Re: The Ownership Society

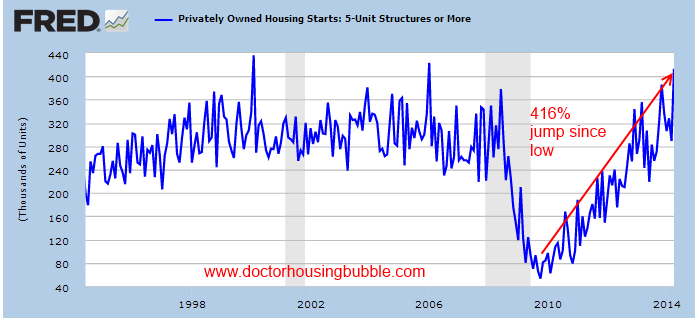

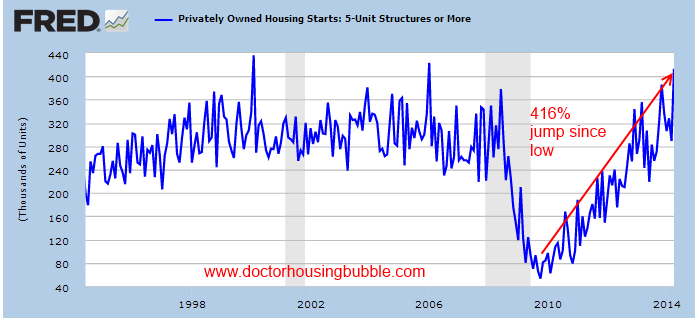

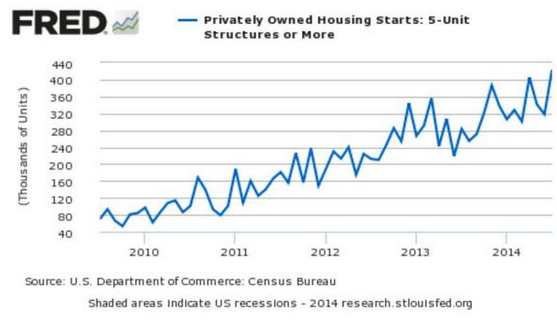

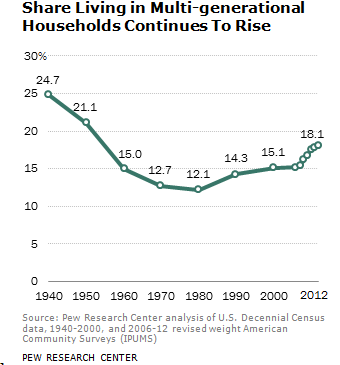

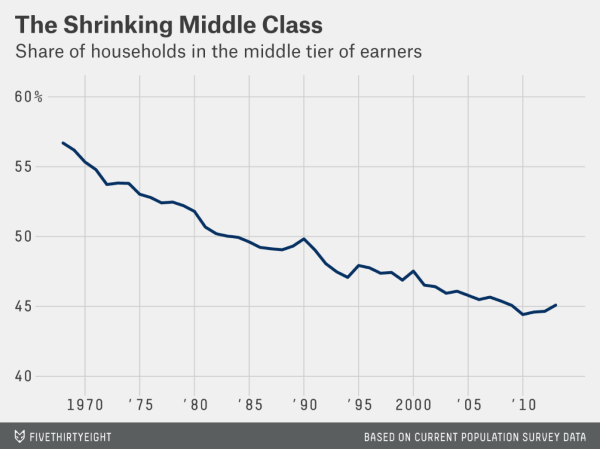

There is a simple bet to take if you believe housing is going to lead this nation into a next wave of prosperity. Take a bet on home builders. The argument is that the U.S. population continues to grow so therefore, prices on homes will simply continue to go up. But what if the growth is coming to households with lower wages? The iShares U.S. Home Construction ETF is down over 6 percent for the year while the S&P 500 is up 1 percent. What gives? Isn’t the housing market recovering? Prices are up because of constrained inventory (now slowly picking up), investor demand (starting to wane), and artificially low interest rates. You’ll notice that few of the major reasons for higher home prices have to do with household balance sheets improving. If you truly believe housing has healthy demographics ahead you would bet on home building. This index is moving in the opposite direction of prices. The place where we do see home building is with multi-family building permits. Builders are gearing up for a nation of renters. In fact, multi-family housing starts are up a massive 416 percent since their low in 2010. Apparently builders are realizing that with incomes so low and weak household formation that when these households begin to form, the first step will be in a rental. Many in the Millennial cohort live at home while house horny parents try their best to out-bid investors.Multi-family