Time to make it easier for people to get loans with lower credit and lower down payments: FHFA looking seriously at making it easier for cash strapped Americans to take on mortgages.

If you had to write two chapters on the housing market between say 2000 and 2007 and one between 2007 and 2014 both would look incredibly different. One was guided by massive exuberance and a populist movement of giving money to anyone with a pulse. The latest chapter is one guided by big investors and low inventory. This long horizon now brings us to the present. Housing values are up solidly over the last year but not because the general public is diving in head first. This latest push came from a multi-year trend of “cash buying” and investor dominance. That trend has slowed. In order to get more interest again, the Federal Housing Finance Agency (FHFA) is looking at making it easier for the public to get loans. Ignore the fact that this agency has been rebranded since it failed fantastically in the last bubble and is now once again in charge of overseeing Fannie Mae, Freddie Mac, and 12 Federal Home Loan Banks. Since many in the public can’t muster 5 percent for a down payment or have blemishes on their credit, the FHFA is looking at making things a tad bit easier for people to qualify. Instead of asking why so many have a hard time saving for a down payment or why people have lower credit scores, the banking/government hybrid is looking at making it easier for people to take on big debt with high leverage.

Cash sales and FHA loans

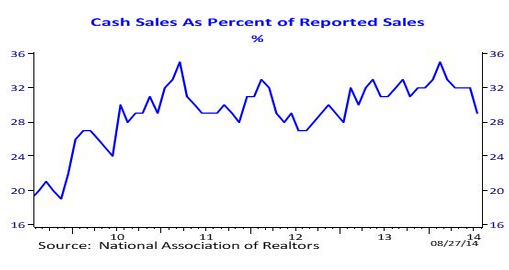

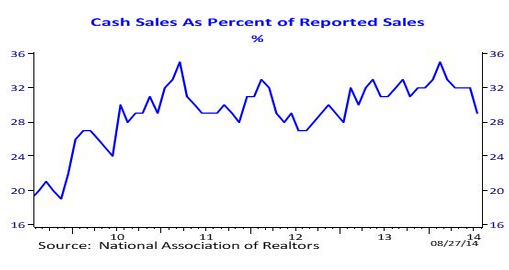

The nation is largely seeing a resurgence of renter demand. People would like to buy but budgets simply do not allow people to purchase homes at current prices. For example, take a look at the volume of cash sales:

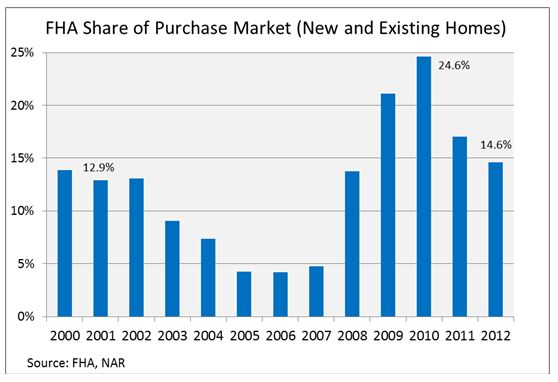

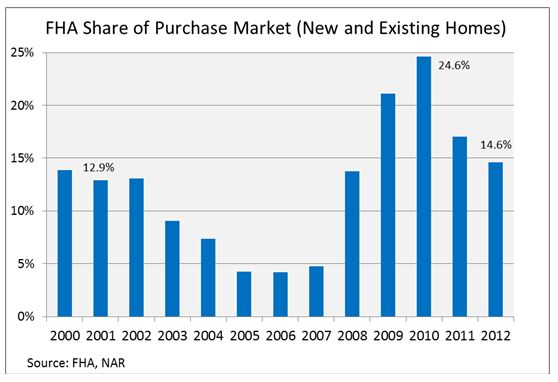

Even for the typical home in the US of say $209,000 most will absolutely need a mortgage. That is just the name of the game. So of course, those circumventing the mortgage system are those with access to larger pools of cash (i.e., investors). Those investors are losing interest in many markets given how quickly prices went up. Value is harder to find. So it makes sense that now the FHFA is going to try to make cash strapped households leverage up at a point where prices are at multi-year highs.FHA loans which are wildly expensive when PMI and other fees are considered, have taken up a large share of the lower-tier market:

Even though FHA insured loans only require 3.5 percent down, many now carry long-term PMI and there is little reason to go this route unless you are exhausting all other borrowing options. The chart above shows that volume has waned here as well since the longer term PMI option was recently implemented.

