The shift to a mandatory two-income family is long completed. Is another more-labor-for-the-same-results underway . . . .

The prospect of home ownership for many young Americans seems so far out of reach that many are resigned to be renters for the rest of their lives.

In places like San Francisco and New York even those with decent paying jobs will find it hard to own a piece of real estate. Obviously many investors with easy money from the Fed realized this end-game and dove into the landlord business with all the gusto in the world.

Wages are weak for the children of baby boomers. Many in fact are back living at home. Homeownership seems like a massive pipedream when many don’t even have the income to support a rental. Of course in California, you have odd inter-family dynamics where some kids are just waiting until the parents keel over so they can inherit the Prop 13 protected World War II built property. What more do people expect from a narrow focus on the present while ignoring the challenges facing a new generation of Americans?

This structural change has also created a big hit on new home sales. Unfortunately for many a modern day system of debt serfdom awaits. For those that have the chance to buy, it may require a massive leap into debt on top of the student debt many already carry.

Living at home is in fashion

The number of young Americans living at home has risen dramatically in the last decade. Many thought this was some short-term shift but it looks to be a significant trend with permanence.

Short of real wages going up for this group, it is unlikely that many of the young Americans out in the market for housing have a fighting chance against the dark pools of money from Wall Street. With limited inventory, prices go up but so do rents since big investors are in the game as modern day mega landlords.

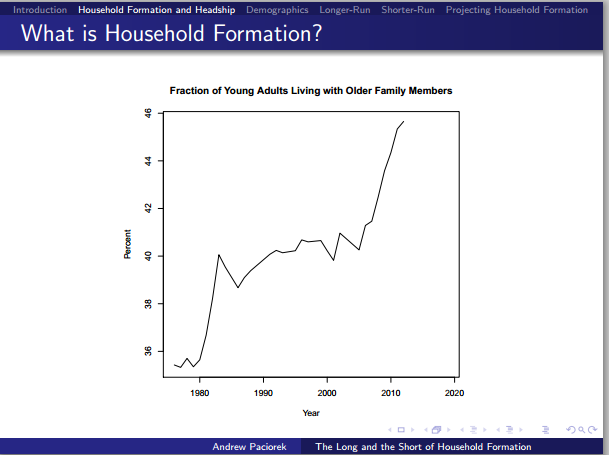

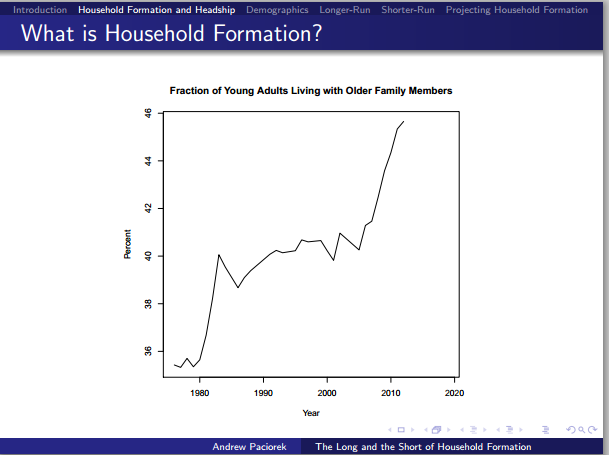

The number of young adults living at home has grown dramatically since the 1980s:

I find this chart very telling. From 1980 to 1990 we saw a sizable jump but this stabilized. For nearly 20 years the percentage stayed within a tight range. That is until the Great Recession hit in 2007. We are now deep into uncharted territory. It isn’t like a lifestyle shift hit where young Americans now want to suddenly live at home with mom and dad. What did occur is weak income growth and low wage jobs that pushed many back home.

