Announcement

Collapse

No announcement yet.

question on deflation I've been thinking of - BART? Aaron? Sapiens?

Collapse

X

-

Re: Coming full circle, Now to extend this to DEFLATION

Bart, what happened from ~1995-2000, where CPI-lies was rising faster than M3? Is it a function of a measurment problem with the data? If not, how does that happen?

Or am I missing something more obvious?

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

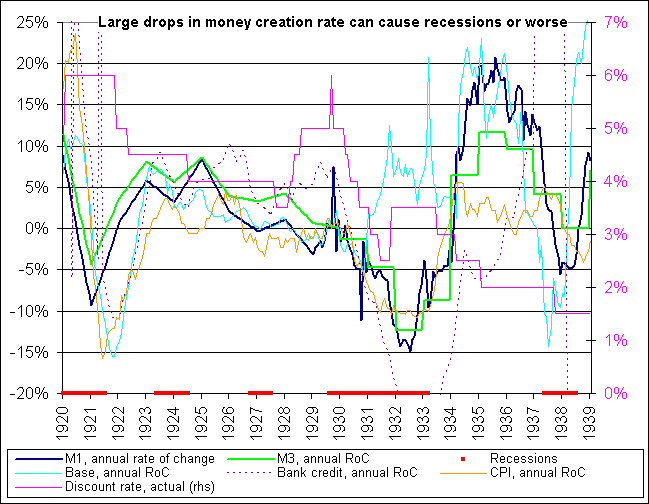

stupid question... my specialty! if payments in the p/c econ are .1% of payments in the total econ and payments in the fire econ are the other 99.9%, why does the p/c econ money supply matter? is the p/c econ money supply geared to the fire econ money supply? at what ratio?Originally posted by bart View PostSort of... and a fuller picture is in the following two charts. There's little question that non Fed member banks going under and things like the Smoot Hawley tariff law also contributed to it, but they occurred well after 1929.

Overly simply perhaps, but deflation is the opposite of inflation... and this chart shows that the money supply (as measured by M2 and M3 with a 10 year moving average) actually was growing slower & slower starting in about 1926, and was "dis-inflating".

Fractional reserve requirements, as measured by the monetary base (the light blue line), actually dropped as the Fed started pumping it in 1930. M3 was also not growing at all in 1929 since the Fed was in restraint mode. M1 (cash & checking accounts, roughly) was mostly negative starting in 1928 too.

Put that together with the concept of lags (it takes a while for money additions or subtractions to actually affect the economy), and it's the largest single cause of the Depression in my opinion.

The rate of credit expansion (the dotted line) didn't start to slow until early 1930... at least on an annual change rate basis.

1. I'm unsure what you're driving at on demand for dollars. Going back to a basic key definition, deflation is less money than goods, and demand is a relatively minor factor in my opinion.

2. I can't imagine a situation where banks would downright refuse to lend, but more conservative practices have been under way for about six months per the Fed's Senior Loan Officer survey,

( http://www.bullandbearwise.com/OfficerSurveyChart.asp ), and the same thing happens during every recession.

Also keep in mind that reserve requirements are quite low now, and there are also plans afoot for the Fed to actually pay interest on required reserves... and that reserves can also be borrowed at the discount window, etc. (about 5% of them are actually borrowed as of the last few months too, for what its worth).

The chances of mass bankruptcies of banks is pretty small too - the primary mission of the Fed is to protect the system, and Bernanke is on record numerous times about not letting another Depression happen. I'm unaware of any banks today that are not members of the Fed too.

Do note though that there's fairly likely to be at least one high profile bank get into serious trouble and get rescued and bought out, and that something like the RTC part deux will be formed too.

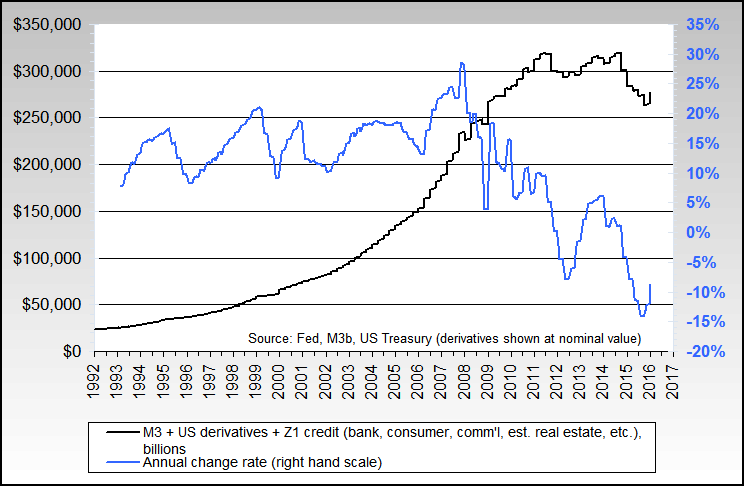

Finally, "money" is a fluid concept and "money supply" today should include both various measures of credit and even derivatives too... and no one currently even attempts to measure them all, although the FDI does indirectly address the area as do my M3 + various credit measures charts.

