let's play two . . .

Game 1

Quantitative easing is unlikely to get any airtime on the local press but this is the overarching policy that the Fed has enacted to pull us out of the recession. What many people do not know is that Japan is ahead of the curve when it comes to enacting quantitative easing to deal with a collapsing real estate bubble. The Bank of Japan has made news this year by aggressively expanding their monetary base to spark some sort of inflation in their underlying economy and subsequently weakening the Yen. The Yen has gotten weaker relative to other currencies and the Nikkei is up 30 percent for the year. One of the bigger questions around quantitative easing and Fed policy is the longer term impact on our economy. Housing prices have moved up because of three major reasons; investor demand, low supply, and historically low interest rates. Each one of these reasons can be traced to the Fed either directly or indirectly. Can an aggressive central bank with a low rate environment re-inflate asset prices?

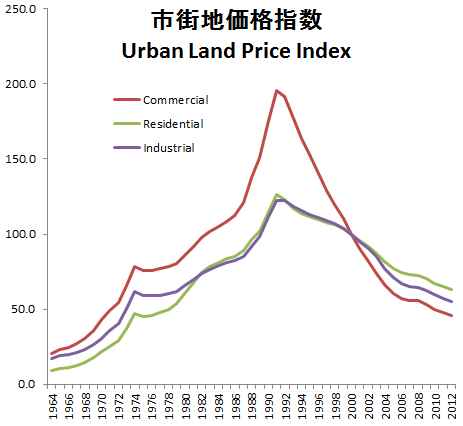

Japan real estate prices

There is an interesting chart showing land prices in Japan:

The real estate market popped in Japan back in the late 1980s. You can see what has occurred over that time. The Bank of Japan has struggled to revive the real estate market since that time. This isnít because the Bank of Japan has acted cautiously. To the contrary, the Bank of Japan has been very extreme when it comes to using their central bank as a means to revive their economy. Yet the struggle is still with deflation.

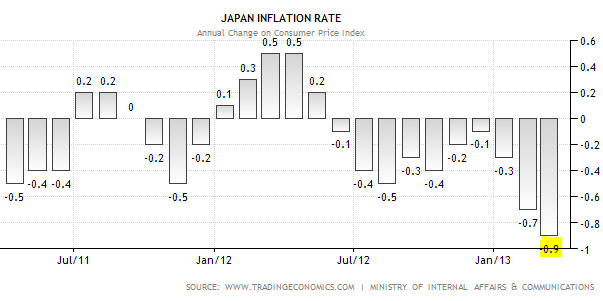

Inflation rate in Japan

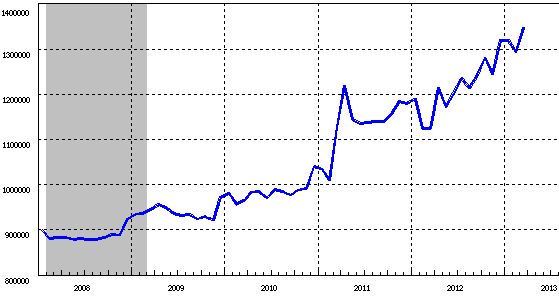

In spite of what is going on, with the monetary base, Japan still struggles with deflation. First take a look at the monetary base expansion:

The Bank of Japan has aggressively increased their monetary base since the global recession hit and this is on top of all their other aggressive quantitative easing measures that created zombie banks and other economic sinkholes. While the Nikkei has gone up strongly this year, deflation is still a major struggle:

What gives? Well first, economic growth has been weak and so has household income growth. This typically goes hand and hand. Over a longer period of time, incomes do matter. So real estate can only increase by so much even with mortgage rates that are lower than those we currently have in the US. Next, Japanís savings rate has been falling for a couple of decades. So in spite of the Bank of Japan flooding the market with all these measures, prices are falling in many categories.

What was accomplished in Japan? There has now been multiple lost decades and overall households in Japan are not better off. The Bank of Japan has had to get more and more aggressive with their monetary policy. So where do we stand?

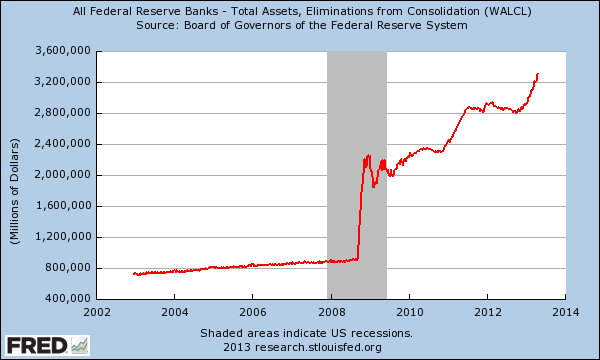

Fed Balance Sheet

There is little doubt that the Fed has thrown everything at our own real estate bubble bursting:

If we are in a solid recovery, why is the Fed balance sheet looking like it was still 2009? In fact, the Fed balance sheet continues to grow and will continue to grow with QE3. The balance sheet is now over $3.3 trillion. A big part of the holdings are mortgage backed securities that no one in the open market will buy. Is there a consequence for this? No one can really answer that because weíve never gone into this kind of aggressive monetary policy. But to think this is a clear cut case of reviving the economy, just look at Japan and see that it isnít as easy as using quantitative easing and expecting the economy to jump back up.

