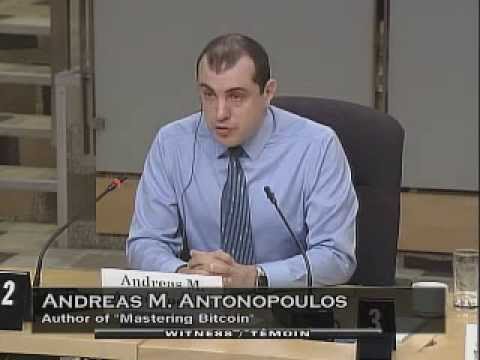

Some of you might remember the New York hearings on Bitcoin several months back and how informative that was. I think this one, one-up's it by a few notches. Today (Oct 8, 2014), for almost 2 hours Andreas Antenopolous, a well known bitcoin spokesperson and tech security guru from the states, answered some pretty tough questions from Canadian Senators on Bitcoin. The hearing is primarily focused on government regulation & consumer protection - IMHO, Andreas absolutely nailed every single answer. It was amazing thing to witness!

Andreas is a clear thinker, very knowledgeable on bitcoin, and has the unique skill to provide articulate answers on the spot. Worth your time even if you only have a passing interest in Bitcoin & related crypto currencies.

With his testimony, Canada it seems, is on track to do what it normally does. That is: Wait & watch what the USA is going to do, contemplate it, fix the problems, then execute on it. With any luck (possibly a LOT of luck) Canada will be a regulatory free region for bitcoin for a few years to come.

Andreas is a clear thinker, very knowledgeable on bitcoin, and has the unique skill to provide articulate answers on the spot. Worth your time even if you only have a passing interest in Bitcoin & related crypto currencies.

With his testimony, Canada it seems, is on track to do what it normally does. That is: Wait & watch what the USA is going to do, contemplate it, fix the problems, then execute on it. With any luck (possibly a LOT of luck) Canada will be a regulatory free region for bitcoin for a few years to come.

Comment