ARMs, one of FIRE's Children of the Night, cannot be killed

I am convinced that Californians enjoy having a sordid affair with real estate. The amount of justifications that get thrown around during booms and busts would be enough to fill a diagnostic manual for any aspiring psychologist. It is fairly well accepted that mortgage rates will only move in one direction from this point forward. So why would anyone lock into an artificially low rate via an ARM that is set to adjust in a short timeframe? Many Californians are opting for ARMs to compete with big money investors over the tiny crumbs of inventory out in the market. After all, home prices will be up in 5, 7, or 10 years and by that time you’ll be playing the equity ladder game once again, right? The usage of ARMs is surging for the non-investor share of buyers. A big reason is that California is largely unaffordable for the masses.

Affordability reaches bubble level lows

What is amazing is that some people have somehow confused the definition of prime. Manhattan Beach is not Redondo Beach or Torrance. That should be rather clear. Just because you are near to the coast does not suddenly mean an area is crazy valuable or the next Newport Beach. Think of places like Beverly Hills or San Marino that are not near the coast but legitimately are prime. Or think of other places where this rule does not apply (i.e., Oxnard and Thousand Oaks comes to mind).

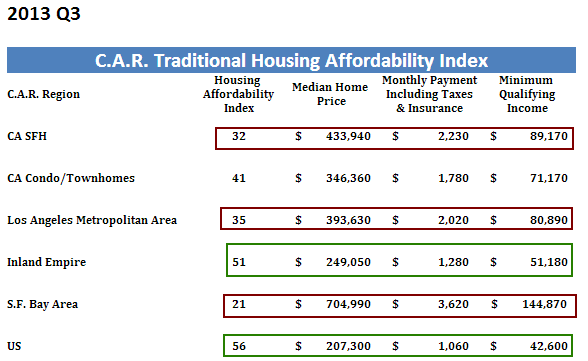

The bottom line is that affordability is very low for many parts of California again:

Source: CAR

Only 32 percent of households can actually afford to purchase a median priced home in the state. However, affordability across the US is still high and this also applies to the Inland Empire. The L.A. region is once again very unaffordable although pales in comparison to San Francisco.

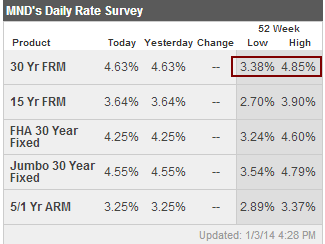

The affordability calculations largely rest on the 30-year fixed mortgage rate. As we know, this has undergone a big change recently:

A move from 3.38 to the current 4.63 percent market rate is a big move. Big enough that it has slowed down the market dramatically starting in the second half of 2013. In fact, the Southern California median home price hasn’t moved much from where it was in June of 2013. Of course momentum keeps on trucking and those families needing to buy are leveraging into properties with those trusty ARMs.

ARM usage increases

ARM usage in Southern California has doubled in the last year:

“(LA Times) When Michael Shuken recently bought his family’s first home, a four-bedroom in Mar Vista,his adjustable-rate mortgage helped them stay on the pricey Westside.

For now, his interest-only loan costs him about 35% less per month than a 30-year fixed mortgage, he said. But he’ll have a much bigger monthly bill in 10 years, when the loan terms require him to start paying off principal at potentially high rates.

“What is going to happen if I can’t restructure my loan and extend it? Are interest rates going to be 7%, 8%?” the 43-year-old commercial real estate broker said. “The home is big enough for me to grow into. The question is, will I be able to?”

Employed in commercial real estate and diving in with an interest-only loan. Talk about putting all your eggs in one basket. People do realize that since the housing crisis hit over 5.4 million people have seen their homes repossessed? No one likes to brag about making a bad purchase at a peak but my goodness will we hear about those that lucked out and timed a short-term trough as if that was the only time prices would be affordable ever in the existence of California (have we not already established that California loves to boom and bust?). Many of these folks forget about opportunity cost. What if you put that $200,000 down payment in the stock market? If you did this last year, it would now be up to $260,000 merely by investing in the broad market. However you slice the pie, it is market timing. By the way, you don’t get that equity until you sell. You know how that story goes with the baby boomers hanging onto properties even if it means they eat Puppy Chow before letting go of those granite countertops.

It is fascinating to see the market slowly shift as sales downgrade and the average Joe is now diving in with ARMs throwing caution to the wind. Others are squeezing in with small down payments because most people in glamorous California live life with the all hat and no cattle philosophy. Leverage is the name of the game once again in California and new car leases are once again humming along. This time it is different. No really. That is why investors with big money are now slowly stepping back. Buy now or be priced out forever! Based on affordability, the middle class is already priced out and those wanting to play are using risky leverage products trying to compete with investors.

Comment