Renter nation

Many large hedge funds and investors have already securitized large pools of single family homes and have created a monthly payout structure based on monthly rents. Returns so far are not looking fantastic since being a landlord is a slow churn business. The Wall Street crowd is accustomed to big wins via Google, Tesla, or Twitter and not a drip-drip leak that is provided from monthly rental payments. Keep in mind that with rentals, you have expenses via repairs, vacancies, and you are essentially capped on how much you can jack up rents by how much households actually earn since people pay rents out of monthly incomes, not heavily subsidized mortgage payments.

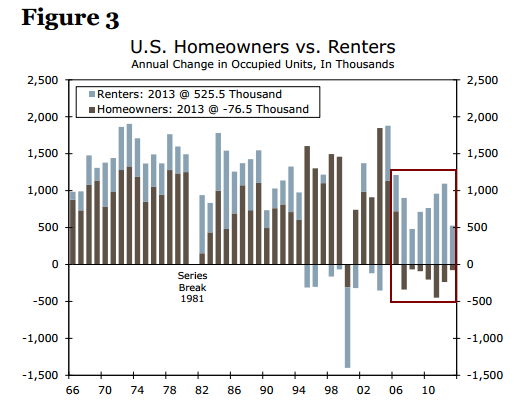

You would think that with rates still being low we would have been adding large numbers of households to the ownership column. The opposite has occurred:

Source: Wells Fargo

This is not your baby boomer housing market which many are accustomed to. In fact, you’ll notice that the period between 2006 to the present is very much an anomaly. We’ve been adding a boatload of renter households for six full years while the over 5,000,000+ foreclosed owners have shifted ownership back into the hands of the banking system. This is the first time a trend like this has occurred going back to data from 1966.

What is important to remember based on economic metrics is that the recession officially ended in the summer of 2009. We’ve been nearly half a decade in recovery and all we can muster is net adds of renter households? Is owning a home no longer part of the American dream? Not when you can’t afford to buy because you are being outbid by hedge funds leveraging cheap digital debt or your income is simply unable to swing the payment.

Purchase applications

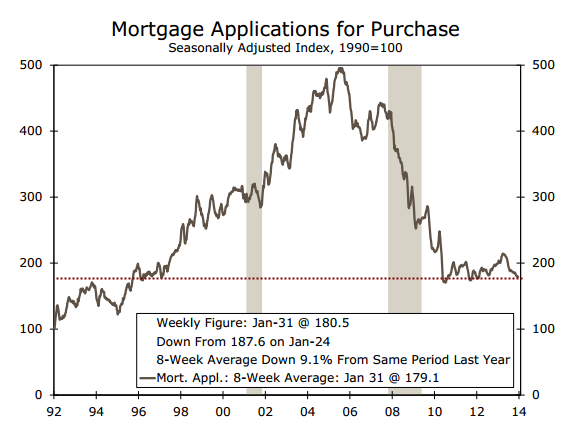

The first chart should highlight the dramatic shift of adding renter households since 2006. It is also interesting to note that this trend started in 2006, not 2008 when the market went into full meltdown mode. Why? Because households were already broke going back prior to the official meltdown. The nucleus of the meltdown was households and banks using money they didn’t have to leverage into speculation. Households are paying the price while banks have mastered the churn business and are leveraging low rates for their own gain. You begin to scratch your head regarding the massive run-up in prices last year when you look at purchase applications:

Where is this demand to cause prices to go up? The demand is coming from controlled supply, banking demand for homes, and massive speculation. It certainly isn’t coming from households buying in mass. The chart above shows that purchase applications are essentially back to where they were 20 years ago. The difference? We’ve added 54,000,000 people since then.

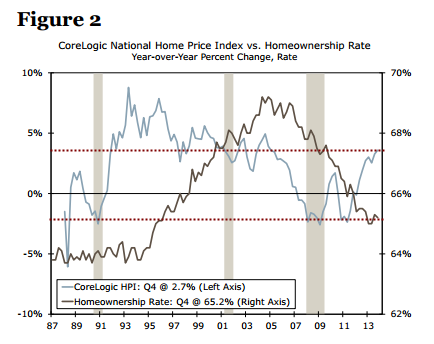

Homeownership

The homeownership rate peaked in 2006. This logically coincides with the jump in renter households starting around this period:

The current homeownership rate is the same as it was 20 years ago. We’ve done a good job cutting out young households from buying. Unfortunately there seems to be a myopic disregard of younger generations in the current economy. Rarely will someone admit it but the younger households of today are unlikely to have it as good as did the baby boomers. The data backs this up. A common rebuttal to this revolves around all the goodies added by technological advancement. Sure, we all benefit from this, young and old. But you can’t live in an iPad or pay the grocery bill with your Facebook posts. Aside from a handful that can leverage technological gains, many others are left in the financial dust.

