left unsaid in the following is the cracks in the confidence (game) of savings in the bank and would you rather have a middling rental or an involuntary savings haircut . . .

It is astounding how people brush off an overall weak economy and suddenly justify all cash investors as somehow a normal part of the real estate market. Once again, we are in uncharted territory. The amount of all cash buyers is off the charts. Not only are these Wall Street investors but also foreign money flowing into targeted markets. It is one thing to push it off but it is another thing to actually look at historical data. It is amazing how quickly people drink from the fountain of cultural amnesia and suddenly forget the environment that led us into this mess. This is a fact however; never have we had so much of the real estate market dominated by all cash purchases. But what is a normal amount? Let us go ahead and look at historical data here to see what we can find.

All cash purchases hit a record in 2012

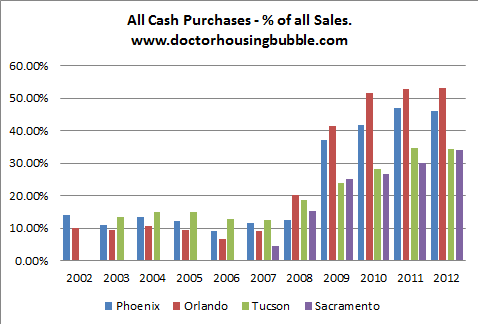

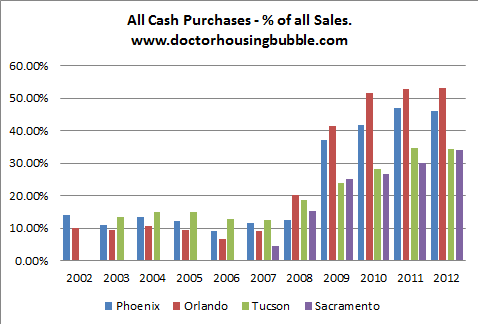

It is hard to find nationwide data for the real estate market going back past 2000 but here we have data on four large areas. It looks like overall, all cash purchases range from 5 to 10 percent:

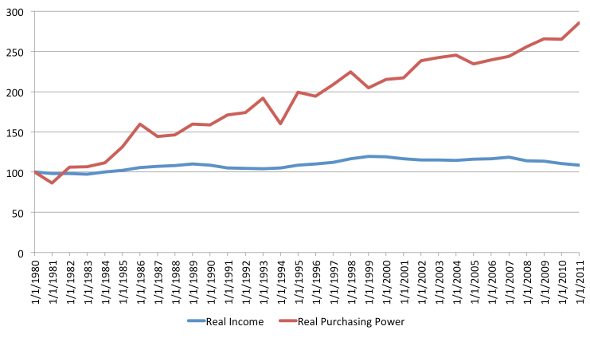

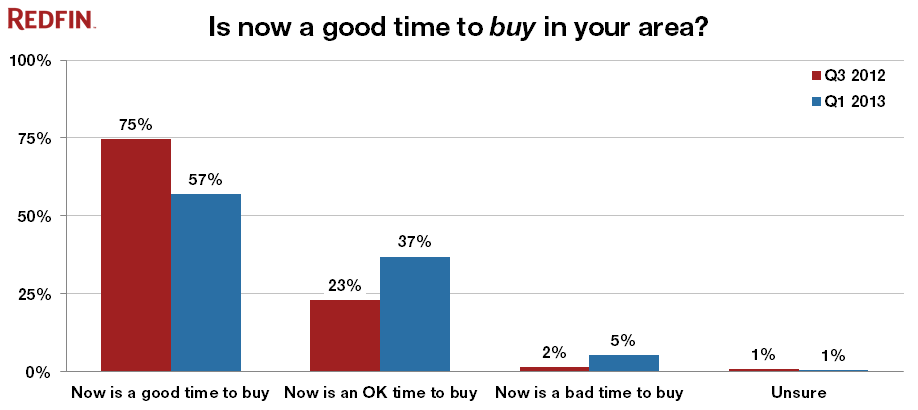

What is amazing is how crazy some markets have gotten like Phoenix and Orlando where basically investors have become the vast majority of the market. Much of the price gains in the last year are driven by investors competing for the small lot of inventory regardless of what underlying rental yields will produce. The Fed of course is luring in buyers with stagnant incomes and low interest rates. The reality is, households are looking at their balance sheets and are saying “what the heck, rates are low so let us go dive in.” It is more enticing especially when every headline is now talking about the reemergence of the housing market.

