The CA bubble that isn’t from California: Canadians come face to face with the paradox of golden real estate handcuffs and a younger less affluent generation.

I really enjoy Canada. A beautiful country with great cities and fantastic food. Leave it to our neighbors to the north to show us how it is done for a real housing mania. For the first time in history we have experienced coordinated global housing bubbles courtesy of central banks following very similar policies. The addiction to debt isn’t only a U.S. born condition. While the recent U.S. market is dominated by low supply and massive investor buying, Canada continues to see rising home prices even right through the global Great Recession. The Canadians interestingly enough also face similar dilemmas between older and younger generations.

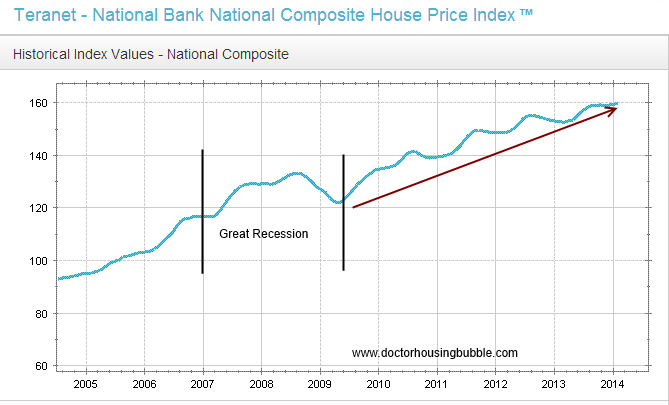

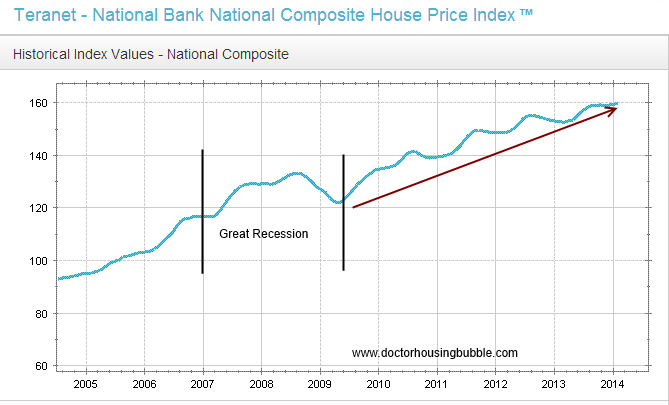

Many young professionals are fully priced out of the real estate market even when they are working at relatively good careers. Many battle it out in the condo markets were even in this market prices are inflated. Canada has an incredibly heavy reliance on real estate, more so than the United States and their household debt ratios make the U.S. look like a frugal uncle. One fascinating story highlights a similar story to what many baby boomers here in the U.S. are facing with their offspring. They face the reality that they are house rich but cash poor.Canada’s inflated real estate marketHome prices in Canada are inflated. Global cities like Vancouver and Toronto face massive investor buying that largely makes it tough for local families to buy. Many pre-bubble buyers are caught in a golden castle but unable to unlock the money until they sell, a similar condition to many baby boomers here in California.It is important to note that there was no correction in home values even during the Great Recession in Canada:

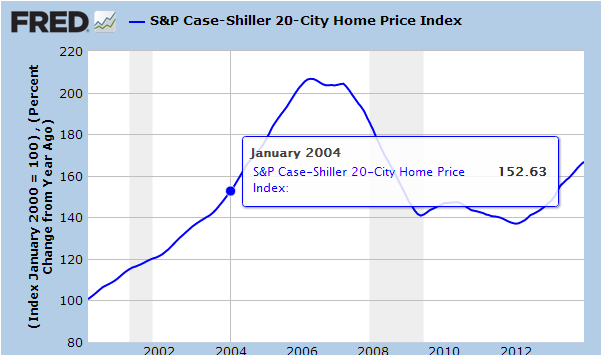

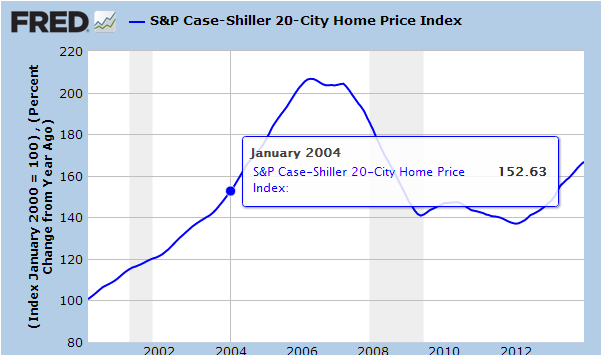

Canada home values have increased by close to 80 percent in the last decade. For the U.S. over this same period of 1994 to 2004 home prices are up (adjusting for inflation) by a modest 10 percent even after the 2013 mania:

The housing market in Canada has been split in many areas between mass produced cheaper condos versus single family homes:

“(CBC) One market is facing too much supply, while another appears to be heating up,” the bank said. “The GTA housing market is a tale of several markets with divergent conditions.”

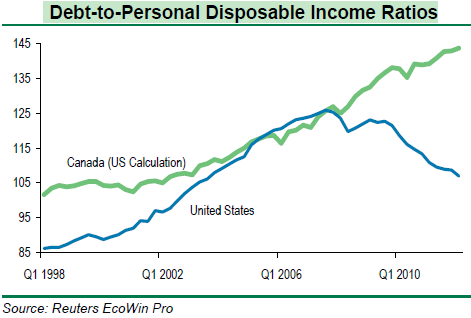

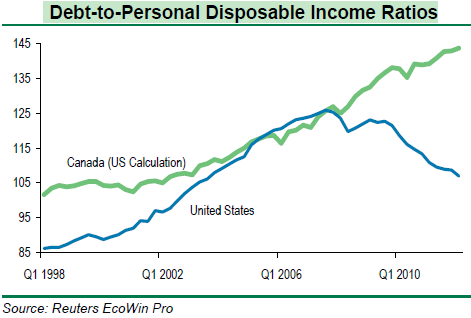

There are certainly changes in the wind but bubbles can go on for much longer than you think. How are Canadians keeping this thing going? For one, they are going into massive debt and putting the consumer hungry Americans to shame:

The above chart is very important. The U.S. hit an apex in terms of how much household debt would tip an economy over. Debt-to-personal income in the U.S. hit a peak of roughly 125 percent during 2007 at the height of the housing bubble. You can see the correction that followed in the U.S. and many have felt on a personal level. Yet Canadian’s continue to pile on debt beyond their actual incomes. As of more recent data, they are closer to a 150 percent ratio. Which leads us to those golden real estate handcuffs in Canada. A great piece on the Great Fool blog highlights this generational divide:

“(Greater Fool) Cheryl and Paul are 57 and 60 and live in a Mississauga house they figure is worth $900,000. They’ve spent the last 14 years paying down the mortgage and have about $80,000 yet to go. She’s been at home since the last kid left the nest six years ago. He sells real estate, made $126,000 last year and has no pension. Between them they have $37,000 in TFSAs, $160,000 in RRSPs and about forty grand in a high-yield savings account.“How we doing?” Cheryl asked, hopefully. I paused to collect my thoughts. “Oh,” she said. “That bad?”Of course she knew the answer. The Boomer couple has just over $1 million in net worth, but 80% of it’s in one asset. Paul has no pension. Worse, as a commissioned salesguy, he has no business to sell. And he’s just as good as his last deal – which means any housing correction will not only sideswipe his income, but also his family’s net worth. It’s double jeopardy. And then there’s the nature of their liquid investments – the bulk of which sits in high-cost mutual funds inside an RRSP, meaning the money’s fully taxable.”

