carrier capacity was, ironically, driven by bloated demand for the iron ore needed to make the steel to build China’s empty apartments and office towers and unused airports, highways and rails.

In short, when the credit and building frenzy stops, China will be drowning in excess steel capacity and will try to export its way out— flooding the world with cheap steel. A trade crisis will soon ensue, and we will shortly have the kind of globalized import quota system that was imposed on Japan in the early 1980s. Needless to say, the latter may stabilize steel prices at levels far below current quotes, but it will also mean a drastic cutback in global steel production and iron ore demand.

And that gets to the core component of the deformation arising from central bank fueled credit expansion and the drastic worldwide repression of interest rates and cost of capital. The 12X expansion of China’s steel industry was accompanied by an even more fantastic expansion of iron ore production, processing, transportation, port and ocean shipping capacity.

On the one hand, capacity could not grow at the breakneck speed of China’s initial ramp in steel production—so prices soared. And again, not just in the range of traditional cyclical amplitudes. As indicated above, prices rose from $20 per ton in the early 1990s to $180 per ton by 2012—meaning that vast windfall rents were earned on the difference between low cash costs on existing or recently constructed iron ore capacity and the soaring prices in spot and contract markets.

The reality of truly obscene current profits and the propaganda about endless growth in the miracle of red capitalism, combined with the cheap debt available in global capital markets, resulted in an explosion of iron ore mining capacity like the world has never before witnessed in any mineral industry.

Stated differently, the Big Three miners would never have expanded their capacity from 250 million tons to 1.1 billion tons in an honest free market. Nor would they have posted such egregious financial trends as have occurred over the past decade. To wit, even as the global iron ore (and also copper) boom gather steam in the run-up to the financial crisis, the three miners spent $55 billion on CapEx during the four years ending in 2007.

By contrast, during the four most recent years they spent 3.2X more or $175 billion. Not surprisingly, the residue on their balance sheets is unmistakable. Their combined debt went from about $12 billion in 2004 to more than $90 billion at present.

But now, prices will be driven down to the lowest marginal cost of supply, meaning that Big Three EBITDA will violently collapse, causing leverage ratios to soar and new CapEx to be drastically downsized. In turn, Caterpillar’s order book will take a giant hit, and so will its supply chain running all the way back to Peoria.

So the collapse of the mother of all commodity bubbles is virtually baked into the cake. As one industry CEO recently acknowledged, his company’s truly variable, cash cost of production is about $20 per ton and he will not hesitate to keep producing for positive variable profit. That means iron ore prices will also plunge far below the current $66 per ton quote now extant in the market.

In short, when the classical Austrians talked about “malinvestment” the pending disasters in the global steel and iron ore industries (and also mining equipment and other supplier industries) are what they had in mind. Except none of them could have imagined the fevered and irrational magnitudes of the deformations that have resulted from the actions of the mad money printers who now run the world’s central banks.

David Stockton

Comment