he leaves out a few investment 'fun-damentals' (aka RBS)

A plague on both of your houses. Unless of course, you are buying a few extra homes as investments and then the market is conveniently setup for you. The Fed has created a housing market dominated by a herd of investors. There is no hyperbole in this statement when the latest report shows that for the latest month of home sales, 42 percent of sales went to “all-cash” buyers. Keep in mind this data reflects sales where no loan is recorded at the sales date thus eliminating most traditional home buyers. The all-cash segment of buyers has typically been a tiny portion of the overall sales pool. The fact that so many sales are occurring off the typical radar suggests that the Fed’s easy money eco-system has created a ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields in every nook and cranny of the economy. This helps to explain why we have such a twisted system where homeownership is declining yet prices are soaring. What do we expect when nearly half of sales are going to investors? The all-cash locusts flood is still ravaging the housing market.

A peak in all-cash buying

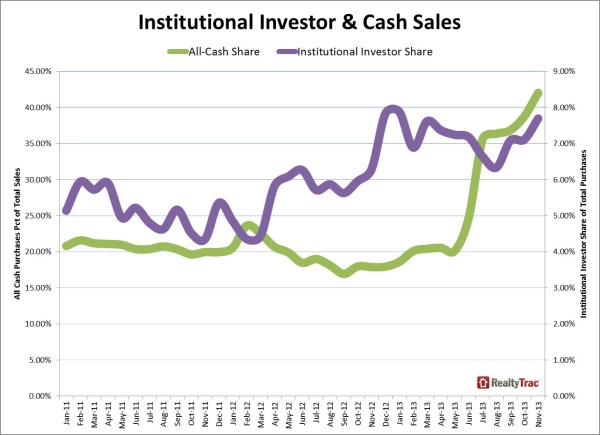

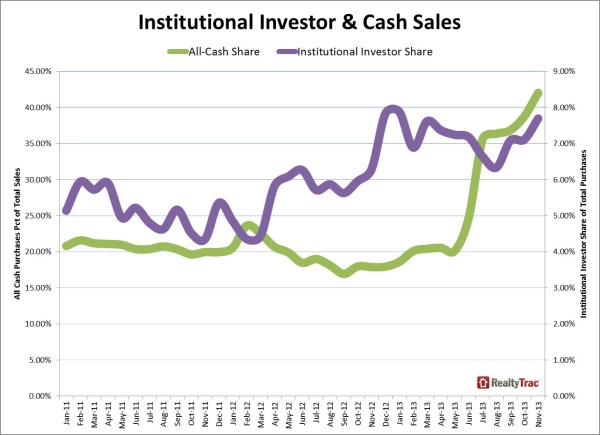

Reports vary in the amount of investors buying. Yet the difference ranges from “a lot” to a “ton” of investor activity. The latest data from RealtyTrac shows 42 percent of November sales coming from all-cash buyers, a new record via this dataset:

Source: RealtyTrac

According to RealtyTrac an all-cash purchase is labeled as:

“All-cash purchases: sales where no loan is recorded at the time of sale and where RealtyTrac has coverage of loan data.”

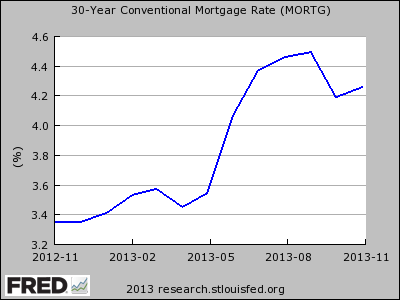

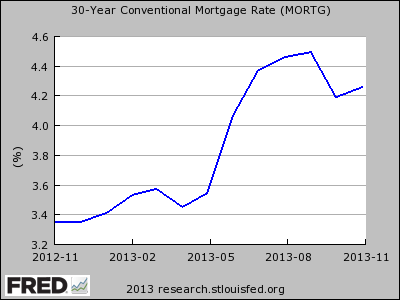

According to this, all-cash purchases went bananas once rates spiked in the summer. Or more to the point, they were the only group not living on a razor’s edge when the interest rate on 30-year fixed rate mortgages soared. Examine the chart above closely. Starting in May, all-cash purchases went from 20 percent to the latest figure of 42 percent. From 2011 all the way to the end of spring 2013 all-cash sales accounted for roughly 20 percent of all sales (a very high amount to begin with). This figure went through the roof with the 100 basis point increase in interest rates:

There is no coincidence that the share of investor buying shot up through the roof once rates went up. Your typical American household is financially strapped to the max and is once again living in a world of easy debt. Once rates went up (still at historically cheap levels) the number of people buying with mortgages fell through the floor. This is reflected with the collapse of mortgage apps hitting a 13 year low:

Source: Bloomberg, ZeroHedge

The problem with all-cash buying dominating the market

The cash segment of the market is fickle and we started seeing a pullback in California as the year ended.

