Re: The Ownership Society

a SoCal exception . . .

Real Overpriced Counties of America: Orange County named most overpriced county in the entire United States. Fitch Ratings and Trulia point to a bubble in the OC with prices overvalued by 30 percent.

When it comes to real estate, we know that Californians enjoy drinking from the gold cup of mania. Lusting over real estate seems to be as common as traffic on the 405. People in California have a deep rooted cultural and economic amnesia. I bet half the population has very little idea regarding the history of many cities in Southern California. Heck, most don’t even know where their drinking water comes from. So trying to discuss Fed policy, skewing based on investors, or market manipulation with a large portion of people is like talking to your dog about Hemmingway. Some people only understand “real estate goes up!” and when it doesn’t, they only understand “buying is bad!” California real estate is overvalued by most economic measures. Sure, people are willing to pay insane prices but they did this as well in 2006 and 2007 and people also paid crazy prices for tech companies in a previous delusion based boom. Investors are pulling back because they simply don’t perceive value at current prices. We are now seeing more reports putting a price on how overvalued the region is. Fitch Ratings and Trulia both point to SoCal as being massively overpriced. In fact, Fitch Ratings has Orange County overvalued by a whopping 30 percent. Congratulations to Orange County for being the most overpriced county in the entire United States.Real Overpriced Homes of CaliforniaOrange County is back in full bubble mode.

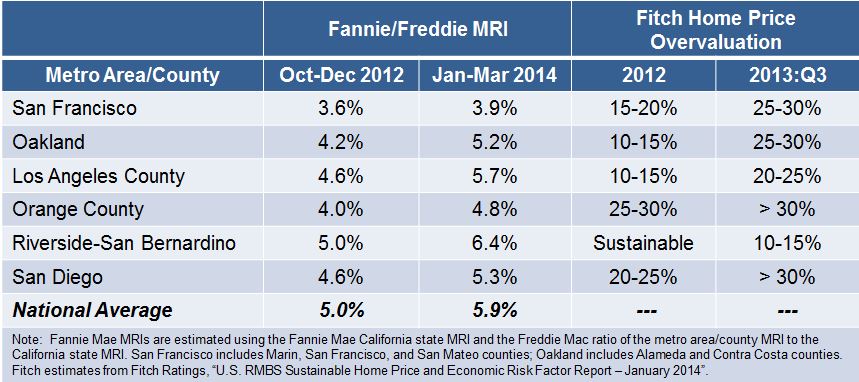

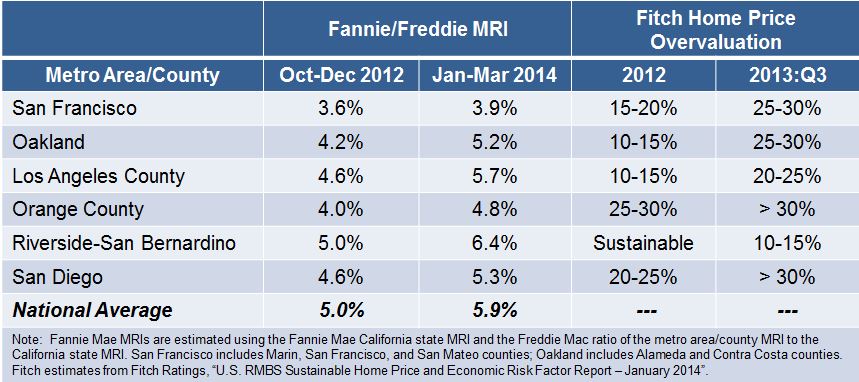

This year however, we have seen inventory increase even inprime areas like Irvine. Paying $500,000 for a poorly built condo with mega-HOAs isn’t exactly a deal. I know some people that have paid off condos that pay $1,000 and more a month just in HOAs, taxes, insurance, and maintenance. You want cable, food, and internet? Add that in as well. Keep in mind these are people that failed to fund retirement accounts or build any other income streams because they thought “hey, once the home is paid off I won’t have any other costs!” Wrong. It is crazy to see people living in $500,000 to $1 million homes shopping at Wal-Mart and the 99 Cents Store because their budgets are so stretched. I’ve seen a handful of pizza delivery people driving in fairly new Mercedes and BMWs. Living the California dream baby! This is the type of financial logic that permeates in the region.Compared to last year, the sales volume is dropping and homes are sitting longer. What always intrigues me is that people would be willing to buy in heavier volume if banks would simply give them the money. Can they afford it long-term? Hell no. Only 1 out of 3 California families can afford a home in the state to begin with and this also applies to crazy Orange County.The bulk of people in the OC live in: Anaheim, Santa Ana, Irvine, Costa Mesa, and Huntington Beach. So it is no surprise that home prices are reaching an apex. Take a look at a report put out by Fitch Ratings regarding real estate values in California:

What is interesting is that Fitch had the Inland Empire priced as sustainable last year. That is of course before the house horny investors flooded the market and jacked prices up in 2013. What cracks me up about the list above is that Orange County is even more overvalued than San Francisco. Why is this the case? Because everyone thinks that all OC households are making six-figures driving around in foreign luxury cars. Hey, if a pizza delivery person is riding around in a Benz then things must be great right? Let us take a look at household income data:

Source: CensusThe median household income in Orange County is $71,983. Much higher than the California and US figures. What is the median home price going for? The latest figures show that the median home that sold in March went for $580,000. In other words, the typical family in no way shape or form can afford to buy a home in the county in which they live. The story of SoCal. So it is no wonder that SoCal is a region of renters and this is only growing.For a $600,000 home, you definitely need a household income of $150,000 or more without putting all your eggs in one basket. How many families make more than $150,000 a year in Orange County? 35 percent.And don’t think that Fitch is only overvaluing California:

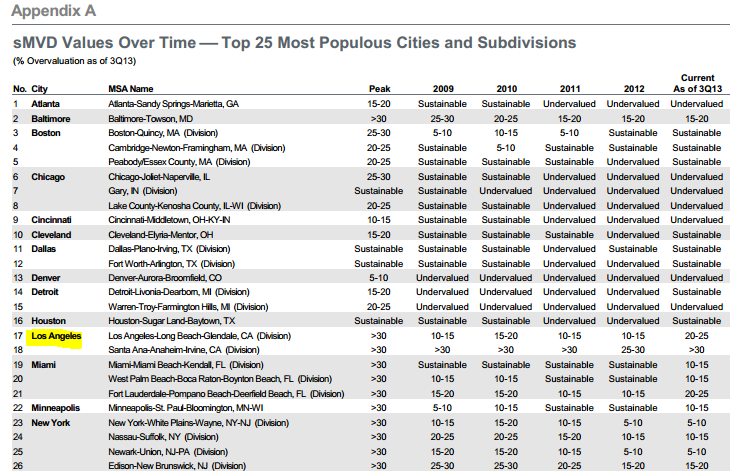

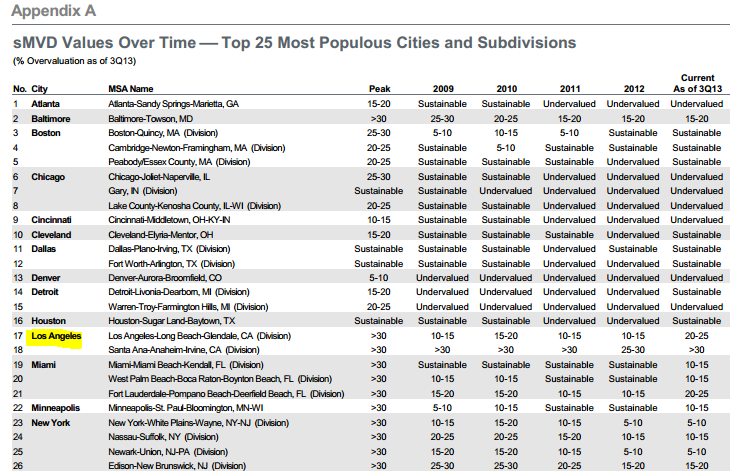

In fact, some markets are seen as undervalued. What is important to understand is that crazy high housing prices for giant regions are not sustainable. California is boom and bust central. I know a few people that work at Toyota that were blindsided with the announcement that the Torrance Toyota division is going to leave. Where? To lower cost Texas. I found the comments made by an executive at Toyota interesting:

“(Reuters) Our decision was not based on the dollar amount we received,” but rather on a friendly overall business climate and certain advantages for Toyota employees, from affordable housing and shorter commutes to the absence in Texas of a personal income tax.Those supposed quality of life advantages don’t ensure success in a big corporate relocation, however.Larry Dominique, a former Nissan executive, recalled how Nissan lost about two-thirds of its California employees in the move to suburban Nashville.While some employees liked the lack of income tax in Tennessee, which was akin to “getting a 20-percent raise,” Dominique said many others couldn’t be persuaded to go. That included a sizeable number who were not their family’s primary earners.”