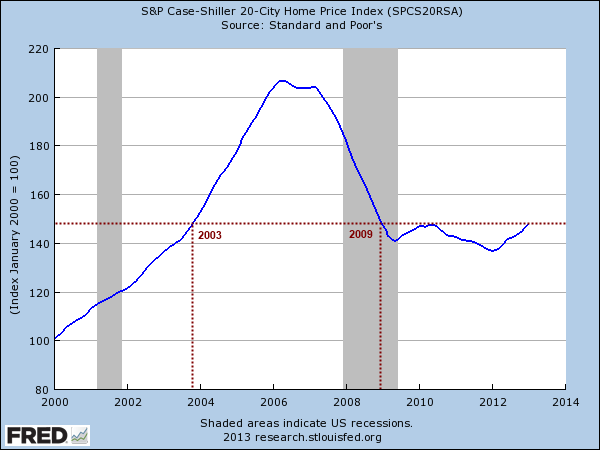

Case Shiller

Home prices are essentially where they were in 2003 across the US. It is clear that in the last year prices have picked up steam. Low rates, low supply, and massive amounts of investors are definitely having an impact. Low supply is going to adjust if prices keep moving up spurring more people to sell and more home builders to dive back into the market. Investors are already pushing cap rates beyond normal levels.

In this area, the US is looking different from Japan already. It is still too early to tell how much momentum this trend will have.

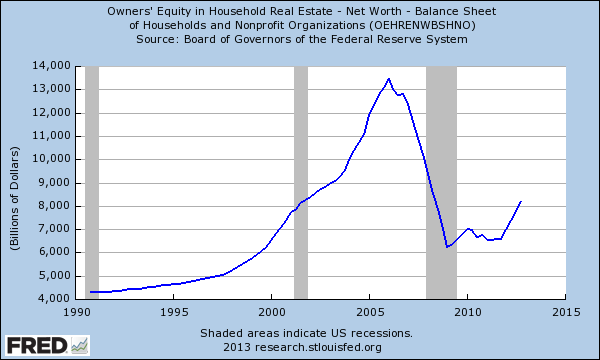

Equity in real Estate

While home prices are picking up, ownersí equity in real estate is still back to levels last seen in the early 2000s:

American homeowners are still over $4 trillion short in equity from the peak that was reached. As home prices rise the equation shifts but much of pressure going forward will depend on economic growth coupled by actual income growth.

Household incomes

Household income growth has been incredibly weak in the 21st Century:

In this regard we are very similar to Japan. While the stock market is at all-time highs and real estate prices continue to move up, the same cannot be said for overall household income growth. You can see the big drops above and most came after the recession was over.

It should be obvious that the rise in stocks and housing prices are not coming from household income growth. Much of it is coming from low rates brought on by the Fed, investor demand, and very low supply. Japan isnít exactly evidence that we should be going full steam ahead with quantitative easing but that is the path we have taken. Even with mortgage rates in the 1 percent range Japanís economy is still stuck in the mud. While there are similarities and differences, one thing is clear and that is both the BoJ and Fed have gone into uncharted central bank territory.

Game 2

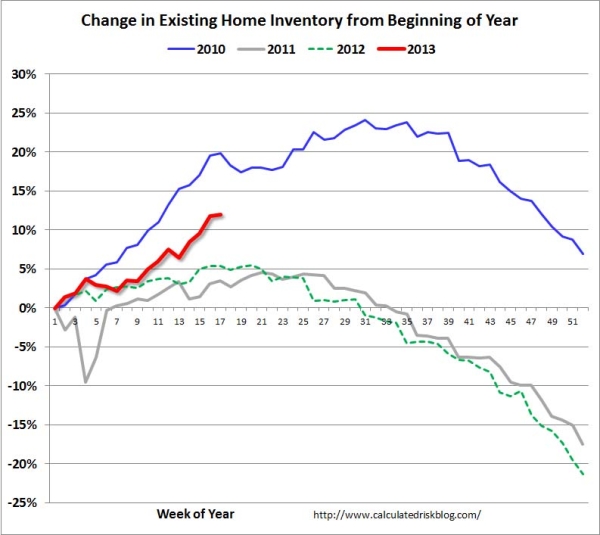

The good news for our inventory starved nation is that supply is indeed increasing. The trend is positive this year and it is starting to look like we reached a bottom when it comes to the lack of inventory. The only caveat in this is that it is unlikely to be in an area where you are looking to buy. Now we have readers from all across the country and the positive news is that the pressure valve might be opening up this year when it comes to the selection of homes. Yet we also have a large contingent of California buyers looking to buy in very select markets. There is little indication that inventory is coming back here and some of these markets are actually making new or close to new record highs when it comes to prices. Let us first look at the change in nationwide inventory and then target a few prime SoCal markets.

