Re: There is no inflation... there is no inflation... there is no inflation

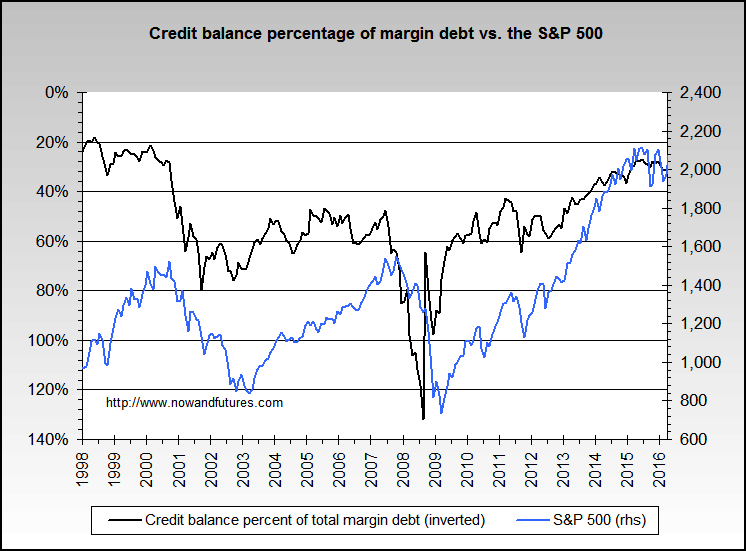

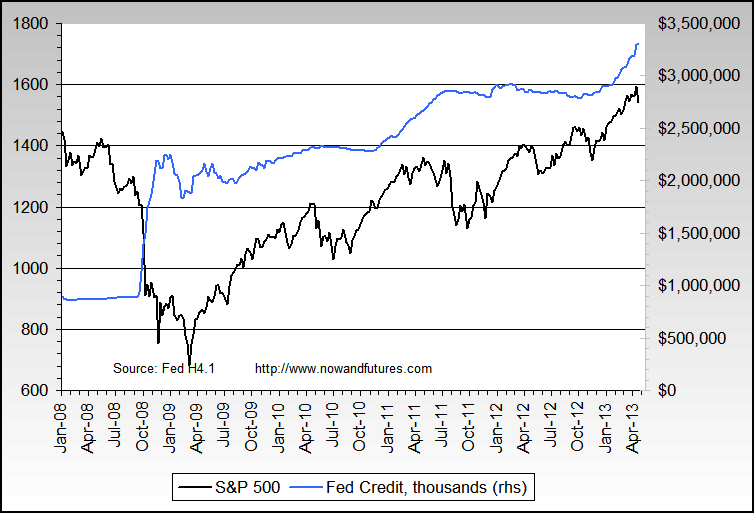

Actually, what I get from that chart is that the Dow is highly correlated to the Margin Debt-to-GDP ratio. The chart is not simply saying that the Dow is a function of GDP alone, because if GDP rises but margin debt rises less than GDP, then the Dow would be expected to fall, not rise. Also, a correlation that so evidently holds over 60 years seems far more compelling to me than a correlation that holds over a few months/years. The question I'm left with is the degree to which Fed credit expansion translates into margin debt expansion.

Actually, what I get from that chart is that the Dow is highly correlated to the Margin Debt-to-GDP ratio. The chart is not simply saying that the Dow is a function of GDP alone, because if GDP rises but margin debt rises less than GDP, then the Dow would be expected to fall, not rise. Also, a correlation that so evidently holds over 60 years seems far more compelling to me than a correlation that holds over a few months/years. The question I'm left with is the degree to which Fed credit expansion translates into margin debt expansion.

.png)

.png)

Comment