Re: China in the Shadows

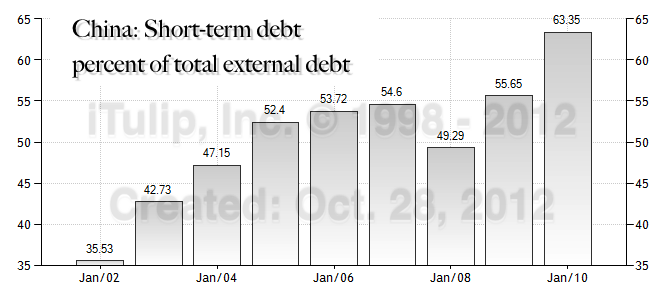

Thrifty, it was more recent (as in last two years or so). I believe it was a chart from Trading Economics on the external debt position of China and how it has gone through the roof. I am searching iTulip now for it.

Thrifty, it was more recent (as in last two years or so). I believe it was a chart from Trading Economics on the external debt position of China and how it has gone through the roof. I am searching iTulip now for it.

. However can be done of course. ) US would need Russia support US in this to cut China from resources.

. However can be done of course. ) US would need Russia support US in this to cut China from resources.

Comment