Apparently housing costs do matter. Like the previous move from Nissan some of these people simply cannot give up the California weather. Like the baby boomers eating cat food instead of selling their home, many Californians are punch-drunk in love with real estate to the overall detriment to their lifestyle. You notice how the executive mentioned affordable housing, traffic, and taxes in his reasons for leaving? By the way, Torrance is massively overpriced and they just lost their largest employer. Zip codes in Torrance go from $500k to $800k.Back to Orange County however, you have a large number of people that are now making money because of high prices in real estate (i.e., banks, investors, flippers, agents, contractors, house furnishing stores etc). It is interesting to hear agents complain because of the incredibly low volume of home sales. You make more by selling five $400,000 homes compared to one $600,000 home. So what happens when prices ebb lower? The Case-Shiller Index saw a monthly decline for the OC/LA MSA data:

What do you expect? Prices went up by 18.2 percent year-over-year because of low inventory, househorny investors, and the continual flow of lemmings buying up homes. Even the Fed is telegraphing higher rates so what do you think this is going to do to housing? Or what above investors pulling back? These are things that are simply starting to happen. But use your common sense here. Fitch put a hard number on this saying that prices are overvalued by 30 percent. Trulia puts it at roughly 20 percent. At a $580,000 median priced home, this means prices are overvalued by $116,000 to $174,000. That is a big chunk of money given that the typical OC family is bringing in less than $72,000 a year.Bottom line is that California is one giant speculation circus when it comes to real estate. Boom and bust central. The P.T. Barnum of housing. Those that say buy and stay put fail to realize that most people stay in their place for an average of 7 to 10 years. Many people buying in OC are squeezing into condos with insane HOAs or small beat up World War II shacks and guess what? Most are seeing this as their “starter” home for when they move up into that $750,000 to $1 million home. Are they counting on saving money to get there? Absolutely not. They are counting on multiple years like 2013 to build that equity so they can then have hundreds of thousands in equity to squeeze into their other home. Like the last bust, the hundreds of thousands that lose their homes will go off into the darkness to lick their wounds so they can spin the carnival wheel one more time once those FICO scores allow them to lever up once again. You know, because real estate in California is always a great buy no matter the price!

a SoCal exception . . .

Real Overpriced Counties of America: Orange County named most overpriced county in the entire United States. Fitch Ratings and Trulia point to a bubble in the OC with prices overvalued by 30 percent.

When it comes to real estate, we know that Californians enjoy drinking from the gold cup of mania. Lusting over real estate seems to be as common as traffic on the 405. People in California have a deep rooted cultural and economic amnesia. I bet half the population has very little idea regarding the history of many cities in Southern California. Heck, most don’t even know where their drinking water comes from. So trying to discuss Fed policy, skewing based on investors, or market manipulation with a large portion of people is like talking to your dog about Hemmingway. Some people only understand “real estate goes up!” and when it doesn’t, they only understand “buying is bad!” California real estate is overvalued by most economic measures. Sure, people are willing to pay insane prices but they did this as well in 2006 and 2007 and people also paid crazy prices for tech companies in a previous delusion based boom. Investors are pulling back because they simply don’t perceive value at current prices. We are now seeing more reports putting a price on how overvalued the region is. Fitch Ratings and Trulia both point to SoCal as being massively overpriced. In fact, Fitch Ratings has Orange County overvalued by a whopping 30 percent. Congratulations to Orange County for being the most overpriced county in the entire United States.Real Overpriced Homes of CaliforniaOrange County is back in full bubble mode.