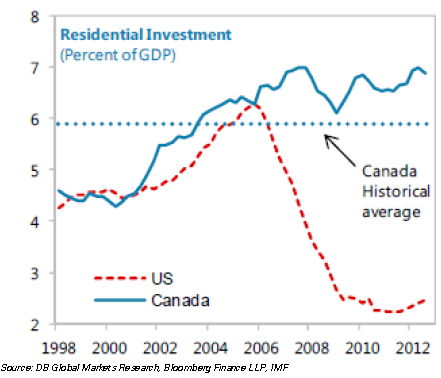

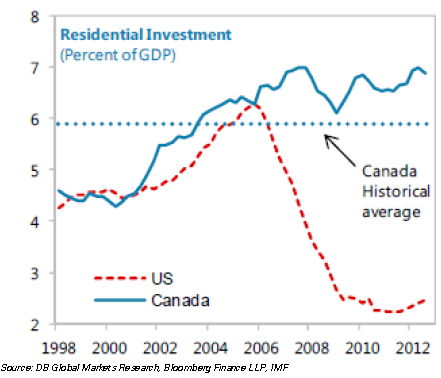

This is an interesting situation very similar to our struggle for housing for younger professionals today in many high priced metro areas. The couple in the story above is massively house rich. 80 percent of their net worth is tied up in housing. Their retirement accounts are paltry assuming they will be living off this amount for 15, 20, or even 30 years. The house does not throw off any income. The only way to unlock the money is to sell. A home equity loan essentially means resetting the clock on additional debt. Downsizing or moving to a cheaper area is the only way to leverage that massive gain in housing. But how many people actually move? In the U.S. we pointed out that most people are home bodies that would rather eat cat food in their million dollar home versus selling and using the money to live a decent retirement.Canada’s economy is too focused on residential investment:

Canada has been investing too much into real estate going back to 2002. You can see the correction for the U.S. but is there something else going on here? The article highlights a reality that many even in the U.S. will face when they are house rich and cash poor:

“But it’s a house. No dividends or interest. Just property taxes, maintenance, insurance and eight hundred grand of locked-in equity which must be released, or these folks are going to run out of money before they run out of time.This brings us to Jason. Their kid. He’s 28. A member of Gen Y which, at 27% of the population is almost as big as the Boomers (32%). Jason rents in Toronto, makes $52,000 as a IT guy, rides a bicycle and the TTC, likes being urban, has no debt and puts money monthly into a TFSA with $18,000 in it. That makes him typical, too.”

This story is all too familiar to people in high priced Southern California. The vast majority of people in SoCal that bought pre-bubble have locked in some solid games. Yet how do you unlock those? Heck, the advice is to stretch to the limit (meaning forego the retirement accounts or other alternatives) and double-down on housing. We have seen the resurgence of adjustable rate mortgages (ARMs) to stretch the budget even further. So all the money goes into this one asset. But then what? The truth is most will want to move up with that equity they build up (the average hold time in housing is seven years across the U.S.). So many simply kept resetting the clock up on the property ladder. Age doesn’t care about your new 2,000 square foot house with granite countertops and if you have a mortgage, you’ll need to continue generating income to pay the bills.The story above also highlights the story of one of their “kids” at 28 that has a job in IT and makes $52,000 a year. How in the world is an $800,000 home even feasible for their son? Even a $400,000 condo would be a stretch. Should he save for a down payment? If he starts now he might be able to buy in his forties. But then a home will cost $1.2 million according to some analysts based on future projections (simply using the current trajectory in Canadian home values).The young in Canada seem to be facing similar predicaments to those in the United States:

“Incredibly, almost 45% of all young people between 20 and 29 live at home. The jobless rate for the cohort is about 14%. Student debt averages $37,000 after a four-year degree. Underemployment is endemic.And this is the big hope for so many Boomers – that the ‘next generation’ will pony up and bail them out? Good luck with that.”

