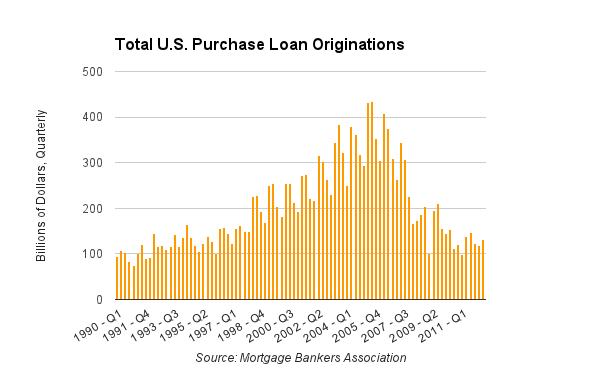

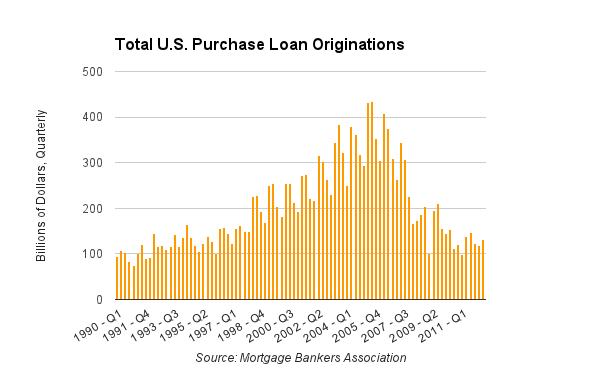

Most people have a hard time with regular math problems, let alone complicated financial instruments like derivatives. So to think that most people are following the movements of the Fed and basing buying decision on this is somewhat unrealistic. The rush to buy homes today is driven by a different set of factors from the previous mania yet the psychology is the same. Underlying the motivation of many is a fear of missing out on higher prices and jumping in because the time is right. The comments in the last article highlighted many people that recently bought and their motivations. They run the spectrum and are truly valuable. It also discussed many that are actively seeking to buy and how they are encountering manic like behavior from current buyers. There is an insatiable demand for rentals from investors and big money is targeting prime markets. You would think that with all this rage, home sales would be solidly up. In fact, California home sales are down 3 percent on a year-over-year basis for the last month of data. When we look at US purchase loan originations we find the volume and amount being pushed out to be at levels last seen in the 1990s. What gives?

The non-existent home buyers

The housing market is largely being driven by investors. The noise that we are seeing is large money from both Wall Street and foreign money clogging up real estate across the US. Foreign money is more concentrated in targeted niche markets while big money is dominating bulk sales in places like the Inland Empire, Arizona, Nevada, and Florida. One interesting chart shows how distorted this current market is:

“(Bloomberg) With all the real estate investment action, you’d expect the number of new mortgage loans to be shooting upwards. No such luck. Look at the chart below, which shows new purchase mortgages through the 3rd quarter of 2012, using data from the Mortgage Bankers Association. For that quarter, buyers took out $129 billion in purchase loans. Not only is that much lower than the numbers from the boom, but it’s less the post-crash levels of 2009. You need to go back to the mid-1990s to get back to numbers like those (and they’re not adjusted for inflation).”

The obvious reason for this is that the volume of all cash buying form investors is off the charts. We’re not talking about a handful of buyers but billions upon billions of dollars flowing into the housing market from sources outside of your traditional buyer. Couple this with Fed and government regulations that now allow banks to rent homes out plus the fact that many of these investors are buying to hold for a few years and then sell, you end up simply removing inventory from an already depleted market.

