Re: It's official: Deal reached on "fiscal cliff"

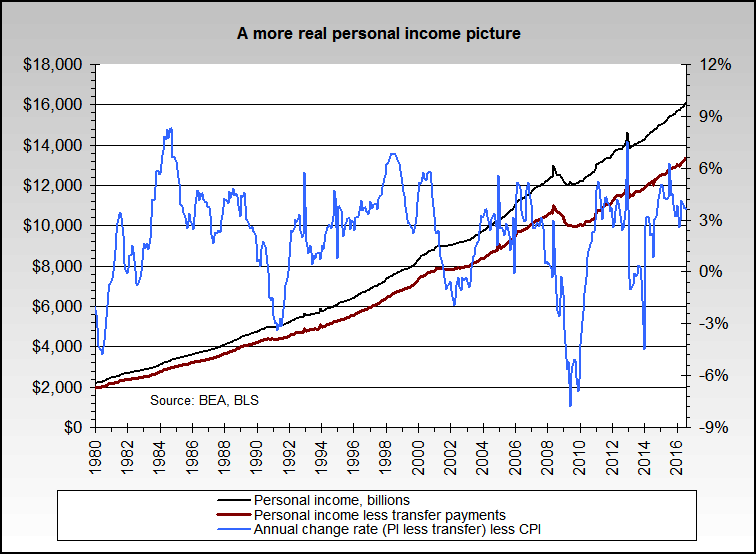

I think the PCE is measuring "nominal dollars spent". The inflation was getting worse 1970-1980, so the annual change is larger each year. After 1980, the inflation is decreasing each year, so the annual change is smaller. The curve would look quite different if adjusted for CPI, or "purchasing power".

Originally posted by javaljav

View Post

.png)

.png)

Comment