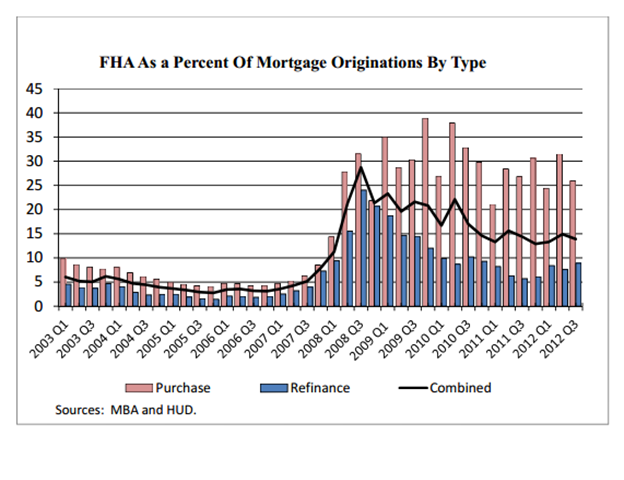

FHA insured loans stepped in to take up a lot of the slack when other low down payment loans exited the market in 2007. FHA insured loans are still a low down payment option requiring only 3.5 percent down but at least with these loans, some level of due diligence is done when looking at potential borrowers. Yet over the last few years, FHA insured loans have gone from a tiny piece of the housing market to now being up over $1.1 trillion in loan guarantees outstanding.

The housing market is now becoming largely bimodal with all cash buyers picking up better properties while those with barely any down payment funds opt to go the FHA route. Given how expensive FHA loans have become, it is apparent that a large portion of the population doesn’t even have enough to enter the housing market without 30x leverage. Changes are also coming to FHA insured loans that will make them more expensive in a few months. Why are these loans getting more expensive when the housing market is supposedly robust?

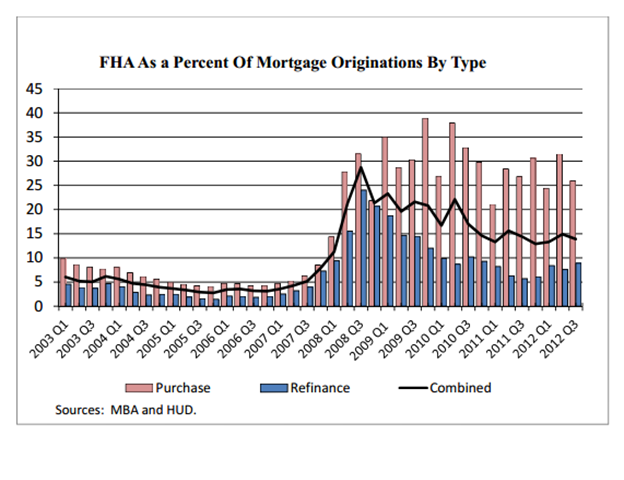

FHA loan volume since recession began

FHA insured loan volume picked up directly as toxic mortgages exited the market:

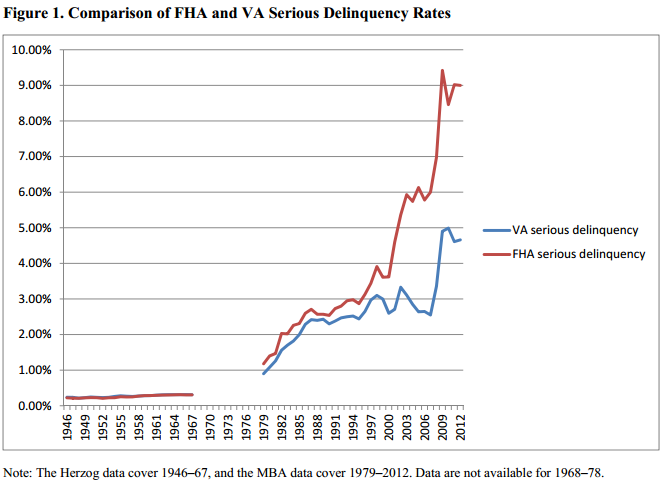

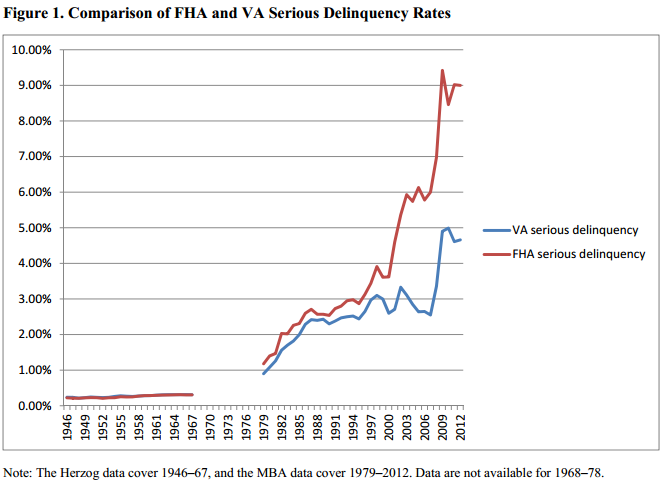

You can see how quickly it picked up in 2008. In some markets like Southern California, FHA insured loans make up about 25 percent of all purchases. In Northern California it is about 15 percent. A large portion of FHA loans are in some sate of serious delinquency:

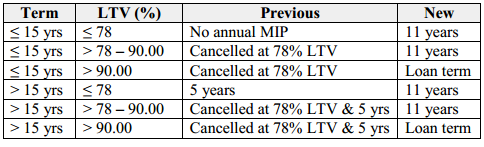

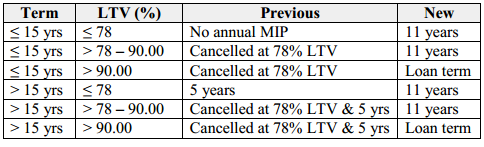

The FHA under GAAP analysis is basically in a -$32.13 billion position on $1.1 trillion in guaranteed loans. Is this an issue? Well it is for these loans since mortgage insurance premiums are going to become even more expensive in the next few months for good reason. One major change is the duration of MIP on loans. This will now be extended for the life of the loan:

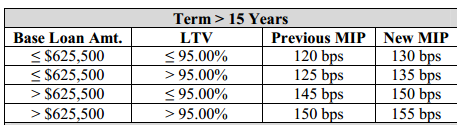

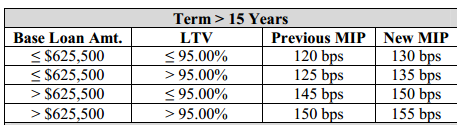

This was typically canceled at earlier times but the FHA needs to shore up its capital position given how many defaults it is facing. If the FHA isn’t in a bad position, then why jack up rates so high? Obviously something else is going on here. The amount paid on a monthly basis is also going up:

Since the vast majority of FHA borrowers go with the lowest down payment amount, we are looking at 130 bps for loans below $625,000. So run the numbers for a $400,000 home purchased with a FHA insured loan:

*Before new FHA changes go into effect later this year

Purchase price: $400,000

Down payment: 3.5%

Down payment amount: $14,000

Interest rate: 4.25%

Up Front MIP: 1.75%

Monthly MIP: 1.25%

Tax rate: 1%

Loan amount: $392,755

Payment 1: $1,932

MIP: $409

Total payment 1 and MIP: $2,341

+Taxes monthly: $333

Insurance monthly: $100

Other (HOA/maintenance) $144

Total monthly payment: $2,919

This is no longer a “cheap” loan given what $400,000 buys you in SoCal. Plus, if you look at condos in places like Orange County you are looking at monthly HOA fees of $200 to $700. You can read more about the FHA changes at the HUD website. A few readers have mentioned that there are other ways to extract money from housing and one of them is through all these added costs. Add up taxes, MIP, HOAs, insurance, and other items and you can see that a low interest rate is suddenly masked by higher ancillary costs.