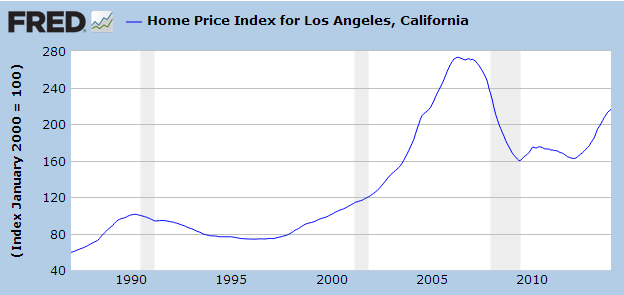

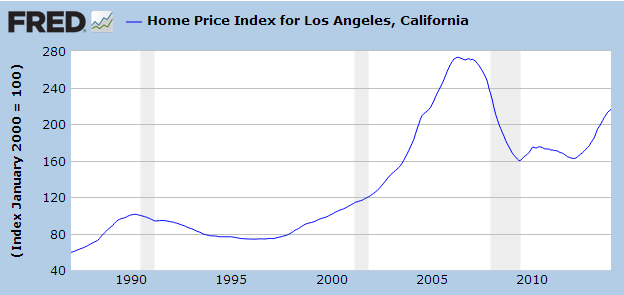

Living at home and massive student debt! A story near and dear to our hearts. As much as some Canadians would like to believe they are different from their neighbors to the south we are very much alike in our addiction to debt. We also apparently have a large portion of youth living at home. I can imagine this is more pronounced in high priced areas. Just look at the L.A. region in SoCal versus Vancouver in terms of prices:

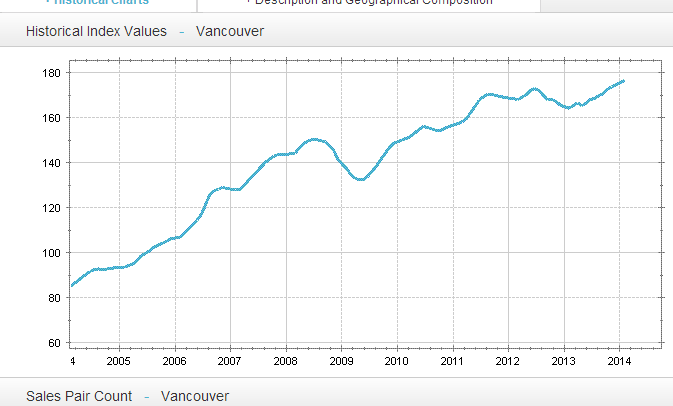

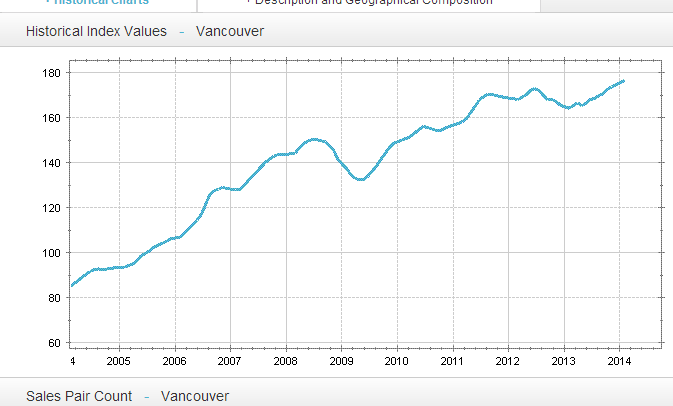

Going back to 2004 home prices in L.A. adjusting for inflation are up 30 percent. A pretty big jump considering household incomes have not gone up in tandem. But just look at Vancouver:

Home prices are up 110 percent during this similar period! Vancouver makes SoCal look like an affordable paradise. It is interesting to know that Canadians are basically facing similar demographic challenges and have a massive amount of young people living at home. They beat us in hockey and they certainly beat us in going into massive debt.

I really enjoy Canada. A beautiful country with great cities and fantastic food. Leave it to our neighbors to the north to show us how it is done for a real housing mania. For the first time in history we have experienced coordinated global housing bubbles courtesy of central banks following very similar policies. The addiction to debt isn’t only a U.S. born condition. While the recent U.S. market is dominated by low supply and massive investor buying, Canada continues to see rising home prices even right through the global Great Recession. The Canadians interestingly enough also face similar dilemmas between older and younger generations.