housing starts up 400+ percentThere is a simple bet to take if you really think the housing market is going to take the lead in a new recovery. Bet on U.S. Home Construction. Simple enough. You can purchase the ETF tracking the sector. As I mentioned before, this ETF is down over 6 percent for the year. Why? Because when it comes to supply and demand, you actually need the right supply and the right demand. You don’t see Ferrari setting up shops on every corner in Detroit. I’m sure people would love a Ferrari but simply put, they don’t have the income for this. Similar to housing in places like California, current residents do not have the income to buy even with artificially low interest rates and paltry down payment requirements. This trend has actually caused an out migration of domestic Californians out of the state for over a decade.

One sure bet however is the need for rental housing. Builders are ahead of the game on this one:

Housing starts for multi-unit buildings are up 416 percent from 2010. As the nation becomes one of more renters, this is a good bet to make. At some point, many younger American adults will set out to form their own households. Given their weak balance sheets, the first step is likely to be in a rental. In the past, this was the traditional route. First you move out into a rental, save for a down payment, then bought a home. That part of the market has been stunted in this recovery because first-time buyers make a pathetic amount of all current home sales.

A nation of renters

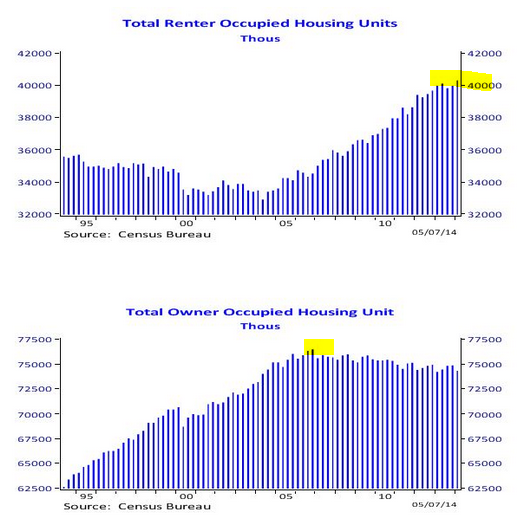

The trend is very favorable to multi-family building:

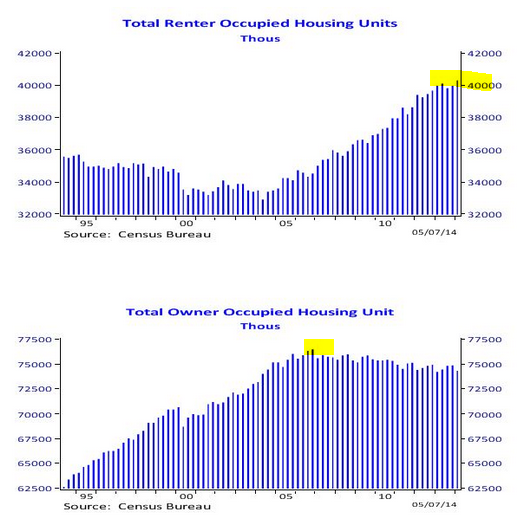

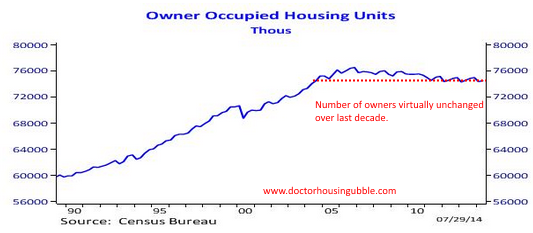

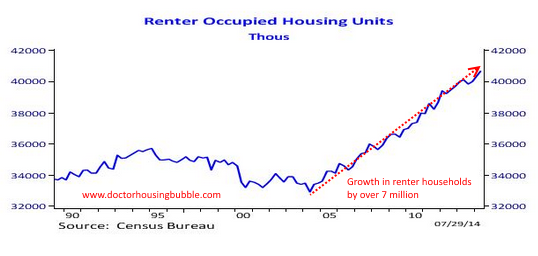

Since 2005 we have added 7 million rental households (no coincidence that we have witnessed 7 million foreclosures as well). During this same time, owner occupied housing has actually fallen. This is a trend that is fully in place. In more expensive markets, the rental share of the market is growing at a quicker pace. For example, in California you have 2.3 million adults living at home. Why? They either have no job, a job with low wages, or are financially struggling. These are the main culprits. This group is struggling to enter into a rental let alone buy a home. That is why in some areas investors make up thebulk of all home sales.And the political winds are shifting. For example, the untouchable Prop 13 looks to be on the table for changes:

“(LA Times) I think that the withdrawal of our opposition, at least for now, suggests that we don’t see this as a direct threat to Prop. 13,” said Jon Coupal, president of the Jarvis group, whose crusade for the law sparked a nationwide tax revolt.”

This is to close a loophole on commercial properties. This loophole has been around for ages. Why be open to this change now especially from such a staunch opponent? Because California is building a bigger renting majority. Now just think when more and more of the population is renting and has little at stake in the property market. This is the trend.

Slow household formation

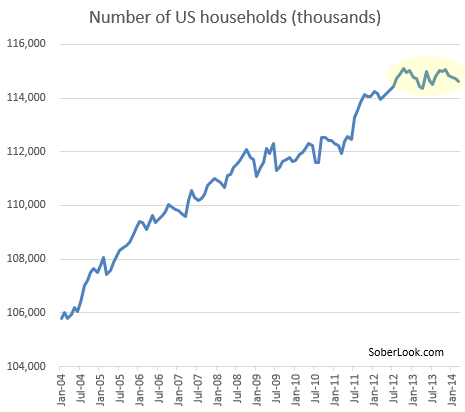

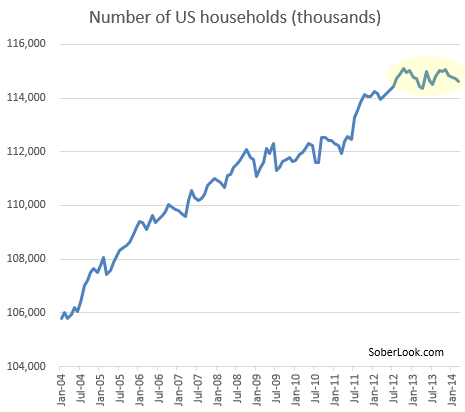

One of the more startling trends is in light of population growth, household formation has hit a wall:

This trend has been in place for over a generation and suddenly has stopped. What we will see however is more demand for rentals. As we have previously noted, we have added 7 million rental households in the last 10 years. With more rental housing on the market at some point you will see young adults moving out and getting their own place to live. In most areas of the country, housing is still affordable. Yet in many large metro areas this is simply not the case.There are simple bets to make if you feel housing will continue to go up. Put your money on the line and buy. No one will stop you. Be an investor and purchase a home to rent out or flip. Prices only go up right? It is amazing how some people think that once you buy, you suddenly “own” the place when in fact, you have a 30 year locked in commitment. Similar to renting, you have to pay someone for a very long-time regardless of your path. In California house horny buyers would plunk down money they don’t even have to squeeze into a house to be an owner but at least we are still checking incomes for loans. We already have stats showing that usage of ARMs is at multi-year highs highlighting that people need every gimmick to squeeze the monthly payment down to as low as possible just so they can compete with investors. However, inventory is rising and in non-prime areas, the fever of house lusting lemmings is slowly cooling off. As it turns out when we look at the bigger picture, we truly are becoming a nation largely made up of renters.

