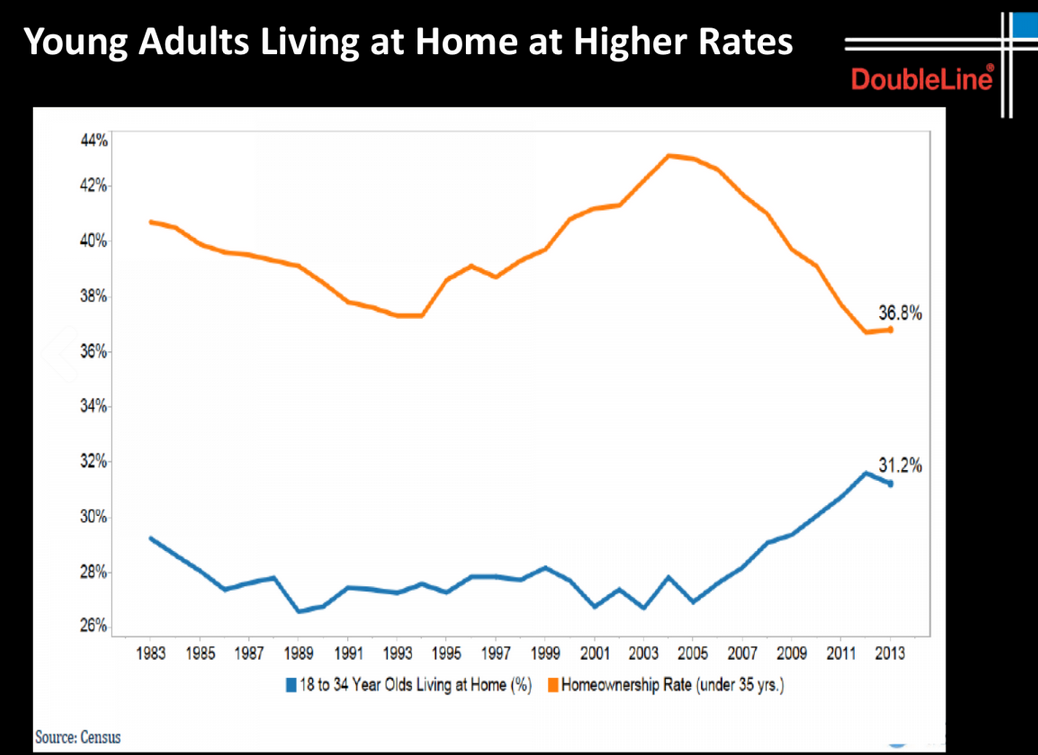

The drop in the homeownership rate is epic:

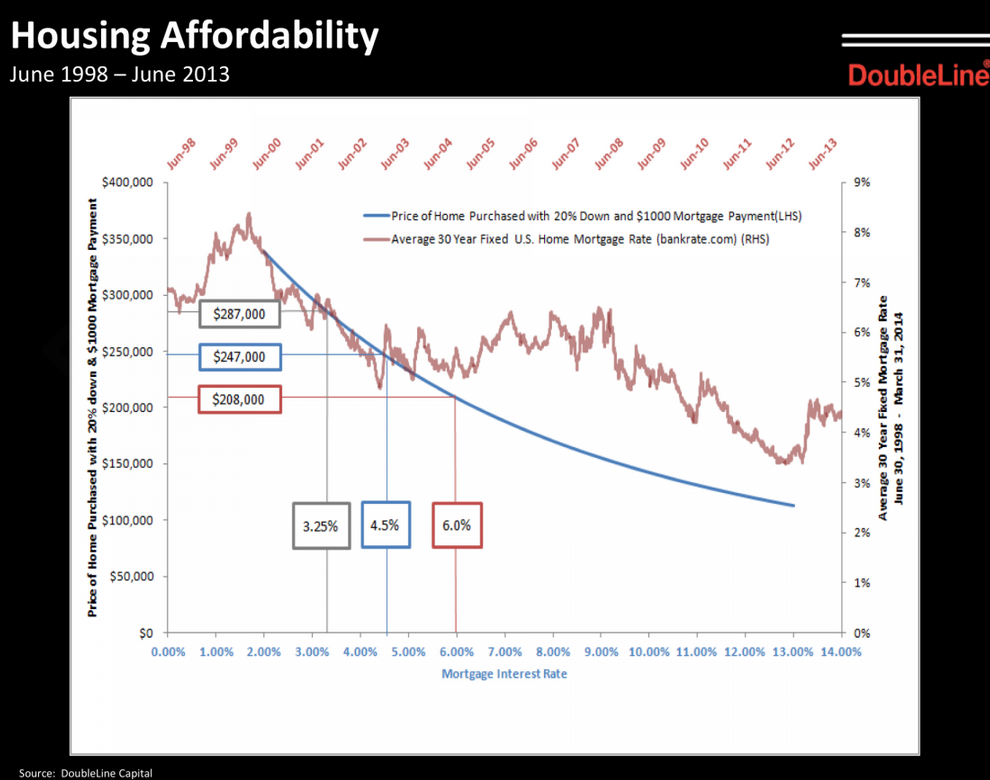

Housing affordability is all about the monthly nut. That is why the modest 100 basis move in interest rates last summer basically stopped the mania right in the middle of its slobbering delusion:

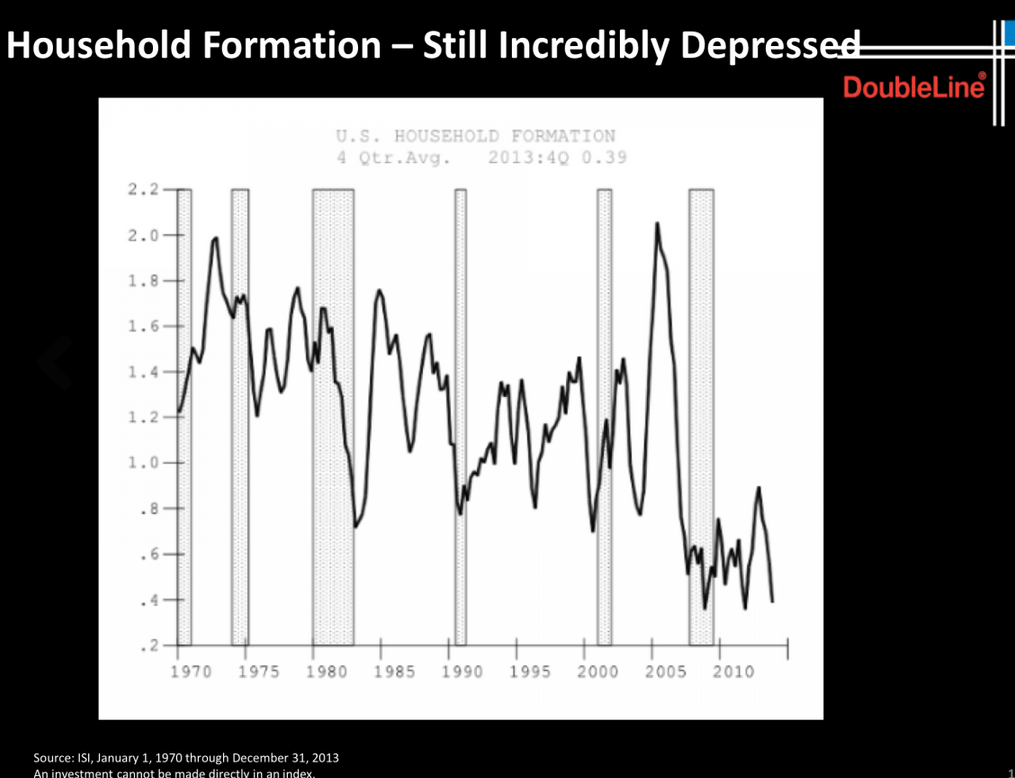

Household formation is at multi-generational lows:

Some might think that living at home is only for expensive markets like L.A. County or San Francisco but this is also a national trend:

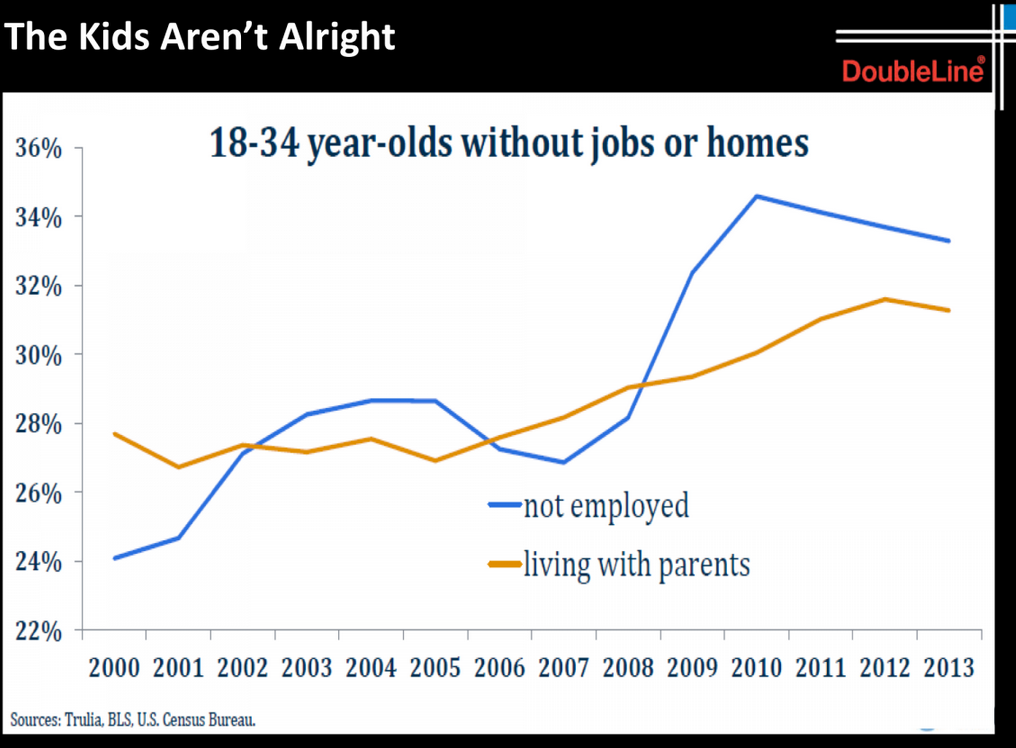

Many are living at home because they are economically struggling:

Comment