Will easing standards work?

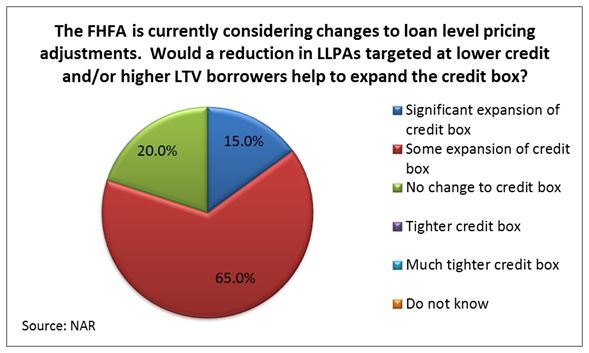

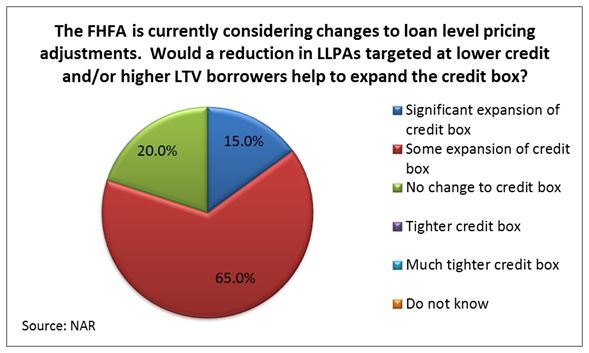

It isn’t all too clear that lowering standards will cause a massive resurgence or short-term burst similar to the home buying tax credit we saw a few years ago. Those in the industry do see this as expanding the borrower pool:

15 percent think this expansion will bring in more borrowers. 65 percent see some expansion while 20 percent see relatively no change. I believe that the lower you set the bar, the more people you will bring in. This should be obvious. But why is the bar being lowered? If we bring back no-income and no-doc loans you will have many people chomping at the bit to buy. Debt does not scare Americans.So how does the FHFA plan on expanding mortgage availability?

“(WaPo) DOWNPAYMENTS. Saving enough money for a downpayment is often cited as the toughest hurdle for first-time buyers in particular. Watt said that Fannie and Freddie are working to develop “sensible and responsible” guidelines that will allow them to buy mortgages with down payments as low as 3 percent, instead of the 5 percent minimum that both institutions currently require.This change would apply to a “targeted segment of creditworthy borrowers” and take into account “compensating factors,” Watt said. (Housing experts speculate that maybe the lower downpayments would only be offered to first-time buyers.) More details to come in the weeks ahead, Watt added.”

“CREDIT SCORES. Most housing advocates agree that a bigger bang for the buck would come from having lenders lower the unusually high credit scores that they’re now demanding from borrowers.After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. Housing experts say the push to hold lenders accountable for loose lending practices of the past steered the industry toward the highest-quality borrowers, undermining the mission of Fannie and Freddie to serve the broader population, including low- to moderate- income borrowers.”

It is funny that the FHFA, now seven years after the bust is interested in helping “low- to moderate- income borrowers.” No matter how you slice this, they are trying to squeeze more debt onto already cash strapped households. Dropping the down payment to 3 percent is comical and frankly puts buyers into a negative equity position from day one (given that selling commission will eat up 5 to 6 percent). This push of course is coming because regular buyers are having a tougher time buying homes in the current market and many have already forgotten the graveyard of 7,000,000 foreclosures we went through.