The middle class is simply shrinking in the US. This is a challenging reality. The “American Dream” of everyone owning a home may have been a baby boomer mantra but doesn’t seem to be the case since the early 2000s. Even the bubble of the 2000s was a delusional boom built on easy debt papering over lost wages and a shrinking standard of living. In addition, not everyone should own but why subsidize big banks in purchasing single family homes by crushing real interest rates? There is absolutely nothing wrong with renting. In fact, this may make more sense for millions of households. Yet there is a massive propaganda machine for homeownership around the country that slowly nudges people into buying based on age and emotions rather than subtle personal economic circumstances.

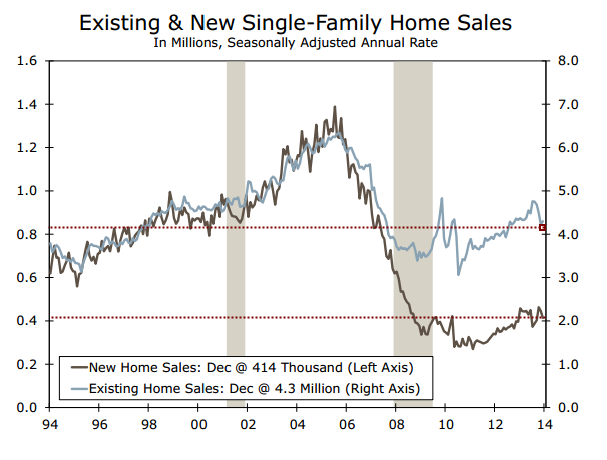

New home sales still extremely weak

Another major divergence we are seeing is with new home sales. New home sales were always a big part of the “newly formed” household movement. Yet you need a steady tide of households to actually afford new homes that carry a premium in price. There has been a massive disconnect here going back to 2006 again:

New home sales remain incredibly weak. Investors are looking for lower priced deals for better cap rates. You don’t make solid money by purchasing a $250,000 new home and renting it out for $1,500.

First time buyers shutout

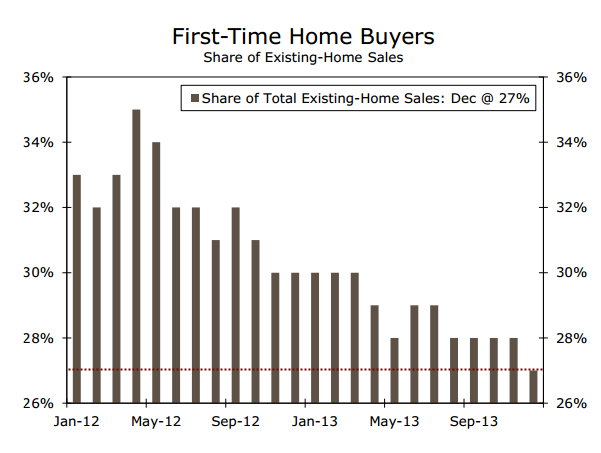

Finally, the bread and butter of any healthy housing market is the first-time buyer. First-time buyers make up a remarkably small portion of the existing home sale market:

First-time buyers are typically young Americans. With $1.2 trillion in student debt and lower paying jobs, do you think the rise in home prices is a plus for this group? Ironically, government backed student debt is hovering around 6.8 percent while mortgages are cheaper at around 4.5 percent! Since the government owns both of these manipulated debt markets, they are essentially favoring housing over educating future generations which ultimately is a bigger asset to our nation. Instead, we rather finance a crappy World War II shack in Southern California with manipulated debt for up to $700,000 and allow others to lock in golden real estate handcuffs. These charts, if you looked at them without knowing the inside game of the Fed and banks, would lead you to believe that home values were falling or at best, stagnant. You wouldn’t expect to see one of the best annual increases in prices on record.

A few years ago when I mentioned that our economy was becoming more feudal in nature some readers felt this was farfetched. Those comments have slowly disappeared. Why? Because many people over these years have faced the repercussions of the massive number of big bank investor buyers either through being outbid, seeing prices re-inflate, or through a lack of inventory controlled by banks. What is certain is that we now have mega-landlords in this country and this trend continues as the overall homeownership rate dips. The fact that foreclosures recently surged tells you that something else is going on here. Given the above figures it is understandable why we’ve slowly shifted to a renter nation.

Comment