A mortuary of 7,000,000 foreclosures and counting: Nation still faces 9.1 million properties that are seriously underwater.

If a foreclosure happens in the wilderness, does it make a sound? It seems like people have conveniently forgotten that since the housing crisis hit we have witnessed more than 7,000,000+ foreclosures. Do you think these people believe the Fed is almighty and can stop a speeding train or turn water into wine?

Apparently some people forget that the Fed failed to prevent the tech bust or the housing bust in the first place. Now, the Fed is somehow the cult leader and the leader will not let housing values fall. The nation still has 9.1 million seriously underwater homeowners on top of the more 7 million that have gone through foreclosure. It is abundantly clear that the mindless drivel of “buying is always a good decision” is just that. Investors are starting to pull back in expensive states because value is harder to find. I see the lemmings at open houses and you can see the drool at the side of their mouths hoping for a morsel of real estate. The Fed, for better or worse, has turned us all into speculators. Simply putting your money in a bank is a losing battle because inflation is eroding your buying power. Yet wages are not keeping up. What you have is people competing with investors, foreign money, and a market with low inventory and trying to guess the next move from the Fed. Yet the tech bust and housing crash (keep in mind these happened only since 2000) were major events not prevented by the Fed.

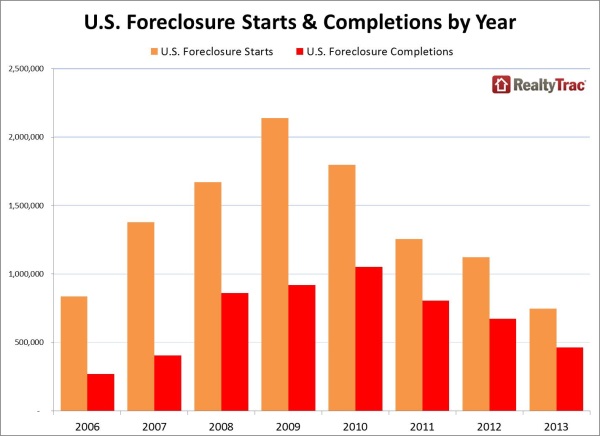

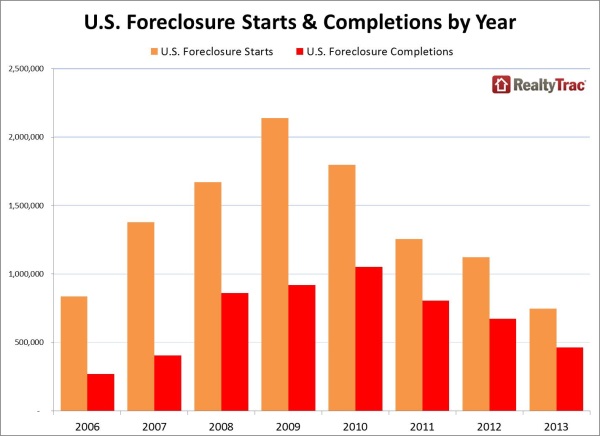

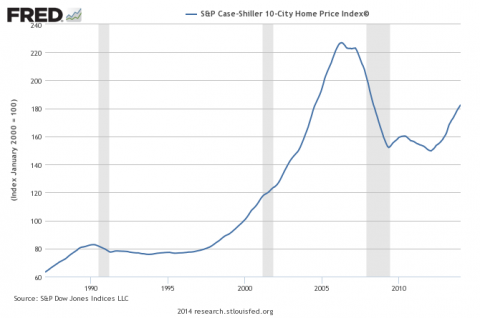

Does buying today make sense?The big question for many is whether buying today makes sense. Hopefully the 7 million foreclosures within the last decade highlights that housing isn’t always a simple buying decision. Investors have been dominant in the market since 2009. Big money is clearly pulling back from inflated markets like those in California. This trend is fairly new but even with this minor twist, inventory is picking up and sales are still very low.It helps to understand that many foreclosures are happening because people are spread thin. People are still maxed out. Unlike big banks with sophisticated deals and systems in place, most households are living paycheck to paycheck even those with higher incomes. First, take a look at some foreclosure history:

Print this chart out and just remember that housing is a big freaking purchase. Probably the biggest you will ever make. Just because someone is house horny doesn’t mean they should act on it. What fascinates me is that late in 2012, most of those in the housing industry failed to see the big run-up in prices for 2013. Most were predicting 2 to 5 percent price gains. Instead, we saw double-digit gains. At the end of 2013, the predictions were incredibly optimistic for 2014.If the trend is so obvious and clear, why do we see low volume in housing sales?

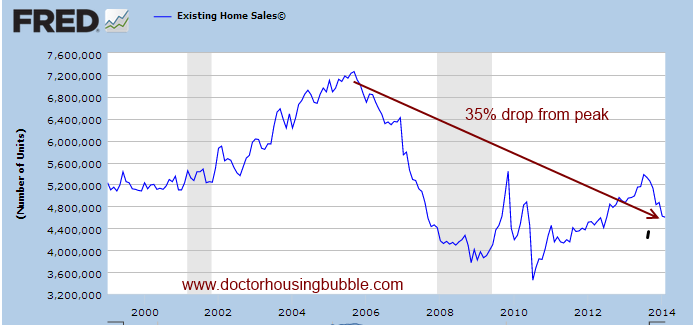

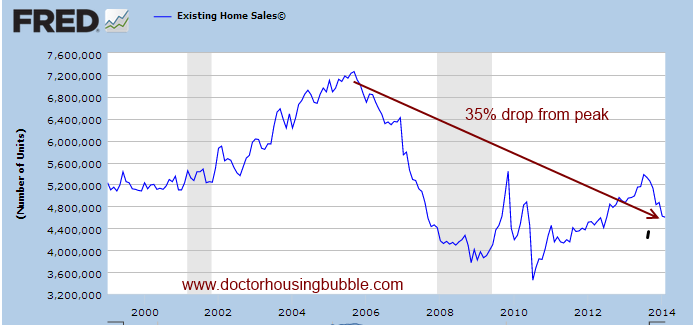

Existing home sales are down more than 35 percent from their peak reached in 2006. Our population is growing and prices are going up. Yet the push for higher prices has come from Wall Street, low rates, and normal buyers competing with the investor group. A big question that many are wondering is what will happen when big money starts to flow out of real estate. We are starting to find out slowly. Rates are also likely to go up – so for those that believe the almighty Fed can do anything they should listen to their leader that is utterly telling the market rates will go in one direction.What we don’t have to guess on is that this recent trend has made it tougher for first time buyers:

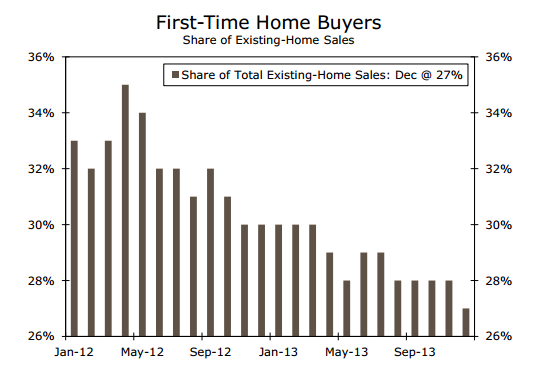

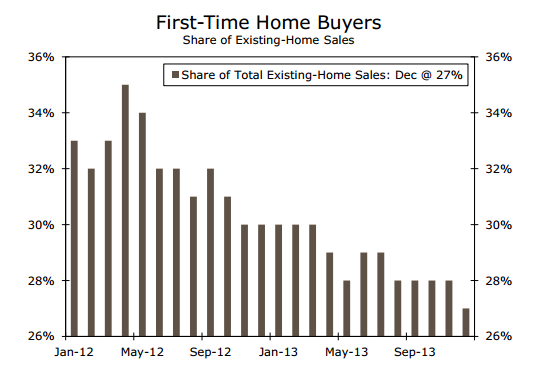

First-time home buyers are a small portion of the market today because of investors crowding them out. We also have a large number of young ones living in the basement of their parent’s granite countertop sarcophagus.Still underwaterDespite the recent rise in home prices we still have 9.1 million home owners seriously underwater. What this tells us is that many people pushed their budgets to the financial limits merely to squeeze in. If this were truly a solid housing uptrend we would be seeing home builders doing what they do, building homes. We would also see existing home sales kicking butt. Yet we have a juiced up system with countless forms of accounting shenanigans. Some try to make it out as if economics and finance are somehow a new science. Unlike Newtonian physics on Earth, the Fed can act like a deus ex machina and literally change the rules for a brief period of time. And people are emotional and the reptilian part of our brain goes haywire when you talk about the “nest” – you need only go to an open house to see the house horny folks battle it out.We’ve been adding many more rental households over the last few years, just in line with the big investor buying (those 7 million foreclosures have to move somewhere but foreclosures are also slowing down):

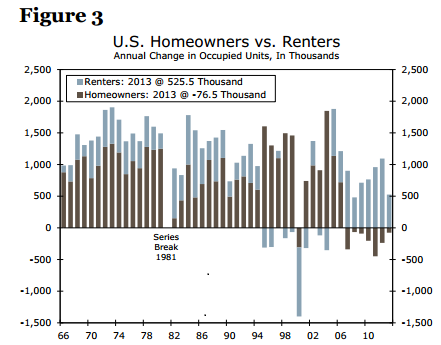

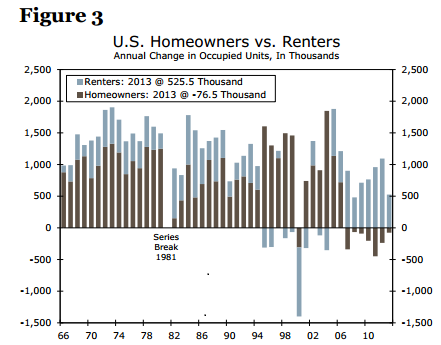

What is telling about this chart is that we have never had a sustained period of actually losing home owner households since, well this last crisis. Why? Take a look at the graveyard of 7,000,000 foreclosures. The Fed has turned the housing market into a speculative vehicle and with this volume of investor buying, you should proceed with the caution of buying a stock. This is another critical point here in regards to perceived risk. You have people staying miles away from stocks (which are up 170+ percent since 2009) yet are more than willing to stuff their entire $100,000 or $200,000 down payment into a highly priced piece of property that just went up by double-digits courtesy of investor fever. Yet they feel this is safer! California was a big chunk of the 7,000,000 foreclosures folks. You have people with pathetic 401ks and retirement funds yet 80 to 90 percent of their wealth tied up in one piece of real estate.7 million foreclosures and currently 9.1 million seriously underwater home owners. It should be apparent that when it comes to buying a house, you really need to run the numbers. Investors have and they are pulling back from certain markets.

If a foreclosure happens in the wilderness, does it make a sound? It seems like people have conveniently forgotten that since the housing crisis hit we have witnessed more than 7,000,000+ foreclosures. Do you think these people believe the Fed is almighty and can stop a speeding train or turn water into wine?