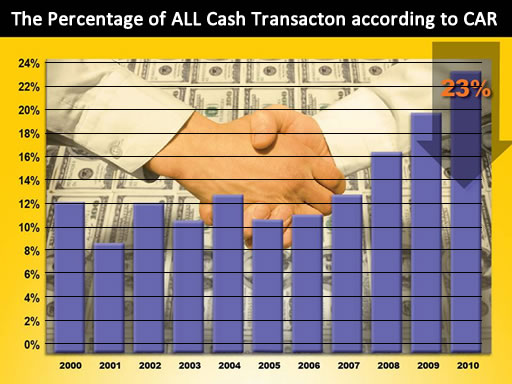

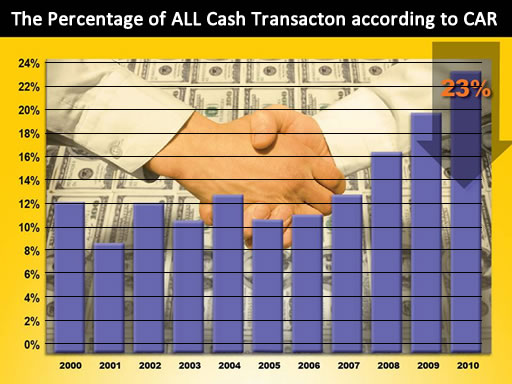

If you think this isn’t the case for California, think again:

Source: CAR, Buildbankroll

It got worse in 2011 and 2012. In fact, at least for data for Southern California, all cash buying hit a record of 35.8 percent in December (last month it was 35.6). Last year it was 33.7 percent showing that a large amount of buying in Southern California is coming from the all cash crowd, way higher than historical norms. And most of these people are not planning on living in these places. 31.4 percent of purchases in SoCal are absentee buyers. The monthly average dating back to 2000 is around 17 percent. In other words this is a market dominated by the all cash crowd. Some would like to pretend like this is normal but it is clearly not. This is hot money flooding into the market. If it isn’t big money, it is balance sheet weak buyers going in with FHA insured loans and the tiny 3.5 percent down payment.

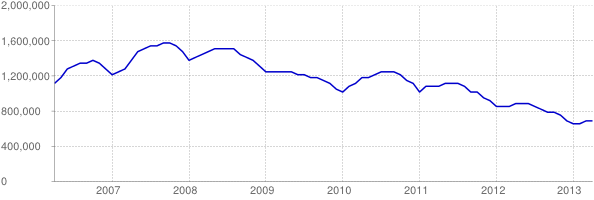

Tracking the investor market carefully, you realize that these people do pay attention to incomes and local regional economics. When you are buying lots of homes, you better make sure the local crowd can cover a certain amount of rents to make yields worthwhile. There is no Fed incentive to renting so this money has to come from your net income. In other words, what you actually earn from the real economy instead of flipping homes like burgers. Signs are already showing a peak in investor buying, at least from the pro crowd:

“(Fortune) While this has gone on for some time, the investor frenzy might have peaked. Rents for single-family homes have essentially flattened — rising just 0.1% in March from a year earlier, according to a report released Thursday by real estate listing website Trulia. What’s more, in some cities where investors had the biggest appetite for properties on the cheap, rents have fallen: Take Los Angeles, where rents fell 1.9%; rents in Orange County slipped down 0.7%; Las Vegas saw a 1.9% drop. And in two other key investor markets — Atlanta and Phoenix — single-family home rents remained flat, rising less than 1%.

Meanwhile, rents for apartments have continued to rise, climbing 2.9% in March from a year earlier.”

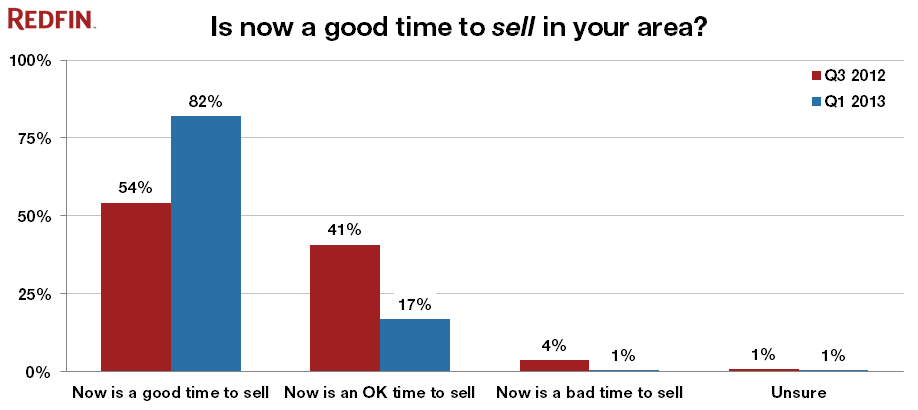

So much for rents going up forever and ever even in untouchable Southern California. The article goes on to point out that “small investors” are now becoming a bigger part of sales. Yeah, after the massive recent run-up. Of course it is hard to break out the type of all cash buyer from the 35 percent of purchases in Southern California. One thing is certain, this market is not normal. But this market has not been normal since the early 2000s. Basically you have to ask at what stage or bubble are we currently in? Does this boom have many years to go? I think most would feel comfortable if a flood of good paying jobs were coming online at the same time. Is that even the case?