The push coming from renter nation

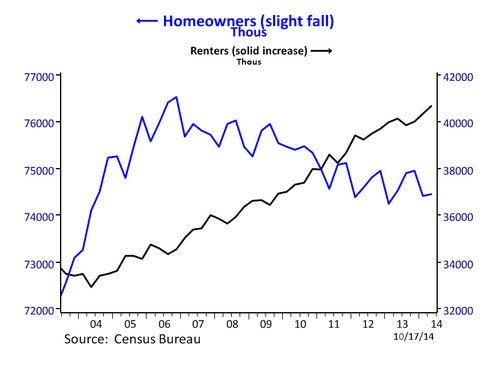

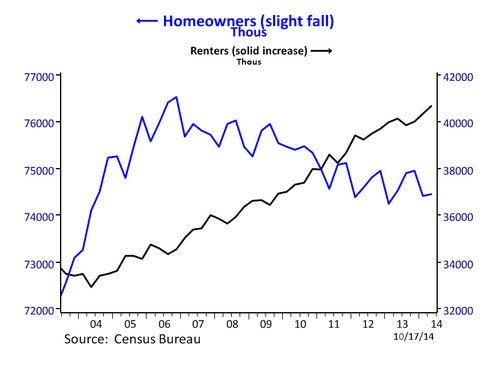

The second chapter has also been one of adding more renter households:

It is no surprise that while this talk of the FHFA lowering standards is happening, the homeownership rate hit a near two decade low:

“(LA Times) The share of Americans who own their homes slipped again in the second quarter to its lowest level in nearly two decades.Just 64.8% of U.S. homes are owner-occupied, the Commerce Department said Tuesday, down from 65% in the first quarter and the lowest count since the third quarter of 1995. The figures are adjusted to account for seasonal variations.In Los Angeles and Orange counties, 49.1% of homes are owner-occupied. That’s the lowest rate of any big metropolitan area in the country.”

You also have Los Angeles and Orange counties reporting the lowest homeownership rate of all big metro areas in the country. This is now a renting majority region.

Implications?

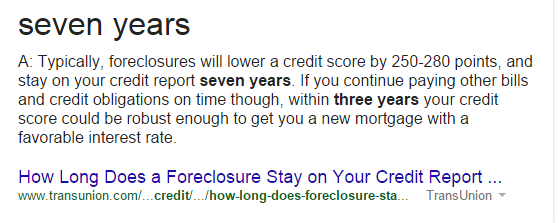

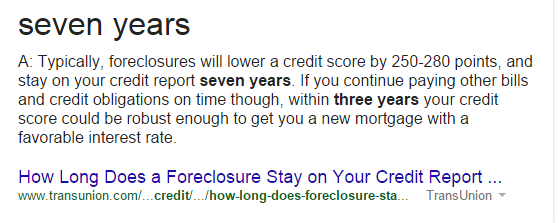

Should this occur, it is very likely to aid in sales nationwide. By how much? That is hard to say since dropping the down payment from 5 to 3 percent will simply cut into the more expensive FHA market that already allows you to go in with 3.5 percent down. I do agree that the credit change will be more substantive. I find it interesting that this aligns perfectly with the length of time a foreclosure stays on your credit report:

The bubble imploded in 2007 so this is a nice time to wash away those old foreclosures and hit the reset button on your FICO score. Whenever you lower credit standards you will increase the pool of potential buyers. That is what will happen here. But you are setting up a large portion of the population on a razor thin margin and you have to wonder what will happen when the next inevitable recession hits. Boom and bust. The makeup of the current housing market has turned everyone into a speculator. Nice to see the FHFA is now “concerned” with housing affordability and access to debt.

If you had to write two chapters on the housing market between say 2000 and 2007 and one between 2007 and 2014 both would look incredibly different. One was guided by massive exuberance and a populist movement of giving money to anyone with a pulse. The latest chapter is one guided by big investors and low inventory. This long horizon now brings us to the present. Housing values are up solidly over the last year but not because the general public is diving in head first. This latest push came from a multi-year trend of “cash buying” and investor dominance. That trend has slowed. In order to get more interest again, the Federal Housing Finance Agency (FHFA) is looking at making it easier for the public to get loans. Ignore the fact that this agency has been rebranded since it failed fantastically in the last bubble and is now once again in charge of overseeing Fannie Mae, Freddie Mac, and 12 Federal Home Loan Banks. Since many in the public can’t muster 5 percent for a down payment or have blemishes on their credit, the FHFA is looking at making things a tad bit easier for people to qualify. Instead of asking why so many have a hard time saving for a down payment or why people have lower credit scores, the banking/government hybrid is looking at making it easier for people to take on big debt with high leverage.

