Re: The Young & Not So Restless

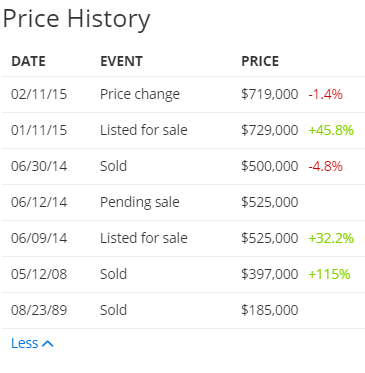

During the Mother-of-all-Housing-Bubbles there was a national petition by appraisers to Washington to reign in the banker demands for ever-higher appraisals. I recall the signatures were in the 10,000 range and represented those appraisers who were proving " difficult" in pushing the "Ownership Society" towards its Elysium. If you didn't play, you were no longer called. (needless to say, the industry's stooges did nothing)

During the Mother-of-all-Housing-Bubbles there was a national petition by appraisers to Washington to reign in the banker demands for ever-higher appraisals. I recall the signatures were in the 10,000 range and represented those appraisers who were proving " difficult" in pushing the "Ownership Society" towards its Elysium. If you didn't play, you were no longer called. (needless to say, the industry's stooges did nothing)

Comment