Americans for the most part are bad at saving money. In fact, the entire credit boom and bust was largely fueled by people and banks living way beyond their means. Even after the recent boom in the stock market and housing market, many Americans are not in a better financial position. The problem with housing is that this is like having golden handcuffs. You will likely only unlock the wealth when you sell it. As we have discussed many are simply reluctant to sell. So in essence, the wealth is locked away. To sell a home also costs money and real estate for the most part is illiquid. And since the recession ended a large portion of home purchases have gone to investors. Never in the history of the US have we seen so many large institutions dive into the housing market in aspiration of being a landlord. Recent surveys show that many Americans plan on working until they end up in their grave. But what about the boom in housing? Unfortunately many are locked in a granite countertop laden sarcophagus.

Source of income – most will rely on Social Security

Most Americans will rely on one shaky stream of income in their retirement, Social Security:

Source: NPR

Social Security was never designed to be the cornerstone of a long-term retirement plan for Americans. It was supposed to be one part of a “three legged stool” of retirement that included savings, pensions/work based retirement income, and finally Social Security. Well look at the chart above. The vast majority of Americans are not approaching this anywhere close to the three legged stool approach. This is a one leg chair and Social Security is the foundation. When Americans were living in homes and having mortgage burning parties this made sense but now we have people rarely paying off their homes. Where is the income going to come from in retirement? And with the homeownership rate plunging, many will be paying rent in their older years as well. And don’t think that by simply owning your home that you get away with no costs. You still pay insurance, taxes, and maintenance costs. Americans have much less saved up than you think.

The typical amount saved for retirement less than you think

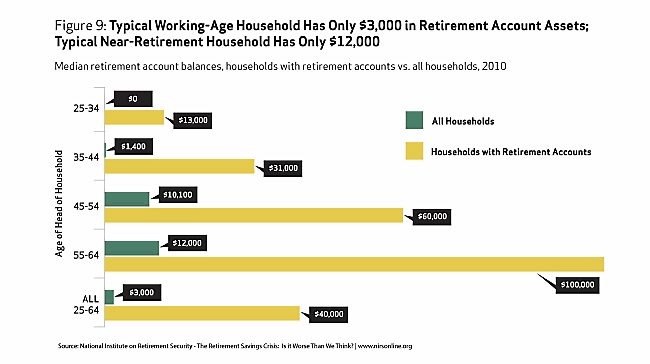

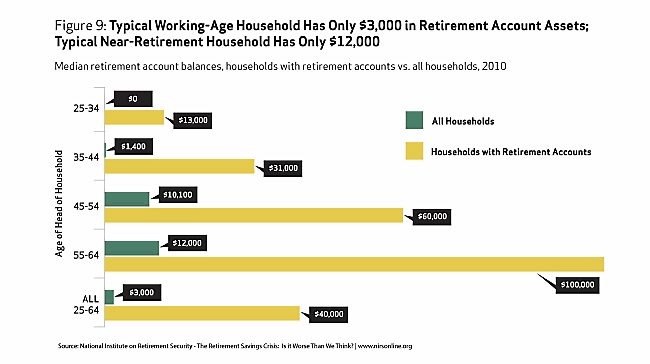

The money saved for retirement by Americans is ridiculously low:

The typical working household has $3,000 saved for retirement while the household nearing retirement has about $12,000. This isn’t exactly a good situation. And reverse mortgages are not the answer because this is simply another transfer of an asset to a banking institution (and usually the terms are not good in your favor). And if you think this boom in housing and the stock market is helping Americans think again:

“(Forbes) Forget pushing retirement off a few years. A growing number of Americans believe they’ll be working until death.

An alarming 37% of middle class Americans believe they’ll work until they’re too sick or until they die.

Another 34% believes retirement will come at the ripe age of 80. Just two years ago only 25% of respondents felt the same way.”

And this is for middle class Americans. This isn’t looking at lower income Americans that presumably already know that they won’t retire and will largely be dependent on Social Security if they are lucky enough to make the cut. 37 percent of middle class Americans believe they will work until they kick the bucket. Let us not even discuss the situation of younger Americans looking to buy real estate and have mountains of student debt to contend with.