This year however, we have seen inventory increase even inprime areas like Irvine. Paying $500,000 for a poorly built condo with mega-HOAs isn’t exactly a deal. I know some people that have paid off condos that pay $1,000 and more a month just in HOAs, taxes, insurance, and maintenance. You want cable, food, and internet? Add that in as well. Keep in mind these are people that failed to fund retirement accounts or build any other income streams because they thought “hey, once the home is paid off I won’t have any other costs!” Wrong. It is crazy to see people living in $500,000 to $1 million homes shopping at Wal-Mart and the 99 Cents Store because their budgets are so stretched. I’ve seen a handful of pizza delivery people driving in fairly new Mercedes and BMWs. Living the California dream baby! This is the type of financial logic that permeates in the region.Compared to last year, the sales volume is dropping and homes are sitting longer. What always intrigues me is that people would be willing to buy in heavier volume if banks would simply give them the money. Can they afford it long-term? Hell no. Only 1 out of 3 California families can afford a home in the state to begin with and this also applies to crazy Orange County.The bulk of people in the OC live in: Anaheim, Santa Ana, Irvine, Costa Mesa, and Huntington Beach. So it is no surprise that home prices are reaching an apex. Take a look at a report put out by Fitch Ratings regarding real estate values in California:

What is interesting is that Fitch had the Inland Empire priced as sustainable last year. That is of course before the house horny investors flooded the market and jacked prices up in 2013. What cracks me up about the list above is that Orange County is even more overvalued than San Francisco. Why is this the case? Because everyone thinks that all OC households are making six-figures driving around in foreign luxury cars. Hey, if a pizza delivery person is riding around in a Benz then things must be great right? Let us take a look at household income data:

Source: CensusThe median household income in Orange County is $71,983. Much higher than the California and US figures. What is the median home price going for? The latest figures show that the median home that sold in March went for $580,000. In other words, the typical family in no way shape or form can afford to buy a home in the county in which they live. The story of SoCal. So it is no wonder that SoCal is a region of renters and this is only growing.For a $600,000 home, you definitely need a household income of $150,000 or more without putting all your eggs in one basket. How many families make more than $150,000 a year in Orange County? 35 percent.And don’t think that Fitch is only overvaluing California:

In fact, some markets are seen as undervalued. What is important to understand is that crazy high housing prices for giant regions are not sustainable. California is boom and bust central. I know a few people that work at Toyota that were blindsided with the announcement that the Torrance Toyota division is going to leave. Where? To lower cost Texas. I found the comments made by an executive at Toyota interesting:

“(Reuters) Our decision was not based on the dollar amount we received,” but rather on a friendly overall business climate and certain advantages for Toyota employees, from affordable housing and shorter commutes to the absence in Texas of a personal income tax.Those supposed quality of life advantages don’t ensure success in a big corporate relocation, however.Larry Dominique, a former Nissan executive, recalled how Nissan lost about two-thirds of its California employees in the move to suburban Nashville.While some employees liked the lack of income tax in Tennessee, which was akin to “getting a 20-percent raise,” Dominique said many others couldn’t be persuaded to go. That included a sizeable number who were not their family’s primary earners.”

What do you expect? Prices went up by 18.2 percent year-over-year because of low inventory, househorny investors, and the continual flow of lemmings buying up homes. Even the Fed is telegraphing higher rates so what do you think this is going to do to housing? Or what above investors pulling back? These are things that are simply starting to happen. But use your common sense here. Fitch put a hard number on this saying that prices are overvalued by 30 percent. Trulia puts it at roughly 20 percent. At a $580,000 median priced home, this means prices are overvalued by $116,000 to $174,000. That is a big chunk of money given that the typical OC family is bringing in less than $72,000 a year.Bottom line is that California is one giant speculation circus when it comes to real estate. Boom and bust central. The P.T. Barnum of housing. Those that say buy and stay put fail to realize that most people stay in their place for an average of 7 to 10 years. Many people buying in OC are squeezing into condos with insane HOAs or small beat up World War II shacks and guess what? Most are seeing this as their “starter” home for when they move up into that $750,000 to $1 million home. Are they counting on saving money to get there? Absolutely not. They are counting on multiple years like 2013 to build that equity so they can then have hundreds of thousands in equity to squeeze into their other home. Like the last bust, the hundreds of thousands that lose their homes will go off into the darkness to lick their wounds so they can spin the carnival wheel one more time once those FICO scores allow them to lever up once again. You know, because real estate in California is always a great buy no matter the price!

Comment