By Masaaki Iwamoto and Kyko Shimodoi

Japan risks losing its position as the world’s top creditor nation, as dwindling savings become insufficient to finance growing public debt, a Bloomberg News survey of economists indicates.

A run of current-account surpluses that drove Japan’s net asset position to the largest in the world starting in 1991 is set to reverse, according to 10 of 16 economists in a Bloomberg News survey, with nine projecting sustained deficits by the end of 2020. Japan had net assets of 325 trillion yen ($3.2 trillion) at the end of 2013, with China in second place with 208 trillion yen, according to Japan’s finance ministry.

As an aging population draws down its savings, Japan will become more dependent on foreign creditors to finance its budget deficits and manage the world’s biggest debt burden. A swing to current-account deficits could augur a surge in bond yields as investors reassess the nation’s prospects, and clear the way for China to overtake it as the world’s biggest net creditor.

“Chances are high that China will surpass Japan as early as 2020 in the size of net overseas assets,” said Hidenori Suezawa, a financial market and fiscal analyst at SMBC Nikko Securities Inc. “The issue will be whether Japan can attract enough foreign capital to make up for the current-account deficits as countries like the U.S. do.

”‘Twin Deficits’

Japan has posted a surplus on its current-account balance since 1973 on a quarterly basis, excluding a seven-quarter run of shortfalls in 1979 and 1980 caused by a surge in oil prices. Last year, the surplus shrank to the smallest since 1985, as a weaker yen inflated an energy import bill that soared after a nuclear disaster in March 2011.

Finance Minister Taro Aso last month pointed out risks the country would face should it register “twin deficits” in the current-account and budget: the proportion of the government’s debt held by foreign investors would rise, giving them a “large influence” on the market, he wrote in a May 27 submission to the Council on Economic and Fiscal Policy, which advises Prime Minister Shinzo Abe.

Aso said the government can’t delay a target to achieve a primary budget surplus by the fiscal year starting in April 2020 — a goal he previously said would be “very difficult” to reach.

Falling Savings

Government debt will rise to 935 trillion yen in fiscal 2020, equal to 169 percent of annual economic output, from 769 trillion yen this fiscal year, according to finance ministry projections.

The savings rate fell to 1.1 percent in 2012 from 9.7 percent in 1994, according to the Cabinet Office. The declines are likely to accelerate as more babyboomers retire, said Kyohei Morita, chief Japan economist at Barclays Plc. The population is projected to drop 2.7 percent to 124 million in 2020 from 127 million in 2012, according to the National Institute of Population and Social Security Research.

A current-account deficit driven by swelling public debt and falling household savings would lead to higher bond yields, said Eiji Ogawa, executive vice president for finance at Hitotsubashi University.

“Unless the government raises the sales tax to 20 percent or makes drastic reform on social welfare spending, this scenario is highly likely,” said Ogawa. “Higher interest rates will discourage domestic capital investment and spur the shift of production abroad, increasing the number of people unemployed.”

Bond Yields

The yield on Japan’s benchmark 10-year government bond, now around 0.6 percent, could rise to 4 percent — a level unseen since March 1995 — should the current-account balance drop into deficit as public debt eclipses the nation’s savings, said Toshihiro Nagahama, chief economist at Dai-ichi Life Research Institute.

Income from investments overseas is likely to head off a fall into current-account deficits, said Nomura Securities Inc. economist Minoru Nogimori, who predicts surpluses will continue at least through 2020.

Japan’s overseas assets increased to 797 trillion yen as of the end of 2013, nearly doubling from 386 trillion yen in 2003, according to the finance ministry.

Market Turmoil

Koya Miyamae, an economist at SMBC Nikko Securities Inc., said concerns about the threat from a current-account deficit may be overblown.

The U.S. has run a shortfall every year since 1992 while posting average economic growth of 2.6 percent over the period, higher than an average 0.9 percent for Japan, he said. At the same time, the U.S. has been able to attract sufficient investment from abroad to make up for its current-account shortfall.

“The current account is just one picture,” said Miyamae, who forecasts the current account will be in deficit in 2020. “In the case of a country falling into a current-account deficit due to strong domestic demand or active private investment, what’s wrong with that?”

Still, countries with fiscal and current-account deficits tend to be hit harder than those with surpluses when the world is going through market turmoil, said Masaaki Kanno, chief Japan economist at JPMorgan Chase & Co. It will be important for Japan to attract long-term inward direct investment as it becomes more reliant on foreign creditors, Kanno said.

http://www.bloomberg.com/news/2014-06-10/japan-s-top-creditor-title-at-risk-as-surplus-end-looms-economy.html

How Japan Blew Its Savings Surplus: What A Keynesian Dystopia Looks Like

by David Stockman

Financially speaking, Japan is fast becoming a Keynesian dystopia. Its entire economy is now hostage to a fiscal time bomb. Namely, government debt which already exceeds 240% of GDP and which is growing rapidly because even the recent traumatic increase in the sales tax from 5% to 8% does not come close to filling the fiscal gap. Moreover, even at today’s absurdly low and BOJ rigged bond rate of 0.6% nearly 25% of government revenue is absorbed by interest payments.