“(MarketWatch) While cash buys help explain the surge in home sales over the past year, some experts say it’s an unsustainable trend — and one that should be greeted with caution. “The rise in cash sales is not a good long-term trend for the housing market,” Blomquist says. Although RealtyTrac doesn’t identify who has cash-in-hand, experts say wealthy Americans and downsizing retirees account for some of these all-cash deals. Investors who are keen to make a profit by buying low and renting those properties — or flipping them — also drive up the number of all-cash deals, he says. None of these three groups — flippers, retirees and the wealthy — are big enough to sustain the market in the long run, he says. If it remains dominant in the long run, cash buying “will have a chilling effect on home sales and prices,” Blomquist says.”

This helps to explain the odd non-market like behavior of falling inventory and booming prices. Typically, when prices rise you would expect to see some subsequent rise in supply (i.e., building, people selling, etc). The recent rise in building permits has been largely driven by multi-family units reflecting a growing renting population. This is the multi-year consequence of the Fed’s favoritism to the banking sector combined with the banking sectors manipulation of inventory and accounting standards. Those in the know are not out building in mass because they read the same reports regarding household wealth and income. They are looking at the impact of a modest 100 basis point increase and how it put the brakes on the housing market. There is now talk of tapering as the Fed’s balance sheet becomes comically massive at over $4 trillion.

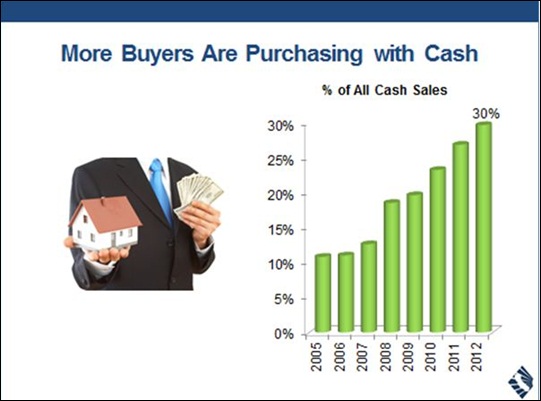

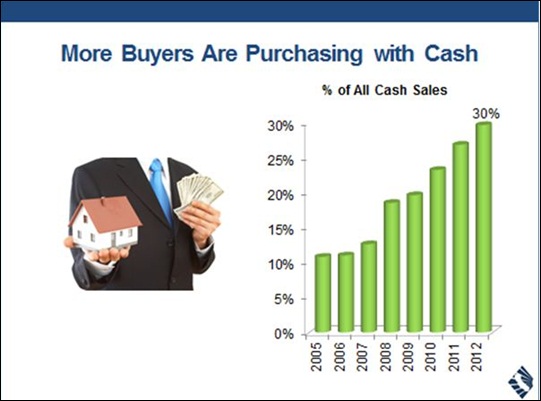

In California, the all-cash segment has also been enormous:

This California data doesn’t include this year which is the record year. The highest percentage of all-cash buying for SoCal occurred earlier in the year at 36 percent of all sales. In more “normal years” this figure should be around 10 percent. Prices even in hot SoCal have stalled out since June. Again, investors are a fickle group. There is no “setting roots” or “cheering for the community here” but a calculated and cold decision to make a quick buck on an easy interest rate environment. The problem with this eco-system created by the Fed is that it is favoring big money to essentially gobble up properties on the cheap over the last few years while the public is once again late to the table.

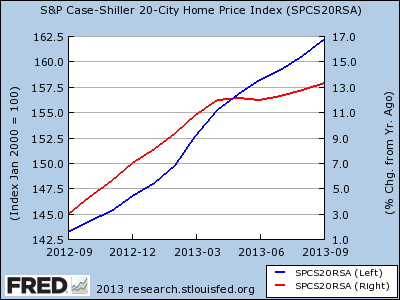

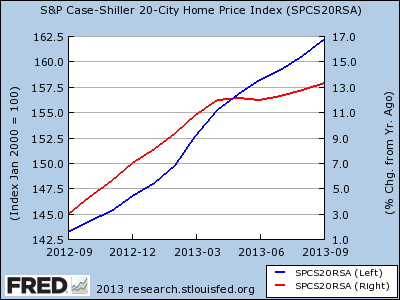

It is fascinating to see people root for higher prices while incomes are stagnant. It goes to show that people are still addicted to debt and leverage even after the deepest recession since the Great Depression. Over the last year, the Case Shiller registered a 13 percent increase nationwide:

In California home prices are up 23 percent year-over-year. What this means is that a typical home went up $69,000 (more than the median household income of a family living in California). At the same time, per capita income went up 1.5 percent (or $930 for each worker). Many years ago I wrote that there is little need to work when your home is appreciating more than the annual income of a family working in the state. Just sit back and cash in on the equity. There is one caveat however. You need to sell. In California, you have baby boomers hunkering down in their wood floor, granite countertop, and recessed lighting glorious sarcophaguses. I’ve started hearing some people quoting “summer prices” as if this was the true value of their property.

