Re: PPI Whopper

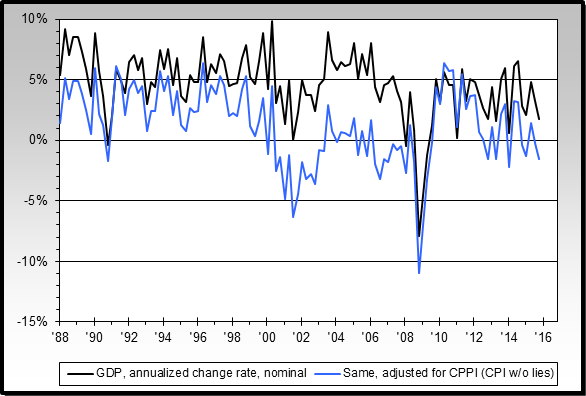

Economy slowing, change in money supply dropping faster = deflation

Economy growing, change in money supply steady = deflation

Are these the same from an investment standpoint?

If not, and there are no good measures of real GDP to tell you which scenario you're in, how do you go about deciding what to do with your $$?

Economy slowing, change in money supply dropping faster = deflation

Economy growing, change in money supply steady = deflation

Are these the same from an investment standpoint?

If not, and there are no good measures of real GDP to tell you which scenario you're in, how do you go about deciding what to do with your $$?

Comment