Prices have surged in the last couple of years especially in certain markets. Very little supply and investor demand has been a large reason for this. We’ve discussed that the big question would be what happens to the market when investor demand pulls back? In SoCal, most investors trying to cash flow have to come in with big cash. It is funny to hear some all cash buyers saying they are cash flowing on a $500,000 purchase that rents for $2,000 in rent. Of course! But you’re basically getting a 4.8 percent return assuming you have no expenses, no property management, no vacancies, and no repairs. Most professional landlords realize that about 40 to 50 percent of gross rents will go to operating expenses. In other words, that $2,000 is really like $1,000. Then that 4.8 percent return turns into 2.4 percent. Can you see why the pros are pulling back? By the time the masses get in line the money has already been made.

http://www.doctorhousingbubble.com/a...ent-of-market/

It is astounding how people brush off an overall weak economy and suddenly justify all cash investors as somehow a normal part of the real estate market. Once again, we are in uncharted territory. The amount of all cash buyers is off the charts. Not only are these Wall Street investors but also foreign money flowing into targeted markets. It is one thing to push it off but it is another thing to actually look at historical data. It is amazing how quickly people drink from the fountain of cultural amnesia and suddenly forget the environment that led us into this mess. This is a fact however; never have we had so much of the real estate market dominated by all cash purchases. But what is a normal amount? Let us go ahead and look at historical data here to see what we can find.

All cash purchases hit a record in 2012

It is hard to find nationwide data for the real estate market going back past 2000 but here we have data on four large areas. It looks like overall, all cash purchases range from 5 to 10 percent:

What is amazing is how crazy some markets have gotten like Phoenix and Orlando where basically investors have become the vast majority of the market. Much of the price gains in the last year are driven by investors competing for the small lot of inventory regardless of what underlying rental yields will produce. The Fed of course is luring in buyers with stagnant incomes and low interest rates. The reality is, households are looking at their balance sheets and are saying “what the heck, rates are low so let us go dive in.” It is more enticing especially when every headline is now talking about the reemergence of the housing market.

If you think this isn’t the case for California, think again:

Source: CAR, Buildbankroll

It got worse in 2011 and 2012. In fact, at least for data for Southern California, all cash buying hit a record of 35.8 percent in December (last month it was 35.6). Last year it was 33.7 percent showing that a large amount of buying in Southern California is coming from the all cash crowd, way higher than historical norms. And most of these people are not planning on living in these places. 31.4 percent of purchases in SoCal are absentee buyers. The monthly average dating back to 2000 is around 17 percent. In other words this is a market dominated by the all cash crowd. Some would like to pretend like this is normal but it is clearly not. This is hot money flooding into the market. If it isn’t big money, it is balance sheet weak buyers going in with FHA insured loans and the tiny 3.5 percent down payment.

Tracking the investor market carefully, you realize that these people do pay attention to incomes and local regional economics. When you are buying lots of homes, you better make sure the local crowd can cover a certain amount of rents to make yields worthwhile. There is no Fed incentive to renting so this money has to come from your net income. In other words, what you actually earn from the real economy instead of flipping homes like burgers. Signs are already showing a peak in investor buying, at least from the pro crowd:

“(Fortune) While this has gone on for some time, the investor frenzy might have peaked. Rents for single-family homes have essentially flattened — rising just 0.1% in March from a year earlier, according to a report released Thursday by real estate listing website Trulia. What’s more, in some cities where investors had the biggest appetite for properties on the cheap, rents have fallen: Take Los Angeles, where rents fell 1.9%; rents in Orange County slipped down 0.7%; Las Vegas saw a 1.9% drop. And in two other key investor markets — Atlanta and Phoenix — single-family home rents remained flat, rising less than 1%.

Meanwhile, rents for apartments have continued to rise, climbing 2.9% in March from a year earlier.”

So much for rents going up forever and ever even in untouchable Southern California. The article goes on to point out that “small investors” are now becoming a bigger part of sales. Yeah, after the massive recent run-up. Of course it is hard to break out the type of all cash buyer from the 35 percent of purchases in Southern California. One thing is certain, this market is not normal. But this market has not been normal since the early 2000s. Basically you have to ask at what stage or bubble are we currently in? Does this boom have many years to go? I think most would feel comfortable if a flood of good paying jobs were coming online at the same time. Is that even the case?

Prices have surged in the last couple of years especially in certain markets. Very little supply and investor demand has been a large reason for this. We’ve discussed that the big question would be what happens to the market when investor demand pulls back? In SoCal, most investors trying to cash flow have to come in with big cash. It is funny to hear some all cash buyers saying they are cash flowing on a $500,000 purchase that rents for $2,000 in rent. Of course! But you’re basically getting a 4.8 percent return assuming you have no expenses, no property management, no vacancies, and no repairs. Most professional landlords realize that about 40 to 50 percent of gross rents will go to operating expenses. In other words, that $2,000 is really like $1,000. Then that 4.8 percent return turns into 2.4 percent. Can you see why the pros are pulling back? By the time the masses get in line the money has already been made.

http://www.doctorhousingbubble.com/a...ent-of-market/

Comment