Re: What is th edeal with GOLD???

Well, production cost at around 1200 is encouraging. I'm planning to hold, it just sucks to watch it go down and up and down and down and up and down and down...

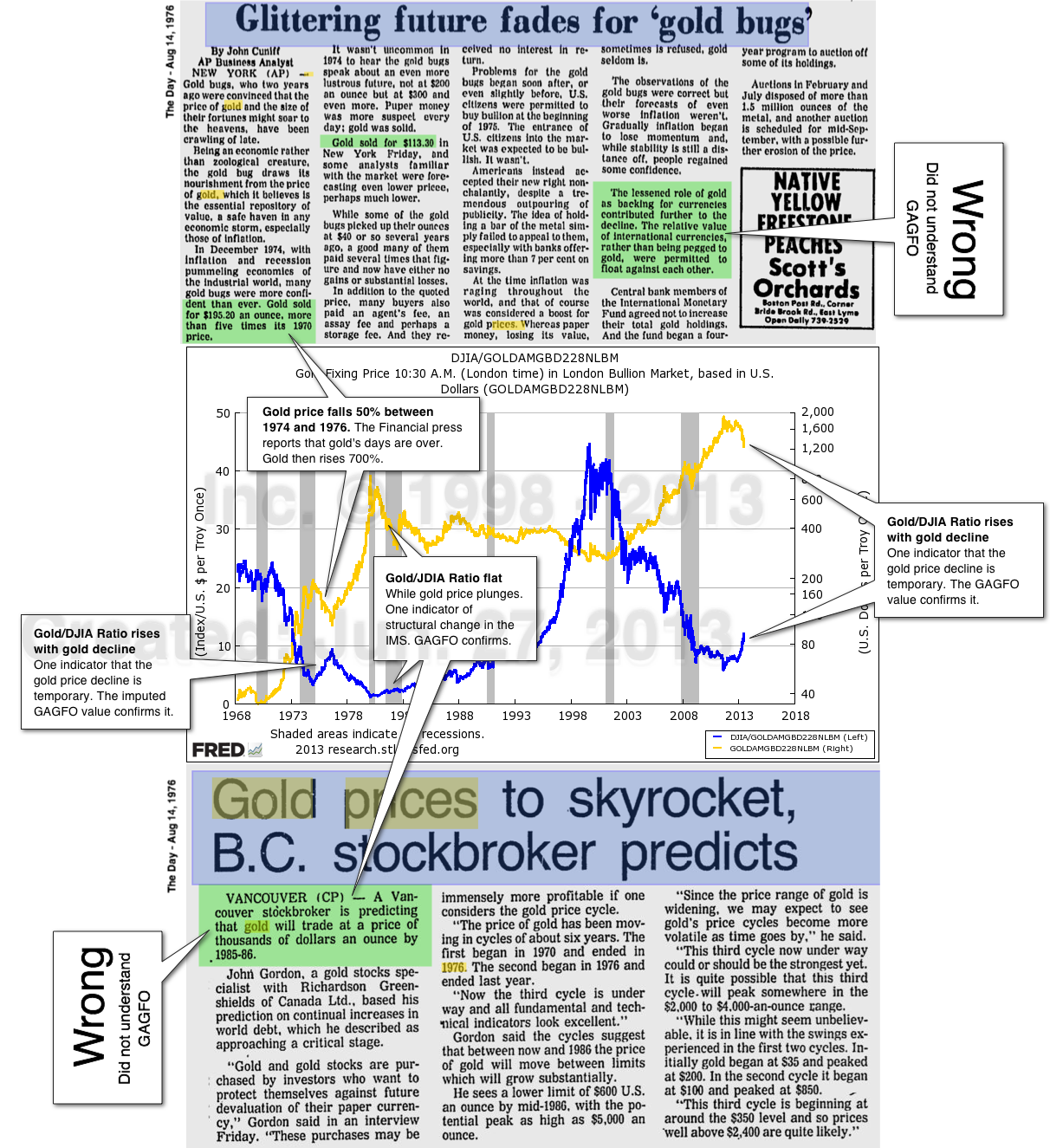

Also, I don't suppose this could be the Ka before a Poom (if not *the* Poom)?

Well, production cost at around 1200 is encouraging. I'm planning to hold, it just sucks to watch it go down and up and down and down and up and down and down...

Also, I don't suppose this could be the Ka before a Poom (if not *the* Poom)?

Comment