Many young professionals are fully priced out of the real estate market even when they are working at relatively good careers. Many battle it out in the condo markets were even in this market prices are inflated. Canada has an incredibly heavy reliance on real estate, more so than the United States and their household debt ratios make the U.S. look like a frugal uncle. One fascinating story highlights a similar story to what many baby boomers here in the U.S. are facing with their offspring. They face the reality that they are house rich but cash poor.Canada’s inflated real estate marketHome prices in Canada are inflated. Global cities like Vancouver and Toronto face massive investor buying that largely makes it tough for local families to buy. Many pre-bubble buyers are caught in a golden castle but unable to unlock the money until they sell, a similar condition to many baby boomers here in California.It is important to note that there was no correction in home values even during the Great Recession in Canada:

Canada home values have increased by close to 80 percent in the last decade. For the U.S. over this same period of 1994 to 2004 home prices are up (adjusting for inflation) by a modest 10 percent even after the 2013 mania:

The housing market in Canada has been split in many areas between mass produced cheaper condos versus single family homes:

“(CBC) One market is facing too much supply, while another appears to be heating up,” the bank said. “The GTA housing market is a tale of several markets with divergent conditions.”

The above chart is very important. The U.S. hit an apex in terms of how much household debt would tip an economy over. Debt-to-personal income in the U.S. hit a peak of roughly 125 percent during 2007 at the height of the housing bubble. You can see the correction that followed in the U.S. and many have felt on a personal level. Yet Canadian’s continue to pile on debt beyond their actual incomes. As of more recent data, they are closer to a 150 percent ratio. Which leads us to those golden real estate handcuffs in Canada. A great piece on the Great Fool blog highlights this generational divide:

“(Greater Fool) Cheryl and Paul are 57 and 60 and live in a Mississauga house they figure is worth $900,000. They’ve spent the last 14 years paying down the mortgage and have about $80,000 yet to go. She’s been at home since the last kid left the nest six years ago. He sells real estate, made $126,000 last year and has no pension. Between them they have $37,000 in TFSAs, $160,000 in RRSPs and about forty grand in a high-yield savings account.“How we doing?” Cheryl asked, hopefully. I paused to collect my thoughts. “Oh,” she said. “That bad?”Of course she knew the answer. The Boomer couple has just over $1 million in net worth, but 80% of it’s in one asset. Paul has no pension. Worse, as a commissioned salesguy, he has no business to sell. And he’s just as good as his last deal – which means any housing correction will not only sideswipe his income, but also his family’s net worth. It’s double jeopardy. And then there’s the nature of their liquid investments – the bulk of which sits in high-cost mutual funds inside an RRSP, meaning the money’s fully taxable.”

Canada has been investing too much into real estate going back to 2002. You can see the correction for the U.S. but is there something else going on here? The article highlights a reality that many even in the U.S. will face when they are house rich and cash poor:

“But it’s a house. No dividends or interest. Just property taxes, maintenance, insurance and eight hundred grand of locked-in equity which must be released, or these folks are going to run out of money before they run out of time.This brings us to Jason. Their kid. He’s 28. A member of Gen Y which, at 27% of the population is almost as big as the Boomers (32%). Jason rents in Toronto, makes $52,000 as a IT guy, rides a bicycle and the TTC, likes being urban, has no debt and puts money monthly into a TFSA with $18,000 in it. That makes him typical, too.”

“Incredibly, almost 45% of all young people between 20 and 29 live at home. The jobless rate for the cohort is about 14%. Student debt averages $37,000 after a four-year degree. Underemployment is endemic.And this is the big hope for so many Boomers – that the ‘next generation’ will pony up and bail them out? Good luck with that.”

Going back to 2004 home prices in L.A. adjusting for inflation are up 30 percent. A pretty big jump considering household incomes have not gone up in tandem. But just look at Vancouver:

Home prices are up 110 percent during this similar period! Vancouver makes SoCal look like an affordable paradise. It is interesting to know that Canadians are basically facing similar demographic challenges and have a massive amount of young people living at home. They beat us in hockey and they certainly beat us in going into massive debt.

Comment