Cash sales and FHA loans

The nation is largely seeing a resurgence of renter demand. People would like to buy but budgets simply do not allow people to purchase homes at current prices. For example, take a look at the volume of cash sales:

Even for the typical home in the US of say $209,000 most will absolutely need a mortgage. That is just the name of the game. So of course, those circumventing the mortgage system are those with access to larger pools of cash (i.e., investors). Those investors are losing interest in many markets given how quickly prices went up. Value is harder to find. So it makes sense that now the FHFA is going to try to make cash strapped households leverage up at a point where prices are at multi-year highs.FHA loans which are wildly expensive when PMI and other fees are considered, have taken up a large share of the lower-tier market:

Even though FHA insured loans only require 3.5 percent down, many now carry long-term PMI and there is little reason to go this route unless you are exhausting all other borrowing options. The chart above shows that volume has waned here as well since the longer term PMI option was recently implemented.

Will easing standards work?

It isn’t all too clear that lowering standards will cause a massive resurgence or short-term burst similar to the home buying tax credit we saw a few years ago. Those in the industry do see this as expanding the borrower pool:

15 percent think this expansion will bring in more borrowers. 65 percent see some expansion while 20 percent see relatively no change. I believe that the lower you set the bar, the more people you will bring in. This should be obvious. But why is the bar being lowered? If we bring back no-income and no-doc loans you will have many people chomping at the bit to buy. Debt does not scare Americans.So how does the FHFA plan on expanding mortgage availability?

“(WaPo) DOWNPAYMENTS. Saving enough money for a downpayment is often cited as the toughest hurdle for first-time buyers in particular. Watt said that Fannie and Freddie are working to develop “sensible and responsible” guidelines that will allow them to buy mortgages with down payments as low as 3 percent, instead of the 5 percent minimum that both institutions currently require.This change would apply to a “targeted segment of creditworthy borrowers” and take into account “compensating factors,” Watt said. (Housing experts speculate that maybe the lower downpayments would only be offered to first-time buyers.) More details to come in the weeks ahead, Watt added.”

“CREDIT SCORES. Most housing advocates agree that a bigger bang for the buck would come from having lenders lower the unusually high credit scores that they’re now demanding from borrowers.After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. Housing experts say the push to hold lenders accountable for loose lending practices of the past steered the industry toward the highest-quality borrowers, undermining the mission of Fannie and Freddie to serve the broader population, including low- to moderate- income borrowers.”

The push coming from renter nation

The second chapter has also been one of adding more renter households:

It is no surprise that while this talk of the FHFA lowering standards is happening, the homeownership rate hit a near two decade low:

“(LA Times) The share of Americans who own their homes slipped again in the second quarter to its lowest level in nearly two decades.Just 64.8% of U.S. homes are owner-occupied, the Commerce Department said Tuesday, down from 65% in the first quarter and the lowest count since the third quarter of 1995. The figures are adjusted to account for seasonal variations.In Los Angeles and Orange counties, 49.1% of homes are owner-occupied. That’s the lowest rate of any big metropolitan area in the country.”

You also have Los Angeles and Orange counties reporting the lowest homeownership rate of all big metro areas in the country. This is now a renting majority region.

Implications?

Should this occur, it is very likely to aid in sales nationwide. By how much? That is hard to say since dropping the down payment from 5 to 3 percent will simply cut into the more expensive FHA market that already allows you to go in with 3.5 percent down. I do agree that the credit change will be more substantive. I find it interesting that this aligns perfectly with the length of time a foreclosure stays on your credit report:

The bubble imploded in 2007 so this is a nice time to wash away those old foreclosures and hit the reset button on your FICO score. Whenever you lower credit standards you will increase the pool of potential buyers. That is what will happen here. But you are setting up a large portion of the population on a razor thin margin and you have to wonder what will happen when the next inevitable recession hits. Boom and bust. The makeup of the current housing market has turned everyone into a speculator. Nice to see the FHFA is now “concerned” with housing affordability and access to debt.