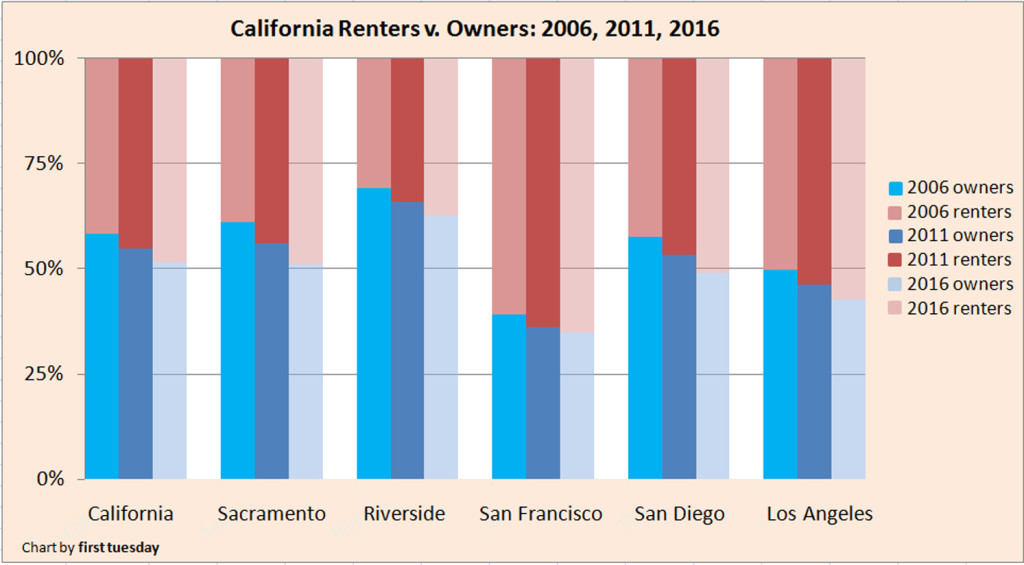

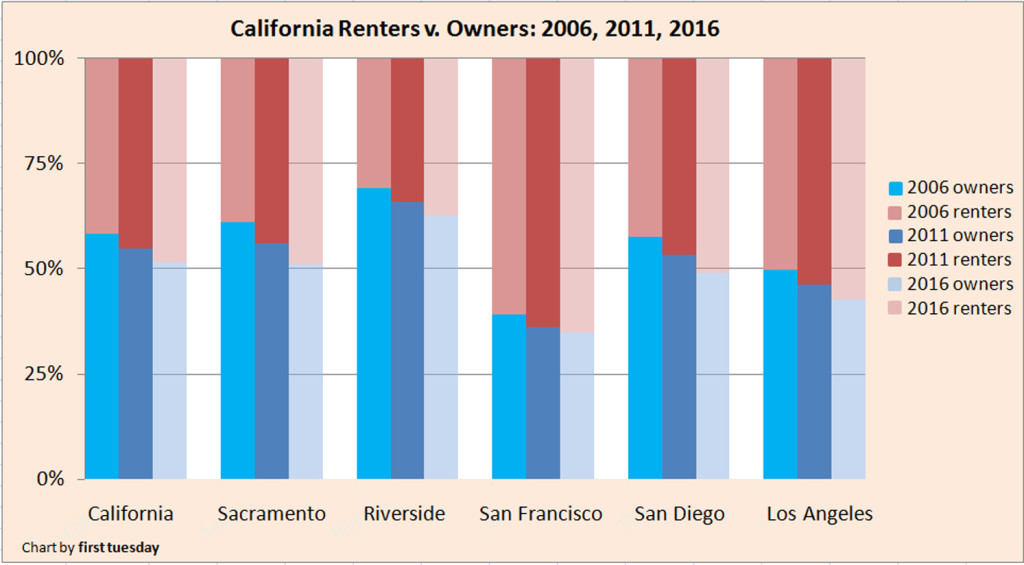

The hunger for rentals is high but there seems to be some market saturation that is now occurring. In California, we have become an even larger renter state since the housing market peaked in 2007:

2011

Owner-occupied: 6,843,369 (-233,603 from 2007)