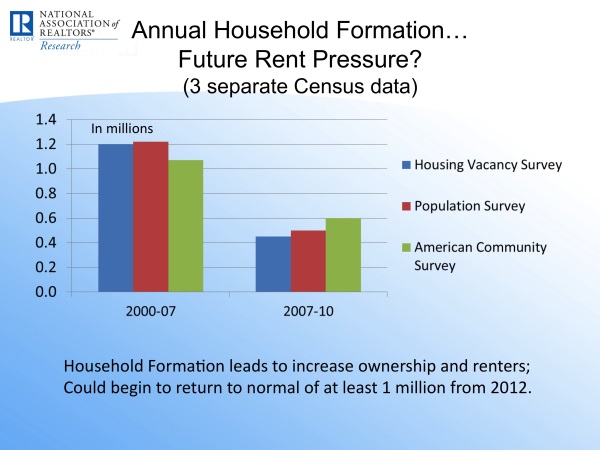

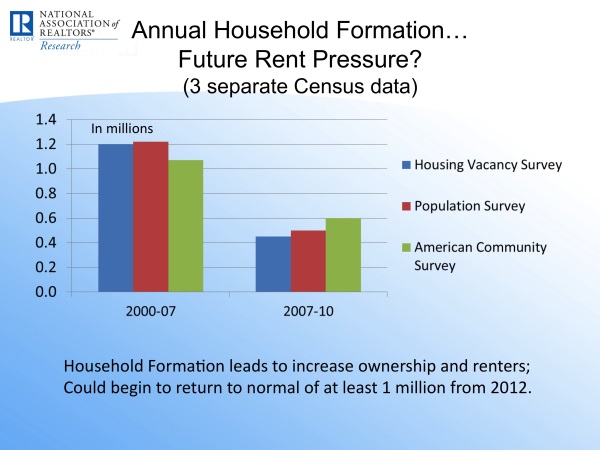

The Great Recession took a hammer to household formation:

From 2000 to 2007 household formation was running at around 1.2 million per year. From 2007 to 2010 it was roughly 500,000. The latest figures have it back around 1 million. Keep in mind that from 2000 to 2007 NINJA loans allowed anyone and everyone to buy a home. So low incomes didn’t matter. We essentially lived a late night real estate infomercial in real-time. Today, with government backed mortgages, people have to show legitimate income and this has hit sales. Of course investors using non-traditional financing are eating up a large share of inventory.

