Re: Oil to $60.....by January?

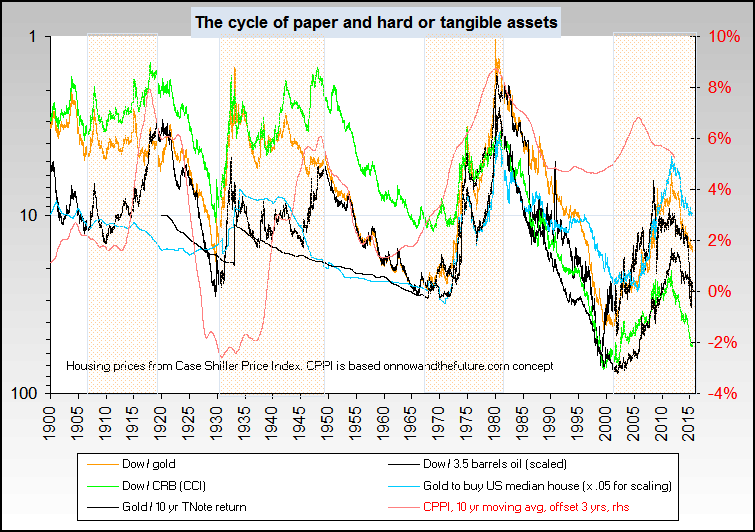

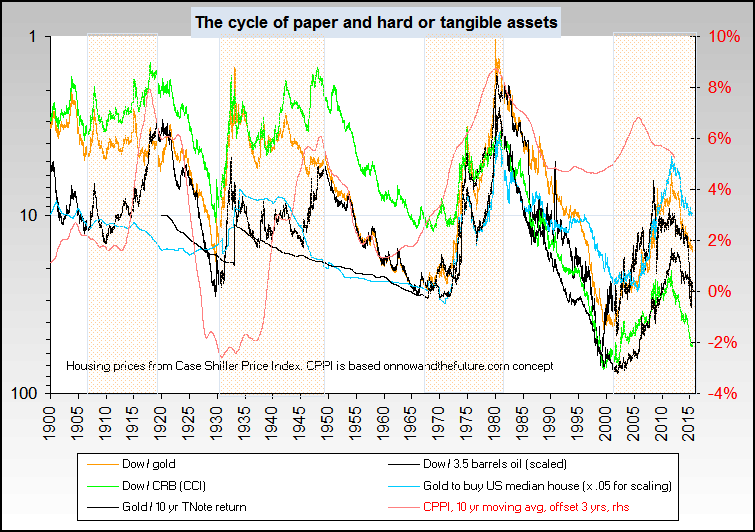

You neglect to take into account things like my hard vs. soft assets ultra long term cycle.

Central banks can not control *where* the created money goes and what it inflates, nor how much.

And let me be clear here too - supply and demand *are* factors, especially since about 2006.

"By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft."

-- John Maynard Keynes (the father of 'Keynesian Economics' which our nation now endures) in his book "THE ECONOMIC CONSEQUENCES OF THE PEACE" (1920). (this is in the context of speaking about the ability to control money supply) (emphasis mine)

Originally posted by GRG55

View Post

You neglect to take into account things like my hard vs. soft assets ultra long term cycle.

Central banks can not control *where* the created money goes and what it inflates, nor how much.

And let me be clear here too - supply and demand *are* factors, especially since about 2006.

"By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft."

-- John Maynard Keynes (the father of 'Keynesian Economics' which our nation now endures) in his book "THE ECONOMIC CONSEQUENCES OF THE PEACE" (1920). (this is in the context of speaking about the ability to control money supply) (emphasis mine)

Comment