Renter-occupied: 5,625,374 (+501,674 from 2007

2007

Owner-occupied: 7,076,972

Renter-occupied: 5,123,700

Source: Census

The state now has at least 500,000+ renters more than it did in 2007. We’ve lost over 233,000+ home owners. So the net result is much bigger for the renting side of the equation. This is how the numbers now look:

And the amount of buying from all cash buyers is likely to make this ratio even larger. We noted that last month we had the largest amount of all cash sales in the history of SoCal (some 35.6 percent of all sales). Cash buyers paid a median price of $260,000 in SoCal so this is likely to be a larger pool of investment properties for rent versus foreign money that is bidding properties up in niche markets.

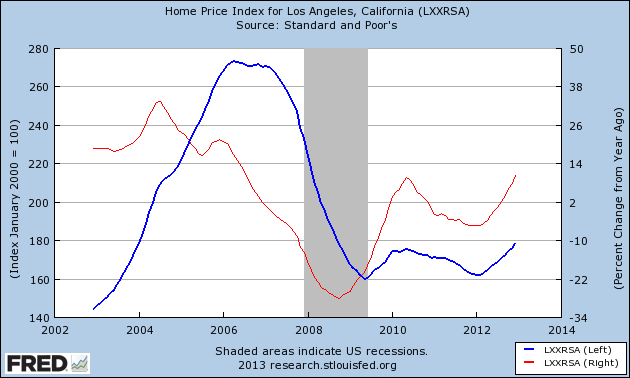

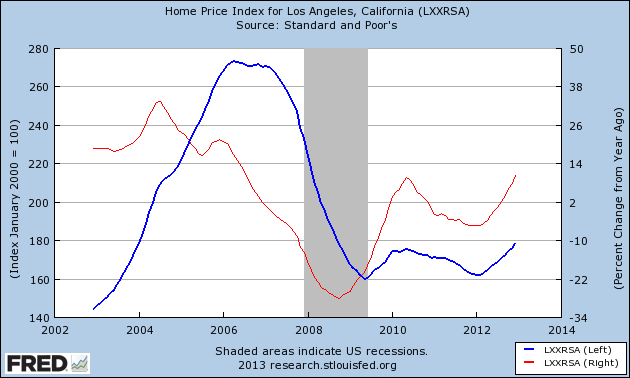

While the median home price is radically up because of the change in mix of home sales, we can look at the Case Shiller to see beyond the noise:

The Case Shiller Index now shows an increase in home prices for Los Angeles of 11 percent since 2009. You can see from the red line that the year-over-year gains have accelerated. The volume of home sales is starting to soften because it really is manic in many areas of California. The low home purchase origination figure is simply an indicator that your average buyer is being out bid by investors. Last month in SoCal we hit a record amount of all cash buying. When people say that incomes do not matter the bigger picture is missed. It does matter because even with a solid down payment and solid incomes many people are being outbid by the hot money market the Fed has created with big hedge funds and Wall Street money. Some seem to believe that the Fed is targeting prime areas to keep prices inflated. To this, I say that the Fed has bigger fish to fry compared to worrying about hipster markets in Southern California like the stock market and our national economy. In the eyes of the Fed, the housing market on a nationwide scale is picking up.

Remember that 5,000,000 Americans have gone through the foreclosure process since 2007 and a few more million will do so in the next few years. Given the volume of investor buying, the odds are strong that these homes will end up in the hands of big investors. Just like the Census figures show, California gained 500,000+ renters since 2007 while losing over 200,000+ home owners. Every mania has a different story but the sentiment of “priced out forever” or “I have to act now” is back in vogue. Just because people realize something is going on doesn’t mean they’ll successfully navigate it. Entire cities like Las Vegas are built by the illustrious vision of beating the house. Many current home shoppers are in fierce competition with big hedge funds and investors and all cash sounds a lot better than FHA or conventional financing. How badly do you want to own? If you are planning on buying shortly, good luck, you have a lot of big money competition.