Easy money is coming from those chasing yields in this distorted Fed economy. Greed still looks the same even though we have different players at hand. It is likely that 2014 is the year we see a slow retreat from investors and get a taste of how well this market can stand on its own two feet.

A plague on both of your houses. Unless of course, you are buying a few extra homes as investments and then the market is conveniently setup for you. The Fed has created a housing market dominated by a herd of investors. There is no hyperbole in this statement when the latest report shows that for the latest month of home sales, 42 percent of sales went to “all-cash” buyers. Keep in mind this data reflects sales where no loan is recorded at the sales date thus eliminating most traditional home buyers. The all-cash segment of buyers has typically been a tiny portion of the overall sales pool. The fact that so many sales are occurring off the typical radar suggests that the Fed’s easy money eco-system has created a ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields in every nook and cranny of the economy. This helps to explain why we have such a twisted system where homeownership is declining yet prices are soaring. What do we expect when nearly half of sales are going to investors? The all-cash locusts flood is still ravaging the housing market.

A peak in all-cash buying

Reports vary in the amount of investors buying. Yet the difference ranges from “a lot” to a “ton” of investor activity. The latest data from RealtyTrac shows 42 percent of November sales coming from all-cash buyers, a new record via this dataset:

Source: RealtyTrac

According to RealtyTrac an all-cash purchase is labeled as:

“All-cash purchases: sales where no loan is recorded at the time of sale and where RealtyTrac has coverage of loan data.”

There is no coincidence that the share of investor buying shot up through the roof once rates went up. Your typical American household is financially strapped to the max and is once again living in a world of easy debt. Once rates went up (still at historically cheap levels) the number of people buying with mortgages fell through the floor. This is reflected with the collapse of mortgage apps hitting a 13 year low:

Source: Bloomberg, ZeroHedge

The problem with all-cash buying dominating the market

The cash segment of the market is fickle and we started seeing a pullback in California as the year ended.

“(MarketWatch) While cash buys help explain the surge in home sales over the past year, some experts say it’s an unsustainable trend — and one that should be greeted with caution. “The rise in cash sales is not a good long-term trend for the housing market,” Blomquist says. Although RealtyTrac doesn’t identify who has cash-in-hand, experts say wealthy Americans and downsizing retirees account for some of these all-cash deals. Investors who are keen to make a profit by buying low and renting those properties — or flipping them — also drive up the number of all-cash deals, he says. None of these three groups — flippers, retirees and the wealthy — are big enough to sustain the market in the long run, he says. If it remains dominant in the long run, cash buying “will have a chilling effect on home sales and prices,” Blomquist says.”

In California, the all-cash segment has also been enormous:

This California data doesn’t include this year which is the record year. The highest percentage of all-cash buying for SoCal occurred earlier in the year at 36 percent of all sales. In more “normal years” this figure should be around 10 percent. Prices even in hot SoCal have stalled out since June. Again, investors are a fickle group. There is no “setting roots” or “cheering for the community here” but a calculated and cold decision to make a quick buck on an easy interest rate environment. The problem with this eco-system created by the Fed is that it is favoring big money to essentially gobble up properties on the cheap over the last few years while the public is once again late to the table.

It is fascinating to see people root for higher prices while incomes are stagnant. It goes to show that people are still addicted to debt and leverage even after the deepest recession since the Great Depression. Over the last year, the Case Shiller registered a 13 percent increase nationwide:

In California home prices are up 23 percent year-over-year. What this means is that a typical home went up $69,000 (more than the median household income of a family living in California). At the same time, per capita income went up 1.5 percent (or $930 for each worker). Many years ago I wrote that there is little need to work when your home is appreciating more than the annual income of a family working in the state. Just sit back and cash in on the equity. There is one caveat however. You need to sell. In California, you have baby boomers hunkering down in their wood floor, granite countertop, and recessed lighting glorious sarcophaguses. I’ve started hearing some people quoting “summer prices” as if this was the true value of their property.

Easy money is coming from those chasing yields in this distorted Fed economy. Greed still looks the same even though we have different players at hand. It is likely that 2014 is the year we see a slow retreat from investors and get a taste of how well this market can stand on its own two feet.

Comment