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

Originally posted by WDCRob View PostBart, what happened from ~1995-2000, where CPI-lies was rising faster than M3? Is it a function of a measurement problem with the data? If not, how does that happen?

Or am I missing something more obvious?

There's all sorts of reasons but the primary one is that M2 & M3 are far from a perfect representation of "money supply".

For example, there was a large jump in monetary base during 1994-1999 that had a large effect on credit creation. Neither M2 nor M3 have any credit measures in them.

The basic purpose of the chart is to show the very strong link between inflation and money supply, not so much that it's a 1.0 correlation.

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

I was thinking deflation in terms of dollar supply vs demand - if demand for dollars rises, supply falls - by basic economics, the value (purchasing power) of each dollar increases (when applied to a constant volume of goods)

various thingsOriginally posted by bart View Post1. I'm unsure what you're driving at on demand for dollars. Going back to a basic key definition, deflation is less money than goods, and demand is a relatively minor factor in my opinion.

foreigners wanting safe US bonds dumping other currencies to buy the bonds

Petrol becomes $200 a barrel and OPEC keeps the US dollar pricing

I'm not clear on what other writers (Ackerman, Richard Russell) mean by their claim that US indebtedness means there's a massive short position on US dollars

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

No such thing as a stupid question, seriously.Originally posted by metalman View Poststupid question... my specialty! if payments in the p/c econ are .1% of payments in the total econ and payments in the fire econ are the other 99.9%, why does the p/c econ money supply matter? is the p/c econ money supply geared to the fire econ money supply? at what ratio?

One good answer is contained in my last paragraph:

The F.I.R.E. economy contains derivatives and credit, neither of which are represented in "conventional" money supply figures. And measuring (or even modeling) derivatives is well beyond trivial.Finally, "money" is a fluid concept and "money supply" today should include both various measures of credit and even derivatives too... and no one currently even attempts to measure them all, although the FDI does indirectly address the area as do my M3 + various credit measures charts.

Here's another question that may help illustrate the area too. Does it matter much that current U.S. M3 plus credit plus gov't debt is around $49 trillion dollars, conservatively, and that it's growing in the double digits?

I wish I had a decent answer on a ratio between the two economies on "money supply" but it gets back to how non transparent derivatives are and also how little actual track history is available. M3 data goes back to the 1870s (CPI into the late 1700s) where derivatives only go back to about the mid 1990s.

Just on a huge WAG basis though, I wouldn't put the ratio over the 1.2-1.5x range.

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

Maybe I'm missing something this time, but the supply of dollars hasn't ever fallen (with very minor very short term exceptions) for over 80 years and we also haven't ever had a constant supply of goods.Originally posted by Spartacus View PostI was thinking deflation in terms of dollar supply vs demand - if demand for dollars rises, supply falls - by basic economics, the value (purchasing power) of each dollar increases (when applied to a constant volume of goods)

various things

foreigners wanting safe US bonds dumping other currencies to buy the bonds

Petrol becomes $200 a barrel and OPEC keeps the US dollar pricing

But in theory and on a world wide basis, if many others are trading their own currencies for dollars then those currencies would be losing value - making the global effect about even.

Also, the cost/push or demand/pull models in my opinion are very junior to the basic definition of deflation being less money than goods. Money creation always precedes inflation, and money "destruction" always precedes deflation or dis-inflation.

In reality, both the Z1 flow of funds and other measures that I track show that the trend is money is flowing out of the US too.

This one is probably more up Finster's alley, and I'll use his favorite parallel and hope I get it right.Originally posted by Spartacus View PostI'm not clear on what other writers (Ackerman, Richard Russell) mean by their claim that US indebtedness means there's a massive short position on US dollars

If one borrows to buy a house, then one is long housing and short the dollar (hoping to pay back the debt with cheaper dollars). It would be the same with gold - if one buys gold, the expectation would be that it would out perform the dollar - and its a synthetic dollar short (you "sold" dollars to buy the gold).