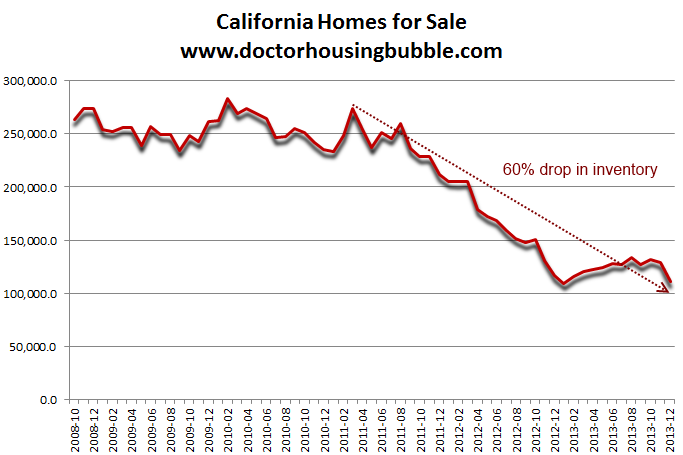

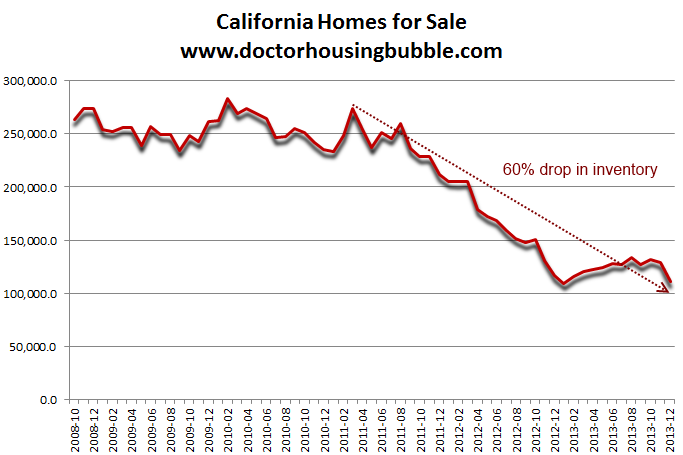

You would think that given these kinds of dynamics that the market would have a healthy amount of inventory. That is not the case. Banks have selectively captured the system and with the Fed pushing big pools of money out of cash, you see money rushing into real estate and the stock market. Take a look at the number of homes available for sale in California over the last few years:

Source: Zillow

Inventory has picked up slightly since the year started which is not reflected in the chart above ending in December of 2013. However, do you see young Americans out in the market trying to buy up real estate? In high priced markets this is even more unlikely.

The new school of thought is “well you get two professionals and you take on a jumbo mortgage.” Ironically, many of these people plan on having a family and guess what? This usually means someone is out of work for a few months and when they go back, a giant chunk of money is going to go to childcare. This is tough on an already stretched budget.

And when you are squeezing into a home based on two incomes you better hope those two incomes continue to exist or be prepared to cover the mortgage on one income. Good luck on that one.

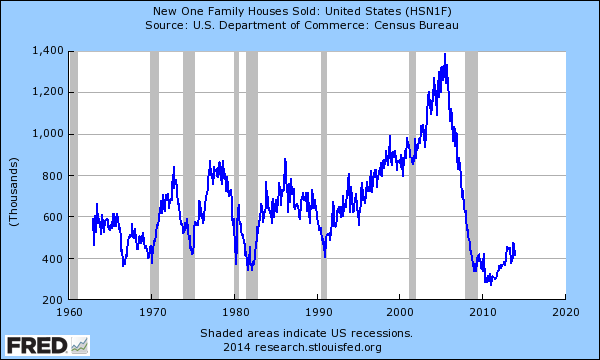

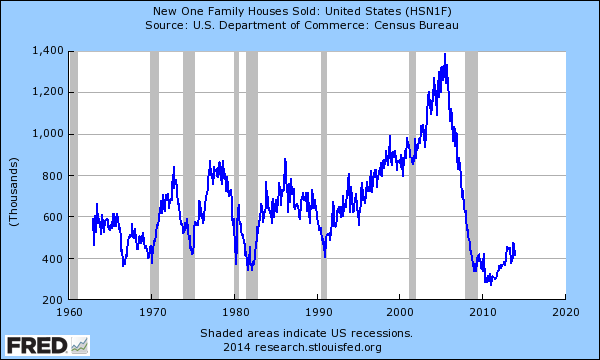

I doubt many young households are even running these numbers at least in expensive areas. In fact, new home sales missed their mark showing that the end of 2013 was not a good one for housing:

This chart doesn’t do justice to the absolute collapse in new home sales:

Builders clearly understand the current trend. This is why there is no flood of new home building. Many of the new home building permits are going to multi-family dwellings (aka apartments for rent). Large investors are aggressively going after this income stream.

In places like Florida over 60 percent of recent purchases went to investors.

Many young Americans will be accustomed to paying their student debt and rents on a monthly basis while these income streams go into banks that own their property. Not a bad situation if the market wasn’t rigged by banks, whose preference is given to large money and where low rates matter little when the Fed has set a fuse to Wall Street to buy outthe real estate market.

Of course many will try to pretend that this is some sort of free market. The housing market is fully subsidized and juiced to the gills and while this is going on, a younger generation gets older and their dreams of home ownership move further and further away.

At least they can bunk with mom and dad and enjoy stories of those beautiful golden real estate handcuffs.

The prospect of home ownership for many young Americans seems so far out of reach that many are resigned to be renters for the rest of their lives.

