Re: What is th edeal with GOLD???

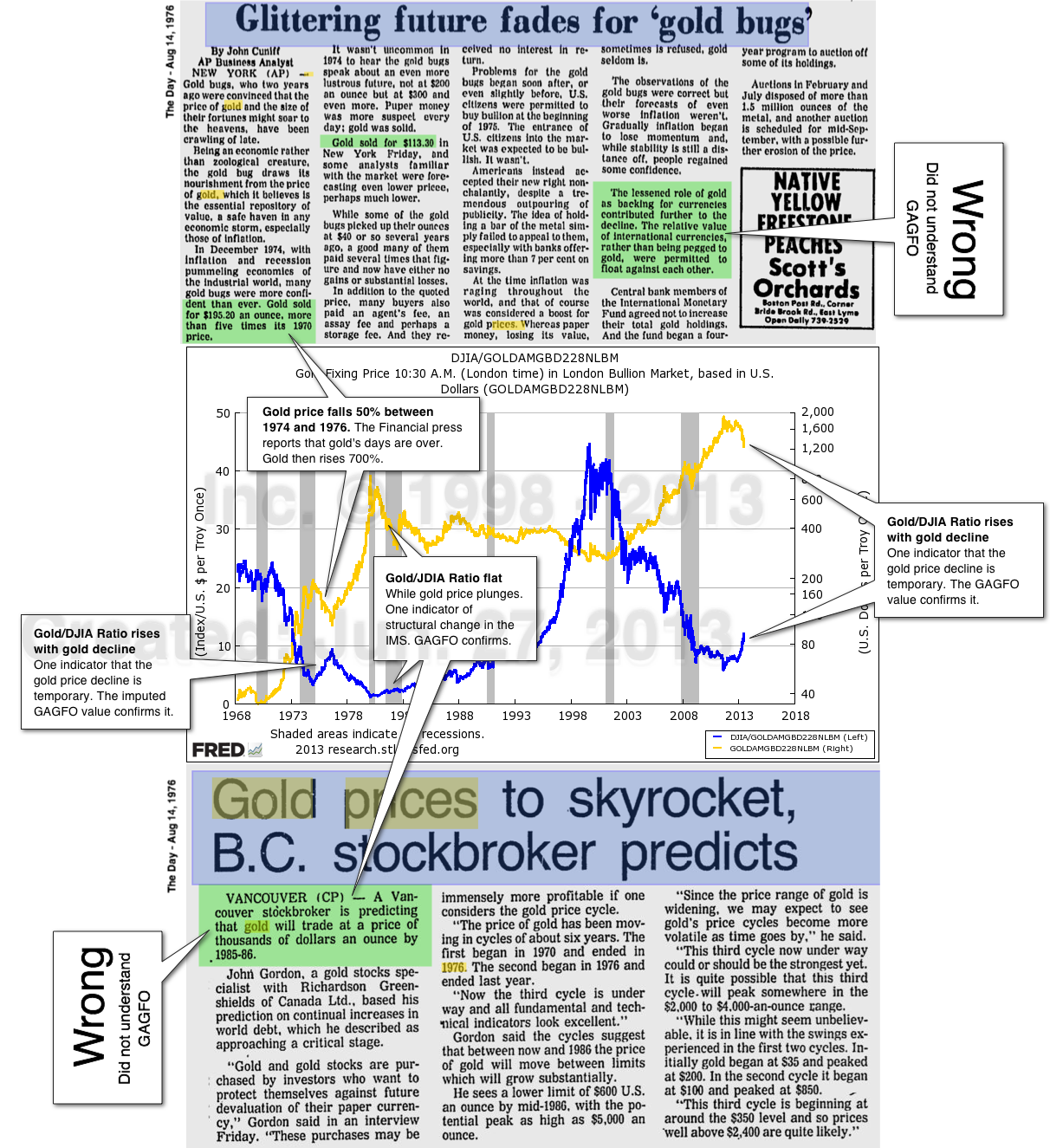

Too bad I didn't have the good fortune to discover iTulip last month instead of two years ago! However, in the end I don't want to be lucky I want to be right. EJ's newspaper is good medicine. This is 1976 not 1980.

Too bad I didn't have the good fortune to discover iTulip last month instead of two years ago! However, in the end I don't want to be lucky I want to be right. EJ's newspaper is good medicine. This is 1976 not 1980.

Comment