There is a simple bet to take if you believe housing is going to lead this nation into a next wave of prosperity. Take a bet on home builders. The argument is that the U.S. population continues to grow so therefore, prices on homes will simply continue to go up. But what if the growth is coming to households with lower wages? The iShares U.S. Home Construction ETF is down over 6 percent for the year while the S&P 500 is up 1 percent. What gives? Isn’t the housing market recovering? Prices are up because of constrained inventory (now slowly picking up), investor demand (starting to wane), and artificially low interest rates. You’ll notice that few of the major reasons for higher home prices have to do with household balance sheets improving. If you truly believe housing has healthy demographics ahead you would bet on home building. This index is moving in the opposite direction of prices. The place where we do see home building is with multi-family building permits. Builders are gearing up for a nation of renters. In fact, multi-family housing starts are up a massive 416 percent since their low in 2010. Apparently builders are realizing that with incomes so low and weak household formation that when these households begin to form, the first step will be in a rental. Many in the Millennial cohort live at home while house horny parents try their best to out-bid investors.Multi-family housing starts up 400+ percentThere is a simple bet to take if you really think the housing market is going to take the lead in a new recovery. Bet on U.S. Home Construction. Simple enough. You can purchase the ETF tracking the sector. As I mentioned before, this ETF is down over 6 percent for the year. Why? Because when it comes to supply and demand, you actually need the right supply and the right demand. You don’t see Ferrari setting up shops on every corner in Detroit. I’m sure people would love a Ferrari but simply put, they don’t have the income for this. Similar to housing in places like California, current residents do not have the income to buy even with artificially low interest rates and paltry down payment requirements. This trend has actually caused an out migration of domestic Californians out of the state for over a decade.

One sure bet however is the need for rental housing. Builders are ahead of the game on this one:

Housing starts for multi-unit buildings are up 416 percent from 2010. As the nation becomes one of more renters, this is a good bet to make. At some point, many younger American adults will set out to form their own households. Given their weak balance sheets, the first step is likely to be in a rental. In the past, this was the traditional route. First you move out into a rental, save for a down payment, then bought a home. That part of the market has been stunted in this recovery because first-time buyers make a pathetic amount of all current home sales.

A nation of renters

The trend is very favorable to multi-family building:

Since 2005 we have added 7 million rental households (no coincidence that we have witnessed 7 million foreclosures as well). During this same time, owner occupied housing has actually fallen. This is a trend that is fully in place. In more expensive markets, the rental share of the market is growing at a quicker pace. For example, in California you have 2.3 million adults living at home. Why? They either have no job, a job with low wages, or are financially struggling. These are the main culprits. This group is struggling to enter into a rental let alone buy a home. That is why in some areas investors make up thebulk of all home sales.And the political winds are shifting. For example, the untouchable Prop 13 looks to be on the table for changes:

“(LA Times) I think that the withdrawal of our opposition, at least for now, suggests that we don’t see this as a direct threat to Prop. 13,” said Jon Coupal, president of the Jarvis group, whose crusade for the law sparked a nationwide tax revolt.”

Slow household formation

One of the more startling trends is in light of population growth, household formation has hit a wall:

This trend has been in place for over a generation and suddenly has stopped. What we will see however is more demand for rentals. As we have previously noted, we have added 7 million rental households in the last 10 years. With more rental housing on the market at some point you will see young adults moving out and getting their own place to live. In most areas of the country, housing is still affordable. Yet in many large metro areas this is simply not the case.There are simple bets to make if you feel housing will continue to go up. Put your money on the line and buy. No one will stop you. Be an investor and purchase a home to rent out or flip. Prices only go up right? It is amazing how some people think that once you buy, you suddenly “own” the place when in fact, you have a 30 year locked in commitment. Similar to renting, you have to pay someone for a very long-time regardless of your path. In California house horny buyers would plunk down money they don’t even have to squeeze into a house to be an owner but at least we are still checking incomes for loans. We already have stats showing that usage of ARMs is at multi-year highs highlighting that people need every gimmick to squeeze the monthly payment down to as low as possible just so they can compete with investors. However, inventory is rising and in non-prime areas, the fever of house lusting lemmings is slowly cooling off. As it turns out when we look at the bigger picture, we truly are becoming a nation largely made up of renters.

Comment