In places like San Francisco and New York even those with decent paying jobs will find it hard to own a piece of real estate. Obviously many investors with easy money from the Fed realized this end-game and dove into the landlord business with all the gusto in the world.

Wages are weak for the children of baby boomers. Many in fact are back living at home. Homeownership seems like a massive pipedream when many don’t even have the income to support a rental. Of course in California, you have odd inter-family dynamics where some kids are just waiting until the parents keel over so they can inherit the Prop 13 protected World War II built property. What more do people expect from a narrow focus on the present while ignoring the challenges facing a new generation of Americans?

This structural change has also created a big hit on new home sales. Unfortunately for many a modern day system of debt serfdom awaits. For those that have the chance to buy, it may require a massive leap into debt on top of the student debt many already carry.

Living at home is in fashion

The number of young Americans living at home has risen dramatically in the last decade. Many thought this was some short-term shift but it looks to be a significant trend with permanence.

Short of real wages going up for this group, it is unlikely that many of the young Americans out in the market for housing have a fighting chance against the dark pools of money from Wall Street. With limited inventory, prices go up but so do rents since big investors are in the game as modern day mega landlords.

The number of young adults living at home has grown dramatically since the 1980s:

I find this chart very telling. From 1980 to 1990 we saw a sizable jump but this stabilized. For nearly 20 years the percentage stayed within a tight range. That is until the Great Recession hit in 2007. We are now deep into uncharted territory. It isn’t like a lifestyle shift hit where young Americans now want to suddenly live at home with mom and dad. What did occur is weak income growth and low wage jobs that pushed many back home.

The Great Recession took a hammer to household formation:

From 2000 to 2007 household formation was running at around 1.2 million per year. From 2007 to 2010 it was roughly 500,000. The latest figures have it back around 1 million. Keep in mind that from 2000 to 2007 NINJA loans allowed anyone and everyone to buy a home. So low incomes didn’t matter. We essentially lived a late night real estate infomercial in real-time. Today, with government backed mortgages, people have to show legitimate income and this has hit sales. Of course investors using non-traditional financing are eating up a large share of inventory.

You would think that given these kinds of dynamics that the market would have a healthy amount of inventory. That is not the case. Banks have selectively captured the system and with the Fed pushing big pools of money out of cash, you see money rushing into real estate and the stock market. Take a look at the number of homes available for sale in California over the last few years:

Source: Zillow

Inventory has picked up slightly since the year started which is not reflected in the chart above ending in December of 2013. However, do you see young Americans out in the market trying to buy up real estate? In high priced markets this is even more unlikely.

The new school of thought is “well you get two professionals and you take on a jumbo mortgage.” Ironically, many of these people plan on having a family and guess what? This usually means someone is out of work for a few months and when they go back, a giant chunk of money is going to go to childcare. This is tough on an already stretched budget.

And when you are squeezing into a home based on two incomes you better hope those two incomes continue to exist or be prepared to cover the mortgage on one income. Good luck on that one.

I doubt many young households are even running these numbers at least in expensive areas. In fact, new home sales missed their mark showing that the end of 2013 was not a good one for housing:

This chart doesn’t do justice to the absolute collapse in new home sales:

Builders clearly understand the current trend. This is why there is no flood of new home building. Many of the new home building permits are going to multi-family dwellings (aka apartments for rent). Large investors are aggressively going after this income stream.

In places like Florida over 60 percent of recent purchases went to investors.

Many young Americans will be accustomed to paying their student debt and rents on a monthly basis while these income streams go into banks that own their property. Not a bad situation if the market wasn’t rigged by banks, whose preference is given to large money and where low rates matter little when the Fed has set a fuse to Wall Street to buy outthe real estate market.

Of course many will try to pretend that this is some sort of free market. The housing market is fully subsidized and juiced to the gills and while this is going on, a younger generation gets older and their dreams of home ownership move further and further away.

At least they can bunk with mom and dad and enjoy stories of those beautiful golden real estate handcuffs.

Comment