This is why a massive increase in real estate values driven by speculation and artificially low rates rarely does much for the underlying households in the economy. Say you have a $200,000 home and now the home is worth $250,000. Okay. Are you going to downsize? Unlikely. You want a bigger home in a better neighborhood. Well guess what? Homes in that area went up as well. In this market, a good agent is going to end up costing 5 to 6 percent (split among two or one agent). After that is done, you probably have enough for a down payment but you just reset and now have a new mortgage bill that is likely at 30-years again. This is common for most Americans. The typical holding period of a US household is 7 years before they move from their current home. Mortgage burning parties are as rare as flapper clothing in a hip-hop club.

Homeowner’s equity up but mortgage debt down – a boon to banks

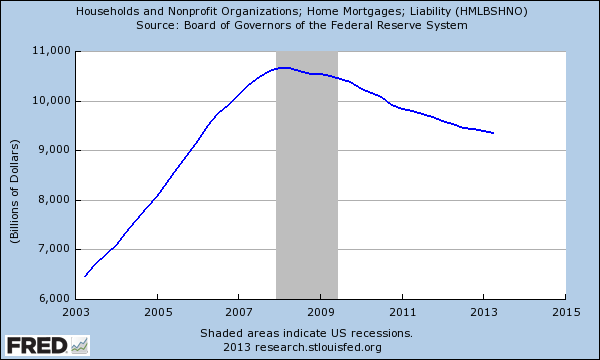

What is shocking is that the balance sheet changes are largely being driven by foreclosures and investors eating up a big portion of properties since the housing market crashed in 2007. Take a look at mortgage debt and then equity in homes:

Mortgage debt has largely fallen because of foreclosures but also, a large portion of recent sales (i.e., 50 percent in Las Vegas, parts of Arizona, 30 to 40 percent in California, etc) have gone to investors. If you are buying with alternative financing either cash or other non-traditional ways mortgage debt is going to fall dramatically. Yet is this really a big benefit for local households that now contend with inflated real estate values and no real tangible gains in household income? Take a look at equity in homes:

This big gain is going to banks and large investors. Even the household that has seen their real estate go up will only benefit if they downsize and that may mean leaving a high cost state (and looking at available data most are going to keep those golden handcuffs on and eat cat food before they sell and “down grade” their standard of living based on zip code). Naïve folks think that “well if the Fed is making rates low, then don’t all people have the same advantage?” Of course not. We are talking about billion dollar hedge funds here that trade in bonds and derivatives. The 30-year mortgage is largely for the average Jane and Joe that can’t contend in this market. We’re talking about negative rates on Treasuries that have forced these banks to ignore rates lower than inflation and go after rental property. Why else would Wall Street be interested in rental real estate? For decades being a “landlord” was seen as beneath them. Yet this is what happens when the Fed is quickly expanding their balance sheet to $4 trillion. This formula is working for a very small portion of our nation.

The big divide in wealth

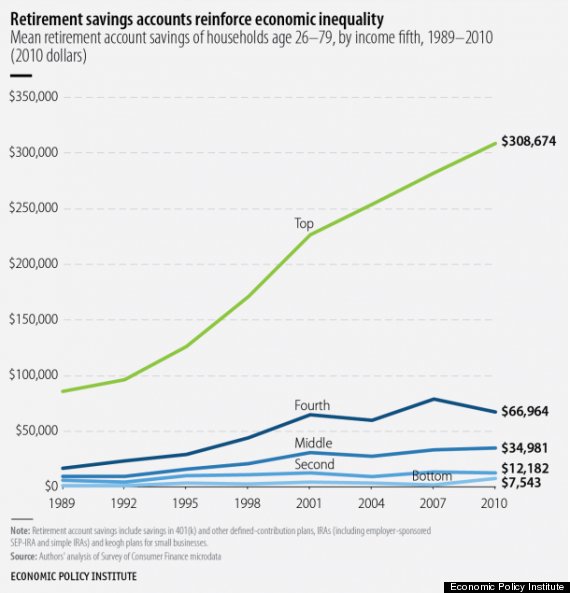

As many of you know income inequality is rising dramatically in the US:

This is simply a fact. It is also a big reason as to why the US is becoming a larger renting nation. In many prime locations hot money is accessible to not only US investors but the world. It is hilarious to hear some “loyalist” talk about how much they love their area as if they will only sell to “Americans” but will sell their property to whoever comes in with the biggest bucks. This is part of a global market. If you think the Fed is looking out for the regular US household you have something coming to you. The facts show a very different reality. Those surveys we mentioned where most are going to rely on Social Security and how many are going to work into their graves were conducted recently. That is, these were done in year 4 of the recovery. Many of the jobs that have come after the recession ended in the summer of 2009 have been lower paying jobs. Certainly not enough to support a mortgage in prime locations.

Many Americans are house broke. Some are so broke that they have lost their homes to foreclosure (over 5,000,000 and many are still losing homes) but many of these homes are going into the hands of banks. The little inventory out there is trading hands in a very tightly controlled range. Supply is restricted and thanks to accounting rules being bent to the will of the banks, the win is very clear for this group. But looking at other metrics of “wealth” most Americans continue to lose out even with this boom in housing and major rally in stocks. Frankly, most don’t even have enough to purchase a seat at the current inflated table.

http://www.doctorhousingbubble.com/h...h-real-estate/

Source of income – most will rely on Social Security

Most Americans will rely on one shaky stream of income in their retirement, Social Security:

Source: NPR

Social Security was never designed to be the cornerstone of a long-term retirement plan for Americans. It was supposed to be one part of a “three legged stool” of retirement that included savings, pensions/work based retirement income, and finally Social Security. Well look at the chart above. The vast majority of Americans are not approaching this anywhere close to the three legged stool approach. This is a one leg chair and Social Security is the foundation. When Americans were living in homes and having mortgage burning parties this made sense but now we have people rarely paying off their homes. Where is the income going to come from in retirement? And with the homeownership rate plunging, many will be paying rent in their older years as well. And don’t think that by simply owning your home that you get away with no costs. You still pay insurance, taxes, and maintenance costs. Americans have much less saved up than you think.

The typical amount saved for retirement less than you think

The money saved for retirement by Americans is ridiculously low:

The typical working household has $3,000 saved for retirement while the household nearing retirement has about $12,000. This isn’t exactly a good situation. And reverse mortgages are not the answer because this is simply another transfer of an asset to a banking institution (and usually the terms are not good in your favor). And if you think this boom in housing and the stock market is helping Americans think again:

“(Forbes) Forget pushing retirement off a few years. A growing number of Americans believe they’ll be working until death.

An alarming 37% of middle class Americans believe they’ll work until they’re too sick or until they die.

Another 34% believes retirement will come at the ripe age of 80. Just two years ago only 25% of respondents felt the same way.”

And this is for middle class Americans. This isn’t looking at lower income Americans that presumably already know that they won’t retire and will largely be dependent on Social Security if they are lucky enough to make the cut. 37 percent of middle class Americans believe they will work until they kick the bucket. Let us not even discuss the situation of younger Americans looking to buy real estate and have mountains of student debt to contend with.

This is why a massive increase in real estate values driven by speculation and artificially low rates rarely does much for the underlying households in the economy. Say you have a $200,000 home and now the home is worth $250,000. Okay. Are you going to downsize? Unlikely. You want a bigger home in a better neighborhood. Well guess what? Homes in that area went up as well. In this market, a good agent is going to end up costing 5 to 6 percent (split among two or one agent). After that is done, you probably have enough for a down payment but you just reset and now have a new mortgage bill that is likely at 30-years again. This is common for most Americans. The typical holding period of a US household is 7 years before they move from their current home. Mortgage burning parties are as rare as flapper clothing in a hip-hop club.

