So you still want to make the argument that cash buying is a small portion of the market? The latest sales data shows that cash buyers made up a record 42.7 percent of all sales in the first quarter of 2014. The latest National Association of Realtors report shows all cash purchases at 33 percent for the last month of data. RealtyTrac also follows auction sales that many times, do not show up on the MLS and as we all know institutional investors at times are buying blocks of homes directly from banks. I would assume this would account for a good portion of the difference between RealtyTrac data and that from the NAR. Either way, both are showing an incredibly high number of cash purchases. Overall, investors are chasing lower priced properties. Markets like Nevada, Arizona, and Florida have cash buyers making up the majority of all home purchases. In one of the reports this morning, a research company mentioned that in prime Irvine California, something like 80 percent of sales are going to Chinese foreign buyers. That is not a small amount of the buying pool. This is definitely not your traditional housing market.

All cash buying reaches record level on low overall sales volume

I always found it amazing how some people downplayed the influence of investors in the real estate market. Many were saying that this was simply a tiny portion of the market. “Nothing to see here” was the argument in the first few years. There is clearly something going on here. RealtyTrac’s data shows that 42.7 percent of all home sales in Q1 of 2014 went to cash buyers, an all-time record. This is the core group of buyers in today’s housing market.

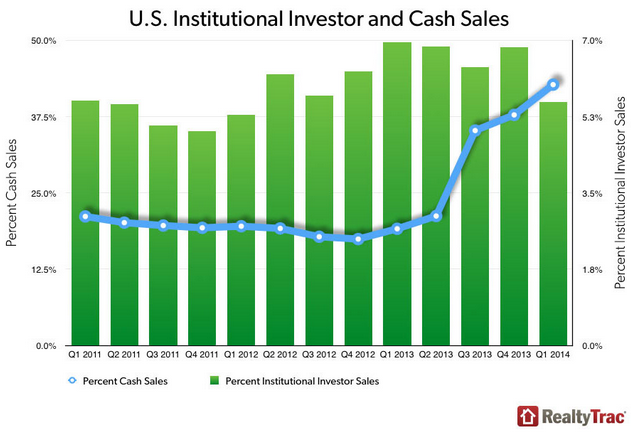

What we can take away from the report is this: (1) traditional buyers are being priced out even with low mortgage rates (2) cash buying although high as a percentage, is dropping in actual purchases (3) foreign buying is focused like a hawk on certain areas.Let us look at the cash buyer data:

You can see that the big spike occurred in 2013 and has yet to subside. You will also notice that institutional buyers, those buying large blocks of homes, are starting to pullback especially in places like California. The cash buyer of today is largely buying investment homes, flips, or foreigners targeting certain cities.

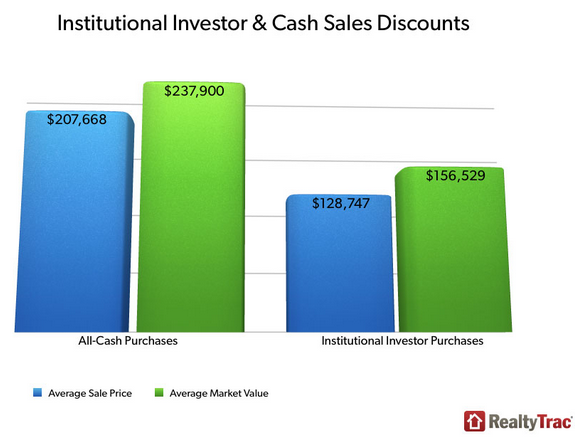

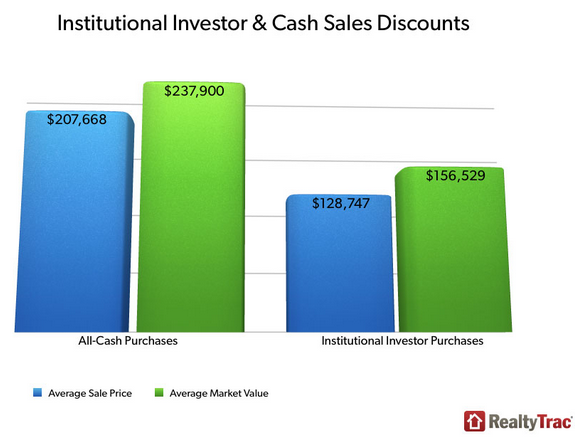

The majority are not buying high priced properties:

You can see that the average price paid by all cash buyers is $207,668 and for institutional investors it was $128,747. Makes sense given the massive amount of buying in places like Arizona, Nevada, and Florida.

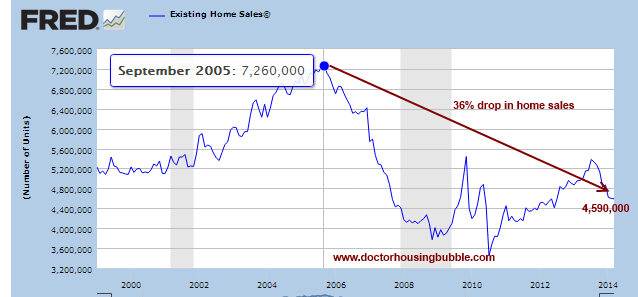

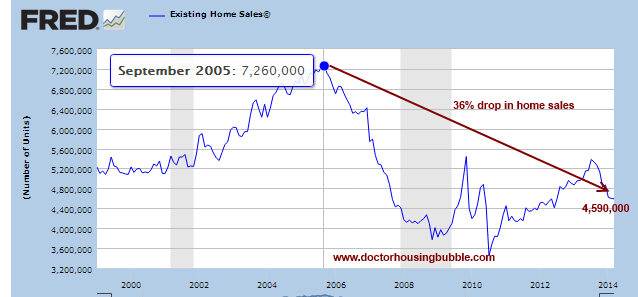

It is important to remember however that this is a percentage of all home sales. And existing home sales are pathetically weak:

This is why you see mortgage applications hitting levels last seen in 2000. The public is largely priced out. In overvalued California, 1 out of 3 families can actually afford to purchase a home at today’s prices.What we do know is that foreign buyers are targeting certain markets.80 percent of sales in Irvine going to foreign buyers from China?Most of the reports over the last few days have been “shocked” at the record number of cash buyers in the market. Nothing surprising here. This has been the juice of the housing recovery going back to 2008. Latin Americans are heavily purchasing in places like Miami while buyers from China are heavily focused in on California. What did stand out to me was a quote from Meyers Research regarding the Irvine housing market:

“(CNN Money) Miami, New York, Boston and coastal California cities are attracting a lot of foreign buyers who are paying in all cash, according to Jeff Meyers, founder of Meyers Research.In Miami, Latin Americans are putting down deposits of 50% or more on apartments in the early stages of development, enabling builders to self-finance the rest of the building or leverage bank loans at attractive rates. The buyer then pays the balance in cash at the time of occupancy.In California, Chinese nationals and immigrants are “parking their cash in single-family homes,” said Meyers.

In Irvine, Calif., for example, 80% of sales over the past year were to Chinese buyers, he said.”

This is a massive amount of targeted home purchasing in one city. I’ve had a few contacts that sell homes in the Orange County market telling me that 7 out of 10 purchases were going to Chinese buyers, all with cash offers. These reports would come in every few months or so but interesting to see this coincide with the report above. We already know that over 30 percent of all purchases in California are going to investors but 80 percent in one city? That would certainly change the dynamics of the market. Irvine is no small city with 230,000+ people living in the city.The traditional home buyer is flat on his back. There is no surprise that California is largely becoming a renter state. When a poorly built condo in Irvine with mega-HOA dues is going for $500,000 you have to question what is truly going on. The above data helps to show us the true face of the market. The traditional buyer is done in high priced metro areas. Cash is king. The only problem is, most Americans don’t have the cash to play and many need to leverage to the hilt with ARMs or get from parents just to get into the game if they have any aspiration of competing in this market. But as it turns out, many of the younger buyers of today are so broke they are living with parents unable to even pay rent for a place, let alone venture out to compete with all cash buyers in inflated markets. This isn’t the housing market of mom and dad.