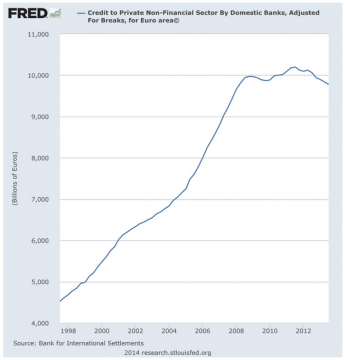

Now comes the coup de grace. Japan’s savings rate has collapsed (see below) and its vaunted current account surplus is about ready to disappear. This means Japan’s accounts with the rest of the world will cross-over into a “financial no man’s land”; it will be forced to steadily liquidate its overseas investments to pay its current bills—an investment surplus built up over the course of 50 years. But this will also reduce foreign earnings and thereby expand Japan’s growing deficit on current account.

Accordingly, to finance its “twin deficits” it will have to attract massive amounts of foreign capital for decades to come—an imperative which will require a devastating rise in interest rates, perhaps as high as 4% according to one expert :

The yield on Japan’s benchmark 10-year government bond, now around 0.6 percent, could rise to 4 percent – a level unseen since March 1995 — should the current-account balance drop into deficit as public debt eclipses the nation’s savings, said Toshihiro Nagahama, chief economist at Dai-ichi Life Research Institute.

Needless to say, were the carry-cost of Japan’s towering fiscal debts to rise by even half that much it would be game over. Interest expense would absorb virtually 100% of current policy revenue, forcing the government to raise taxes over and over. One expert quoted in the Bloomberg article below says that a sales tax of 20%—-nearly tripple the recently enacted level—-would be required to wrestle down the fiscal monster that would result from interest rate normalization.

Unless the government raises the sales tax to 20 percent or makes drastic reform on social welfare spending, this scenario is highly likely,” said Ogawa. “Higher interest rates will discourage domestic capital investmentand spur the shift of production abroad, increasing the number of people unemployed.”

The above quote strongly hints why Keynesian dystopia is an apt description of what is emerging in Japan; and why that descriptor is also reflective of the financial horror show that is coming to our own financial neighborhood a decade or two down the road.

As indicated above, the alternative to an economy killing 20 sales tax is “drastic reform of social welfare spending”. But the latter is not even a remote possibility. Japan’s population is both shrinking and also aging so rapidly that its fast on its way to become an archipelago of old age homes.

Japan savings rate as shown below has dropped from in excess of 20% during its 1970s and 1980s heyday as a mercantilist export power to only 3% today. When Japan’s retired population reaches nearly 40% of the total in the years ahead, this rate will obviously go negative as households liquidate savings in order to survive.

What happened to Japan’s huge savings surplus? The government borrowed it! And wasted it on massive Keynesian stimulus projects that kept the LDP in power for decades but produced bridges and highways to nowhere that will be of no use to Japan’s retirement colony as it ages.

And the adverse demographic tide is indeed powerful as shown by the curve below on Japan’s working age population. In a few short years what was a working age population that peaked at 88 million has dropped to 79 million; and it will plunge to below 50 million persons in the next two decades.

What the Keynesian witch-doctors who advised Japan to bury itself in fiscal stimulation after its financial crisis of 1989-1990 did not explain was how this inexorably shrinking working population could possibly shoulder the tax burden needed to carry Japan’s massive public debt.

Yet there is no other way out of the Keynesian debt trap in which Japan is now impaled. As the current account, also shown below, continues to worsen, the need to import capital to fund the gap will drive interest rates sharply higher. The burden on Japan’s remaining taxpayers will become crushing.

So the graph below should be pasted on every US Congressman’s forehead. When the debt spiral goes too far—it becomes a devastating financial trap. And it cannot ultimately be solved with money printing because if carried to an extreme—even for the so-called reserve currency—it will destroy the monetary system entirely.

It should also never be forgotten that the drastic degeneration of Japan’s public finances happened in real time—–within less than two decades after its leadership was bludgeoned into one fiscal spasm after the next by Keynesian officialdom in the US Treasury, the IMF, the OECD and elsewhere. And this is clearly a case of bad ideas imported from abroad. The generation of officials who lead Japan’s post-war miracle may have been hopelessly addicted to unsustainable models of mercantilist export promotion and currency pegging, but they were not believers in Keynesian borrow and spend.

I know that from personal experience of dealing with Japanese financial officialdom during the early days of the Reagan administration. Quite simply, they were shocked that America was about to take such an immense fiscal gamble by drastically cutting taxes before the inherited domestic spending had been curtailed and the huge defense build-up had been funded.

That was then—at a time when Japan’s debt was under 50% of GDP notwithstanding two decades of government directed internal economic development. Yet just a decade latter— after being bludgeoned to drastically appreciate the yen after the Plaza Accord of 1985—their export mercantilism model broke-down in a vast financial bubble and bust engineered by the BOJ.

Thus, left completely at sea, they were sitting ducks for visiting Keynesian fireman like Professors Bernanke and Summers. Japan then launched upon the greatest experiment in Keynesian fiscal stimulus ever imagined. The catastrophic results speak for themselves and are a potent remainder that bad ideas can wreak immense damage once they are embraced by the machinery of the state.

Comment