wonder where that free money is going . . .

By John Gittelsohn - Mar 13, 2013

Blackstone Group LP (BX), manager of the largest real estate private-equity fund, has expanded a credit line to buy single-family homes to $2.1 billion from $600 million, according to a person with knowledge of the deal.

Deutsche Bank AG (DBK) leads the syndicate of banks, said the person, who asked not to be named because the loan is private. Other lenders include Bank of America Corp., Credit Suisse Group AG (CSGN), Goldman Sachs Group Inc. (GS) and JPMorgan Chase & Co. (JPM)

“The deal demonstrates that the market for these types of loans is expanding and maturing as major Wall Street banks become more and more comfortable with the asset class,” Stephen Blevit, an attorney for Sidley Austin LLP who represented Deutsche Bank, said in an e-mail from Los Angeles.

Blackstone has invested $3.5 billion to buy 20,000 single- family rental homes since last year, making the New York-based company the largest investor of its type in the U.S. The firm is rushing to acquire properties as housing prices recover and as demand for rentals increases among people who can’t qualify for a mortgage or don’t want to own.

Blackstone spokesman Peter Rose and Deutsche Bank spokeswoman Renee Calabro declined to comment. The firm had been trying to increase the loan to $1.2 billion.

The single-family home rental business, which has been dominated by small investors, is attracting more institutional capital. American Homes 4 Rent, a Malibu, California-based company headed by Public Storage (PSA) founder B. Wayne Hughes, has acquired about 10,000 properties. Thomas Barrack’s Colony Capital LLC has raised $2.2 billion for home purchases.

Public Offerings

Silver Bay Realty Trust Corp. (SBY), a Minnetonka, Minnesota- based real estate investment trust, raised $263 million in an initial public offering in December. American Homes 4 Rent issued a statement last month saying it plans to file for an IPO within 60 days.

“The next milestone to come is the securitization of single-family residential rental homes, which we expect will occur in the second half of 2013,” Blevit said, referring to bonds that bundle pools of loans and slice them into securities of varying risk. Charles Schrank and Anny Huang, Sidley Austin attorneys from Chicago, worked with Blevit on the deal.

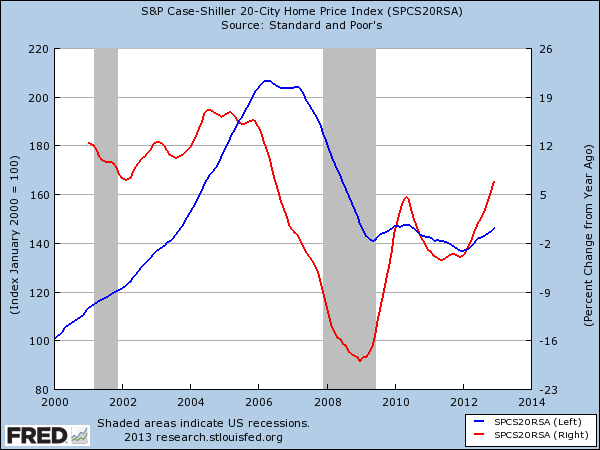

U.S. home prices rose 6.8 percent last year, the biggest 12-month gain since July 2006, according to the S&P/Case-Shiller index of property values in 20 cities.

More than 5 million former owners have lost their properties to foreclosure or in a distressed sale since home prices peaked in 2006, according to RealtyTrac. Last year, the total number of renter-occupied residences increased 1.1 million, while the number of owner-occupied households fell by 106,000, according to a Commerce Department report.

To contact the reporter on this story: John Gittelsohn in Los Angeles at johngitt@bloomberg.net

To contact the editor responsible for this story: Kara Wetzel at kwetzel@bloomberg.net

By John Gittelsohn - Mar 13, 2013

Blackstone Group LP (BX), manager of the largest real estate private-equity fund, has expanded a credit line to buy single-family homes to $2.1 billion from $600 million, according to a person with knowledge of the deal.

Deutsche Bank AG (DBK) leads the syndicate of banks, said the person, who asked not to be named because the loan is private. Other lenders include Bank of America Corp., Credit Suisse Group AG (CSGN), Goldman Sachs Group Inc. (GS) and JPMorgan Chase & Co. (JPM)

“The deal demonstrates that the market for these types of loans is expanding and maturing as major Wall Street banks become more and more comfortable with the asset class,” Stephen Blevit, an attorney for Sidley Austin LLP who represented Deutsche Bank, said in an e-mail from Los Angeles.

Blackstone has invested $3.5 billion to buy 20,000 single- family rental homes since last year, making the New York-based company the largest investor of its type in the U.S. The firm is rushing to acquire properties as housing prices recover and as demand for rentals increases among people who can’t qualify for a mortgage or don’t want to own.

Blackstone spokesman Peter Rose and Deutsche Bank spokeswoman Renee Calabro declined to comment. The firm had been trying to increase the loan to $1.2 billion.

The single-family home rental business, which has been dominated by small investors, is attracting more institutional capital. American Homes 4 Rent, a Malibu, California-based company headed by Public Storage (PSA) founder B. Wayne Hughes, has acquired about 10,000 properties. Thomas Barrack’s Colony Capital LLC has raised $2.2 billion for home purchases.

Public Offerings

Silver Bay Realty Trust Corp. (SBY), a Minnetonka, Minnesota- based real estate investment trust, raised $263 million in an initial public offering in December. American Homes 4 Rent issued a statement last month saying it plans to file for an IPO within 60 days.

“The next milestone to come is the securitization of single-family residential rental homes, which we expect will occur in the second half of 2013,” Blevit said, referring to bonds that bundle pools of loans and slice them into securities of varying risk. Charles Schrank and Anny Huang, Sidley Austin attorneys from Chicago, worked with Blevit on the deal.

U.S. home prices rose 6.8 percent last year, the biggest 12-month gain since July 2006, according to the S&P/Case-Shiller index of property values in 20 cities.

More than 5 million former owners have lost their properties to foreclosure or in a distressed sale since home prices peaked in 2006, according to RealtyTrac. Last year, the total number of renter-occupied residences increased 1.1 million, while the number of owner-occupied households fell by 106,000, according to a Commerce Department report.

To contact the reporter on this story: John Gittelsohn in Los Angeles at johngitt@bloomberg.net

To contact the editor responsible for this story: Kara Wetzel at kwetzel@bloomberg.net

Comment