All cash buying reaches record level on low overall sales volume

I always found it amazing how some people downplayed the influence of investors in the real estate market. Many were saying that this was simply a tiny portion of the market. “Nothing to see here” was the argument in the first few years. There is clearly something going on here. RealtyTrac’s data shows that 42.7 percent of all home sales in Q1 of 2014 went to cash buyers, an all-time record. This is the core group of buyers in today’s housing market.

What we can take away from the report is this: (1) traditional buyers are being priced out even with low mortgage rates (2) cash buying although high as a percentage, is dropping in actual purchases (3) foreign buying is focused like a hawk on certain areas.Let us look at the cash buyer data:

You can see that the big spike occurred in 2013 and has yet to subside. You will also notice that institutional buyers, those buying large blocks of homes, are starting to pullback especially in places like California. The cash buyer of today is largely buying investment homes, flips, or foreigners targeting certain cities.

The majority are not buying high priced properties:

You can see that the average price paid by all cash buyers is $207,668 and for institutional investors it was $128,747. Makes sense given the massive amount of buying in places like Arizona, Nevada, and Florida.

It is important to remember however that this is a percentage of all home sales. And existing home sales are pathetically weak:

This is why you see mortgage applications hitting levels last seen in 2000. The public is largely priced out. In overvalued California, 1 out of 3 families can actually afford to purchase a home at today’s prices.What we do know is that foreign buyers are targeting certain markets.80 percent of sales in Irvine going to foreign buyers from China?Most of the reports over the last few days have been “shocked” at the record number of cash buyers in the market. Nothing surprising here. This has been the juice of the housing recovery going back to 2008. Latin Americans are heavily purchasing in places like Miami while buyers from China are heavily focused in on California. What did stand out to me was a quote from Meyers Research regarding the Irvine housing market:

“(CNN Money) Miami, New York, Boston and coastal California cities are attracting a lot of foreign buyers who are paying in all cash, according to Jeff Meyers, founder of Meyers Research.In Miami, Latin Americans are putting down deposits of 50% or more on apartments in the early stages of development, enabling builders to self-finance the rest of the building or leverage bank loans at attractive rates. The buyer then pays the balance in cash at the time of occupancy.In California, Chinese nationals and immigrants are “parking their cash in single-family homes,” said Meyers.

In Irvine, Calif., for example, 80% of sales over the past year were to Chinese buyers, he said.”

This is a massive amount of targeted home purchasing in one city. I’ve had a few contacts that sell homes in the Orange County market telling me that 7 out of 10 purchases were going to Chinese buyers, all with cash offers. These reports would come in every few months or so but interesting to see this coincide with the report above. We already know that over 30 percent of all purchases in California are going to investors but 80 percent in one city? That would certainly change the dynamics of the market. Irvine is no small city with 230,000+ people living in the city.The traditional home buyer is flat on his back. There is no surprise that California is largely becoming a renter state. When a poorly built condo in Irvine with mega-HOA dues is going for $500,000 you have to question what is truly going on. The above data helps to show us the true face of the market. The traditional buyer is done in high priced metro areas. Cash is king. The only problem is, most Americans don’t have the cash to play and many need to leverage to the hilt with ARMs or get from parents just to get into the game if they have any aspiration of competing in this market. But as it turns out, many of the younger buyers of today are so broke they are living with parents unable to even pay rent for a place, let alone venture out to compete with all cash buyers in inflated markets. This isn’t the housing market of mom and dad.

Comment