There is no (asset) inflation... there is no (asset) inflation... there is no (asset) inflation...

Om mani padme hummmmmmm... ;-)

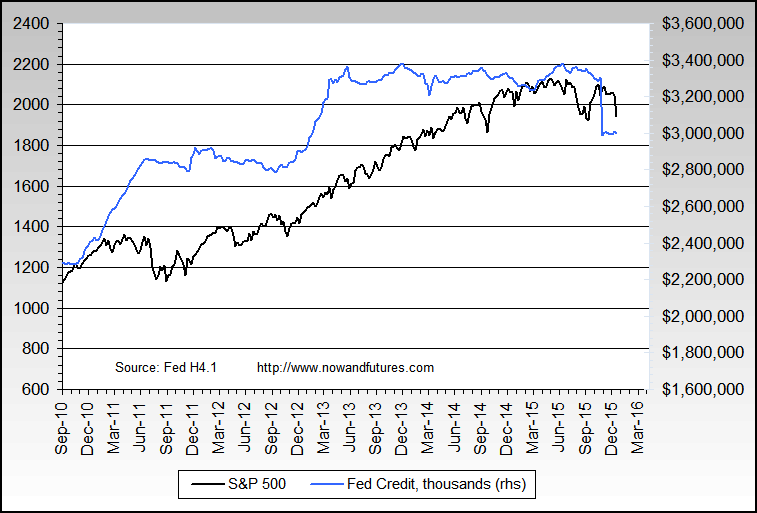

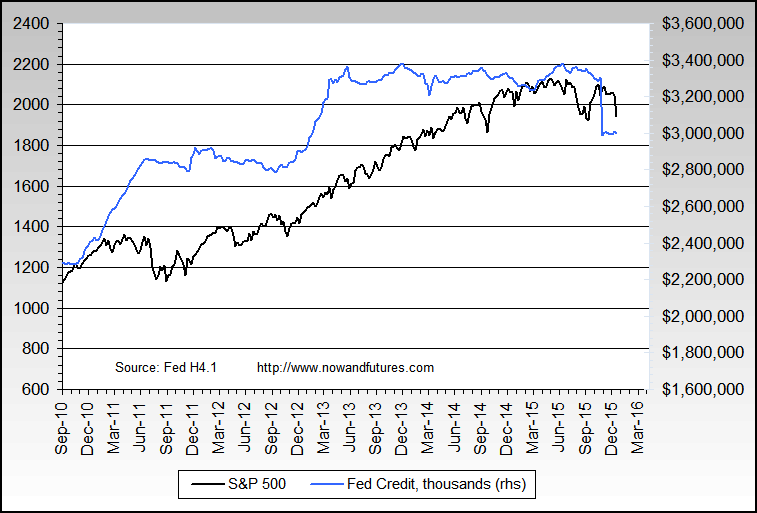

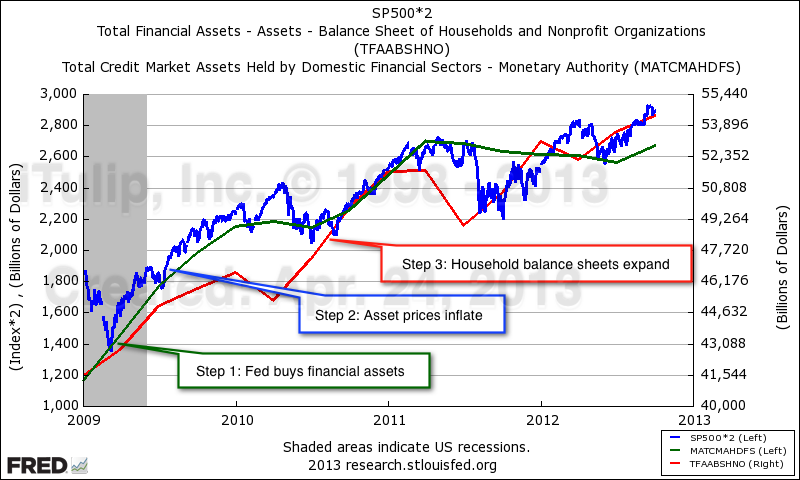

The correlation between Fed credit and the S&P 500 is rather striking.

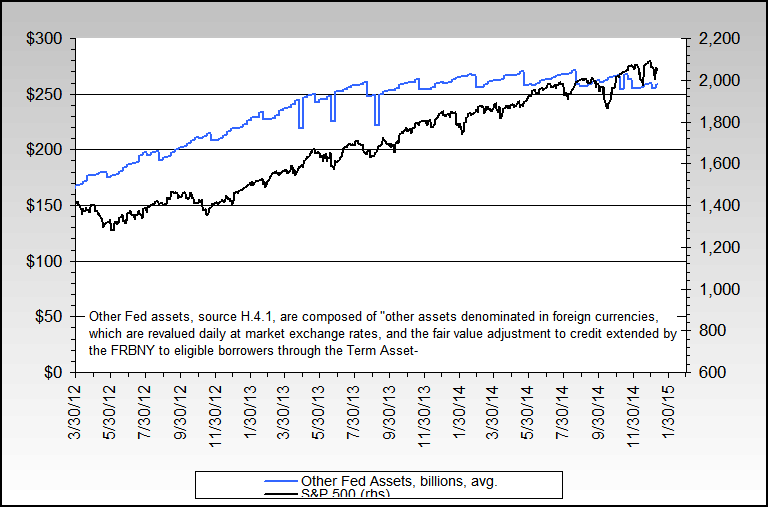

Very unusual large spike (~$300b) in repos last week results M3 money supply growth at over 11% annually.

And the large growth since about mid 2012 also speaks to future inflation.

Om mani padme hummmmmmm... ;-)

The correlation between Fed credit and the S&P 500 is rather striking.

Very unusual large spike (~$300b) in repos last week results M3 money supply growth at over 11% annually.

And the large growth since about mid 2012 also speaks to future inflation.

Comment