Homeowner’s equity up but mortgage debt down – a boon to banks

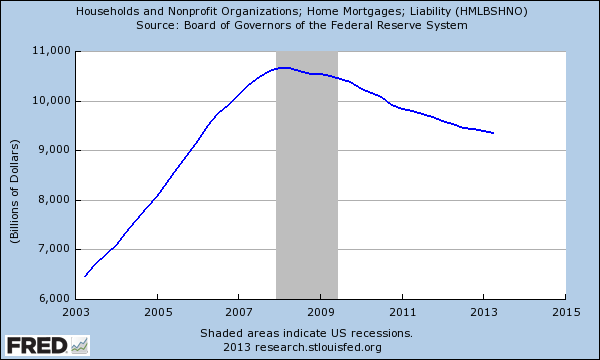

What is shocking is that the balance sheet changes are largely being driven by foreclosures and investors eating up a big portion of properties since the housing market crashed in 2007. Take a look at mortgage debt and then equity in homes:

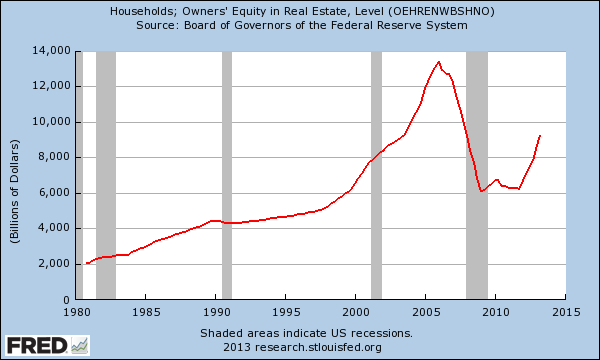

Mortgage debt has largely fallen because of foreclosures but also, a large portion of recent sales (i.e., 50 percent in Las Vegas, parts of Arizona, 30 to 40 percent in California, etc) have gone to investors. If you are buying with alternative financing either cash or other non-traditional ways mortgage debt is going to fall dramatically. Yet is this really a big benefit for local households that now contend with inflated real estate values and no real tangible gains in household income? Take a look at equity in homes:

This big gain is going to banks and large investors. Even the household that has seen their real estate go up will only benefit if they downsize and that may mean leaving a high cost state (and looking at available data most are going to keep those golden handcuffs on and eat cat food before they sell and “down grade” their standard of living based on zip code). Naïve folks think that “well if the Fed is making rates low, then don’t all people have the same advantage?” Of course not. We are talking about billion dollar hedge funds here that trade in bonds and derivatives. The 30-year mortgage is largely for the average Jane and Joe that can’t contend in this market. We’re talking about negative rates on Treasuries that have forced these banks to ignore rates lower than inflation and go after rental property. Why else would Wall Street be interested in rental real estate? For decades being a “landlord” was seen as beneath them. Yet this is what happens when the Fed is quickly expanding their balance sheet to $4 trillion. This formula is working for a very small portion of our nation.

The big divide in wealth

As many of you know income inequality is rising dramatically in the US:

This is simply a fact. It is also a big reason as to why the US is becoming a larger renting nation. In many prime locations hot money is accessible to not only US investors but the world. It is hilarious to hear some “loyalist” talk about how much they love their area as if they will only sell to “Americans” but will sell their property to whoever comes in with the biggest bucks. This is part of a global market. If you think the Fed is looking out for the regular US household you have something coming to you. The facts show a very different reality. Those surveys we mentioned where most are going to rely on Social Security and how many are going to work into their graves were conducted recently. That is, these were done in year 4 of the recovery. Many of the jobs that have come after the recession ended in the summer of 2009 have been lower paying jobs. Certainly not enough to support a mortgage in prime locations.

Many Americans are house broke. Some are so broke that they have lost their homes to foreclosure (over 5,000,000 and many are still losing homes) but many of these homes are going into the hands of banks. The little inventory out there is trading hands in a very tightly controlled range. Supply is restricted and thanks to accounting rules being bent to the will of the banks, the win is very clear for this group. But looking at other metrics of “wealth” most Americans continue to lose out even with this boom in housing and major rally in stocks. Frankly, most don’t even have enough to purchase a seat at the current inflated table.

http://www.doctorhousingbubble.com/h...h-real-estate/

Comment