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

the second part of that doesn't sound right. you're short dollars when you buy a house by taking out a mortgage - you own a house, you owe dollars. if you buy something for cash you exchange one long position for another long position. no short is established. russell talks about all the debt as "synthetic" short dollar positions - i'd say there's nothing synthetic about it.Originally posted by bartIf one borrows to buy a house, then one is long housing and short the dollar (hoping to pay back the debt with cheaper dollars). It would be the same with gold - if one buys gold, the expectation would be that it would out perform the dollar - and its a synthetic dollar short (you "sold" dollars to buy the gold).

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

Hopefully that'll help Spartacus sort it out better and if not, I'll try & get the mighty Fin to help clarify it.Originally posted by jk View Postthe second part of that doesn't sound right. you're short dollars when you buy a house by taking out a mortgage - you own a house, you owe dollars. if you buy something for cash you exchange one long position for another long position. no short is established. russell talks about all the debt as "synthetic" short dollar positions - i'd say there's nothing synthetic about it.

Comment

-

Re: Coming full circle, Now to extend this to DEFLATION

Thank you, Spartacus - and thanks to the other contributors on this thread. It's really helped to explain some of the inflation/deflation conundrum.Originally posted by Spartacus View PostThat's the concensus to date, unless I've really misunderstood

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

JK, that begins to make some sense, but Russell/Ackerman talk about the dollar short raising the value of the dollar - that's the context that was confusing me.

I thought, what is the dollar short relative to, or what is it shorted against and since the context was entirely about the dollar value rising, my mind first went to "it's short against other currencies", which makes no sense.

Also that they spoke of general debt, which in my mind includes US debt owed to foreigners, reinforcing in my mind that this debt means the dollar is short relative to other currencies.

Originally posted by jk View Postthe second part of that doesn't sound right. you're short dollars when you buy a house by taking out a mortgage - you own a house, you owe dollars. if you buy something for cash you exchange one long position for another long position. no short is established. russell talks about all the debt as "synthetic" short dollar positions - i'd say there's nothing synthetic about it.Last edited by Spartacus; November 24, 2007, 12:37 PM.

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

if you owe something, you are short that thing. if i short a stock, i must first borrow it and then sell it. i owe it to the entity from which it was borrowed. if i owe dollars, i am short dollars. it doesn't matter what i used those dollars for: i might have bought something, i might have invested them. nonetheless, i owe dollars. if there is a credit squeeze and dollars are in short supply, the more dollars i owe - i.e. the larger my short position - the more desparate i am to get them, and the fewer i will take in exchange for any particular item i have to sell in order to raise dollars. thus does deflation raise the value of the currency and lower the price of everything denominated in that currency.Originally posted by Spartacus View PostJK, that begins to make some sense, but Russell/Ackerman talk about the dollar short raising the value of the dollar - that's the context that was confusing me.

I thought, what is the dollar short relative to, or what is it shorted against and since the context was entirely about the dollar value rising, my mind first went to "it's short against other currencies", which makes no sense.

Also that they spoke of general debt, which in my mind includes US debt owed to foreigners, reinforcing in my mind that this debt means the dollar is short relative to other currencies.

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

I think the error that the deflationists make is when they say

1. you can't force people to borrow

2. without constant borrowing to gen new money into existence, we will have deflation

3. defaults in loans mean deflation

All 3 of the above are wrong. Well, #1 isn't wrong but you can print money and give it away, so you don't need to force people to borrow money.

Then they bring up Japan. Well, Japan has had falling prices in many parts of the economy but their money supply has barely dipped. It dipped once, and otherwise has continued to grow. Is that deflation? I don't think so.

Certainly we have now, as Finster has pointed out, a time when (temporarily) there is a higher value to cash, coincident with the Yen appreciating vs. the dollar. Debtors need cash to pay back loans. There is demand for "liquidity". But that doesn't mean we have deflation

The money has already been borrowed into existence and is out there. It's already in other people's hands.

If on balance more money is paid back than borrowed, that is deflationary. But is that what is going on now? And if it is, it will only go on for a short time. And I see no evidence of this in the broad money supply figures which seem to say the opposite is happening...

Comment

-

Re: question on deflation I've been thinking of - BART? Aaron? Sapiens?

Originally posted by grapejelly View Post...

If on balance more money is paid back than borrowed, that is deflationary. But is that what is going on now? And if it is, it will only go on for a short time. And I see no evidence of this in the broad money supply figures which seem to say the opposite is happening...

Indeed and here's one of my "scratch" charts that show M3 plus derivatives plus the major credit types.

Comment

Comment