Nationwide inventory coming back

Overall it does look like inventory is starting to come back:

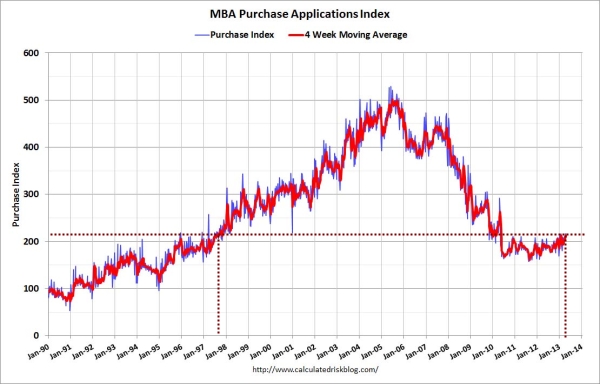

You can see that inventory is now up by double-digits from the start of the year. Part of this is seasonal but you can see that in 2011 and 2012 this seasonal pattern got smashed. This year it looks like the trend is starting to get back to more normal levels. Now this will help since one of the major reasons prices are screaming higher is because inventory is so incredibly low. You hear nonsense that investors are a small part of the market but that is baloney. In SoCal we have something like 34 percent of all homes being purchased by investors with all cash. This has been the trend since the bubble popped. It makes a giant difference when you are battling it out for a tiny number of available properties. We can also see the lack of normal buying by taking a look at purchase applications for mortgages:

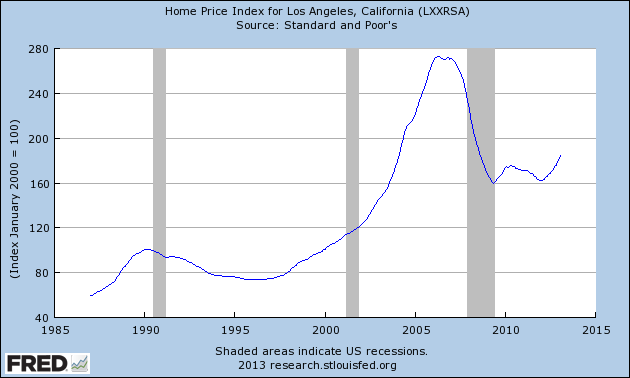

The volume of purchase applications is at levels last seen in 1998. Yeah, the market is booming because of demand right? So it is clear that inventory across the country is starting to ease up a bit. Yet in prime markets, this is not the case. First, I wanted to do a price check on a few areas from peak, to trough, to where we stand today based on the Case Shiller LA-OC index:

So weíll use this as a measure for prices during snapshots in time:

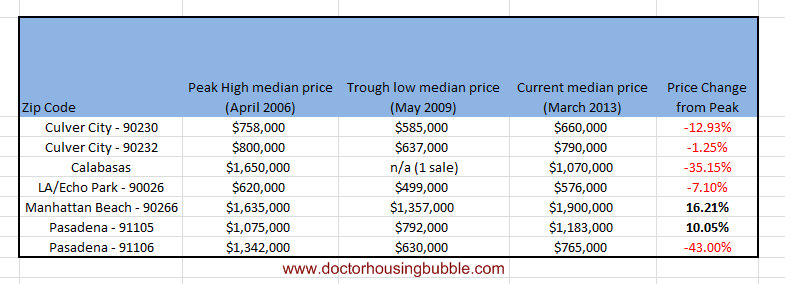

Now remember that in 2006 we were in a delusional mania. If you look at the above chart, youíll see that some places like Manhattan Beach are now up over 16 percent from the crazy peak in 2006. The 91105 zip code in Pasadena is seeing similar changes. Other areas are off from their peak but some not by much. What is interesting is the inventory in these markets. Take a look:

Simple supply and demand. With such a limited amount of supply and added leverage from low interest rates, if you are looking to buy in these markets you are going to confront manic like scenarios including bidding wars and having to write a Jane Eyre like letter to the seller begging them to allow you to spend $1,000,000 for a Great Depression construction home.

I think most reasonable people can see that the very little supply is causing some odd market behavior. Yet this also highlights the regional nature of real estate. While the Case Shiller shows home prices in the LA-OC region being down by 32 percent even after the recent rise, it is obvious that some areas are not down, but to the contrary are hitting prices that are higher than the manic 2006 era.

Nationwide inventory is picking up and so are prices. Yet in some areas it is as if the bubble never happened and now you have the added benefit of record low inventory coupled with investors, low rates, and the momentum that comes from the media cycle constantly talking real estate up.

Comment