Re: Patient's Chart Please

My guess is that if you look at aggregate numbers, boomers on average are consuming fine.

It's just that most of them aren't.

But "the economy" doesn't need most of us.

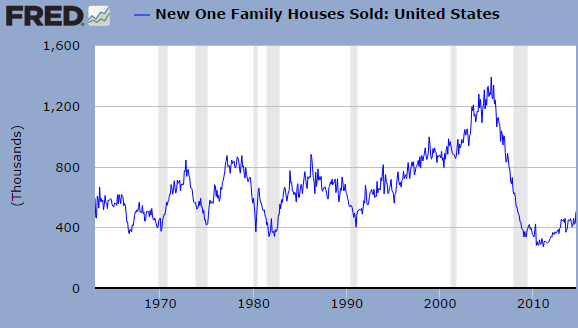

One person who blows $250,000,000 on a mansion does as much "consuming" as 1,000 people who buy new middle class homes.

One person who blows $250,000,000 on a yacht does as much consuming as 10,000 people spending $25,000 per year.

It doesn't matter too much if every middle class boomer cuts back, stops spending as much, and slows consumption

There's more money at the top every year.

The middle class is less relevant to "the economy" every year.

GDP can go up fine without it - maybe a little more slowly - but just fine.

And who care's if GDP's only growing 2% per year, when you're on the super-rich side of plutonomy and your wealth is growing 7%?

It's not like I'm just pulling this out of my butt either. It's not just a left-wing American thing. The banks know it too.

Remember this?:

Originally posted by shiny!

View Post

It's just that most of them aren't.

But "the economy" doesn't need most of us.

One person who blows $250,000,000 on a mansion does as much "consuming" as 1,000 people who buy new middle class homes.

One person who blows $250,000,000 on a yacht does as much consuming as 10,000 people spending $25,000 per year.

It doesn't matter too much if every middle class boomer cuts back, stops spending as much, and slows consumption

There's more money at the top every year.

The middle class is less relevant to "the economy" every year.

GDP can go up fine without it - maybe a little more slowly - but just fine.

And who care's if GDP's only growing 2% per year, when you're on the super-rich side of plutonomy and your wealth is growing 7%?

It's not like I'm just pulling this out of my butt either. It's not just a left-wing American thing. The banks know it too.

Remember this?:

Comment