Announcement

Collapse

No announcement yet.

PPI Whopper

Collapse

X

-

-

Re: PPI Whopper

Is it accurate to say that it's the holders of assets with artificially inflated prices that stand to benefit from these infusions? Isn't the the goal to keep pumping money in until the artificially high prices become fair prices again (with the unit of measure being reduced instead)? i.e. debtors win? Or is that too simple by half?

Comment

-

Re: PPI Whopper

It may be simple, but nevertheless sums it up neatly!Originally posted by WDCRob View PostIs it accurate to say that it's the holders of assets with artificially inflated prices that stand to benefit from these infusions? Isn't the the goal to keep pumping money in until the artificially high prices become fair prices again (with the unit of measure being reduced instead)? i.e. debtors win? Or is that too simple by half?Finster

...

Comment

-

Re: PPI Whopper

If you define "benefit from" as staying in business and greasing the wheels, then yes. I really haven't seen any significant evidence yet that the goal is to pump until the artificial prices become fair again and truly rescue everyone who took too much risk etc.... although in the long term most debtors do win due to the underlying inflation.Originally posted by WDCRob View PostIs it accurate to say that it's the holders of assets with artificially inflated prices that stand to benefit from these infusions? Isn't the the goal to keep pumping money in until the artificially high prices become fair prices again (with the unit of measure being reduced instead)? i.e. debtors win? Or is that too simple by half?

Also keep in mind that LTCM is no longer around. They and the money invested in them are just plain gone, and its very likely that at least one major current player will meet the same fate within no more than 4-6 months. Until that happens, in my opinion the bottom won't be in.

Comment

-

Re: PPI Whopper

Another impetus urging them towards relative conservatism. They are finding it increasingly hard to apply the usual balm, especially now that even the official government inflation figures are starting to look scary. Were they to succeed in fully patching up the credit markets, they would be again looking at a tanking dollar, soaring oil prices, and other inflationary ills.Originally posted by bart View Post"Billions to come" is about the easiest prediction/opinion to have, it's just the timing that's tricky.

The Fed and other CBs are just playing and in the opening innings of "Save Our System".

First and foremost, they're conservative bankers and will virtually never over react to problems. Secondarily, they're literally being the lenders of last resort and trying to grease the wheels between banks and shore up liquidity... and those ephemeral things called trust and confidence.

I'm really glad that you brought up the issue of credit flowing again. The only real problems are between banks and also with the quality of their balance sheets due to derivatives issues.

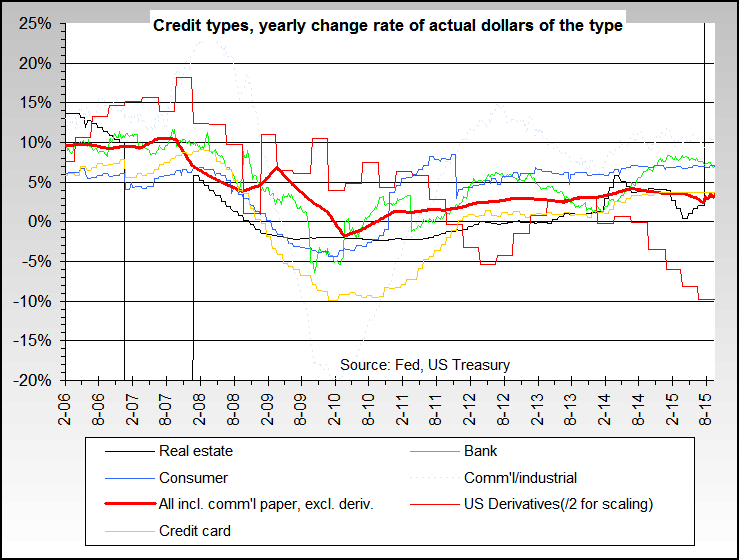

Check this weekly chart of credit annual rates of change - the red line tells the actual story. Credit is continuing to expand at a pretty good clip - almost 10%.

Keep in mind that neither the Asian crisis or the LTCM mess in 1997-8 were resolved overnight. It's only been 4-5 months since the SHTF in June/July.

Also note that just because total credit is still expanding doesn't mean that it won't start dropping on a relative basis soon too. My basic point is simply that the actual total credit numbers look ok right now, even though real estate (and more recently consumer credit) are trending down hard.

And its always appropriate to ask what the Fed is smoking... ;)

Ohhhh ... once the inflation genie is allowed out of the bottle ...

Not a bad chart ...Originally posted by bart View Post

... despite the deficiency of red dots ...

;)Finster

...

Comment

-

Re: PPI Whopper

Truly... on the inflation genie, oil and other commodity prices and even the dollar etc.... but we're still in a globalized and globalizing world, and the US is far from the only one with credit market issues or large debt/GDP ratios, etc.Originally posted by Finster View PostAnother impetus urging them towards relative conservatism. They are finding it increasingly hard to apply the usual balm, especially now that even the official government inflation figures are starting to look scary. Were they to succeed in fully patching up the credit markets, they would be again looking at a tanking dollar, soaring oil prices, and other inflationary ills.

Ohhhh ... once the inflation genie is allowed out of the bottle ...

Just like California leads the US in many areas, the Fed tends to lead many other CBs and the Fed is still very much not in pump mode on an intermediate or longer term basis... yet.

And Benny and his FOMC Jets are well aware of the '70s and stagflation and inflation issues, regardless of their various public "pronouncements" (I just hope they never hire TUS for "PR"... ;) ) and other machinations.

My back order finally came in... were the Manor dungeon beasties (aka deus ex machina) hoarding them again? ;)Originally posted by Finster View PostNot a bad chart ...

... despite the deficiency of red dots ...

;)

Or is this the red dot to which you're referring?

http://www.topglock.com/images/reddottarget.jpg :eek: ;)

;)

Comment

-

Re: PPI Whopper

I think it's fundamental that currency must be depreciated as quickly as possible, in order to make it possible to pay on today's obligations without defaults.

Since there is nothing but debt default on the horizon...the only answer is to pay these debts back in cheaper dollars, Yen, Pounds, Euros, etc.

That's why I see another commodities boom ahead...oil, softs, gold and silver...even stocks really may get a boost. The worst performers will be bonds.

Bonds already give a negative real return...

Comment

Comment