http://www.doctorhousingbubble.com/w...tes/#more-6461

The non-existent home buyers

The housing market is largely being driven by investors. The noise that we are seeing is large money from both Wall Street and foreign money clogging up real estate across the US. Foreign money is more concentrated in targeted niche markets while big money is dominating bulk sales in places like the Inland Empire, Arizona, Nevada, and Florida. One interesting chart shows how distorted this current market is:

“(Bloomberg) With all the real estate investment action, you’d expect the number of new mortgage loans to be shooting upwards. No such luck. Look at the chart below, which shows new purchase mortgages through the 3rd quarter of 2012, using data from the Mortgage Bankers Association. For that quarter, buyers took out $129 billion in purchase loans. Not only is that much lower than the numbers from the boom, but it’s less the post-crash levels of 2009. You need to go back to the mid-1990s to get back to numbers like those (and they’re not adjusted for inflation).”

The obvious reason for this is that the volume of all cash buying form investors is off the charts. We’re not talking about a handful of buyers but billions upon billions of dollars flowing into the housing market from sources outside of your traditional buyer. Couple this with Fed and government regulations that now allow banks to rent homes out plus the fact that many of these investors are buying to hold for a few years and then sell, you end up simply removing inventory from an already depleted market.

The hunger for rentals is high but there seems to be some market saturation that is now occurring. In California, we have become an even larger renter state since the housing market peaked in 2007:

2011

Owner-occupied: 6,843,369 (-233,603 from 2007)

Renter-occupied: 5,625,374 (+501,674 from 2007

2007

Owner-occupied: 7,076,972

Renter-occupied: 5,123,700

Source: Census

The state now has at least 500,000+ renters more than it did in 2007. We’ve lost over 233,000+ home owners. So the net result is much bigger for the renting side of the equation. This is how the numbers now look:

And the amount of buying from all cash buyers is likely to make this ratio even larger. We noted that last month we had the largest amount of all cash sales in the history of SoCal (some 35.6 percent of all sales). Cash buyers paid a median price of $260,000 in SoCal so this is likely to be a larger pool of investment properties for rent versus foreign money that is bidding properties up in niche markets.

While the median home price is radically up because of the change in mix of home sales, we can look at the Case Shiller to see beyond the noise:

The Case Shiller Index now shows an increase in home prices for Los Angeles of 11 percent since 2009. You can see from the red line that the year-over-year gains have accelerated. The volume of home sales is starting to soften because it really is manic in many areas of California. The low home purchase origination figure is simply an indicator that your average buyer is being out bid by investors. Last month in SoCal we hit a record amount of all cash buying. When people say that incomes do not matter the bigger picture is missed. It does matter because even with a solid down payment and solid incomes many people are being outbid by the hot money market the Fed has created with big hedge funds and Wall Street money. Some seem to believe that the Fed is targeting prime areas to keep prices inflated. To this, I say that the Fed has bigger fish to fry compared to worrying about hipster markets in Southern California like the stock market and our national economy. In the eyes of the Fed, the housing market on a nationwide scale is picking up.

Remember that 5,000,000 Americans have gone through the foreclosure process since 2007 and a few more million will do so in the next few years. Given the volume of investor buying, the odds are strong that these homes will end up in the hands of big investors. Just like the Census figures show, California gained 500,000+ renters since 2007 while losing over 200,000+ home owners. Every mania has a different story but the sentiment of “priced out forever” or “I have to act now” is back in vogue. Just because people realize something is going on doesn’t mean they’ll successfully navigate it. Entire cities like Las Vegas are built by the illustrious vision of beating the house. Many current home shoppers are in fierce competition with big hedge funds and investors and all cash sounds a lot better than FHA or conventional financing. How badly do you want to own? If you are planning on buying shortly, good luck, you have a lot of big money competition.

http://www.doctorhousingbubble.com/w...tes/#more-6461