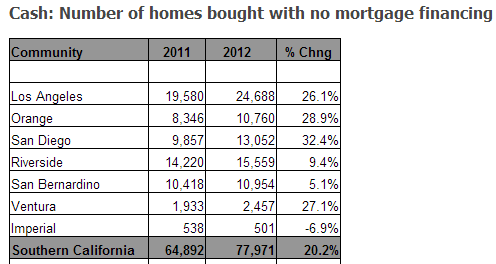

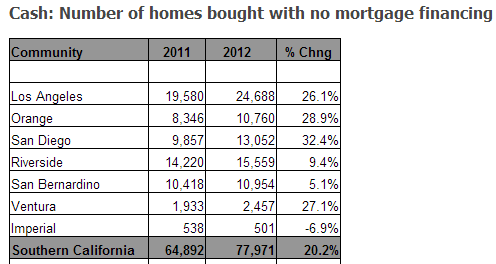

Many current buyers are contending against the jump in all cash buying:

We had a couple of record breaking months of all cash buying in 2013 so the trend continues. FHA loans are becoming more expensive to avoid a bailout on the large number of delinquent loans. In other words, future buyers are going to pay for the mess of the last few years. Yet this is something that is already part of the market. Young buyers saddled with high levels of student debt probably have little alternative for an entry home in high priced areas like California without taking on high leverage loans. Low down payment loans and all cash buyers. Notice how the middle is being squeezed? Not really a surprise given the current state of our economy.

The changes to FHA MIP and duration will start on loans issued on or after June 2013. So if you are eager to buy and are looking for a low down payment loan, you have two months to get on the bandwagon.

http://www.doctorhousingbubble.com/f...cel/#more-6474

The housing market is now becoming largely bimodal with all cash buyers picking up better properties while those with barely any down payment funds opt to go the FHA route. Given how expensive FHA loans have become, it is apparent that a large portion of the population doesn’t even have enough to enter the housing market without 30x leverage. Changes are also coming to FHA insured loans that will make them more expensive in a few months. Why are these loans getting more expensive when the housing market is supposedly robust?

FHA loan volume since recession began

FHA insured loan volume picked up directly as toxic mortgages exited the market:

You can see how quickly it picked up in 2008. In some markets like Southern California, FHA insured loans make up about 25 percent of all purchases. In Northern California it is about 15 percent. A large portion of FHA loans are in some sate of serious delinquency:

The FHA under GAAP analysis is basically in a -$32.13 billion position on $1.1 trillion in guaranteed loans. Is this an issue? Well it is for these loans since mortgage insurance premiums are going to become even more expensive in the next few months for good reason. One major change is the duration of MIP on loans. This will now be extended for the life of the loan:

This was typically canceled at earlier times but the FHA needs to shore up its capital position given how many defaults it is facing. If the FHA isn’t in a bad position, then why jack up rates so high? Obviously something else is going on here. The amount paid on a monthly basis is also going up:

Since the vast majority of FHA borrowers go with the lowest down payment amount, we are looking at 130 bps for loans below $625,000. So run the numbers for a $400,000 home purchased with a FHA insured loan:

*Before new FHA changes go into effect later this year

Purchase price: $400,000

Down payment: 3.5%

Down payment amount: $14,000

Interest rate: 4.25%

Up Front MIP: 1.75%

Monthly MIP: 1.25%

Tax rate: 1%

Loan amount: $392,755

Payment 1: $1,932

MIP: $409

Total payment 1 and MIP: $2,341

+Taxes monthly: $333

Insurance monthly: $100

Other (HOA/maintenance) $144

Total monthly payment: $2,919

This is no longer a “cheap” loan given what $400,000 buys you in SoCal. Plus, if you look at condos in places like Orange County you are looking at monthly HOA fees of $200 to $700. You can read more about the FHA changes at the HUD website. A few readers have mentioned that there are other ways to extract money from housing and one of them is through all these added costs. Add up taxes, MIP, HOAs, insurance, and other items and you can see that a low interest rate is suddenly masked by higher ancillary costs.

Many current buyers are contending against the jump in all cash buying:

We had a couple of record breaking months of all cash buying in 2013 so the trend continues. FHA loans are becoming more expensive to avoid a bailout on the large number of delinquent loans. In other words, future buyers are going to pay for the mess of the last few years. Yet this is something that is already part of the market. Young buyers saddled with high levels of student debt probably have little alternative for an entry home in high priced areas like California without taking on high leverage loans. Low down payment loans and all cash buyers. Notice how the middle is being squeezed? Not really a surprise given the current state of our economy.

The changes to FHA MIP and duration will start on loans issued on or after June 2013. So if you are eager to buy and are looking for a low down payment loan, you have two months to get on the bandwagon.

http://www.doctorhousingbubble.com/f...cel/#more-6474

Comment