Apparently some people forget that the Fed failed to prevent the tech bust or the housing bust in the first place. Now, the Fed is somehow the cult leader and the leader will not let housing values fall. The nation still has 9.1 million seriously underwater homeowners on top of the more 7 million that have gone through foreclosure. It is abundantly clear that the mindless drivel of “buying is always a good decision” is just that. Investors are starting to pull back in expensive states because value is harder to find. I see the lemmings at open houses and you can see the drool at the side of their mouths hoping for a morsel of real estate. The Fed, for better or worse, has turned us all into speculators. Simply putting your money in a bank is a losing battle because inflation is eroding your buying power. Yet wages are not keeping up. What you have is people competing with investors, foreign money, and a market with low inventory and trying to guess the next move from the Fed. Yet the tech bust and housing crash (keep in mind these happened only since 2000) were major events not prevented by the Fed.

Does buying today make sense?The big question for many is whether buying today makes sense. Hopefully the 7 million foreclosures within the last decade highlights that housing isn’t always a simple buying decision. Investors have been dominant in the market since 2009. Big money is clearly pulling back from inflated markets like those in California. This trend is fairly new but even with this minor twist, inventory is picking up and sales are still very low.It helps to understand that many foreclosures are happening because people are spread thin. People are still maxed out. Unlike big banks with sophisticated deals and systems in place, most households are living paycheck to paycheck even those with higher incomes. First, take a look at some foreclosure history:

Print this chart out and just remember that housing is a big freaking purchase. Probably the biggest you will ever make. Just because someone is house horny doesn’t mean they should act on it. What fascinates me is that late in 2012, most of those in the housing industry failed to see the big run-up in prices for 2013. Most were predicting 2 to 5 percent price gains. Instead, we saw double-digit gains. At the end of 2013, the predictions were incredibly optimistic for 2014.If the trend is so obvious and clear, why do we see low volume in housing sales?

Existing home sales are down more than 35 percent from their peak reached in 2006. Our population is growing and prices are going up. Yet the push for higher prices has come from Wall Street, low rates, and normal buyers competing with the investor group. A big question that many are wondering is what will happen when big money starts to flow out of real estate. We are starting to find out slowly. Rates are also likely to go up – so for those that believe the almighty Fed can do anything they should listen to their leader that is utterly telling the market rates will go in one direction.What we don’t have to guess on is that this recent trend has made it tougher for first time buyers:

First-time home buyers are a small portion of the market today because of investors crowding them out. We also have a large number of young ones living in the basement of their parent’s granite countertop sarcophagus.Still underwaterDespite the recent rise in home prices we still have 9.1 million home owners seriously underwater. What this tells us is that many people pushed their budgets to the financial limits merely to squeeze in. If this were truly a solid housing uptrend we would be seeing home builders doing what they do, building homes. We would also see existing home sales kicking butt. Yet we have a juiced up system with countless forms of accounting shenanigans. Some try to make it out as if economics and finance are somehow a new science. Unlike Newtonian physics on Earth, the Fed can act like a deus ex machina and literally change the rules for a brief period of time. And people are emotional and the reptilian part of our brain goes haywire when you talk about the “nest” – you need only go to an open house to see the house horny folks battle it out.We’ve been adding many more rental households over the last few years, just in line with the big investor buying (those 7 million foreclosures have to move somewhere but foreclosures are also slowing down):

What is telling about this chart is that we have never had a sustained period of actually losing home owner households since, well this last crisis. Why? Take a look at the graveyard of 7,000,000 foreclosures. The Fed has turned the housing market into a speculative vehicle and with this volume of investor buying, you should proceed with the caution of buying a stock. This is another critical point here in regards to perceived risk. You have people staying miles away from stocks (which are up 170+ percent since 2009) yet are more than willing to stuff their entire $100,000 or $200,000 down payment into a highly priced piece of property that just went up by double-digits courtesy of investor fever. Yet they feel this is safer! California was a big chunk of the 7,000,000 foreclosures folks. You have people with pathetic 401ks and retirement funds yet 80 to 90 percent of their wealth tied up in one piece of real estate.7 million foreclosures and currently 9.1 million seriously underwater home owners. It should be apparent that when it comes to buying a house, you really need to run the numbers. Investors have and they are pulling back from certain markets.

Comment